Target date fund: Difference between revisions

m Dating maintenance tags: {{When}} |

|||

| (44 intermediate revisions by 30 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|Type of collective investment fund}} |

|||

| ⚫ | |||

{{Personal finance}} |

|||

| ⚫ | A '''target date fund (TDF |

||

| ⚫ | |||

| ⚫ | A '''target date fund''' ('''TDF'''), also known as a '''lifecycle fund''', '''dynamic-risk fund''', or '''age-based fund''', is a [[collective investment scheme]], often a [[mutual fund]] or a collective trust fund, designed to provide a simple investment solution through a portfolio whose [[asset allocation]] mix becomes more conservative as the target date (usually retirement) approaches.<ref>{{cite book | title=ERISA for Money Managers | chapter=§2:125 | year=2013 | author=Lemke, Thomas P. | publisher=[[Thomson West]] | isbn=9780314612618 }}</ref> |

||

==History== |

==History== |

||

| ⚫ | Target-date funds were invented by [[Donald Luskin]] and Larry Tint<ref>{{Cite web|url=http://patents.justia.com/inventor/lawrence-g-tint|title = Lawrence G. Tint Inventions, Patents and Patent Applications – Justia Patents Search}}</ref> of Wells Fargo Investment Advisors (later Barclays Global Investors(BGI)), and first introduced in the early 1990s by [[Barclays Global Investors#1999.E2.80.932009|BGI]].<ref>{{cite press release | url=http://www.marketwire.com/press-release/industrys-first-target-date-fund-celebrates-15-years-since-groundbreaking-launch-918094.htm | title=Industry's First Target-Date Fund Celebrates 15 Years Since Groundbreaking Launch | date=7 Nov 2008 | publisher=[[Barclays Global Investors]] | via=[[Marketwired]] }}</ref> Their popularity in the US increased significantly in recent years due in part to the auto-enrollment legislation [[Pension Protection Act of 2006]] that created the need for safe-harbor type Qualifying Default Investment Alternatives, such as target-date funds, for [[401(k)]] savings plans. With the UK enacting auto-enrollment legislation in 2012, target-date funds are used by the [[National Employment Savings Trust]] (NEST), and are expected to become increasingly popular as their design should satisfy the DWP's eligible default fund criteria.<ref>{{cite book | url=https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/220170/def-opt-guid.pdf | title=Guidance for offering a default option for defined contribution automatic enrolment pension schemes | author=Staff | date=May 2011 | publisher=[[Department for Work and Pensions]] | location=United Kingdom | isbn=978-1-84947-604-1 }}</ref> |

||

A similar approach, called age-based asset allocation, was proposed by Mark Kantrowitz in the mid-1990s and was rapidly adopted by all 529 college savings plans.<ref>{{cite web | url=http://www.finaid.org/savings/strategies.phtml | title=Investment Strategies | author=Mark Kantrowitz | publisher=FinAid.org}}</ref> |

|||

| ⚫ | Target-date funds were invented by [[Donald Luskin]] and Larry Tint<ref>http://patents.justia.com/inventor/lawrence-g-tint</ref> of Wells Fargo Investment Advisors (later Barclays Global Investors), and first introduced in the early 1990s by [[ |

||

==Design== |

==Design== |

||

Target-date funds are aimed at people planning for retirement and have appeal because they offer a lifelong managed investment strategy |

Target-date funds are aimed at people planning for retirement and have appeal because they offer a lifelong managed investment strategy that should remain appropriate to an investor's risk profile even if left unreviewed. Research suggests that age is by far the most important determinant in setting an investment strategy, thus Target Date, or age-based funds are particularly attractive as default investment funds.<ref>[http://www.pensions-pmi.org.uk/images/stories/pdf/SISs/Investment/investment_insight1.pdf Alliance Bernstein: Target date funds explained]{{Dead link|date=June 2018 |bot=InternetArchiveBot |fix-attempted=no }}</ref> They do not offer a guaranteed return but offer a convenient multi-asset retirement savings strategy through a single outcome-oriented fund.<ref>[https://www.sec.gov/investor/alerts/tdf.htm SEC Investor Bulletin on TDFs]</ref> |

