Wachovia: Difference between revisions

fix poor reading of sources on AML/KYC violations and clearly state the amount of laundered money. |

→2007–2009 financial crisis: url updated (journalnow.com) |

||

| (14 intermediate revisions by 12 users not shown) | |||

| Line 7: | Line 7: | ||

| caption = |

| caption = |

||

| type = [[Public company|Public]] |

| type = [[Public company|Public]] |

||

| fate = [[Mergers and acquisitions|Acquired]] by [[Wells Fargo]]<ref>{{Cite web|last=Mukunda|first=Gautam|title=Persistence Is Overrated—Why Learning Is The Hallmark Of Great Crisis Leadership|url=https://www.forbes.com/sites/gautammukunda/2020/06/18/persistence-is-overrated--why-learning-is-the-hallmark-of-great-crisis-leadership/|access-date=2020-06-30|website=Forbes|language=en}}</ref> |

|||

| traded_as = {{NYSE was|WB}} |

| traded_as = {{NYSE was|WB}} |

||

| foundation = {{start date and age|1879|6|16}} |

| foundation = {{start date and age|1879|6|16}} |

||

| defunct = {{End date and age|December 31, 2008}} (as an independent corporation)<br /> {{End date and age|October 15, 2011}} (as a brand) |

| defunct = {{End date and age|December 31, 2008}} (as an independent corporation)<br /> {{End date and age|October 15, 2011}} (as a brand) |

||

| |

| successor = [[Wells Fargo]]<ref name="WFC">{{cite web |title=Wells Fargo Completes Wachovia Purchase |publisher=Wells Fargo |date=2008-12-31 |url=http://markets.financialcontent.com/mi.charlotte/news/read?GUID=7565492 |access-date=2009-01-01 }}</ref> |

||

| industry = [[Financial services]] |

| industry = [[Financial services]] |

||

| location = [[Charlotte, North Carolina]], U.S. |

| location = [[Charlotte, North Carolina]], U.S. |

||

| Line 18: | Line 19: | ||

}} |

}} |

||

'''Wachovia''' was a diversified [[financial services]] company based in [[Charlotte, North Carolina]]. Before its acquisition by [[Wells Fargo and Company]] in 2008, Wachovia was the fourth-largest [[bank holding company]] in the United States, based on total assets.<ref>{{cite news|last1=Alvarez|first1=Scott G.|title=The Acquisition of Wachovia Corporation by Wells Fargo & Company| url= https://www.federalreserve.gov/newsevents/testimony/alvarez20100901a.htm|access-date=6 February 2018|work=Testimony Before the Financial Crisis Inquiry Commission, Washington, D.C.|publisher=Board of Governors of the Federal Reserve System|date=1 September 2010}}</ref> Wachovia provided a broad range of banking, [[asset management]], [[wealth management]], and corporate and [[investment banking]] products and services. |

'''Wachovia''' was a diversified [[financial services]] company based in [[Charlotte, North Carolina]]. Before its acquisition by [[Wells Fargo and Company]] in 2008, Wachovia was the fourth-largest [[bank holding company]] in the United States, based on total assets.<ref>{{cite news|last1=Alvarez|first1=Scott G.|title=The Acquisition of Wachovia Corporation by Wells Fargo & Company| url= https://www.federalreserve.gov/newsevents/testimony/alvarez20100901a.htm|access-date=6 February 2018|work=Testimony Before the Financial Crisis Inquiry Commission, Washington, D.C.|publisher=Board of Governors of the Federal Reserve System|date=1 September 2010}}</ref> Wachovia provided a broad range of banking, [[asset management]], [[wealth management]], and corporate and [[investment banking]] products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and [[Washington, D.C.]], with locations from [[Connecticut]] to [[Florida]] and west to [[California]].<ref name="facts">{{cite web |title=Wachovia Company Facts |publisher=Wachovia |date=2007-04-16 |url=http://www.wachovia.com/inside/page/0,,132_148,00.html |access-date=2007-06-14 }}</ref> Wachovia provided global services through more than 40 offices around the world. |

||

The acquisition of Wachovia by Wells Fargo was completed on December 31, 2008, after a government-forced sale to avoid Wachovia's failure. The Wachovia brand was absorbed into the Wells Fargo brand in a process that lasted three years.<ref name="WFC">{{cite web |title=Wells Fargo Completes Wachovia Purchase |publisher=Wells Fargo |date=2008-12-31 |url=http://markets.financialcontent.com/mi.charlotte/news/read?GUID=7565492 |access-date=2009-01-01 }}</ref> On October 15, 2011, the |

The acquisition of Wachovia by Wells Fargo was completed on December 31, 2008, after a government-forced sale to avoid Wachovia's failure. The Wachovia brand was absorbed into the Wells Fargo brand in a process that lasted three years.<ref name="WFC">{{cite web |title=Wells Fargo Completes Wachovia Purchase |publisher=Wells Fargo |date=2008-12-31 |url=http://markets.financialcontent.com/mi.charlotte/news/read?GUID=7565492 |access-date=2009-01-01 }}</ref> On October 15, 2011, the final Wachovia branches were converted to Wells Fargo.<ref name="Wachovia conversion">{{cite news |title=Farewell to Wachovia: The transition to Wells Fargo |publisher=Charlotte Business Journal |date=2011-10-15 |url=http://www.bizjournals.com/charlotte/feature/farewell-to-wachovia-the-transition.html |first=Adam |last=O'Daniel}}</ref> |

||

==Business lines== |

==Business lines== |

||

| Line 28: | Line 29: | ||

The company was organized into four divisions: General Bank (retail, small business, and commercial customers), Wealth Management (high-net-worth, personal trust, and insurance business), Capital Management (asset management, retirement, and retail brokerage services), and Corporate and Investment Bank (capital markets, investment banking, and financial advisory). |

The company was organized into four divisions: General Bank (retail, small business, and commercial customers), Wealth Management (high-net-worth, personal trust, and insurance business), Capital Management (asset management, retirement, and retail brokerage services), and Corporate and Investment Bank (capital markets, investment banking, and financial advisory). |

||

It served retail brokerage clients under the name [[Wachovia Securities]] nationwide as well as in six [[Latin America]]n countries, and investment banking clients in selected industries nationwide.<ref>{{cite web |url=http://www.richmond-finance.com/issue1_wachovia.asp |title=Wachovia Securities |access-date=2010-03-27 |url-status=dead |archive-url=https://web.archive.org/web/20110313040747/http://www.richmond-finance.com/issue1_wachovia.asp |archive-date=2011-03-13 }}</ref> In 2009, Wachovia Securities was the first Wachovia business to be converted to the Wells Fargo brand, when the business became Wells Fargo Advisors. Calibre was an independent consultant that was hired by Wachovia for the Family Wealth Group to research managers. |

It served retail brokerage clients under the name [[Wachovia Securities]] nationwide as well as in six [[Latin America]]n countries, and investment banking clients in selected industries nationwide.<ref>{{cite web |url=http://www.richmond-finance.com/issue1_wachovia.asp |title=Wachovia Securities |access-date=2010-03-27 |url-status=dead |archive-url=https://web.archive.org/web/20110313040747/http://www.richmond-finance.com/issue1_wachovia.asp |archive-date=2011-03-13 }}</ref> In 2009, Wachovia Securities was the first Wachovia business to be converted to the Wells Fargo brand, when the business became Wells Fargo Advisors. Calibre was an independent consultant that was hired by Wachovia for the Family Wealth Group to research managers. The group no longer uses Calibre.<ref name="Calibre">{{cite web |title=Calibre Wealth Management |publisher=Wachovia |date=2009-01-01 |url=https://www.calibre.com/foundation/v/index.jsp?vgnextoid=1f0a354e20007110VgnVCM1000003f0c1872RCRD&vgnextfmt=default |access-date=2009-01-01 }}</ref> |

||

The company's corporate and institutional capital markets and investment banking groups operated under the Wachovia Securities brand, while its asset management group operated under the [[Evergreen Investments]] brand until 2010, when the Evergreen fund family merged with Wells Fargo Advantage Funds, and institutional and high-net-worth products merged with Wells Capital Management and its affiliates. |

The company's corporate and institutional capital markets and investment banking groups operated under the Wachovia Securities brand, while its asset management group operated under the [[Evergreen Investments]] brand until 2010, when the Evergreen fund family merged with Wells Fargo Advantage Funds, and institutional and high-net-worth products merged with Wells Capital Management and its affiliates. |

||

Wachovia's [[private equity]] arm operated as [[Wachovia Capital Partners]].<ref>{{cite web|url=http://www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_view&newsId=20100324005248&newsLang=en|title=Wachovia Capital Partners Becomes Independent Private Equity Firm Pamlico Capital|website=Businesswire.com|access-date=5 November 2017}}</ref> |

Wachovia's [[private equity]] arm operated as [[Wachovia Capital Partners]].<ref>{{cite web|url=http://www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_view&newsId=20100324005248&newsLang=en|title=Wachovia Capital Partners Becomes Independent Private Equity Firm Pamlico Capital|website=Businesswire.com|access-date=5 November 2017}}</ref> Additionally, the [[asset-based lending]] group operated as Wachovia Capital Finance.<ref>{{cite web |url=https://www.wellsfargo.com/press/2009/20091214_WFCapitalFinance |title=Wells Fargo - News Releases |access-date=2010-03-27 |url-status=dead |archive-url=https://web.archive.org/web/20140406010417/https://www.wellsfargo.com/press/2009/20091214_WFCapitalFinance |archive-date=2014-04-06 }}</ref> |

||

===Origin of corporate name=== |

===Origin of corporate name=== |

||

| Line 45: | Line 46: | ||

The bank merged with First National Bank and Trust Company of [[Asheville, North Carolina]], in 1958 to become First Union National Bank of North Carolina. First Union Corporation was incorporated in 1967. |

