Robert Rubin: Difference between revisions

Monziguazini (talk | contribs) mNo edit summary Tag: Reverted |

Citation bot (talk | contribs) Added date. | Use this bot. Report bugs. | Suggested by Abductive | #UCB_toolbar |

||

| (32 intermediate revisions by 23 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|American |

{{Short description|American banking executive, lawyer, and government official}} |

||

{{About|the U.S economist and Secretary of the Treasury|the mathematician|Robert Joshua Rubin}} |

{{About|the U.S economist and Secretary of the Treasury|the mathematician|Robert Joshua Rubin}} |

||

{{Use mdy dates|date=August 2018}} |

{{Use mdy dates|date=August 2018}} |

||

| Line 34: | Line 34: | ||

| spouse = Judith Oxenberg |

| spouse = Judith Oxenberg |

||

| children = 2 |

| children = 2 |

||

| website = [https://www.robertrubin.com robertrubin.com] |

|||

| education = {{plainlist| |

| education = {{plainlist| |

||

* [[Harvard University]] ([[Bachelor of Arts|BA]]) |

* [[Harvard University]] ([[Bachelor of Arts|BA]]) |

||

| Line 41: | Line 42: | ||

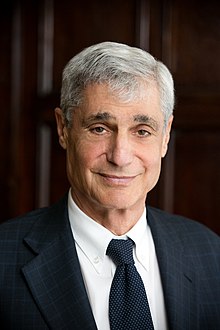

| caption = Rubin in 2014 |

| caption = Rubin in 2014 |

||

}} |

}} |

||

'''Robert Edward Rubin''' (born August 29, 1938) is an American retired banking executive, lawyer, and former government official. He served as the 70th [[United States Secretary of the Treasury]] during the [[Presidency of Bill Clinton|Clinton administration]]. Before his government service, he spent 26 years at [[Goldman Sachs]], eventually serving as a member of the board and co-chairman from 1990 to 1992. |

'''Robert Edward Rubin''' (born August 29, 1938) is an American retired banking executive, lawyer, and former [[Federal government of the United States|government]] official. He served as the 70th [[United States Secretary of the Treasury|U.S. Secretary of the Treasury]] during the [[Presidency of Bill Clinton|Clinton administration]]. Before his government service, he spent 26 years at [[Goldman Sachs]], eventually serving as a member of the board and co-chairman from 1990 to 1992. |

||

Rubin is credited as a force behind Clinton-era economic |

Rubin is credited as a force behind Clinton-era economic prosperity, including the [[Omnibus Budget Reconciliation Act of 1993|1993 Deficit Reduction Act]] and [[Balanced Budget Act of 1997]]. However, critics of Rubin have since argued that the bank-friendly policies he supported contributed to the [[financial crisis of 2007–2008]]. |

||

As of |

As of 2024, Rubin is active in several organizations, including as a co-founder of [[Hamilton Project|The Hamilton Project]], as co-chair emeritus of the [[Council on Foreign Relations]], and as a senior counselor at [[Centerview Partners]]. |

||

==Early life and education== |

==Early life and education== |

||

Rubin was born on August 29, 1938, in New York City<ref>{{Cite news|author= |

Rubin was born on August 29, 1938, in New York City<ref>{{Cite news |author= |date=2009-01-09 |title=TIMELINE: Rubin's career at Citigroup |language=en |work=Reuters |url=https://www.reuters.com/article/us-chronology-rubin-sb-idUSTRE5086XS20090109 |access-date=2020-09-29}}</ref> to Jewish parents Sylvia (née Seiderman) and Alexander Rubin.<ref>[https://query.nytimes.com/gst/fullpage.html?res=9501E1DF1F3AF936A25752C0A9619C8B63 Paid Notice - Deaths RUBIN, SYLVIA SEIDERMAN - Paid Death Notice - NYTimes.com]. ''[[New York Times]]'' (2007-01-15). Retrieved on 2013-07-16.</ref><ref>[https://books.google.com/books?id=FA4ohuvEPkcC&q=Sylvia+(Seiderman)+and+Alexander+Rubin Who's who in Finance and Industry - Google Books]. Books.google.ca. Retrieved on 2013-07-16.</ref> He moved to [[Miami Beach, Florida]], at an early age and graduated from [[Miami Beach Senior High School]].<ref>{{Cite web|date=December 8, 2003|title=The Larger-Than-Life Life of Robert Rubin|url=https://fortune.com/2016/03/13/robert-rubin-life/|access-date=2020-09-29|website=Fortune|language=en}}</ref><ref>{{Cite book|last=Zerivitz|first=Marcia Jo|url=https://books.google.com/books?id=w7q9DwAAQBAJ&q=%22robert+rubin%22+%22miami+beach+high+school%22&pg=PA6|title=Jews of Florida: Centuries of Stories|date=2020-01-06|publisher=Arcadia Publishing|isbn=978-1-4671-4253-3|language=en}}</ref> In 1960, Rubin graduated with a [[Bachelor of Arts]], ''[[summa cum laude]]'', in economics from [[Harvard College]].<ref name=":0">{{Cite news|date=July 2, 2012|title=Washington Post Live Robert Rubin|url=https://www.washingtonpost.com/postlive/robert-rubin/2012/07/02/gJQArDlADY_story.html}}</ref> He then attended [[Harvard Law School]] for three days before leaving to travel the world.<ref name="bbc 1999">{{cite news| url=http://news.bbc.co.uk/2/hi/business/342086.stm | work=BBC News | title=Robert Rubin, the man Wall Street trusts | date=May 12, 1999 | access-date=May 22, 2010}}</ref> He later attended the [[London School of Economics]] and received an [[Bachelor of Laws|LL.B.]] from [[Yale Law School]] in 1964.<ref name=":0" /> |