||

Target-date funds' asset allocation mix typically provides exposure to return-seeking assets, such as [[Equity (finance)#Equity investments|equities]], in early years when risk capacity is higher, and becomes increasingly conservative as time progresses with exposure switched progressively towards capital-preservation assets, such as government- and index-linked bonds.<ref>[http://www.targetdatefunds.co.uk/targetdatefunds-co-uk/_img/pdf/Media_ProfessionalInvestor_201206.pdf Target Date Funds: will the UK follow the American revolution]</ref> |

Target-date funds' asset allocation mix typically provides exposure to return-seeking assets, such as [[Equity (finance)#Equity investments|equities]], in early years when risk capacity is higher, and becomes increasingly conservative as time progresses with exposure switched progressively towards capital-preservation assets, such as government- and index-linked bonds.<ref>[http://www.targetdatefunds.co.uk/targetdatefunds-co-uk/_img/pdf/Media_ProfessionalInvestor_201206.pdf Target Date Funds: will the UK follow the American revolution]</ref> |

||

| Line 14: | Line 18: | ||

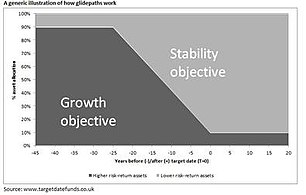

The speed with which a target date fund de-risks its asset allocation is known in the industry as the "glide-path", using the analogy of an airplane (the fund, presumably) coming in for a landing (the landing being, presumably, arriving at the Target Date with the appropriately low-risk mix of underlying assets). |

The speed with which a target date fund de-risks its asset allocation is known in the industry as the "glide-path", using the analogy of an airplane (the fund, presumably) coming in for a landing (the landing being, presumably, arriving at the Target Date with the appropriately low-risk mix of underlying assets). |

||

By taking a managed, or stochastic, approach to de-risking the fund, target-date funds offer a higher level of both technical and fiduciary care than earlier lifestyling techniques that rely on an automated, or deterministic, approach.<ref> |

By taking a managed, or stochastic, approach to de-risking the fund, target-date funds offer a higher level of both technical and fiduciary care than earlier lifestyling techniques that rely on an automated, or deterministic, approach.<ref>{{Cite web |url=http://www.griffith.edu.au/__data/assets/pdf_file/0007/132694/2009-02-dynamic-lifecycle-strategies-for-target-date-retirement-funds.pdf |title=Dynamic Lifecycle Strategies for Target Date Retirement Funds – Basu, Byrne & Drew (2009) |access-date=2012-07-19 |archive-url=https://web.archive.org/web/20170706052915/https://www.griffith.edu.au/__data/assets/pdf_file/0007/132694/2009-02-dynamic-lifecycle-strategies-for-target-date-retirement-funds.pdf |archive-date=2017-07-06 |url-status=dead }}</ref><ref>[http://professoral.edhec.com/servlet/com.univ.collaboratif.utils.LectureFichiergw?ID_FICHIER=1328885973702 From Deterministic to Stochastic Life-Cycle Investing: Implications for the Design of Improved Forms of Target Date Funds – Martellini & Milhau (2010)]</ref> |

||

The theoretical underpinnings to glidepath design are based on combining modern portfolio theory, with the theory of "Human Capital", the [[present value]] of expected future earnings.<ref>[http://corporate.morningstar.com/ib/documents/MethodologyDocuments/IBBAssociates/LifetimeAssetAllocations_new.pdf Ibbotson Associates Research Paper: Lifetime Asset Allocations: Methodologies for Target Maturity Funds]</ref> |