The bank merged with First National Bank and Trust Company of [[Asheville, North Carolina]], in 1958 to become First Union National Bank of North Carolina. First Union Corporation was incorporated in 1967. |

||

By the 1990s, it had grown into a Southern regional powerhouse in a strategy mirroring its longtime rival on Tryon Street in Charlotte, [[North Carolina National Bank|NCNB]] (later [[NationsBank]] and now [[Bank of America]]). |

By the 1990s, it had grown into a Southern regional powerhouse in a strategy mirroring its longtime rival on Tryon Street in Charlotte, [[North Carolina National Bank|NCNB]] (later [[NationsBank]] and now [[Bank of America]]). In 1995, however, it acquired First Fidelity Bancorporation of [[Newark, New Jersey]]; at one stroke becoming a major player in the Northeast. Its Northeastern footprint grew even larger in 1998, when it acquired [[CoreStates Financial Corporation]] of [[Philadelphia]]. One of CoreStates' predecessors, the [[Bank of North America]], had been the first bank proposed, chartered and incorporated in America on December 31, 1781. A former Bank of North America branch in Philadelphia remains in operation today as a Wells Fargo branch |

||

===Wachovia=== |

===Wachovia=== |

||

| Line 51: | Line 52: | ||

[[File:Wachovia Loan And Trust Company Building.jpg|right|thumb|200px|The first Wachovia Loan And Trust Company Building, located in [[Winston-Salem, North Carolina|Winston-Salem]].]] |

[[File:Wachovia Loan And Trust Company Building.jpg|right|thumb|200px|The first Wachovia Loan And Trust Company Building, located in [[Winston-Salem, North Carolina|Winston-Salem]].]] |

||

Wachovia Corporation began on June 16, 1879, in Winston-Salem, North Carolina as the Wachovia National Bank. |

Wachovia Corporation began on June 16, 1879, in Winston-Salem, North Carolina, as the Wachovia National Bank. The bank was co-founded by James Alexander Gray and William Lemly.<ref>{{cite web |url=http://www.wellsfargohistory.com/states/NorthCarolina.html |title=Wells Fargo History Services - Our History |access-date=2011-06-02 |url-status=dead |archive-url=https://web.archive.org/web/20110718025206/http://www.wellsfargohistory.com/states/NorthCarolina.html |archive-date=2011-07-18 }}</ref> In 1911, the bank merged with Wachovia Loan and [[Trust company|Trust Company]], "the largest trust company between [[Baltimore]] and [[New Orleans]]",<ref>{{cite news|title=Better, bigger and greater|last=Craver|first=Richard|work=[[Winston-Salem Journal]]|date=2013-05-08|page=A1}}</ref> which had been founded on June 15, 1893. Wachovia grew to become one of the largest banks in the Southeast partly on the strength of its accounts from the [[R.J. Reynolds Tobacco Company]], which was also headquartered in Winston-Salem.<ref name="barbarians">{{cite book |

||

|url=https://books.google.com/books?id=8rVQ6wKWdaYC |

|url=https://books.google.com/books?id=8rVQ6wKWdaYC |

||

|publisher=[[HarperCollins]] |

|publisher=[[HarperCollins]] |

||

|year=2003|page=40 |

|year=2003|page=40 |

||

|title=Barbarians at the Gate |first=Bryan |last=Burrough|isbn=9780060536350 |

|title=Barbarians at the Gate |first=Bryan |last=Burrough|isbn=9780060536350 |

||

}}</ref> As of December 31, 1964, Wachovia was the first bank in the [[Southeastern United States]] to exceed $1 billion in resources.<ref>"Wachovia Is First In Southeast To Become 'Billion-Dollar Bank'," ''The Charlotte Observer'', January 7, 1965, p. 20A.</ref> |

|||

| ⚫ | |||

| ⚫ | On December 12, 1986, Wachovia purchased First Atlanta. Founded as Atlanta National Bank on September 14, 1865, and later renamed to First National Bank of Atlanta, this institution was the oldest national bank in Atlanta. This purchase made Wachovia one of the few companies with dual headquarters: one in Winston-Salem and one in Atlanta. In 1991, Wachovia entered the South Carolina market by acquiring South Carolina National Corporation,<ref>{{cite web|url=http://www.answers.com/topic/wachovia-bank-of-south-carolina-n-a|title=Answers - The Most Trusted Place for Answering Life's Questions|website=Answers.com|access-date=5 November 2017}}</ref> founded as the Bank of Charleston in 1834. In 1998, Wachovia acquired two Virginia-based banks, Jefferson National Bank and Central Fidelity Bank. In 1997, Wachovia acquired both 1st United Bancorp and American Bankshares Inc, giving its first entry into [[Florida]]. In 2000, Wachovia made its final purchase, which was Republic Security Bank. |

||

===Merger of First Union and Wachovia=== |

===Merger of First Union and Wachovia=== |

||

On April 16, 2001, First Union announced it would acquire Wachovia, through the exchange of approximately $13.4 billion in First Union stock. |

On April 16, 2001, First Union announced it would acquire Wachovia, through the exchange of approximately $13.4 billion in First Union stock. First Union offered two of its shares for each Wachovia share outstanding. The announcement was made by Wachovia chairman L.M. "Bud" Baker Jr. and First Union chairman [[G. Kennedy Thompson|Ken Thompson]]. Baker would become chairman of the merged bank, while Thompson would become president and CEO.<ref>[[Paul Nowell]], "U.S. bank giant looms". [[Associated Press]] via the''[[Montreal Gazette]]'', April 17, 2001: D7.</ref> First Union was the acquiring party and nominal survivor, and the merged bank was based in Charlotte and adopted First Union's corporate structure and retained First Union's pre-2001 stock price history. However, as an important part of the merger, the merged bank took Wachovia's name and stock ticker symbol; despite First Union technically being the surviving identity and acquiring party. |

||

This merger was viewed with great surprise by the financial press and security analysts.<ref name="surprise">{{cite web |title=Big Banking Merger: Investors, Beware |publisher=The Motley Fool |date=2001-04-16 |url=http://www.fool.com/news/foth/2001/foth010416.htm |access-date=2009-05-12 |archive-url=https://web.archive.org/web/20091106052336/http://www.fool.com/news/foth/2001/foth010416.htm |archive-date=2009-11-06 |url-status=dead }}</ref> While Wachovia had been viewed as an acquisition candidate after running into problems with earnings and credit quality in 2000, the suitor shocked analysts as many speculated that Wachovia would be sold to Atlanta-based [[SunTrust]].<ref name="firstunion">{{cite news |title=THE MARKETS: Market Place; First Union Pursues Wachovia, Making Offer of $13.1 Billion|work=The New York Times |date=2001-04-17 |url=https://www.nytimes.com/2001/04/17/business/markets-market-place-first-union-pursues-wachovia-making-offer-13.1-billion.html | access-date=2010-05-27}}</ref> |

This merger was viewed with great surprise by the financial press and security analysts.<ref name="surprise">{{cite web |title=Big Banking Merger: Investors, Beware |publisher=The Motley Fool |date=2001-04-16 |url=http://www.fool.com/news/foth/2001/foth010416.htm |access-date=2009-05-12 |archive-url=https://web.archive.org/web/20091106052336/http://www.fool.com/news/foth/2001/foth010416.htm |archive-date=2009-11-06 |url-status=dead }}</ref> While Wachovia had been viewed as an acquisition candidate after running into problems with earnings and credit quality in 2000, the suitor shocked analysts as many speculated that Wachovia would be sold to Atlanta-based [[SunTrust]].<ref name="firstunion">{{cite news |title=THE MARKETS: Market Place; First Union Pursues Wachovia, Making Offer of $13.1 Billion|work=The New York Times |date=2001-04-17 |url=https://www.nytimes.com/2001/04/17/business/markets-market-place-first-union-pursues-wachovia-making-offer-13.1-billion.html | access-date=2010-05-27}}</ref> |

||

| Line 67: | Line 70: | ||

On May 14, 2001, SunTrust announced a rival takeover bid for Wachovia, the first hostile takeover attempt in the banking sector in many years. In its effort to make the deal appeal to investors, SunTrust argued that it would provide a smoother transition than First Union and offered a higher cash price for Wachovia stock than First Union.<ref name="suntrust">{{cite news |title=SunTrust Makes Bid for Wachovia, Criticizing First Union's Offer |work=The New York Times |date=2001-05-15 |url=https://www.nytimes.com/2001/05/15/business/suntrust-makes-bid-for-wachovia-criticizing-first-union-s-offer.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> |