||

==Early career== |

==Early career== |

||

| Line 65: | Line 66: | ||

===Secretary of the Treasury=== |

===Secretary of the Treasury=== |

||

[[File:Portrait of Robert Rubin.jpg|thumb|Robert Rubin official Treasury portrait, 1999]] |

|||

Clinton nominated Rubin as Treasury secretary in December 1994. On January 10, 1995, Rubin was sworn in as the 70th United States Secretary of the Treasury after the U.S. Senate confirmed him in a 99-0 vote.<ref name="Wapo-RubinProfile">{{cite news |title=Robert E. Rubin: Treasury Secretary |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/rubin.htm |newspaper=[[The Washington Post]] |date=1998 |access-date=August 19, 2020}}</ref><ref name="Wapo-Chandler-950111">{{cite news |title=Rubin Wins Senate's Approval |last1=Chandler |first1=Clay |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/stories/rubin011195.htm |newspaper=[[The Washington Post]] |date=January 11, 1995 |access-date=September 9, 2020}}</ref> Rubin's tenure with the Clinton administration, especially as the head of Treasury, was marked by economic prosperity in the U.S. Rubin is credited as one of the main individuals behind U.S. economic growth, creating near full-employment and bullish stock markets while avoiding inflation.<ref name="bbc 1999"/> From the time he joined the White House until he announced his resignation from Treasury in 1999, U.S. unemployment fell from 6.9 percent to 4.3 percent; the U.S. budget went from a $255 billion deficit to a $70 billion surplus, and inflation fell.<ref name="BaltSun-Weisman-990513"/><ref>{{Cite web|last=Weisman|first=Jonathan|title=Rubin resigns post at Treasury; Wall Street wizard has helped guide the surging U.S. economy; Deputy picked as successor|url=https://www.baltimoresun.com/news/bs-xpm-1999-05-13-9905130102-story.html|access-date=2021-01-18|website=baltimoresun.com|language=en-US}}</ref> Rubin was succeeded in early July 1999 as Treasury secretary by his deputy, [[Lawrence Summers]].<ref name="cnn-1999">{{cite news |title=Treasury Secretary Rubin resigns |url=https://www.cnn.com/ALLPOLITICS/stories/1999/05/12/rubin/ |work=CNN |date=May 12, 1999 |access-date=August 24, 2020}}</ref> |

Clinton nominated Rubin as Treasury secretary in December 1994. On January 10, 1995, Rubin was sworn in as the 70th United States Secretary of the Treasury after the U.S. Senate confirmed him in a 99-0 vote.<ref name="Wapo-RubinProfile">{{cite news |title=Robert E. Rubin: Treasury Secretary |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/rubin.htm |newspaper=[[The Washington Post]] |date=1998 |access-date=August 19, 2020}}</ref><ref name="Wapo-Chandler-950111">{{cite news |title=Rubin Wins Senate's Approval |last1=Chandler |first1=Clay |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/stories/rubin011195.htm |newspaper=[[The Washington Post]] |date=January 11, 1995 |access-date=September 9, 2020}}</ref> Rubin's tenure with the Clinton administration, especially as the head of Treasury, was marked by economic prosperity in the U.S. Rubin is credited as one of the main individuals behind U.S. economic growth, creating near full-employment and bullish stock markets while avoiding inflation.<ref name="bbc 1999"/> From the time he joined the White House until he announced his resignation from Treasury in 1999, U.S. unemployment fell from 6.9 percent to 4.3 percent; the U.S. budget went from a $255 billion deficit to a $70 billion surplus, and inflation fell.<ref name="BaltSun-Weisman-990513"/><ref>{{Cite web|last=Weisman|first=Jonathan|title=Rubin resigns post at Treasury; Wall Street wizard has helped guide the surging U.S. economy; Deputy picked as successor|url=https://www.baltimoresun.com/news/bs-xpm-1999-05-13-9905130102-story.html|access-date=2021-01-18|website=baltimoresun.com|date=May 13, 1999 |language=en-US}}</ref> Rubin was succeeded in early July 1999 as Treasury secretary by his deputy, [[Lawrence Summers]].<ref name="cnn-1999">{{cite news |title=Treasury Secretary Rubin resigns |url=https://www.cnn.com/ALLPOLITICS/stories/1999/05/12/rubin/ |work=CNN |date=May 12, 1999 |access-date=August 24, 2020}}</ref> |

||

According to ''CNN Money'', Rubin was "one of the architects of the Clinton administration's economic policy, and is often credited—along with Federal Reserve Chairman [[Alan Greenspan]]—for the booming eight-year economic expansion, the second-longest in U.S. history".<ref name="CNN-Slud-990512">{{cite news |title=Treasury's Rubin resigns |last1=Slud |first1=Martha |last2=McMillan |first2=Alex |url=https://money.cnn.com/1999/05/12/markets/rubin/ |work=[[CNN Money]] |date=May 12, 1999 |access-date=August 28, 2020}}</ref> |

