Traditional investments: Difference between revisions

Philafrenzy (talk | contribs) |

Reverted good faith edits by Jweighed1 (talk): Not an improvement (idiosyncratic orthography). |

||

| (45 intermediate revisions by 33 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|Investment in well-known assets and shares}} |

|||

{{ |

{{refimprove|date=September 2013}} |

||

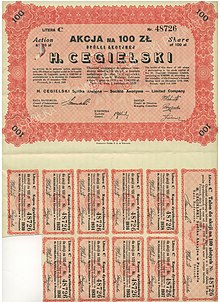

[[File:Akcja1928HCegielski.jpg|thumbnail|right|An old [[stock certificate]] from Poland with most of the coupons still attached.]] |

[[File:Akcja1928HCegielski.jpg|thumbnail|right|An old [[stock certificate]] from Poland with most of the coupons still attached.]] |

||

In finance, the notion of '''traditional investments''' refers to putting money into well-known assets (such as [[Bond (finance)|bonds]], [[cash]], [[real estate]], and equity [[shares]]) with the expectation of [[capital appreciation]], dividends, and interest earnings. Traditional investments are to be contrasted with [[alternative investments]]. |

|||

==Bonds== |

==Bonds== |

||

{{main|Bond (finance)}} |

|||

Here the investor purchases [[debt]] issued by companies or [[Government debt|governments]] which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general [[interest rates]] fluctuates, causing the bond to become more or less valuable. |

Here the investor purchases [[debt]] issued by companies or [[Government debt|governments]] which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general [[interest rates]] fluctuates, causing the bond to become more or less valuable.<ref>{{cite web |title=Are Bonds a Good Investment? in 2020? • Benzinga |url=https://www.benzinga.com/money/are-bonds-a-good-investment/ |website=Benzinga |access-date=6 March 2020 |date=28 February 2020}}</ref> |

||

==Cash== |

==Cash== |

||

In cash [[Investment|investing]], money is typically invested in short-term, low-risk investment vehicles like [[Certificate of deposit|certificates of deposit]], [[money market fund]]s, and |

In cash [[Investment|investing]], money is typically invested in short-term, low-risk investment vehicles like [[Certificate of deposit|certificates of deposit]], [[money market fund]]s, and high yield bank accounts.<ref>{{cite web|title=What is Cash Investment?|url=http://www.investormonkey.com/2013/06/what-is-cash-investment/|publisher=Investor Monkey|access-date=29 June 2013}}</ref> |

||

==Real estate== |

==Real estate== |

||

{{Main|Real estate investing}} |

{{Main|Real estate investing}} |

||

<!-- [[Pakeha settlers#Nelson]] links here. Please update that link when changing this section name --> |

<!-- [[Pakeha settlers#Nelson]] links here. Please update that link when changing this section name --> |

||

In [[real estate]], |

In [[real estate]], money is used to purchase [[property]] for the purpose of holding, reselling or leasing for income and there is an element of capital risk. |

||

===Residential real estate=== |

===Residential real estate=== |

||

Investment in residential real estate is the most common form of real estate investment measured by number of participants because it includes property purchased as a primary residence. In many cases the buyer does not have the full purchase price for a property and must |

Investment in residential real estate is the most common form of real estate investment measured by number of participants because it includes property purchased as a primary residence. In many cases the buyer does not have the full purchase price for a property and must borrow additional money from a bank, finance company or private lender. |

||

===Commercial real estate=== |

===Commercial real estate=== |

||

Commercial real estate consists of |

Commercial real estate consists of apartments, office buildings, retail space, hotels, warehouses, and other commercial properties. Investors may purchase commercial property outright, with the help of a loan, or collectively through a real estate fund. |

||

===Real estate investment trusts=== |

|||

Investment in real estate investment trusts (REITs) is like investing in a pool of real estate that the company manages. |

|||

==Stocks and shares== |

==Stocks and shares== |

||

This involves purchasing a share in the [[Equity (finance)#Shareholders' equity|equity]] of a [[ |

This involves purchasing a share in the [[Equity (finance)#Shareholders' equity|equity]] of a [[company]] with the expectation that the [[share price]] will increase. Purchasing a share in the company is the same as owning part of the company. Stock investing can come in the form of buying individual stocks, mutual funds, index funds and exchange traded funds (ETFs).<ref>{{Cite web|url = http://www.tradingcommand.com/getting-started-in-stock-investing/|title = Getting Started in Stock Investing|website = TradingCommand}}</ref> |

||

==References== |

==References== |

||

{{reflist}} |

{{reflist}} |

||

{{Investment-management|state=expanded}} |

|||

[[Category:Investment]] |

[[Category:Investment]] |

||

Latest revision as of 17:12, 9 September 2024

This article needs additional citations for verification. (September 2013) |

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds, cash, real estate, and equity shares) with the expectation of capital appreciation, dividends, and interest earnings. Traditional investments are to be contrasted with alternative investments.

Bonds

[edit]Here the investor purchases debt issued by companies or governments which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general interest rates fluctuates, causing the bond to become more or less valuable.[1]

Cash

[edit]In cash investing, money is typically invested in short-term, low-risk investment vehicles like certificates of deposit, money market funds, and high yield bank accounts.[2]

Real estate

[edit]In real estate, money is used to purchase property for the purpose of holding, reselling or leasing for income and there is an element of capital risk.

Residential real estate

[edit]Investment in residential real estate is the most common form of real estate investment measured by number of participants because it includes property purchased as a primary residence. In many cases the buyer does not have the full purchase price for a property and must borrow additional money from a bank, finance company or private lender.

Commercial real estate

[edit]Commercial real estate consists of apartments, office buildings, retail space, hotels, warehouses, and other commercial properties. Investors may purchase commercial property outright, with the help of a loan, or collectively through a real estate fund.

Real estate investment trusts

[edit]Investment in real estate investment trusts (REITs) is like investing in a pool of real estate that the company manages.

Stocks and shares

[edit]This involves purchasing a share in the equity of a company with the expectation that the share price will increase. Purchasing a share in the company is the same as owning part of the company. Stock investing can come in the form of buying individual stocks, mutual funds, index funds and exchange traded funds (ETFs).[3]

References

[edit]- ^ "Are Bonds a Good Investment? in 2020? • Benzinga". Benzinga. 28 February 2020. Retrieved 6 March 2020.

- ^ "What is Cash Investment?". Investor Monkey. Retrieved 29 June 2013.

- ^ "Getting Started in Stock Investing". TradingCommand.