On May 14, 2001, SunTrust announced a rival takeover bid for Wachovia, the first hostile takeover attempt in the banking sector in many years. In its effort to make the deal appeal to investors, SunTrust argued that it would provide a smoother transition than First Union and offered a higher cash price for Wachovia stock than First Union.<ref name="suntrust">{{cite news |title=SunTrust Makes Bid for Wachovia, Criticizing First Union's Offer |work=The New York Times |date=2001-05-15 |url=https://www.nytimes.com/2001/05/15/business/suntrust-makes-bid-for-wachovia-criticizing-first-union-s-offer.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> |

||

Wachovia's board of directors rejected SunTrust's offer and supported the merger with First Union. SunTrust continued its hostile takeover attempt, leading to a bitter battle over the summer between SunTrust and First Union.<ref name="hostile">{{cite news |title=Market Place; First Union's Bid for Wachovia Gains Momentum |work=The New York Times |date=2001-06-01 |url=https://www.nytimes.com/2001/06/07/business/market-place-first-union-s-bid-for-wachovia-gains-momentum.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> Both banks increased their offers for Wachovia, took out newspaper ads, mailed letters to shareholders, and initiated court battles to challenge each other's takeover bids.<ref name="media">{{cite news |title=Rivals Waging A Media War Over Wachovia |work=The New York Times |date=2001-07-21 |url=https://www.nytimes.com/2001/07/21/business/rivals-waging-a-media-war-over-wachovia.html | access-date=2010-05-27}}</ref> On August 3, 2001, Wachovia shareholders approved the First Union deal, rejecting |

Wachovia's board of directors rejected SunTrust's offer and supported the merger with First Union. SunTrust continued its hostile takeover attempt, leading to a bitter battle over the summer between SunTrust and First Union.<ref name="hostile">{{cite news |title=Market Place; First Union's Bid for Wachovia Gains Momentum |work=The New York Times |date=2001-06-01 |url=https://www.nytimes.com/2001/06/07/business/market-place-first-union-s-bid-for-wachovia-gains-momentum.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> Both banks increased their offers for Wachovia, took out newspaper ads, mailed letters to shareholders, and initiated court battles to challenge each other's takeover bids.<ref name="media">{{cite news |title=Rivals Waging A Media War Over Wachovia |work=The New York Times |date=2001-07-21 |url=https://www.nytimes.com/2001/07/21/business/rivals-waging-a-media-war-over-wachovia.html | access-date=2010-05-27}}</ref> On August 3, 2001, Wachovia shareholders approved the First Union deal, rejecting SunTrust's attempts to elect a new board of directors for Wachovia and ending SunTrust's hostile takeover attempt.<ref name="wachoviavote">{{cite news |title=Wachovia Says Takeover Vote Went Its Way|work=The New York Times |date=2001-08-04 |url=https://www.nytimes.com/2001/08/04/business/wachovia-says-takeover-vote-went-its-way.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> |

||

Another complication concerned each bank's credit card division. In April 2001, Wachovia had agreed to sell its $8 billion credit card portfolio to [[Bank One]]. The cards, which would have still been branded as Wachovia, would have been issued through Bank One's First USA division. First Union had sold its credit card portfolio to [[MBNA]] in August 2000.<ref name="creditcard">{{cite news |title=THE MARKETS: Market Place; Questions over the sale of a credit card operation cloud a deal to merge banks.|work=The New York Times |date=2001-05-02 |url=https://www.nytimes.com/2001/05/02/business/markets-market-place-questions-over-sale-credit-card-operation-cloud-deal-merge.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> After entering into negotiations, the new Wachovia agreed to buy back its portfolio from Bank One in September 2001 and resell it to MBNA. Wachovia paid Bank One a $350 million [[termination fee]]. |

Another complication concerned each bank's credit card division. In April 2001, Wachovia had agreed to sell its $8 billion credit card portfolio to [[Bank One]]. The cards, which would have still been branded as Wachovia, would have been issued through Bank One's First USA division. First Union had sold its credit card portfolio to [[MBNA]] in August 2000.<ref name="creditcard">{{cite news |title=THE MARKETS: Market Place; Questions over the sale of a credit card operation cloud a deal to merge banks.|work=The New York Times |date=2001-05-02 |url=https://www.nytimes.com/2001/05/02/business/markets-market-place-questions-over-sale-credit-card-operation-cloud-deal-merge.html | first=Riva D. | last=Atlas | access-date=2010-05-27}}</ref> After entering into negotiations, the new Wachovia agreed to buy back its portfolio from Bank One in September 2001 and resell it to MBNA. Wachovia paid Bank One a $350 million [[termination fee]]. |

||

| Line 113: | Line 116: | ||

====Prudential Securities==== |

====Prudential Securities==== |

||

Wachovia Securities and the Prudential Securities Division of [[Prudential Financial, Inc.]] combined to form Wachovia Securities LLC on July 1, 2003. |

Wachovia Securities and the Prudential Securities Division of [[Prudential Financial, Inc.]] combined to form Wachovia Securities LLC on July 1, 2003. Wachovia owned a controlling 62% stake, while Prudential Financial retained the remaining 38%.<ref name=prudential/> At the time, the new firm had client assets of $532.1 billion, making it the nation's third largest full service retail brokerage firm, based on assets.<ref name=prudential>{{cite press release |title=Wachovia Corp. and Prudential Financial, Inc. Complete Combination of Brokerage Units |publisher=Wachovia Corporation |date=2003-07-01 |url=http://www.wachovia.com/inside/page/0,,134_307%5E906,00.html |access-date=2007-10-14 |archive-url=https://web.archive.org/web/20071022153547/http://wachovia.com/inside/page/0,,134_307%5E906,00.html |archive-date=2007-10-22 |url-status=dead }}</ref> |

||

====Metropolitan West Securities==== |

====Metropolitan West Securities==== |

||

| Line 119: | Line 122: | ||

====SouthTrust==== |

====SouthTrust==== |

||

On November 1, 2004, Wachovia completed the acquisition of [[Birmingham, Alabama]]-based [[SouthTrust|SouthTrust Corporation]], a transaction valued at $14.3 billion. The merger created the largest bank in the southeast United States, the fourth largest bank in terms of holdings, and the second largest in terms of number of branches. Integration was completed by the end of 2005.<ref>{{cite press release |title=Wachovia Completes SouthTrust Merger Integration |publisher=Wachovia Corporation |date=2005-12-05 |url=http://www.wachovia.com/inside/page/0,,134_307%5E1282,00.html |access-date=2007-10-14 |archive-url=https://web.archive.org/web/20071022153537/http://wachovia.com/inside/page/0,,134_307%5E1282,00.html |archive-date=2007-10-22 |url-status=dead }}</ref> |

On November 1, 2004, Wachovia completed the acquisition of [[Birmingham, Alabama]]-based [[SouthTrust (1887-2005)|SouthTrust Corporation]], a transaction valued at $14.3 billion. The merger created the largest bank in the southeast United States, the fourth largest bank in terms of holdings, and the second largest in terms of number of branches. Integration was completed by the end of 2005.<ref>{{cite press release |title=Wachovia Completes SouthTrust Merger Integration |publisher=Wachovia Corporation |date=2005-12-05 |url=http://www.wachovia.com/inside/page/0,,134_307%5E1282,00.html |access-date=2007-10-14 |archive-url=https://web.archive.org/web/20071022153537/http://wachovia.com/inside/page/0,,134_307%5E1282,00.html |archive-date=2007-10-22 |url-status=dead }}</ref> |

||

====Failed MBNA purchase==== |

====Failed MBNA purchase==== |

||

| Line 129: | Line 132: | ||

====Golden West Financial/World Savings Bank==== |

====Golden West Financial/World Savings Bank==== |

||

Wachovia agreed to purchase [[Golden West Financial]] for a little under $25.5 billion on May 7, 2006.<ref name=goldenwest/><ref>{{cite press release |title=Wachovia To Acquire Golden West Financial, Nation's Most Admired and 2nd Largest Savings Institution |publisher=Wachovia Corporation |date=2006-05-07 |url=http://www.wachovia.com/inside/page/0,,134_307%5E1344,00.html |access-date=2007-07-18 |archive-url=https://web.archive.org/web/20070808073551/http://www.wachovia.com/inside/page/0,,134_307%5E1344,00.html |archive-date=2007-08-08 |url-status=dead }}</ref> This acquisition gave Wachovia an additional 285-branch network spanning 10 states. |

Wachovia agreed to purchase [[Golden West Financial]] for a little under $25.5 billion on May 7, 2006.<ref name=goldenwest/><ref>{{cite press release |title=Wachovia To Acquire Golden West Financial, Nation's Most Admired and 2nd Largest Savings Institution |publisher=Wachovia Corporation |date=2006-05-07 |url=http://www.wachovia.com/inside/page/0,,134_307%5E1344,00.html |access-date=2007-07-18 |archive-url=https://web.archive.org/web/20070808073551/http://www.wachovia.com/inside/page/0,,134_307%5E1344,00.html |archive-date=2007-08-08 |url-status=dead }}</ref> This acquisition gave Wachovia an additional 285-branch network spanning 10 states. Wachovia greatly raised its profile in California, where Golden West held $32 billion in deposits and operated 123 branches.<ref name=goldenwest>{{cite news |title=Wachovia acquires Golden West Financial |agency=Associated Press |date=2006-05-08 |url=https://www.nbcnews.com/id/wbna12680868 |access-date=2007-07-18 }}</ref> |

||

Golden West, which operated branches under the name World Savings Bank, was the second largest [[savings and loan]] in the United States. The business was a small savings and loan in the San Francisco Bay area when it was purchased in 1963 for $4 million by [[Herb Sandler|Herbert and Marion Sandler]]. |