According to ''CNN Money'', Rubin was "one of the architects of the Clinton administration's economic policy, and is often credited—along with Federal Reserve Chairman [[Alan Greenspan]]—for the booming eight-year economic expansion, the second-longest in U.S. history".<ref name="CNN-Slud-990512">{{cite news |title=Treasury's Rubin resigns |last1=Slud |first1=Martha |last2=McMillan |first2=Alex |url=https://money.cnn.com/1999/05/12/markets/rubin/ |work=[[CNN Money]] |date=May 12, 1999 |access-date=August 28, 2020}}</ref> |

||

| Line 72: | Line 74: | ||

====1990s international crises==== |

====1990s international crises==== |

||

| ⚫ | |||

Upon being sworn into office as Treasury secretary in January 1995, Rubin was confronted with the [[Mexican peso crisis]], which threatened to result in Mexico [[Default (finance)|defaulting]] on its foreign obligations.<ref name="Brook-lustig-1997">{{cite news |title=Mexico in Crisis, the U.S. to the Rescue. The Financial Assistance Packages of 1982 and 1995 |last1=Lustig |first1=Nora |url=https://www.brookings.edu/articles/mexico-in-crisis-the-u-s-to-the-rescue-the-financial-assistance-packages-of-1982-and-1995/ |work=Brookings |date=January 1, 1997 |access-date=August 24, 2020}}</ref> President [[Bill Clinton]], with the advice of Rubin and Greenspan, provided $20 billion in U.S. [[loan guarantee]]s to the Mexican government through the [[Exchange Stabilization Fund]].<ref name="Cooper Ramo-Time-1999" /><ref name="Brook-lustig-1997"/><ref name="Sanger-times-1997">{{cite news |title=Mexico Repays Bailout by U.S. Ahead of Time |last1=Sanger |first1=David |url=https://www.nytimes.com/1997/01/16/business/mexico-repays-bailout-by-us-ahead-of-time.html |work=The New York Times |access-date=August 24, 2020}}</ref> Mexico recovered and the U.S. Treasury made a $580 million profit as a result of the loan agreement.<ref name="Sanger-times-1997"/><ref name="NYT-Broder-990513">{{cite news |title=Rubin Resigning as Treasury Secretary |last1=Broder |first1=John M. |last2=Sanger |first2=David E. |url=https://archive.nytimes.com/www.nytimes.com/library/financial/051399rubin-resign.html |work=[[The New York Times]] |date=May 13, 1999 |access-date=September 9, 2020}}</ref> |

Upon being sworn into office as Treasury secretary in January 1995, Rubin was confronted with the [[Mexican peso crisis]], which threatened to result in Mexico [[Default (finance)|defaulting]] on its foreign obligations.<ref name="Brook-lustig-1997">{{cite news |title=Mexico in Crisis, the U.S. to the Rescue. The Financial Assistance Packages of 1982 and 1995 |last1=Lustig |first1=Nora |url=https://www.brookings.edu/articles/mexico-in-crisis-the-u-s-to-the-rescue-the-financial-assistance-packages-of-1982-and-1995/ |work=Brookings |date=January 1, 1997 |access-date=August 24, 2020}}</ref> President [[Bill Clinton]], with the advice of Rubin and Greenspan, provided $20 billion in U.S. [[loan guarantee]]s to the Mexican government through the [[Exchange Stabilization Fund]].<ref name="Cooper Ramo-Time-1999" /><ref name="Brook-lustig-1997"/><ref name="Sanger-times-1997">{{cite news |title=Mexico Repays Bailout by U.S. Ahead of Time |last1=Sanger |first1=David |url=https://www.nytimes.com/1997/01/16/business/mexico-repays-bailout-by-us-ahead-of-time.html |work=The New York Times |access-date=August 24, 2020}}</ref> Mexico recovered and the U.S. Treasury made a $580 million profit as a result of the loan agreement.<ref name="Sanger-times-1997"/><ref name="NYT-Broder-990513">{{cite news |title=Rubin Resigning as Treasury Secretary |last1=Broder |first1=John M. |last2=Sanger |first2=David E. |url=https://archive.nytimes.com/www.nytimes.com/library/financial/051399rubin-resign.html |work=[[The New York Times]] |date=May 13, 1999 |access-date=September 9, 2020}}</ref> |