The theoretical underpinnings to glidepath design are based on combining modern portfolio theory, with the theory of "Human Capital", the [[present value]] of expected future earnings.<ref>[http://corporate.morningstar.com/ib/documents/MethodologyDocuments/IBBAssociates/LifetimeAssetAllocations_new.pdf Ibbotson Associates Research Paper: Lifetime Asset Allocations: Methodologies for Target Maturity Funds]</ref> |

||

==The Glidepath== |

==The Glidepath== |

||

The strategic asset allocation model over time is known as the 'glidepath' illustrating how an investment strategy becomes increasingly conservative over time towards the target date. An example of a glidepath for a selection of savings strategies for the UK market is shown |

The strategic asset allocation model over time is known as the '' glidepath '' illustrating how an investment strategy becomes increasingly conservative over time towards the target date. An example of a glidepath for a selection of savings strategies for the UK market is shown in the above graphic. Generally, each fund's managements provide different glidepaths depending upon the end requirement of each client (a lump sum for withdrawal or an income producing portfolio for income drawdown), in terms of different target dates. |

||

==Nudge and behavioral economics== |

==Nudge and behavioral economics== |

||

| Line 26: | Line 30: | ||

According to 2016 research study of retirement plan participants, 74% of respondents would like to see more socially responsible investments in their retirement plan offerings and most (78%) believe it is important to make the world a better place while growing their personal assets.<ref>[http://www.businesswire.com/news/home/20170228005470/en/Natixis-Global-Asset-Management-Launches-Industry%E2%80%99s-ESG Natixis Global Asset Management Launches Industry’s First ESG Target-Date Funds]</ref> |

According to 2016 research study of retirement plan participants, 74% of respondents would like to see more socially responsible investments in their retirement plan offerings and most (78%) believe it is important to make the world a better place while growing their personal assets.<ref>[http://www.businesswire.com/news/home/20170228005470/en/Natixis-Global-Asset-Management-Launches-Industry%E2%80%99s-ESG Natixis Global Asset Management Launches Industry’s First ESG Target-Date Funds]</ref> |

||

A 2016 Survey of Defined Contribution Plan Participants found that 71% of millennial-age investors would be |

A 2016 Survey of Defined Contribution Plan Participants found that 71% of millennial-age investors would be "more willing to contribute to their retirement plan if they knew their investments were doing social good". The survey also finds 84% of millennials want their "investments to reflect their personal values" and 77% want more socially responsible investments in their retirement planning.<ref>[http://www.barrons.com/articles/here-come-the-first-sustainable-target-date-funds-1482868271 Here Come the First Sustainable Target-Date Funds]</ref><ref>[https://ngam.natixis.com/us/resources/2016-survey-of-defined-contribution-plan-participants 2016 Survey of Defined Contribution Plan Participants (.pdf)]</ref> |

||

== |

==TDFs in the United States== |

||

In the |

In the US, the use of Target Date Funds accelerated from 2006 onwards with the introduction of automatic-enrollment pensions legislation, where the convenience of a single 'fund for life' made them the most popular type of default strategy. Since that, time TDF assets under management have grown more than 10x reaching $763 billion at end 2015.<ref>[Morningstar (US)]</ref> As of March 2020, assets in target-date mutual funds and collective investment trusts (CITs) totaled approximately $1.9 trillion.<ref>{{Cite web|last=Kephart|first=Jason|date=12 May 2020|title=The Best Target-Date Series|url=https://www.morningstar.com/articles/983199/the-best-target-date-series|archive-url=|archive-date=|access-date=2020-07-28|website=Morningstar, Inc.|language=en}}</ref> At the end of 2020, target-date assets in CITs reached $1.18 trillion according to data from Morningstar. Target-date mutual funds held $1.57 trillion.<ref>{{Cite web|last=Hallez|first=Emile|date=2021-03-18|title=Target-date assets favoring CITs, now at 43%, report finds|url=https://www.investmentnews.com/target-date-assets-cits-morningstar-204119|access-date=2021-03-26|website=InvestmentNews|language=en-US}}</ref><ref>{{Cite web|last1=Kephart|first1=Jason|last2=Dziubinski|first2=Susan|date=March 22, 2021|title=3 Key Developments in the Target-Date Landscape|url=https://www.morningstar.com/articles/1028826/3-key-developments-in-the-target-date-landscape|access-date=2021-03-26|website=Morningstar.com|language=en}}</ref> |

||

[[File:Target Date Funds AUM $bn (US).jpg|thumbnail|TDF growth in the US from 2000]] |