Golden West, which operated branches under the name World Savings Bank, was the second largest [[savings and loan]] in the United States. The business was a small savings and loan in the San Francisco Bay area when it was purchased in 1963 for $4 million by [[Herb Sandler|Herbert and Marion Sandler]]. Golden West specialized in [[option ARMs]] loans, marketed under the name "Pick-A-Pay." These loans gave the borrower a choice of payment plans, including the option to defer paying a part of the interest owed, which was then added onto the balance of the loan. In 2006, Golden West Financial was named the "Most Admired Company" in the [[Mortgage loan|mortgage]] services business by [[Fortune magazine]].<ref>{{cite news |title=Fortune: America's Most Admired Companies 2006 |publisher=CNNMoney.com |url=https://money.cnn.com/magazines/fortune/mostadmired/snapshots/574.html |access-date=2007-07-18 }}</ref> By the time Wachovia announced its acquisition, Golden West had over $125 billion in assets and 11,600 employees. By October 2, 2006, Wachovia had closed the acquisition of Golden West Financial Corporation. The Sandlers agreed to remain on the board at Wachovia.<ref name=goldenwest/> |

||

The Sandlers sold their firm at the top of the market, saying that they were growing older and wanted to devote themselves to philanthropy. A year earlier, in 2005, World Savings lending had started to slow, after more than quadrupling since 1998. Some current and former Wachovia officials said that the merger was agreed to within days, making it impossible to thoroughly vet the World Savings loan portfolio. They noted that the creditworthiness of World Savings borrowers edged down from 2004 to 2006, while Pick-A-Pay borrowers had credit scores well below the industry average for traditional loans. World Savings lending volume dipped again in 2006 shortly after the sale to Wachovia was initiated. In 2007, after the merger, World Savings, then known as Wachovia Mortgage began to attract more borrowers by taking a step that some regulators{{Who|date=April 2010}} frowned upon, and which the former World Savings management had resisted for years: it allowed borrowers to make monthly payments with an annual interest rate of just 1 percent. While Wachovia Mortgage continued to scrutinize borrowers' ability to manage increased payments, the move to rock-bottom rates lured customers whose financial reliability was more difficult to verify.<ref>{{cite news| url=https://www.nytimes.com/2008/12/25/business/25sandler.html?em=&pagewanted=print | work=The New York Times | title=Once Trusted Mortgage Pioneers, Now Scrutinized | first1=Michael | last1=Moss | first2=Geraldine | last2=Fabrikant | date=2008-12-25 | access-date=2010-05-27}}</ref> |

The Sandlers sold their firm at the top of the market, saying that they were growing older and wanted to devote themselves to philanthropy. A year earlier, in 2005, World Savings lending had started to slow, after more than quadrupling since 1998. Some current and former Wachovia officials said that the merger was agreed to within days, making it impossible to thoroughly vet the World Savings loan portfolio. They noted that the creditworthiness of World Savings borrowers edged down from 2004 to 2006, while Pick-A-Pay borrowers had credit scores well below the industry average for traditional loans. World Savings lending volume dipped again in 2006 shortly after the sale to Wachovia was initiated. In 2007, after the merger, World Savings, then known as Wachovia Mortgage began to attract more borrowers by taking a step that some regulators{{Who|date=April 2010}} frowned upon, and which the former World Savings management had resisted for years: it allowed borrowers to make monthly payments with an annual interest rate of just 1 percent. While Wachovia Mortgage continued to scrutinize borrowers' ability to manage increased payments, the move to rock-bottom rates lured customers whose financial reliability was more difficult to verify.<ref>{{cite news| url=https://www.nytimes.com/2008/12/25/business/25sandler.html?em=&pagewanted=print | work=The New York Times | title=Once Trusted Mortgage Pioneers, Now Scrutinized | first1=Michael | last1=Moss | first2=Geraldine | last2=Fabrikant | date=2008-12-25 | access-date=2010-05-27}}</ref> More than 70% of the Pick-A-Pay loans were made in California, Florida and Arizona, where home prices had declined severely. In 2009 ''[[New York Times]]'' reporter [[Floyd Norris]] called World Savings a "ticking timebomb" that created "zombie homeowners".<ref>{{cite news| url=https://www.nytimes.com/2009/05/15/business/economy/15norris.html?ref=business | work=The New York Times | title=A Bank Is Survived by Its Loans | first=Floyd | last=Norris | date=2009-05-15 | access-date=2010-05-27}}</ref> |

||

While Wachovia Chairman and CEO G. Kennedy "Ken" Thompson had described Golden West as a "crown jewel",<ref>{{cite web |url=http://www.businessweek.com/magazine/content/08_24/b4088026392160.htm |title=Wachovia: Golden West Wasn't Golden |access-date=2010-05-14 |url-status=dead |archive-url=https://web.archive.org/web/20081008052736/http://www.businessweek.com/magazine/content/08_24/b4088026392160.htm |archive-date=2008-10-08 }}</ref> investors did not react positively to the deal. Analysts said that Wachovia purchased Golden West at the peak of the US housing boom. Wachovia Mortgage's mortgage-related problems led to Wachovia suffering writedowns and losses that far exceeded the price paid in the acquisition, ending up in the fire-sale of Wachovia to [[Wells Fargo]].<ref>{{cite news| url=https://blogs.wsj.com/deals/2008/07/22/wachovia-golden-west-another-deal-from-hell/?mod=googlenews_wsj | work=The Wall Street Journal | title=Wachovia-Golden West: Another Deal From Hell? | first=Heidi N. | last=Moore | date=2008-07-22}}</ref> |

While Wachovia Chairman and CEO G. Kennedy "Ken" Thompson had described Golden West as a "crown jewel",<ref>{{cite web |url=http://www.businessweek.com/magazine/content/08_24/b4088026392160.htm |title=Wachovia: Golden West Wasn't Golden |access-date=2010-05-14 |url-status=dead |archive-url=https://web.archive.org/web/20081008052736/http://www.businessweek.com/magazine/content/08_24/b4088026392160.htm |archive-date=2008-10-08 }}</ref> investors did not react positively to the deal. Analysts said that Wachovia purchased Golden West at the peak of the US housing boom. Wachovia Mortgage's mortgage-related problems led to Wachovia suffering writedowns and losses that far exceeded the price paid in the acquisition, ending up in the fire-sale of Wachovia to [[Wells Fargo]].<ref>{{cite news| url=https://blogs.wsj.com/deals/2008/07/22/wachovia-golden-west-another-deal-from-hell/?mod=googlenews_wsj | work=The Wall Street Journal | title=Wachovia-Golden West: Another Deal From Hell? | first=Heidi N. | last=Moore | date=2008-07-22}}</ref> |

||

| Line 139: | Line 142: | ||

====A. G. Edwards==== |

====A. G. Edwards==== |

||

[[File:AGEdwardnewlogo.png|right]] |

[[File:AGEdwardnewlogo.png|right]] |

||

On May 31, 2007, Wachovia announced plans to purchase [[A. G. Edwards]] for $6.8 billion to create the United States' second largest retail brokerage firm.<ref>{{cite news |title=Wachovia to buy A.G. Edwards for $6.8B |publisher=CNNMoney.com |date=2007-05-31 |url=https://money.cnn.com/2007/05/31/news/companies/wachovia.reut/index.htm?postversion=2007053106 }} {{Dead link|date=August 2010|bot=RjwilmsiBot}}</ref> |

On May 31, 2007, Wachovia announced plans to purchase [[A. G. Edwards]] for $6.8 billion to create the United States' second largest retail brokerage firm.<ref>{{cite news |title=Wachovia to buy A.G. Edwards for $6.8B |publisher=CNNMoney.com |date=2007-05-31 |url=https://money.cnn.com/2007/05/31/news/companies/wachovia.reut/index.htm?postversion=2007053106 }} {{Dead link|date=August 2010|bot=RjwilmsiBot}}</ref> The acquisition closed on October 1, 2007. In early March 2008 Wachovia began to phase out the A.G. Edwards brand in favor of a unified [[Wachovia Securities]]. |

||

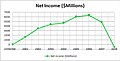

== Historical data (2000–2008) == |

== Historical data (2000–2008) == |

||

| Line 150: | Line 153: | ||

==2007–2009 financial crisis== |

==2007–2009 financial crisis== |

||

Exposed to risky loans, such as [[adjustable rate mortgages]] acquired during the acquisition of [[Golden West Financial]] in 2006, Wachovia began to experience heavy losses in its loan portfolios during the [[subprime mortgage crisis]].<ref name="wsj">{{cite |

Exposed to risky loans, such as [[adjustable rate mortgages]] acquired during the acquisition of [[Golden West Financial]] in 2006, Wachovia began to experience heavy losses in its loan portfolios during the [[subprime mortgage crisis]].<ref name="wsj">{{cite news | last=Craver | first=Richard | title=Wachovia dealt to Citigroup after 129 years as independent | publisher=[[Winston-Salem Journal]] | date=September 30, 2008 | url=https://journalnow.com/business/wachovia-dealt-to-citigroup-after-129-years-as-independent/article_e72d9a6d-7235-5af2-ae66-db83c906da36.html }}</ref><ref>{{cite web|title=Wachovia reportedly in talks with three suitors|publisher=Dow Jones|url=http://www.marketwatch.com/news/story/wachovia-reportedly-talks-three-suitors/story.aspx?guid=%7B27BDCA8E-4B3F-4793-A142-28EC29262506%7D|access-date=2009-05-01}}</ref> |

||

In the first quarter of 2007, Wachovia reported $2.3 billion in earnings, including acquisitions and divestitures.<ref>{{cite web|title=Wachovia Earns $2.30 Billion, EPS Up 10% to $1.20 in 1st Quarter 2007|publisher=Press release|url=http://www.wachovia.com/inside/page/0,,134_307%5E1461,00.html|access-date=2007-04-26|archive-url=https://web.archive.org/web/20070501024145/http://www.wachovia.com/inside/page/0%2C%2C134_307%5E1461%2C00.html|archive-date=2007-05-01|url-status=dead}}</ref> However, in the second quarter of 2008, Wachovia reported a much larger than anticipated $8.9 billion loss.<ref> |