||

| Line 78: | Line 79: | ||

====Balanced budget agreement==== |

====Balanced budget agreement==== |

||

| ⚫ | |||

Early in the Clinton administration, Rubin touted a balanced budget and a strong dollar as a way for the Fed to lower interest rates.<ref name="CT-Goozner-990513">{{cite news |title=Rubin Turns Over The Reins |last1=Goozner |first1=Merrill |url=https://advance.lexis.com/enwiki/api/permalink/7f4abb01-5173-4ed4-9ef1-b71efefaefe6/?context=1519360 |work=[[Chicago Tribune]] |date=May 13, 1999 |access-date=September 1, 2020}}</ref> He also argued that a balanced federal budget's broad benefits to society outweighed concerns that one group could benefit more than others.<ref name="Wapo-Pearlstein-970504">{{cite news |title=Winners and Losers In a Balanced Budget |last1=Pearlstein |first1=Steven |last2=Chandler |first2=Clay |url=https://www.washingtonpost.com/wp-srv/politics/special/budget/stories/050497.htm |newspaper=[[The Washington Post]] |date=May 4, 1997 |access-date=September 1, 2020}}</ref> Rubin was the Clinton administration's chief negotiator with a Republican-controlled Congress on the balanced-budget deal.<ref name="BaltSun-Weisman-990513"/><ref name="AP-Crutsinger-990513">{{cite news |title=Treasury Secretary Rubin Plans To Step Down In July |last1=Crutsinger |first1=Martin |url=https://advance.lexis.com/enwiki/api/permalink/f01b4902-84af-45bb-99cf-57c21bd094ad/?context=1519360 |work=[[The Associated Press]] |date=May 13, 1999 |access-date=September 1, 2020}}</ref> The [[Balanced Budget Act of 1997]] has been referred to as the "capstone" of Rubin's tenure as Treasury secretary.<ref name="Rubin-CNN-1997">{{cite news |title=Robert Rubin |url=https://www.cnn.com/ALLPOLITICS/1997/gen/resources/players/rubin/ |work=CNN |date=1997 |access-date=August 31, 2020}}</ref> |

Early in the Clinton administration, Rubin touted a balanced budget and a strong dollar as a way for the Fed to lower interest rates.<ref name="CT-Goozner-990513">{{cite news |title=Rubin Turns Over The Reins |last1=Goozner |first1=Merrill |url=https://advance.lexis.com/enwiki/api/permalink/7f4abb01-5173-4ed4-9ef1-b71efefaefe6/?context=1519360 |work=[[Chicago Tribune]] |date=May 13, 1999 |access-date=September 1, 2020}}</ref> He also argued that a balanced federal budget's broad benefits to society outweighed concerns that one group could benefit more than others.<ref name="Wapo-Pearlstein-970504">{{cite news |title=Winners and Losers In a Balanced Budget |last1=Pearlstein |first1=Steven |last2=Chandler |first2=Clay |url=https://www.washingtonpost.com/wp-srv/politics/special/budget/stories/050497.htm |newspaper=[[The Washington Post]] |date=May 4, 1997 |access-date=September 1, 2020}}</ref> Rubin was the Clinton administration's chief negotiator with a Republican-controlled Congress on the balanced-budget deal.<ref name="BaltSun-Weisman-990513"/><ref name="AP-Crutsinger-990513">{{cite news |title=Treasury Secretary Rubin Plans To Step Down In July |last1=Crutsinger |first1=Martin |url=https://advance.lexis.com/enwiki/api/permalink/f01b4902-84af-45bb-99cf-57c21bd094ad/?context=1519360 |work=[[The Associated Press]] |date=May 13, 1999 |access-date=September 1, 2020}}</ref> The [[Balanced Budget Act of 1997]] has been referred to as the "capstone" of Rubin's tenure as Treasury secretary.<ref name="Rubin-CNN-1997">{{cite news |title=Robert Rubin |url=https://www.cnn.com/ALLPOLITICS/1997/gen/resources/players/rubin/ |work=CNN |date=1997 |access-date=August 31, 2020}}</ref> |

||

| Line 87: | Line 89: | ||

[[Arthur Levitt Jr.]], a former chairman of the [[Securities and Exchange Commission]], has said in explaining Rubin's strong opposition to the regulations proposed by Born that Greenspan and Rubin were "joined at the hip on this. They were certainly very fiercely opposed to this and persuaded me that this would cause chaos."<ref name="nyt-reckoning">Goodman, Peter S. (October 8, 2008). [https://www.nytimes.com/2008/10/09/business/economy/09greenspan.html "Taking Hard New Look at a Greenspan Legacy"]. ''The New York Times''.</ref> However, in Rubin's autobiography, he notes that he believed derivatives could pose significant problems and that many people who used derivatives did not fully understand the risks they were taking.<ref>Rubin, Robert (2003). ''In An Uncertain World''. pp. 287–288. [[Random House]]. {{ISBN|978-0-375-50585-0}}.</ref> In 2008, ''The New York Times'' reported that the proposal in 1997 would not have improved oversight of derivatives. Rubin said the financial system "could benefit from better regulation of derivatives". However, "the politics would have made this impossible," he said.<ref name="NYT-Schwartz-080427">{{cite news |title=Where Was the Wise Man? |last1=Schwartz |first1=Nelson D. |last2=Dash |first2=Eric |url=https://www.nytimes.com/2008/04/27/business/27rubin.html |work=[[The New York Times]] |date=April 27, 2008 |access-date=August 31, 2020}}</ref> Rubin said he had been concerned about derivatives' potential to create systemic risk since his time at Goldman Sachs.<ref name="HuffPost-Froomkin-100620">{{cite news |title=Rubin: I Actually Supported Regulating Derivatives |last1=Froomkin |first1=Dan |url=https://www.huffpost.com/entry/rubin-i-actually-supporte_n_545113 |work=[[HuffPost]] |date=June 20, 2010 |access-date=August 31, 2020}}</ref> |