[[File:Target Date Funds AUM $bn (US).jpg|thumbnail|TDF growth in the US from 2000]] |

||

| ⚫ | |||

==Largest TDF Managers in the USA== |

|||

| ⚫ | |||

S&P Target Date Indices<ref>{{Cite web |url=http://us.spindices.com/index-family/strategy/asset-allocation |title=S&P Target Date Index Home Page |access-date=2014-10-22 |archive-url=https://web.archive.org/web/20141020213658/http://us.spindices.com/index-family/strategy/asset-allocation |archive-date=2014-10-20 |url-status=dead }}</ref> |

|||

| ⚫ | |||

| ⚫ | |||

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government [[Thrift Savings Plan]]), Principal Funds, Wells Fargo Advantage, American Century, and Northern Trust. |

|||

| ⚫ | |||

==TDFs in the United Kingdom== |

|||

| ⚫ | In the UK, the use of Target Date Funds is gaining traction, with the first launch in 2003, and current{{when|date=September 2024}} AUM estimated to be approximately £4.0bn.<ref>[http://www.defaqto.com/adviser/insights/How-Target-Date-Funds-can-help-simplify-the-savings-journey Defaqto: Introductory Guide to Target Date Funds/]{{deadlink|date=September 2024}}</ref> This is expected to increase with the advent of automatic enrolment pensions legislation.{{when|date=September 2024}} |

||

==UK TDF Assets Under Management== |

|||

Major TDF managers in the UK include: |

|||

| ⚫ | In the UK, the use of Target Date Funds is gaining traction, with the first launch in 2003, and current AUM estimated to be approximately £4.0bn.<ref>[http://www.defaqto.com/adviser/insights/How-Target-Date-Funds-can-help-simplify-the-savings-journey Defaqto: Introductory Guide to Target Date Funds/]</ref> |

||

==List of TDF Providers in the UK== |

|||

Retail: Architas BirthStar (managed by AllianceBernstein), Fidelity |

Retail: Architas BirthStar (managed by AllianceBernstein), Fidelity |

||

Institutional: AllianceBernstein, BirthStar, BlackRock, Fidelity, JPMorgan, NEST, State Street Global Advisers |

Institutional: AllianceBernstein, BirthStar, BlackRock, Fidelity, JPMorgan, NEST, State Street Global Advisers |

||

==Use of TDFs by pension schemes in the UK== |

|||

According to independent research, TDFs are expected to grow from a low base to 17% of all UK Defined Contribution (DC) default assets by 2023.<ref>[Spence Johnson, Morningstar Investment Conference, May 2014]</ref> |

|||

Multi-employer pensions schemes (also known as 'master trusts') are amongst the early adopters of Target Date Funds in the UK market. |

Multi-employer pensions schemes (also known as 'master trusts') are amongst the early adopters of Target Date Funds in the UK market. |

||

BlackRock Master Trust: BlackRock Lifepath Target Date Funds<ref>[http://www.investmenteurope.net/investment-europe/news/2277173/blackrock-extends-access-for-pension-schemes-to-targetdate-funds Investment Europe: BlackRock extends access for pension schemes to Target Date Funds]</ref> |

BlackRock Master Trust: BlackRock Lifepath Target Date Funds<ref>[http://www.investmenteurope.net/investment-europe/news/2277173/blackrock-extends-access-for-pension-schemes-to-targetdate-funds Investment Europe: BlackRock extends access for pension schemes to Target Date Funds]</ref> |

||

Carey Workplace Pension Trust: BirthStar Target Date Funds<ref>[http://www.careygroup.gg/files/managed/brochure_-_the_carey_workplace_pension_trust_-_pdf.PDF Carey Workplace Pension Scheme]</ref> |