In the first quarter of 2007, Wachovia reported $2.3 billion in earnings, including acquisitions and divestitures.<ref>{{cite web|title=Wachovia Earns $2.30 Billion, EPS Up 10% to $1.20 in 1st Quarter 2007|publisher=Press release|url=http://www.wachovia.com/inside/page/0,,134_307%5E1461,00.html|access-date=2007-04-26|archive-url=https://web.archive.org/web/20070501024145/http://www.wachovia.com/inside/page/0%2C%2C134_307%5E1461%2C00.html|archive-date=2007-05-01|url-status=dead}}</ref> However, in the second quarter of 2008, Wachovia reported a much larger than anticipated $8.9 billion loss.<ref> |

||

| Line 162: | Line 165: | ||

===Government intervention=== |

===Government intervention=== |

||

After Steel took over, he insisted that Wachovia would stay independent. However, its stock price plunged 27 percent on September 26 due to the seizure of [[Washington Mutual]] the previous night. On the same day, several businesses and institutional depositors withdrew money from their accounts in order to drop their balances below the $100,000 insured by the [[Federal Deposit Insurance Corporation]] (FDIC) |

After Steel took over, he insisted that Wachovia would stay independent. However, its stock price plunged 27 percent on September 26 due to the seizure of [[Washington Mutual]] the previous night. On the same day, several businesses and institutional depositors withdrew money from their accounts in order to drop their balances below the $100,000 insured by the [[Federal Deposit Insurance Corporation]] (FDIC)—an event known in banking circles as a "silent run". Ultimately, Wachovia lost a total of $5 billion in deposits that day—about one percent of the bank's total deposits.<ref>Rothacker, Rick. [http://www.charlotteobserver.com/news/article9016391.html "$5 billion withdrawn in one day in silent run"]. ''[[The Charlotte Observer]]'', 2008-10-11.</ref> The large outflow of deposits attracted the attention of the [[Office of the Comptroller of the Currency]], which regulates national banks. Federal regulators pressured Wachovia to put itself up for sale over the weekend. Had Wachovia failed, it would have been a severe drain on the FDIC's insurance fund due to its size (it operated one of the largest branch networks on the East Coast).<ref name="StOnge">St. Onge, Peter. [http://www.charlotteobserver.com/news/article9012821.html "Stunningly swift fall for Wachovia"]. ''[[The Charlotte Observer]]'', 2008-09-30.</ref><ref name="SilentRun">Rothacker, Rick; and Kerry Hall. [http://www.charlotteobserver.com/news/article9013478.html "Wachovia faced a 'silent' bank run"]. ''[[The Charlotte Observer]]'', 2008-10-02.</ref> |

||

As business halted for the weekend, Wachovia was already in FDIC-brokered talks with [[Citigroup]] and [[Wells Fargo]]; the latter company initially emerged as the frontrunner to acquire the ailing Wachovia's banking operations. Wells Fargo originally backed out of this particular deal due to concerns over Wachovia's commercial loans. With no deal in place as September 28 dawned, regulators were concerned that Wachovia |

As business halted for the weekend, Wachovia was already in FDIC-brokered talks with [[Citigroup]] and [[Wells Fargo]]; the latter company initially emerged as the frontrunner to acquire the ailing Wachovia's banking operations. Wells Fargo originally backed out of this particular deal due to concerns over Wachovia's commercial loans. With no deal in place as September 28 dawned, regulators were concerned that Wachovia would not have enough short-term funding to open for business the next day. In order to obtain enough liquidity to do business, banks usually depend on short-term loans to each other. However, the markets had been so battered by a credit crisis related to the housing bubble that banks were skittish about making such loans. Under the circumstances, regulators feared that if customers pulled out more money, Wachovia would not have enough liquidity to meet its obligations. This would have resulted in a failure dwarfing that of WaMu.<ref name="SilentRun"/> |

||

When FDIC Chairwoman [[Sheila Bair]] got word of Wachovia's situation, she initially decided to handle the situation the same way she handled WaMu a day earlier. Under this scenario, the Comptroller of the Currency would have seized Wachovia's banking assets (Wachovia Bank, N.A. and Wachovia Bank of Delaware, N.A.) and placed them under the receivership of the FDIC |

When FDIC Chairwoman [[Sheila Bair]] got word of Wachovia's situation, she initially decided to handle the situation the same way she handled WaMu a day earlier. Under this scenario, the Comptroller of the Currency would have seized Wachovia's banking assets (Wachovia Bank, N.A. and Wachovia Bank of Delaware, N.A.) and placed them under the receivership of the FDIC, which would have then sold the banking assets to the highest bidder. Bair called Steel on September 28 and told him that the FDIC would be auctioning off Wachovia's banking assets. Bair felt this would best protect the small banks. However, several federal regulators, led by [[Federal Reserve Bank of New York|New York Fed]] President [[Tim Geithner]], felt such a course would be politically unjustifiable so soon after WaMu's seizure.<ref name="GeithnerWSJ">{{cite news |url=https://blogs.wsj.com/economics/2009/08/04/geithner-has-blown-his-top-with-regulators-before/|work=The Wall Street Journal |title=Geithner Has Blown His Top with Regulators Before |date=2009-08-04}}</ref> |

||

After a round of mediation between Geithner and Bair, the FDIC declared that Wachovia was "[[too big to fail|systemically important]]" to the health of the economy, and thus could not be allowed to fail. |

After a round of mediation between Geithner and Bair, the FDIC declared that Wachovia was "[[too big to fail|systemically important]]" to the health of the economy, and thus could not be allowed to fail. It was the first time the FDIC had made such a determination since the passage of a 1991 law allowing the FDIC to handle large bank failures on short notice.<ref name="GeithnerWSJ"/> Later that night, in an FDIC-brokered deal, Citigroup agreed to buy Wachovia's retail banking operations in an "open bank" transfer of ownership. The transaction would have been facilitated by the FDIC, with the concurrence of the [[Board of Governors of the Federal Reserve]] and the [[Secretary of the Treasury]] in consultation with the President. The FDIC's open bank assistance procedures normally require the FDIC to find the cheapest way to rescue a failing bank. However, when a bank is deemed "systemically important," the FDIC is allowed to bypass this requirement. Steel had little choice but to agree, and the decision was announced on the morning of September 29, roughly 45 minutes before the markets opened.<ref name="SilentRun"/><ref name="FDIC-Wachovia-2008-09-29"> |

||

{{cite |

{{cite press release | title= Citigroup Inc. to Acquire Banking Operations of Wachovia: FDIC, Federal Reserve and Treasury Agree to Provide Open Bank Assistance to Protect Depositors | date= 2008-09-29 | publisher= [[Federal Deposit Insurance Corporation]] | url = http://www.fdic.gov/news/news/press/2008/pr08088.html | access-date = 2008-09-29}} |

||

</ref><ref name="Wachovia-Bank Subsidiary Divestitures-2008-09-29"> |

</ref><ref name="Wachovia-Bank Subsidiary Divestitures-2008-09-29"> |

||

{{cite |

{{cite press release | title= Wachovia Announces Bank Subsidiary Divestitures to Citigroup: Wachovia Corporation to become a focused leader in retail brokerage and asset management. | date= 2008-09-29 | url = https://www.sec.gov/Archives/edgar/data/36995/000119312508203286/dex99.htm|access-date = 2008-09-29 }} |

||

| ⚫ | |||

</ref><ref> |

|||

| ⚫ | |||

| ⚫ | |||

| ⚫ | |||

In its announcement, the FDIC stressed that Wachovia did not fail and was not placed into receivership. |

In its announcement, the FDIC stressed that Wachovia did not fail and was not placed into receivership. In addition, the FDIC said that the agency would absorb Citigroup's losses above $42 billion; Wachovia's loan portfolio was valued at $312 billion. In exchange for assuming this risk, the FDIC would receive $12 billion in preferred stock and warrants from Citigroup.<ref name="FDIC-Wachovia-2008-09-29"/><ref name="Bloomberg-2008-09-29"/><ref> |

||

{{cite news| url=https://www.nytimes.com/2008/09/30/business/30bank.html |

{{cite news| url=https://www.nytimes.com/2008/09/30/business/30bank.html | work=The New York Times | title=Citigroup Buys Bank Operations of Wachovia | first1=Eric | last1=Dash | date=2008-09-30 | access-date=2010-05-27}}</ref> The transaction would have been an all-stock transfer, with Wachovia Corporation stockholders to have received stock from Citigroup, valuing Wachovia stock at about one dollar per share for a total transaction value of about $2.16 billion. Citigroup would have also assumed Wachovia's senior and subordinated debt.<ref name="Bloomberg-2008-09-29"/><ref name="NYT-Dash-2008-09-29"/> Citigroup intended to sell ten billion dollars of new stock on the open market to recapitalize its purchased banking operations.<ref name="Bloomberg-2008-09-29"> |

||

{{cite news | first= Steve | last= Dickson |author2=David Mildenberg | title= Citigroup Agrees to Buy Wachovia's Banking Business (Update6) | date= 2008-09-29 | publisher= Bloomberg LLC | url = https://www.bloomberg.com/apps/news?pid=newsarchive&sid=agVqu_CIqFyw | work = Bloomberg.com | access-date = 2008-09-29}} |