[[Arthur Levitt Jr.]], a former chairman of the [[Securities and Exchange Commission]], has said in explaining Rubin's strong opposition to the regulations proposed by Born that Greenspan and Rubin were "joined at the hip on this. They were certainly very fiercely opposed to this and persuaded me that this would cause chaos."<ref name="nyt-reckoning">Goodman, Peter S. (October 8, 2008). [https://www.nytimes.com/2008/10/09/business/economy/09greenspan.html "Taking Hard New Look at a Greenspan Legacy"]. ''The New York Times''.</ref> However, in Rubin's autobiography, he notes that he believed derivatives could pose significant problems and that many people who used derivatives did not fully understand the risks they were taking.<ref>Rubin, Robert (2003). ''In An Uncertain World''. pp. 287–288. [[Random House]]. {{ISBN|978-0-375-50585-0}}.</ref> In 2008, ''The New York Times'' reported that the proposal in 1997 would not have improved oversight of derivatives. Rubin said the financial system "could benefit from better regulation of derivatives". However, "the politics would have made this impossible," he said.<ref name="NYT-Schwartz-080427">{{cite news |title=Where Was the Wise Man? |last1=Schwartz |first1=Nelson D. |last2=Dash |first2=Eric |url=https://www.nytimes.com/2008/04/27/business/27rubin.html |work=[[The New York Times]] |date=April 27, 2008 |access-date=August 31, 2020}}</ref> Rubin said he had been concerned about derivatives' potential to create systemic risk since his time at Goldman Sachs.<ref name="HuffPost-Froomkin-100620">{{cite news |title=Rubin: I Actually Supported Regulating Derivatives |last1=Froomkin |first1=Dan |url=https://www.huffpost.com/entry/rubin-i-actually-supporte_n_545113 |work=[[HuffPost]] |date=June 20, 2010 |access-date=August 31, 2020}}</ref> |

||

In an interview on ''ABC'''s ''[[This Week (ABC TV series)|This Week]]'' program in April 2010, former President Clinton said Rubin was wrong in the advice he gave him not to regulate derivatives, which was by then seen as one of the underlying causes of the 2007–08 financial crisis.<ref>{{Cite news|title=Clinton Calls Advice He Got on Derivatives 'Wrong' (Update1)|url=http://www.businessweek.com/news/2010-04-19/clinton-calls-advice-he-got-on-derivatives-wrong-update1-.html|date=April 19, 2010|first=Joshua|last=Zumbrun|work=[[Bloomberg Businessweek]]|archiveurl=https://web.archive.org/web/20110416030157/http://www.businessweek.com/news/2010-04-19/clinton-calls-advice-he-got-on-derivatives-wrong-update1-.html|archivedate=April 16, 2011 |access-date=January 5, 2012}}</ref> Clinton adviser [[Doug Band]] later said Clinton "inadvertently conflated an analysis he received on a specific derivatives proposal with then-Federal Reserve Chairman Alan Greenspan's arguments against any regulation of derivatives". He said Clinton still wished he had pursued legislation to regulate derivatives while confirming that he still believed he had received excellent advice on the economy and the financial system from Rubin and others during his presidency.<ref>{{Cite news|title=Clinton: I Was Wrong to Listen to Wrong Advice Against Regulating Derivatives*|url=https://abcnews.go.com/blogs/politics/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it/ |archive-url=https://web.archive.org/web/20111003010916/https://abcnews.go.com/blogs/politics/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it/ |archive-date=October 3, 2011 |date=April 17, 2010|first=Evan|last=Harris|publisher=[[ABC News]]|access-date=January 5, 2012}}</ref> |

In an interview on ''ABC'''s ''[[This Week (ABC TV series)|This Week]]'' program in April 2010, former President Clinton said Rubin was wrong in the advice he gave him not to regulate derivatives, which was by then seen as one of the underlying causes of the 2007–08 financial crisis.<ref>{{Cite news|title=Clinton Calls Advice He Got on Derivatives 'Wrong' (Update1)|url=http://www.businessweek.com/news/2010-04-19/clinton-calls-advice-he-got-on-derivatives-wrong-update1-.html|date=April 19, 2010|first=Joshua|last=Zumbrun|work=[[Bloomberg Businessweek]]|archiveurl=https://web.archive.org/web/20110416030157/http://www.businessweek.com/news/2010-04-19/clinton-calls-advice-he-got-on-derivatives-wrong-update1-.html|archivedate=April 16, 2011 |access-date=January 5, 2012}}</ref> Clinton adviser [[Doug Band]] later said Clinton "inadvertently conflated an analysis he received on a specific derivatives proposal with then-Federal Reserve Chairman Alan Greenspan's arguments against any regulation of derivatives". He said Clinton still wished he had pursued legislation to regulate derivatives while confirming that he still believed he had received excellent advice on the economy and the financial system from Rubin and others during his presidency.<ref>{{Cite news|title=Clinton: I Was Wrong to Listen to Wrong Advice Against Regulating Derivatives*|url=https://abcnews.go.com/blogs/politics/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it/ |archive-url=https://web.archive.org/web/20111003010916/https://abcnews.go.com/blogs/politics/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it/ |archive-date=October 3, 2011 |date=April 17, 2010|first=Evan|last=Harris|publisher=[[ABC News (United States)|ABC News]]|access-date=January 5, 2012}}</ref> |