Carey Workplace Pension Trust: BirthStar Target Date Funds<ref>[http://www.careygroup.gg/files/managed/brochure_-_the_carey_workplace_pension_trust_-_pdf.PDF Carey Workplace Pension Scheme]{{Dead link|date=June 2018 |bot=InternetArchiveBot |fix-attempted=no }}</ref> |

||

Intelligent Money: IM Optimum Portfolios<ref> |

[[Intelligent Money]]: IM Optimum Portfolios<ref>{{cite web |url=http://www.intelligentmoney.com/ |title=Home |website=intelligentmoney.com}}</ref> Intelligent Money provides Target Date Portfolios (rather than Funds). |

||

| ⚫ | |||

==TDF Benchmarks in the US== |

|||

| ⚫ | |||

S&P Target Date Indices<ref>[http://us.spindices.com/index-family/strategy/asset-allocation S&P Target Date Index Home Page]</ref> |

|||

| ⚫ | |||

| ⚫ | |||

| ⚫ | Lighthouse Pensions Trust: BirthStar Target Date Funds<ref>[https://archive.today/20140605064000/http://www.corporate-adviser.com/news-and-analysis/latest-news/lighthouse-launches-master-trust-with-birthstar-tdfs/2006043.article Corporate Adviser: Lighthouse launches master trust with BirthStar TDFs]</ref> |

||

==TDF Benchmarks in the UK== |

|||

Target Date Benchmarks in the UK are: |

Target Date Benchmarks in the UK are: |

||

| Line 73: | Line 72: | ||

FTSE UK DC Benchmarks<ref>[http://www.ftseglobalmarkets.com/news/ftse-launches-new-benchmarks-for-uk-dc-pensions-market.html FTSE Global Markets report]</ref> |

FTSE UK DC Benchmarks<ref>[http://www.ftseglobalmarkets.com/news/ftse-launches-new-benchmarks-for-uk-dc-pensions-market.html FTSE Global Markets report]</ref> |

||

== |

==Controversy== |

||

The funds are not without their critics, who point to the unexpected volatility of some near-dated target-date funds in the [[financial crisis of 2007–2008]], suggesting they were not as conservatively positioned as their name would imply.<ref>[https://www.usnews.com/money/blogs/Fund-Observer/2009/10/30/target-date-funds-go-under-the-microscope Target-Date Funds Go Under the Microscope]</ref> In response to this, the SEC and DoL hosted a joint hearing on Examining Target Date Funds in June 2009,<ref>[http://corporate.morningstar.com/us/documents/MediaMentions/IbbotsonSEC_DOJ_Target-DateHearingCommentary.pdf Ibbotson's reaction to the Joint SEC DOL Target-Date Fund Hearing]</ref> which found that while target-date funds were generally a welcome innovation, disclosure had to be improved to ensure investors were fully aware of a target-date fund glidepath, which may differ from manager to manager. The rules on disclosures for target-date funds were published by the SEC in 2010.<ref>[https://www.sec.gov/news/press/2010/2010-103.htm SEC Proposes New Measures to Help Investors in Target Date Funds]</ref> |