{{cite news | first= Steve | last= Dickson |author2=David Mildenberg | title= Citigroup Agrees to Buy Wachovia's Banking Business (Update6) | date= 2008-09-29 | publisher= Bloomberg LLC | url = https://www.bloomberg.com/apps/news?pid=newsarchive&sid=agVqu_CIqFyw | work = Bloomberg.com | access-date = 2008-09-29}}</ref> The proposed closing date for the Wachovia purchase was by the end of the year, 2008.<ref name="Citigroup-Press Release-2008-09-29">{{cite press release | title= Citi and Wachovia Reach Agreement-in-Principle for Citi to Acquire Wachovia's Banking Operations in An FDIC-Assisted Transaction | date= 2008-09-29 | publisher= CitiGroup Press Room | url= http://www.citigroup.com/citi/press/2008/080929a.htm | access-date= 2008-09-29 | archive-date= 2008-10-02 | archive-url= https://web.archive.org/web/20081002045546/http://www.citigroup.com/citi/press/2008/080929a.htm | url-status= dead }}</ref> |

||

</ref> |

|||

The proposed closing date for the Wachovia purchase was by the end of the year, 2008.<ref name="Citigroup-Press Release-2008-09-29">{{cite news | title= Citi and Wachovia Reach Agreement-in-Principle for Citi to Acquire Wachovia's Banking Operations in An FDIC-Assisted Transaction | date= 2008-09-29 | publisher= CitiGroup | url= http://www.citigroup.com/citi/press/2008/080929a.htm | work= Press Room | access-date= 2008-09-29 | archive-date= 2008-10-02 | archive-url= https://web.archive.org/web/20081002045546/http://www.citigroup.com/citi/press/2008/080929a.htm | url-status= dead }}</ref> |

|||

Wachovia expected to continue as a publicly traded company, retaining its retail brokerage arm, Wachovia Securities and [[Evergreen Investments|Evergreen mutual funds]].<ref name="NYT-Dash-2008-09-29">{{cite news | first= Eric | last= Dash |author2=Andrew Ross Sorkin | title= Citigroup Buys Bank Operations of Wachovia | date= 2008-09-29 | url = https://www.nytimes.com/2008/09/30/business/30bank.html | work = [[The New York Times]] | access-date = 2008-09-29}}</ref> At the time, Wachovia Securities had 14,600 financial advisers and managed more than $1 trillion, third in the U.S. after [[Merrill Lynch]] and Citigroup's [[Smith Barney]].<ref name="Bloomberg-2008-09-29"/> |

Wachovia expected to continue as a publicly traded company, retaining its retail brokerage arm, Wachovia Securities and [[Evergreen Investments|Evergreen mutual funds]].<ref name="NYT-Dash-2008-09-29">{{cite news | first= Eric | last= Dash |author2=Andrew Ross Sorkin | title= Citigroup Buys Bank Operations of Wachovia | date= 2008-09-29 | url = https://www.nytimes.com/2008/09/30/business/30bank.html | work = [[The New York Times]] | access-date = 2008-09-29}}</ref> At the time, Wachovia Securities had 14,600 financial advisers and managed more than $1 trillion, third in the U.S. after [[Merrill Lynch]] and Citigroup's [[Smith Barney]].<ref name="Bloomberg-2008-09-29"/> |

||

The announcement drew some criticism from Wachovia stockholders who felt the dollar-per-share price was too cheap. |

The announcement drew some criticism from Wachovia stockholders who felt the dollar-per-share price was too cheap. Some of them planned to try to defeat the deal when it came up for shareholder approval. However, [[institutional investor]]s such as [[mutual fund]]s and [[pension fund]]s controlled 73 percent of Wachovia's stock; individual stockholders would have had to garner a significant amount of support from institutional shareholders to derail the sale. Also, several experts in corporate dealmaking told ''[[The Charlotte Observer]]'' that such a strategy is very risky since federal regulators helped broker the deal. One financial expert told the ''Observer'' that if Wachovia's shareholders voted the deal down, the OCC could have simply seized Wachovia and placed it into the receivership of the FDIC, which would then sell it to Citigroup. Had this happened, the shareholders of Wachovia risked being completely wiped out.<ref>Rexrode, Christina; and Jen (2008-10-02). [https://archive.today/20120723031317/http://www.charlotteobserver.com/408/story/226825.html "Shareholders talk of fighting Citi deal"]. ''[[The Charlotte Observer]]''.</ref> |

||

==Acquisition by Wells Fargo== |

==Acquisition by Wells Fargo== |

||

[[File:2011-11-22 Wells Fargo ATMs lit at night.jpg|thumb|A Wells Fargo branch in [[Durham, North Carolina]]; previously a Wachovia branch until 2011.]] |

[[File:2011-11-22 Wells Fargo ATMs lit at night.jpg|thumb|A Wells Fargo branch in [[Durham, North Carolina]]; previously a Wachovia branch until 2011.]] |

||

Though Citigroup was providing the liquidity that allowed Wachovia to continue to operate, [[Wells Fargo]] and Wachovia announced on October 3, 2008, that they had agreed to merge in an all-stock transaction requiring no government involvement. Wells Fargo announced it had agreed to acquire all of Wachovia for $15.1 billion in stock. Wachovia preferred the Wells Fargo deal because it would be worth more than the Citigroup deal and keep all of its businesses intact. |

Though Citigroup was providing the liquidity that allowed Wachovia to continue to operate, [[Wells Fargo]] and Wachovia announced on October 3, 2008, that they had agreed to merge in an all-stock transaction requiring no government involvement. Wells Fargo announced it had agreed to acquire all of Wachovia for $15.1 billion in stock. Wachovia preferred the Wells Fargo deal because it would be worth more than the Citigroup deal and keep all of its businesses intact. Also, there is far less overlap between the banks, as Wells Fargo is dominant in the [[Western United States|West]] and [[Midwestern United States|Midwest]] compared to the redundant footprint of Wachovia and [[Citibank]] along the [[East Coast of the United States|East Coast]]. Both companies' boards unanimously approved the merger on the night of October 2.<ref name="WellsFargo-PR-2008-10-03">{{cite news|title=WELLS FARGO, WACHOVIA AGREE TO MERGE|url=https://www.wellsfargo.com/downloads/pdf/press/WFC_WB_100308.pdf|date=2008-10-03|access-date=2008-10-03|publisher=[[Wells Fargo]]}}{{Dead link|date=May 2019 |bot=InternetArchiveBot |fix-attempted=yes }}</ref> |

||

Citigroup explored its legal options and demanded that Wachovia and Wells Fargo cease discussions, claiming that Wells Fargo engaged in "tortious interference" with an [[exclusivity agreement]] between Citigroup and Wachovia. |

Citigroup explored its legal options and demanded that Wachovia and Wells Fargo cease discussions, claiming that Wells Fargo engaged in "tortious interference" with an [[exclusivity agreement]] between Citigroup and Wachovia. That agreement states in part that until October 6, 2008 "Wachovia shall not, and shall not permit any of its subsidiaries or any of its or their respective officers, directors, [...] to [...] take any action to facilitate or encourage the submission of any Acquisition Proposal.".<ref>{{cite news |

||

|url=http://graphics8.nytimes.com/images/blogs/dealbook/wachovia_exclusivity.pdf |

|url=http://graphics8.nytimes.com/images/blogs/dealbook/wachovia_exclusivity.pdf |

||

|title=Wachovia-Citigroup Exclusivity Agreement |

|title=Wachovia-Citigroup Exclusivity Agreement |

||

| Line 206: | Line 206: | ||

|last=Dash |

|last=Dash |

||

|author2=Jonathan D. Glater |

|author2=Jonathan D. Glater |

||

}}</ref> |

}}</ref> This ruling was later overturned by Judge James M. McGuire of the [[New York Supreme Court, Appellate Division|Supreme Court of the State of New York, Appellate Division, First Department]], partly because he believed Ramos did not have the right to rule on the case in Connecticut.<ref name="nyt frenzy">{{cite news |

||

|url=https://www.nytimes.com/2008/10/06/business/06bank.html?bl&ex=1223438400&en=f895f0fd514c47fb&ei=5087%0A |

|url=https://www.nytimes.com/2008/10/06/business/06bank.html?bl&ex=1223438400&en=f895f0fd514c47fb&ei=5087%0A |

||

|title=Weekend Legal Frenzy Between Citigroup and Wells Fargo for Wachovia |

|title=Weekend Legal Frenzy Between Citigroup and Wells Fargo for Wachovia |

||

| Line 222: | Line 222: | ||

|date=2008-10-09 |

|date=2008-10-09 |

||

|access-date=2008-10-10 |

|access-date=2008-10-10 |

||

}} {{Dead link|date=October 2010|bot=H3llBot}}</ref> |

}} {{Dead link|date=October 2010|bot=H3llBot}}</ref> Wells Fargo settled this dispute with Citigroup Inc. for $100 Million on November 19, 2010.<ref> |

||

{{cite news |

{{cite news |

||

|url=https://www.wellsfargo.com/press/2010/20101119_Settlement |

|url=https://www.wellsfargo.com/press/2010/20101119_Settlement |

||

| Line 234: | Line 234: | ||

}} |

}} |

||

</ref> |

</ref> |

||

Citigroup may have been pressured by regulators to back out of the deal; Bair endorsed Wells Fargo's bid because it removed the FDIC from the picture. |

Citigroup may have been pressured by regulators to back out of the deal; Bair endorsed Wells Fargo's bid because it removed the FDIC from the picture. Geithner was furious, claiming that the FDIC's reversal would undermine the government's ability to quickly rescue failing banks. However, Geithner's colleagues at the Fed were not willing to take responsibility for selling Wachovia.<ref name="GeithnerWSJ"/> |

||

The Federal Reserve unanimously approved the merger with Wells Fargo on October 12, 2008.<ref>{{cite web |url=http://www.federalreserve.gov/newsevents/press/orders/20081012a.htm |title=FRB: Press Release – Approval of proposal by Wells Fargo & Company to acquire Wachovia Corporation |publisher=Federal Reserve Board |date=2008-10-12 |access-date=2008-10-12}}</ref> |