||

====Urban policy==== |

====Urban policy==== |

||

| Line 93: | Line 95: | ||

|url=http://news.bbc.co.uk/2/hi/business/342086.stm |work=[[BBC News]] |date=May 12, 1999 |access-date=August 18, 2020}}</ref><ref name="USNews-Walsh-970224">{{cite news |title=Treasury's New Age liberal |last1=Walsh |first1=Kenneth T. |url=https://advance.lexis.com/document/index?crid=1c8ec9d8-1be8-41a1-9a07-911d20bfa810&pdpermalink=2bd3d8c9-865b-43dc-b3aa-d1f8659cc8cd&pdmfid=1519360&pdisurlapi=true |work=[[U.S. News & World Report]] |date=February 24, 1997 |access-date=August 28, 2020}}</ref><ref name="WSJ-Wessel-970328">{{cite news |title=Treasury Chief Robert Rubin Cultivates an Atypical Image |last1=Wessel |first1=David |url=https://www.wsj.com/articles/SB859509936135865500 |work=[[The Wall Street Journal]] |date=March 28, 1997 |access-date=September 2, 2020}}</ref> Addressing the needs of the urban poor was a top priority for Rubin during his tenure in the Clinton administration.<ref name="wapo-chandler-1995">{{cite news |title=Rubin Wins Senate's Approval |last1=Chandler |first1=Clay |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/stories/rubin011195.htm |newspaper=Washington Post |date=January 11, 1995 |access-date=September 2, 2020}}</ref> Rubin also assisted with the Clinton administration's plan to increase [[empowerment zone|empowerment]] and [[Urban enterprise zone|enterprise]] zones across the U.S. The initiative offered tax breaks for businesses investing in those zones.<ref name="USNews-Walsh-970224"/> |

|url=http://news.bbc.co.uk/2/hi/business/342086.stm |work=[[BBC News]] |date=May 12, 1999 |access-date=August 18, 2020}}</ref><ref name="USNews-Walsh-970224">{{cite news |title=Treasury's New Age liberal |last1=Walsh |first1=Kenneth T. |url=https://advance.lexis.com/document/index?crid=1c8ec9d8-1be8-41a1-9a07-911d20bfa810&pdpermalink=2bd3d8c9-865b-43dc-b3aa-d1f8659cc8cd&pdmfid=1519360&pdisurlapi=true |work=[[U.S. News & World Report]] |date=February 24, 1997 |access-date=August 28, 2020}}</ref><ref name="WSJ-Wessel-970328">{{cite news |title=Treasury Chief Robert Rubin Cultivates an Atypical Image |last1=Wessel |first1=David |url=https://www.wsj.com/articles/SB859509936135865500 |work=[[The Wall Street Journal]] |date=March 28, 1997 |access-date=September 2, 2020}}</ref> Addressing the needs of the urban poor was a top priority for Rubin during his tenure in the Clinton administration.<ref name="wapo-chandler-1995">{{cite news |title=Rubin Wins Senate's Approval |last1=Chandler |first1=Clay |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/stories/rubin011195.htm |newspaper=Washington Post |date=January 11, 1995 |access-date=September 2, 2020}}</ref> Rubin also assisted with the Clinton administration's plan to increase [[empowerment zone|empowerment]] and [[Urban enterprise zone|enterprise]] zones across the U.S. The initiative offered tax breaks for businesses investing in those zones.<ref name="USNews-Walsh-970224"/> |