The funds are not without their critics, who point to the unexpected volatility of some near-dated target-date funds in the [[financial crisis of 2007–2008]], suggesting they were not as conservatively positioned as their name would imply.<ref>[https://www.usnews.com/money/blogs/Fund-Observer/2009/10/30/target-date-funds-go-under-the-microscope Target-Date Funds Go Under the Microscope]</ref> While this is expected in the earlier phases of [[capital accumulation]],<ref>{{Cite web |last=Wilson |first=John |date=2022-11-25 |title=What is a target-date retirement fund? |url=https://cleverbanker.ca/what-is-a-target-date-retirement-fund/ |access-date=2022-11-25 |website=Clever Banker |language=en-CA}}</ref> it was unexpected at the money-market and bond stage of near-dated funds. In response to this, the SEC and DoL hosted a joint hearing on Examining Target Date Funds in June 2009,<ref>[http://corporate.morningstar.com/us/documents/MediaMentions/IbbotsonSEC_DOJ_Target-DateHearingCommentary.pdf Ibbotson's reaction to the Joint SEC DOL Target-Date Fund Hearing]</ref> which found that while target-date funds were generally a welcome innovation, disclosure had to be improved to ensure investors were fully aware of a target-date fund glidepath, which may differ from manager to manager. The rules on disclosures for target-date funds were published by the SEC in 2010.<ref>[https://www.sec.gov/news/press/2010/2010-103.htm SEC Proposes New Measures to Help Investors in Target Date Funds]</ref> |

||

==See also== |

==See also== |

||

| Line 84: | Line 83: | ||

*[[Behavioral economics]] |

*[[Behavioral economics]] |

||

*[[Exchange-traded fund]] |

*[[Exchange-traded fund]] |

||

*[[Balanced fund]] |

|||

*[[Stock fund]] |

*[[Stock fund]] |

||

*[[Bond fund]] |

*[[Bond fund]] |

||

*[[Money fund]] |

*[[Money fund]] |

||

*[[Income fund]] |

*[[Income fund]] |

||

*[[Intelligent Money]] |

|||

*[[Lifestyling]] |

*[[Lifestyling]] |

||

| Line 96: | Line 93: | ||

{{DEFAULTSORT:Target Date Fund}} |

{{DEFAULTSORT:Target Date Fund}} |

||

[[Category:Investment]] |

[[Category:Investment funds]] |

||

[[Category:Funds]] |

|||

Latest revision as of 23:51, 18 September 2024

A target date fund (TDF), also known as a lifecycle fund, dynamic-risk fund, or age-based fund, is a collective investment scheme, often a mutual fund or a collective trust fund, designed to provide a simple investment solution through a portfolio whose asset allocation mix becomes more conservative as the target date (usually retirement) approaches.[1]

History

[edit]Target-date funds were invented by Donald Luskin and Larry Tint[2] of Wells Fargo Investment Advisors (later Barclays Global Investors(BGI)), and first introduced in the early 1990s by BGI.[3] Their popularity in the US increased significantly in recent years due in part to the auto-enrollment legislation Pension Protection Act of 2006 that created the need for safe-harbor type Qualifying Default Investment Alternatives, such as target-date funds, for 401(k) savings plans. With the UK enacting auto-enrollment legislation in 2012, target-date funds are used by the National Employment Savings Trust (NEST), and are expected to become increasingly popular as their design should satisfy the DWP's eligible default fund criteria.[4]

A similar approach, called age-based asset allocation, was proposed by Mark Kantrowitz in the mid-1990s and was rapidly adopted by all 529 college savings plans.[5]

Design

[edit]Target-date funds are aimed at people planning for retirement and have appeal because they offer a lifelong managed investment strategy that should remain appropriate to an investor's risk profile even if left unreviewed. Research suggests that age is by far the most important determinant in setting an investment strategy, thus Target Date, or age-based funds are particularly attractive as default investment funds.[6] They do not offer a guaranteed return but offer a convenient multi-asset retirement savings strategy through a single outcome-oriented fund.[7]

Target-date funds' asset allocation mix typically provides exposure to return-seeking assets, such as equities, in early years when risk capacity is higher, and becomes increasingly conservative as time progresses with exposure switched progressively towards capital-preservation assets, such as government- and index-linked bonds.[8]

The speed with which a target date fund de-risks its asset allocation is known in the industry as the "glide-path", using the analogy of an airplane (the fund, presumably) coming in for a landing (the landing being, presumably, arriving at the Target Date with the appropriately low-risk mix of underlying assets).