The Federal Reserve unanimously approved the merger with Wells Fargo on October 12, 2008.<ref>{{cite web |url=http://www.federalreserve.gov/newsevents/press/orders/20081012a.htm |title=FRB: Press Release – Approval of proposal by Wells Fargo & Company to acquire Wachovia Corporation |publisher=Federal Reserve Board |date=2008-10-12 |access-date=2008-10-12}}</ref> |

||

The combined company retained the Wells Fargo name, and was based in [[San Francisco]]. However, Charlotte remained as the headquarters for the combined company's East Coast banking operations, and Wachovia Securities remained in Charlotte{{Citation needed|date=November 2021}}<!-- Wachovia Securities was based in St. Louis. A quick internet search revealed to me that the subsidiary's successor, Wells Fargo Securities, is either based in San Francisco or St. Louis. I have found only contradictory evidence to the claim Wachovia Securities was based in Charlotte. -->. |

The combined company retained the Wells Fargo name, and was based in [[San Francisco]]. However, Charlotte remained as the headquarters for the combined company's East Coast banking operations, and Wachovia Securities remained in Charlotte{{Citation needed|date=November 2021}}<!-- Wachovia Securities was based in St. Louis. A quick internet search revealed to me that the subsidiary's successor, Wells Fargo Securities, is either based in San Francisco or St. Louis. I have found only contradictory evidence to the claim Wachovia Securities was based in Charlotte. -->. Three members of the Wachovia board joined the Wells Fargo board. The merger created the largest branch network in the United States. |

||

In filings unsealed two days before the merger approval in a New York federal court, Citigroup argued that its own deal was better for U.S. taxpayers and Wachovia shareholders. It said that it had exposed itself to "substantial economic risk" by stating its intent to rescue Wachovia after less than 72 hours of due diligence. Citigroup had obtained an exclusive agreement in order to protect itself.<ref>[http://www.bizjournals.com/jacksonville/stories/2008/10/13/daily6.html Filings outline demise of Citi-Wachovia deal]</ref> Wachovia suffered a $23.9 billion loss in the third quarter.<ref>{{cite news |

In filings unsealed two days before the merger approval in a New York federal court, Citigroup argued that its own deal was better for U.S. taxpayers and Wachovia shareholders. It said that it had exposed itself to "substantial economic risk" by stating its intent to rescue Wachovia after less than 72 hours of due diligence. Citigroup had obtained an exclusive agreement in order to protect itself.<ref>[http://www.bizjournals.com/jacksonville/stories/2008/10/13/daily6.html Filings outline demise of Citi-Wachovia deal]</ref> Wachovia suffered a $23.9 billion loss in the third quarter.<ref>{{cite news |

||

| Line 250: | Line 250: | ||

}}</ref> |

}}</ref> |

||

In September 2008, the [[Internal Revenue Service]] issued a notice providing tax breaks to companies that acquire troubled banks. |

In September 2008, the [[Internal Revenue Service]] issued a notice providing tax breaks to companies that acquire troubled banks. According to analysts, these tax breaks were worth billions of dollars to Wells Fargo. Vice Chairman Bill Thomas of the Financial Crisis Inquiry Commission indicated that these tax breaks may have been a factor in Wells Fargo's decision to purchase Wachovia.<ref>{{cite news| url=https://www.bloomberg.com/news/2010-09-01/former-wachovia-chief-steel-says-fdic-s-bair-sought-to-avert-systemic-risk.html | work=Bloomberg | first=David | last=Mildenberg | title=Wachovia Rescue Relied on 'Usurpation' of Tax Law, Thomas Says | date=2010-09-01}}</ref> |

||

Wells Fargo's purchase of Wachovia closed on December 31, 2008. |

Wells Fargo's purchase of Wachovia closed on December 31, 2008. By the time Wells Fargo completed the acquisition of Wachovia, the byline "A Wells Fargo company" was added to the logo. |

||

==Controversies== |

==Controversies== |

||

| Line 265: | Line 265: | ||

In April 2008, the ''[[Wall Street Journal]]'' reported that [[U.S. Attorney|federal prosecutors]] had initiated a probe into Wachovia and other U.S. banks for aiding drug [[money laundering]] by [[Mexican Drug War|Mexican]] and [[Illegal drug trade in Colombia|Colombia]]n money-transfer companies, also known as ''casas de cambio''. These companies help [[Mexican Americans|Mexican immigrants]] in the United States send [[remittance]]s back to family in Mexico, but it is widely known that they also present a significant money-laundering risk. However, not only is it a "lucrative industry" that is able to charge high fees, but Wachovia also viewed it as a way to gain a foothold in the [[Hispanic and Latino Americans|Hispanic]] banking market.<ref name="eperez">{{cite news|author1=Evan Perez|author2=Glenn R. Simpson|title=Wachovia Is Under Scrutiny In Latin Drug-Money Probe|url=https://www.wsj.com/articles/SB120917664876446995|access-date=6 February 2018|work=Wall Street Journal|date=26 April 2008|archive-url=https://archive.today/20180206123851/https://www.wsj.com/articles/SB120917664876446995|archive-date=6 February 2018|url-status=dead}}</ref> |

In April 2008, the ''[[Wall Street Journal]]'' reported that [[U.S. Attorney|federal prosecutors]] had initiated a probe into Wachovia and other U.S. banks for aiding drug [[money laundering]] by [[Mexican Drug War|Mexican]] and [[Illegal drug trade in Colombia|Colombia]]n money-transfer companies, also known as ''casas de cambio''. These companies help [[Mexican Americans|Mexican immigrants]] in the United States send [[remittance]]s back to family in Mexico, but it is widely known that they also present a significant money-laundering risk. However, not only is it a "lucrative industry" that is able to charge high fees, but Wachovia also viewed it as a way to gain a foothold in the [[Hispanic and Latino Americans|Hispanic]] banking market.<ref name="eperez">{{cite news|author1=Evan Perez|author2=Glenn R. Simpson|title=Wachovia Is Under Scrutiny In Latin Drug-Money Probe|url=https://www.wsj.com/articles/SB120917664876446995|access-date=6 February 2018|work=Wall Street Journal|date=26 April 2008|archive-url=https://archive.today/20180206123851/https://www.wsj.com/articles/SB120917664876446995|archive-date=6 February 2018|url-status=dead}}</ref> |

||

In March 2010, Wachovia admitted to having |

In March 2010, Wachovia admitted to having insufficient anti-money laundering controls on $378.4 billion of transfers between 2004 and 2007. The violations were described as "serious and systemic" and as the "largest violation of the Bank Secrecy Act".<ref name="bbweek"/><ref name="cyrus">{{cite news|last1=Sanati|first1=Cyrus|title=Money Laundering: The Drug Problem at Banks|url=https://dealbook.nytimes.com/2010/06/29/money-laundering-the-drug-problem-at-banks|access-date=6 February 2018| work= New York Times| date=29 June 2010}}</ref> The oversight violations allowed [[Mexican drug war|Mexican]] and [[Illegal drug trade in Colombia|Colombian drug cartels]] to launder at least $110 million.<ref name="bbweek">{{cite news|work=Businessweek |first= David| last= Voreacos |title=Wachovia to Pay $160 to End Money Laundering Probe |url= http://www.businessweek.com/news/2010-03-18/wachovia-to-pay-160-million-to-end-money-laundering-probe.html |url-status=dead |archive-url= https://web.archive.org/web/20100323010353/http://www.businessweek.com/news/2010-03-18/wachovia-to-pay-160-million-to-end-money-laundering-probe.html |archive-date=March 23, 2010 }}</ref> Wachovia negotiated a [[deferred prosecution]] agreement with the [[U.S. Department of Justice|Justice Department]] to resolve criminal charges for willfully failing to set up an effective anti-money-laundering program. It agreed to forfeit $110 million and pay a $50 million fine to the [[U.S. Treasury]]. |

||

Reports in ''[[Bloomberg Businessweek]]'' in June 2010<ref>{{cite news |author=Michael Smith |title=Banks Financing Mexico Gangs Admitted in Wells Fargo Deal|url=https://www.bloomberg.com/news/2010-06-29/banks-financing-mexico-s-drug-cartels-admitted-in-wells-fargo-s-u-s-deal.html| work =Bloomberg Businessweek|date=28 June 2010 |access-date = 1 September 2010}}</ref> and ''[[The Observer]]'' in April 2011 shed light on the extent to which Wachovia went to turn a blind eye, including by ignoring the warnings and [[suspicious activity report]]s (SARs) of its London-based director of anti-money-laundering.<ref>{{cite news |url=https://www.theguardian.com/world/2011/apr/03/us-bank-mexico-drug-gangs |title=How a big US bank laundered billions from Mexico's murderous drug gangs |first=Ed |last=Vulliamy |work=[[The Guardian]] |date=2 April 2012 |access-date=6 February 2018}}</ref> |