||

==== |

====Decline of the Glass-Steagall Act==== |

||

As Treasury Secretary, Robert Rubin was on the record for stating that the Glass-Steagall Act was obsolete and outdated, and indeed its provisions had become less effective over time. However, it was not until the late 1990s that the Congress and the Clinton administration finally came round to repealing the act. This resulted in part from lobbying pressure exercised by [[Sanford I. Weill]] on Congress and the White House to repeal the Act, and so allow the mega-merger he had organized between [[Citigroup#Merger of Citicorp and Travelers (1998–2001)|Travelers Group and Citicorp]] in 1998 to stand.<ref>PBS, "[https://www.pbs.org/wgbh/pages/frontline/shows/wallstreet/weill/demise.html The Wall Street: The Long Demise of Glass-Steagall]", May 8, 2003.</ref> Rubin resigned from the Clinton administration in July 1999.<ref name="cnn-1999"/> In October 1999, Rubin joined the leadership at Citigroup.<ref name="NYT-Kahn-992710">{{cite news |title=Former Treasury Secretary Joins Leadership Triangle at Citigroup |last1=Kahn |first1=Joseph |url=https://www.nytimes.com/1999/10/27/business/former-treasury-secretary-joins-leadership-triangle-at-citigroup.html |work=[[The New York Times]] |date=October 27, 1999 |access-date=November 19, 2021}}</ref> Glass–Steagall was eventually repealed by the Gramm–Leach–Bliley Act under Rubin's successor, Lawrence Summers, and was signed by Clinton in November 1999.<ref name="NYT-Schwartz-080427"/><ref>{{cite web |url= http://www.presidency.ucsb.edu/ws/?pid=56922 |title= William J. Clinton: "Statement on Signing the Gramm–Leach–Bliley Act," November 12, 1999 |author1= Peters, Gerhard |author2= Woolley, John T |publisher= University of California – Santa Barbara |work= The American Presidency Project |url-status= live |archive-url= https://web.archive.org/web/20160207062207/http://www.presidency.ucsb.edu/ws/?pid=56922 |archive-date= February 7, 2016 }}</ref> |

As Treasury Secretary, Robert Rubin was on the record for stating that the Glass-Steagall Act was obsolete and outdated, and indeed its provisions had become less effective over time. However, it was not until the late 1990s that the Congress and the Clinton administration finally came round to repealing the act. This resulted in part from lobbying pressure exercised by [[Sanford I. Weill]] on Congress and the White House to repeal the Act, and so allow the mega-merger he had organized between [[Citigroup#Merger of Citicorp and Travelers (1998–2001)|Travelers Group and Citicorp]] in 1998 to stand.<ref>PBS, "[https://www.pbs.org/wgbh/pages/frontline/shows/wallstreet/weill/demise.html The Wall Street: The Long Demise of Glass-Steagall]", May 8, 2003.</ref> Rubin resigned from the Clinton administration in July 1999.<ref name="cnn-1999"/> In October 1999, Rubin joined the leadership at Citigroup.<ref name="NYT-Kahn-992710">{{cite news |title=Former Treasury Secretary Joins Leadership Triangle at Citigroup |last1=Kahn |first1=Joseph |url=https://www.nytimes.com/1999/10/27/business/former-treasury-secretary-joins-leadership-triangle-at-citigroup.html |work=[[The New York Times]] |date=October 27, 1999 |access-date=November 19, 2021}}</ref> Glass–Steagall was eventually repealed by the Gramm–Leach–Bliley Act under Rubin's successor, Lawrence Summers, and was signed by Clinton in November 1999.<ref name="NYT-Schwartz-080427"/><ref>{{cite web |url= http://www.presidency.ucsb.edu/ws/?pid=56922 |title= William J. Clinton: "Statement on Signing the Gramm–Leach–Bliley Act," November 12, 1999 |author1= Peters, Gerhard |author2= Woolley, John T |publisher= University of California – Santa Barbara |work= The American Presidency Project |url-status= live |archive-url= https://web.archive.org/web/20160207062207/http://www.presidency.ucsb.edu/ws/?pid=56922 |archive-date= February 7, 2016 }}</ref> |

||

| Line 103: | Line 105: | ||

Rubin joined [[Citigroup]] in 1999 as chairman of the executive committee of the board.<ref name="Reuters-Timeline">{{cite news |title=Timeline: Rubin's career at Citigroup |url=https://www.reuters.com/article/us-chronology-rubin-sb/timeline-rubins-career-at-citigroup-idUKTRE5086XS20090109 |work=[[Reuters]] |date=January 9, 2009 |access-date=January 13, 2022}}</ref> In 2001, [[Enron]], a major client of Citigroup, faced a credit ratings downgrade as a result of the [[Enron scandal]]. Rubin called a ranking [[U.S. Treasury Department|Treasury Department]] official, unsuccessfully seeking the Bush Administration's help in forestalling the downgrade.<ref name="Bloomberg-Cohan-120930">{{cite news |title=Rethinking Robert Rubin |last1=Cohan |first1=William D. |url=https://www.bloomberg.com/news/articles/2012-09-30/rethinking-robert-rubin |work=Bloomberg News |date=September 30, 2012 |access-date=August 27, 2020}}</ref> A subsequent staff investigation by the [[United States Senate Committee on Homeland Security and Governmental Affairs#Committee on Governmental Affairs, 1977–2005|Senate Governmental Affairs committee]] cleared Rubin of having done anything illegal.<ref>C-SPAN Q&A with Janet Tavakoli. Air date: April 19, 2009, http://qanda.org/Transcript/?ProgramID=1228</ref><ref name="NYT-Oppel-030103">{{cite news |title=Senate Report Says Rubin Acted Legally in Enron Matter |last1=Oppel Jr. |first1=Richard A. |url=https://www.nytimes.com/2003/01/03/business/senate-report-says-rubin-acted-legally-in-enron-matter.html |work=[[The New York Times]] |date=January 3, 2003 |access-date=August 24, 2020}}</ref> Rubin later maintained that he had acted both as a Citigroup executive protecting his company's position and as a former Treasury official concerned about the impact that Enron's failure might have on the larger economy. Rubin rejected criticisms of a possible conflict of interest and has said that if faced with the same choice, he would do it again.<ref name="Bloomberg-Cohan-120930"/> |