By taking a managed, or stochastic, approach to de-risking the fund, target-date funds offer a higher level of both technical and fiduciary care than earlier lifestyling techniques that rely on an automated, or deterministic, approach.[9][10]

The theoretical underpinnings to glidepath design are based on combining modern portfolio theory, with the theory of "Human Capital", the present value of expected future earnings.[11]

The Glidepath

[edit]The strategic asset allocation model over time is known as the glidepath illustrating how an investment strategy becomes increasingly conservative over time towards the target date. An example of a glidepath for a selection of savings strategies for the UK market is shown in the above graphic. Generally, each fund's managements provide different glidepaths depending upon the end requirement of each client (a lump sum for withdrawal or an income producing portfolio for income drawdown), in terms of different target dates.

Nudge and behavioral economics

[edit]Target Date Funds are commonly used as default funds as they make it easier for savers to select a savings strategy. This reduces the risk of inferior outcomes that behavioral tendencies might create.

According to 2016 research study of retirement plan participants, 74% of respondents would like to see more socially responsible investments in their retirement plan offerings and most (78%) believe it is important to make the world a better place while growing their personal assets.[12]

A 2016 Survey of Defined Contribution Plan Participants found that 71% of millennial-age investors would be "more willing to contribute to their retirement plan if they knew their investments were doing social good". The survey also finds 84% of millennials want their "investments to reflect their personal values" and 77% want more socially responsible investments in their retirement planning.[13][14]

TDFs in the United States

[edit]In the US, the use of Target Date Funds accelerated from 2006 onwards with the introduction of automatic-enrollment pensions legislation, where the convenience of a single 'fund for life' made them the most popular type of default strategy. Since that, time TDF assets under management have grown more than 10x reaching $763 billion at end 2015.[15] As of March 2020, assets in target-date mutual funds and collective investment trusts (CITs) totaled approximately $1.9 trillion.[16] At the end of 2020, target-date assets in CITs reached $1.18 trillion according to data from Morningstar. Target-date mutual funds held $1.57 trillion.[17][18]

The main Target Date Benchmarks in the US are:

S&P Target Date Indices[19] Dow Jones Target Date Indices[20] Morningstar Lifetime Allocation Indexes[21]

Major TDF managers in the United States include Fidelity, Vanguard, T. Rowe Price, BlackRock (which manages the "Lifecycle Funds" – the target-date funds within the US Government Thrift Savings Plan), Principal Funds, Wells Fargo Advantage, American Century, and Northern Trust.

Note that the actual sizes of the books of different managers are difficult to estimate, as many hold assets in vehicles other than mutual funds. Northern Trust, for example, uses Collective Trust Funds (CTFs), which typically do not figure in Morningstar or Bloomberg estimates of AUM.

TDFs in the United Kingdom

[edit]In the UK, the use of Target Date Funds is gaining traction, with the first launch in 2003, and current[when?] AUM estimated to be approximately £4.0bn.[22] This is expected to increase with the advent of automatic enrolment pensions legislation.[when?]

Major TDF managers in the UK include:

Retail: Architas BirthStar (managed by AllianceBernstein), Fidelity

Institutional: AllianceBernstein, BirthStar, BlackRock, Fidelity, JPMorgan, NEST, State Street Global Advisers

Multi-employer pensions schemes (also known as 'master trusts') are amongst the early adopters of Target Date Funds in the UK market.

BlackRock Master Trust: BlackRock Lifepath Target Date Funds[23]

Carey Workplace Pension Trust: BirthStar Target Date Funds[24]

Intelligent Money: IM Optimum Portfolios[25] Intelligent Money provides Target Date Portfolios (rather than Funds).