Reports in ''[[Bloomberg Businessweek]]'' in June 2010<ref>{{cite news |author=Michael Smith |title=Banks Financing Mexico Gangs Admitted in Wells Fargo Deal|url=https://www.bloomberg.com/news/2010-06-29/banks-financing-mexico-s-drug-cartels-admitted-in-wells-fargo-s-u-s-deal.html| work =Bloomberg Businessweek|date=28 June 2010 |access-date = 1 September 2010}}</ref> and ''[[The Observer]]'' in April 2011 shed light on the extent to which Wachovia went to turn a blind eye, including by ignoring the warnings and [[suspicious activity report]]s (SARs) of its London-based director of anti-money-laundering.<ref>{{cite news |url=https://www.theguardian.com/world/2011/apr/03/us-bank-mexico-drug-gangs |title=How a big US bank laundered billions from Mexico's murderous drug gangs |first=Ed |last=Vulliamy |work=[[The Guardian]] |date=2 April 2012 |access-date=6 February 2018}}</ref> |

||

| Line 284: | Line 284: | ||

{{Commons category|Wachovia Bank}} |

{{Commons category|Wachovia Bank}} |

||

* {{Official website|https://web.archive.org/*/www.wachovia.com}} (Archive) |

* {{Official website|https://web.archive.org/*/www.wachovia.com}} (Archive) |

||

*[http://biz.yahoo.com/ic/103/103806.html |

* [https://web.archive.org/web/20141018162316/http://biz.yahoo.com/ic/103/103806.html Wachovia Corporation Company Profile] at [[Yahoo! Finance]] |

||

{{Wells Fargo}} |

{{Wells Fargo}} |

||

| Line 291: | Line 291: | ||

{{Online brokerages}} |

{{Online brokerages}} |

||

[[Category: |

[[Category:1879 establishments in North Carolina]] |

||

[[Category:2008 mergers and acquisitions]] |

|||

| ⚫ | |||

[[Category:American companies established in 1879]] |

[[Category:American companies established in 1879]] |

||

[[Category:Banks |

[[Category:Banks based in North Carolina]] |

||

[[Category:Banks disestablished in 2008]] |

[[Category:Banks disestablished in 2008]] |

||

[[Category:Banks disestablished in 2011]] |

[[Category:Banks disestablished in 2011]] |

||

[[Category: |

[[Category:Banks established in 1879]] |

||

[[Category:1879 establishments in North Carolina]] |

|||

| ⚫ | |||

[[Category:Companies based in Charlotte, North Carolina]] |

[[Category:Companies based in Charlotte, North Carolina]] |

||

| ⚫ | |||

[[Category:Companies formerly listed on the New York Stock Exchange]] |

[[Category:Companies formerly listed on the New York Stock Exchange]] |

||

| ⚫ | |||

| ⚫ | |||

| ⚫ | |||

[[Category:Online brokerages]] |

[[Category:Online brokerages]] |

||

[[Category:Wells Fargo]] |

|||

[[Category:Wells Fargo legacy banks]] |

[[Category:Wells Fargo legacy banks]] |

||

| ⚫ | |||

| ⚫ | |||

Latest revision as of 15:10, 21 September 2024

| |

| Company type | Public |

|---|---|

| NYSE: WB | |

| Industry | Financial services |

| Founded | June 16, 1879 |

| Defunct | December 31, 2008 (as an independent corporation) October 15, 2011 (as a brand) |

| Fate | Acquired by Wells Fargo[1] |

| Successor | Wells Fargo[2] |

| Headquarters | Charlotte, North Carolina, U.S. |

| Products | Banking, Investments |

| Owner | Wells Fargo |

| Website | Archived official website at the Wayback Machine (archive index) |

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets.[3] Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California.[4] Wachovia provided global services through more than 40 offices around the world.

The acquisition of Wachovia by Wells Fargo was completed on December 31, 2008, after a government-forced sale to avoid Wachovia's failure. The Wachovia brand was absorbed into the Wells Fargo brand in a process that lasted three years.[2] On October 15, 2011, the final Wachovia branches were converted to Wells Fargo.[5]

Business lines

[edit]

Wachovia was the product of a 2001 merger between the original Wachovia Corporation, based in Winston-Salem, North Carolina, and Charlotte-based First Union Corporation.

The company was organized into four divisions: General Bank (retail, small business, and commercial customers), Wealth Management (high-net-worth, personal trust, and insurance business), Capital Management (asset management, retirement, and retail brokerage services), and Corporate and Investment Bank (capital markets, investment banking, and financial advisory).

It served retail brokerage clients under the name Wachovia Securities nationwide as well as in six Latin American countries, and investment banking clients in selected industries nationwide.[6] In 2009, Wachovia Securities was the first Wachovia business to be converted to the Wells Fargo brand, when the business became Wells Fargo Advisors. Calibre was an independent consultant that was hired by Wachovia for the Family Wealth Group to research managers. The group no longer uses Calibre.[7]

The company's corporate and institutional capital markets and investment banking groups operated under the Wachovia Securities brand, while its asset management group operated under the Evergreen Investments brand until 2010, when the Evergreen fund family merged with Wells Fargo Advantage Funds, and institutional and high-net-worth products merged with Wells Capital Management and its affiliates.

Wachovia's private equity arm operated as Wachovia Capital Partners.[8] Additionally, the asset-based lending group operated as Wachovia Capital Finance.[9]

Origin of corporate name

[edit]Wachovia (/wɑːˈkoʊviə/ wah-KOH-vee-ə) has its origins in the Latin form of the Austrian name Wachau.[4] When Moravian settlers arrived in Bethabara, North Carolina, in 1753, they gave this name to the land they acquired, because it resembled the Wachau valley along the Danube River.[4] The area formerly known as Wachovia now makes up most of Forsyth County, and the largest city is now Winston-Salem.

First Union

[edit]

First Union was founded as Union National Bank on June 2, 1908, a small banking desk in the lobby of a Charlotte hotel by H.M. Victor.

The bank merged with First National Bank and Trust Company of Asheville, North Carolina, in 1958 to become First Union National Bank of North Carolina. First Union Corporation was incorporated in 1967.

By the 1990s, it had grown into a Southern regional powerhouse in a strategy mirroring its longtime rival on Tryon Street in Charlotte, NCNB (later NationsBank and now Bank of America). In 1995, however, it acquired First Fidelity Bancorporation of Newark, New Jersey; at one stroke becoming a major player in the Northeast. Its Northeastern footprint grew even larger in 1998, when it acquired CoreStates Financial Corporation of Philadelphia. One of CoreStates' predecessors, the Bank of North America, had been the first bank proposed, chartered and incorporated in America on December 31, 1781. A former Bank of North America branch in Philadelphia remains in operation today as a Wells Fargo branch

Wachovia

[edit]

Wachovia Corporation began on June 16, 1879, in Winston-Salem, North Carolina, as the Wachovia National Bank. The bank was co-founded by James Alexander Gray and William Lemly.[10] In 1911, the bank merged with Wachovia Loan and Trust Company, "the largest trust company between Baltimore and New Orleans",[11] which had been founded on June 15, 1893. Wachovia grew to become one of the largest banks in the Southeast partly on the strength of its accounts from the R.J. Reynolds Tobacco Company, which was also headquartered in Winston-Salem.[12] As of December 31, 1964, Wachovia was the first bank in the Southeastern United States to exceed $1 billion in resources.[13]

On December 12, 1986, Wachovia purchased First Atlanta. Founded as Atlanta National Bank on September 14, 1865, and later renamed to First National Bank of Atlanta, this institution was the oldest national bank in Atlanta. This purchase made Wachovia one of the few companies with dual headquarters: one in Winston-Salem and one in Atlanta. In 1991, Wachovia entered the South Carolina market by acquiring South Carolina National Corporation,[14] founded as the Bank of Charleston in 1834. In 1998, Wachovia acquired two Virginia-based banks, Jefferson National Bank and Central Fidelity Bank. In 1997, Wachovia acquired both 1st United Bancorp and American Bankshares Inc, giving its first entry into Florida. In 2000, Wachovia made its final purchase, which was Republic Security Bank.

Merger of First Union and Wachovia

[edit]On April 16, 2001, First Union announced it would acquire Wachovia, through the exchange of approximately $13.4 billion in First Union stock. First Union offered two of its shares for each Wachovia share outstanding. The announcement was made by Wachovia chairman L.M. "Bud" Baker Jr. and First Union chairman Ken Thompson. Baker would become chairman of the merged bank, while Thompson would become president and CEO.[15] First Union was the acquiring party and nominal survivor, and the merged bank was based in Charlotte and adopted First Union's corporate structure and retained First Union's pre-2001 stock price history. However, as an important part of the merger, the merged bank took Wachovia's name and stock ticker symbol; despite First Union technically being the surviving identity and acquiring party.

This merger was viewed with great surprise by the financial press and security analysts.[16] While Wachovia had been viewed as an acquisition candidate after running into problems with earnings and credit quality in 2000, the suitor shocked analysts as many speculated that Wachovia would be sold to Atlanta-based SunTrust.[17]

The deal was met with skepticism and criticism. Analysts, remembering the problems with the CoreStates acquisition, were concerned about First Union's ability to merge with another large company. Winston-Salem's citizens and politicians suffered a blow to their civic pride because the merged company would be based in Charlotte. The city of Winston-Salem was concerned both by job losses and the loss of stature from losing a major corporate headquarters. First Union was concerned by the potential deposit attrition and customer loss in the city.[18] First Union responded to these concerns by placing the wealth management and Carolinas-region headquarters in Winston-Salem.

On May 14, 2001, SunTrust announced a rival takeover bid for Wachovia, the first hostile takeover attempt in the banking sector in many years. In its effort to make the deal appeal to investors, SunTrust argued that it would provide a smoother transition than First Union and offered a higher cash price for Wachovia stock than First Union.[19]