Lighthouse Pensions Trust: BirthStar Target Date Funds[26]

Target Date Benchmarks in the UK are:

FTSE UK DC Benchmarks[27]

Controversy

[edit]The funds are not without their critics, who point to the unexpected volatility of some near-dated target-date funds in the financial crisis of 2007–2008, suggesting they were not as conservatively positioned as their name would imply.[28] While this is expected in the earlier phases of capital accumulation,[29] it was unexpected at the money-market and bond stage of near-dated funds. In response to this, the SEC and DoL hosted a joint hearing on Examining Target Date Funds in June 2009,[30] which found that while target-date funds were generally a welcome innovation, disclosure had to be improved to ensure investors were fully aware of a target-date fund glidepath, which may differ from manager to manager. The rules on disclosures for target-date funds were published by the SEC in 2010.[31]

See also

[edit]- Defined contribution plan

- 401(k)

- 529 plan

- Nudge theory

- Behavioral economics

- Exchange-traded fund

- Stock fund

- Bond fund

- Money fund

- Income fund

- Lifestyling

References

[edit]- ^ Lemke, Thomas P. (2013). "§2:125". ERISA for Money Managers. Thomson West. ISBN 9780314612618.

- ^ "Lawrence G. Tint Inventions, Patents and Patent Applications – Justia Patents Search".

- ^ "Industry's First Target-Date Fund Celebrates 15 Years Since Groundbreaking Launch" (Press release). Barclays Global Investors. 7 Nov 2008 – via Marketwired.

- ^ Staff (May 2011). Guidance for offering a default option for defined contribution automatic enrolment pension schemes (PDF). United Kingdom: Department for Work and Pensions. ISBN 978-1-84947-604-1.

- ^ Mark Kantrowitz. "Investment Strategies". FinAid.org.

- ^ Alliance Bernstein: Target date funds explained[permanent dead link]

- ^ SEC Investor Bulletin on TDFs

- ^ Target Date Funds: will the UK follow the American revolution

- ^ "Dynamic Lifecycle Strategies for Target Date Retirement Funds – Basu, Byrne & Drew (2009)" (PDF). Archived from the original (PDF) on 2017-07-06. Retrieved 2012-07-19.

- ^ From Deterministic to Stochastic Life-Cycle Investing: Implications for the Design of Improved Forms of Target Date Funds – Martellini & Milhau (2010)

- ^ Ibbotson Associates Research Paper: Lifetime Asset Allocations: Methodologies for Target Maturity Funds

- ^ Natixis Global Asset Management Launches Industry’s First ESG Target-Date Funds

- ^ Here Come the First Sustainable Target-Date Funds

- ^ 2016 Survey of Defined Contribution Plan Participants (.pdf)

- ^ [Morningstar (US)]

- ^ Kephart, Jason (12 May 2020). "The Best Target-Date Series". Morningstar, Inc. Retrieved 2020-07-28.

- ^ Hallez, Emile (2021-03-18). "Target-date assets favoring CITs, now at 43%, report finds". InvestmentNews. Retrieved 2021-03-26.

- ^ Kephart, Jason; Dziubinski, Susan (March 22, 2021). "3 Key Developments in the Target-Date Landscape". Morningstar.com. Retrieved 2021-03-26.

- ^ "S&P Target Date Index Home Page". Archived from the original on 2014-10-20. Retrieved 2014-10-22.

- ^ Dow Jones Target Date Indices Home Page

- ^ Morningstar Lifetime Allocation Indices Home Page

- ^ Defaqto: Introductory Guide to Target Date Funds/[dead link]

- ^ Investment Europe: BlackRock extends access for pension schemes to Target Date Funds

- ^ Carey Workplace Pension Scheme[permanent dead link]

- ^ "Home". intelligentmoney.com.

- ^ Corporate Adviser: Lighthouse launches master trust with BirthStar TDFs

- ^ FTSE Global Markets report

- ^ Target-Date Funds Go Under the Microscope

- ^ Wilson, John (2022-11-25). "What is a target-date retirement fund?". Clever Banker. Retrieved 2022-11-25.

- ^ Ibbotson's reaction to the Joint SEC DOL Target-Date Fund Hearing

- ^ SEC Proposes New Measures to Help Investors in Target Date Funds