Rubin joined [[Citigroup]] in 1999 as chairman of the executive committee of the board.<ref name="Reuters-Timeline">{{cite news |title=Timeline: Rubin's career at Citigroup |url=https://www.reuters.com/article/us-chronology-rubin-sb/timeline-rubins-career-at-citigroup-idUKTRE5086XS20090109 |work=[[Reuters]] |date=January 9, 2009 |access-date=January 13, 2022}}</ref> In 2001, [[Enron]], a major client of Citigroup, faced a credit ratings downgrade as a result of the [[Enron scandal]]. Rubin called a ranking [[U.S. Treasury Department|Treasury Department]] official, unsuccessfully seeking the Bush Administration's help in forestalling the downgrade.<ref name="Bloomberg-Cohan-120930">{{cite news |title=Rethinking Robert Rubin |last1=Cohan |first1=William D. |url=https://www.bloomberg.com/news/articles/2012-09-30/rethinking-robert-rubin |work=Bloomberg News |date=September 30, 2012 |access-date=August 27, 2020}}</ref> A subsequent staff investigation by the [[United States Senate Committee on Homeland Security and Governmental Affairs#Committee on Governmental Affairs, 1977–2005|Senate Governmental Affairs committee]] cleared Rubin of having done anything illegal.<ref>C-SPAN Q&A with Janet Tavakoli. Air date: April 19, 2009, http://qanda.org/Transcript/?ProgramID=1228</ref><ref name="NYT-Oppel-030103">{{cite news |title=Senate Report Says Rubin Acted Legally in Enron Matter |last1=Oppel Jr. |first1=Richard A. |url=https://www.nytimes.com/2003/01/03/business/senate-report-says-rubin-acted-legally-in-enron-matter.html |work=[[The New York Times]] |date=January 3, 2003 |access-date=August 24, 2020}}</ref> Rubin later maintained that he had acted both as a Citigroup executive protecting his company's position and as a former Treasury official concerned about the impact that Enron's failure might have on the larger economy. Rubin rejected criticisms of a possible conflict of interest and has said that if faced with the same choice, he would do it again.<ref name="Bloomberg-Cohan-120930"/> |

||

Rubin briefly became chairman of Citigroup's board of directors from November 2007 to December 2007.<ref name="citigroup"/><ref name="NYT-Dash-071107">{{cite news |title=Robert Rubin, the new chairman at Citigroup, hits the ground running |last1=Dash |first1=Eric |url=https://www.nytimes.com/2007/11/07/business/worldbusiness/07iht-citi.1.8225588.html |work=[[The New York Times]] |date=November 7, 2007 |access-date=August 24, 2020}}</ref> According to ''The New York Times'', Rubin's role at Citigroup focused on meeting with clients and government and business leaders, bringing in business, and serving as a sounding board to bank leadership. |

Rubin briefly became chairman of Citigroup's board of directors from November 2007 to December 2007.<ref name="citigroup"/><ref name="NYT-Dash-071107">{{cite news |title=Robert Rubin, the new chairman at Citigroup, hits the ground running |last1=Dash |first1=Eric |url=https://www.nytimes.com/2007/11/07/business/worldbusiness/07iht-citi.1.8225588.html |work=[[The New York Times]] |date=November 7, 2007 |access-date=August 24, 2020}}</ref> According to ''The New York Times'', Rubin's role at Citigroup focused on meeting with clients and government and business leaders, bringing in business, and serving as a sounding board to bank leadership. As the ''Times'' reported in 2007, Rubin "has said publicly since he came to Citigroup in 1999 that he had no interest in running the bank".<ref name="NYT-Dash-071107"/> ''The Wall Street Journal'' reported Rubin joined Citigroup as a board member and as a participant "in strategic managerial and operational matters of the Company, but [...] no line responsibilities".<ref name="WSJ20081203">{{cite news| title=No line responsibilities| work=[[The Wall Street Journal]]| publisher=[[Dow Jones & Company]]| date=December 3, 2008| url=https://www.wsj.com/articles/SB122826632081174473| url-access=subscription}}</ref> The newspaper called this mix of oversight and management responsibilities "murky".<ref name=WSJ20081203 /> |

||

Following the 2008 financial crisis, critics argued Rubin increased risk-taking at Citigroup, thereby exposing the bank to greater losses, and that economic policies he promoted as Treasury secretary exacerbated the situation. According to ''The Wall Street Journal'', Rubin has stated that "he wasn't alone in failing to foresee the severity of the crisis that would emerge".<ref name="WSJ-Demos-180608">{{cite news |title=Robert Rubin's Legacy Up for Debate 10 Years After Citigroup Bailout |last1=Demos |first1=Telis |url=https://www.wsj.com/articles/robert-rubins-legacy-up-for-debate-10-years-after-citigroup-bailout-1528462800 |work=[[The Wall Street Journal]] |date=June 8, 2018 |access-date=August 18, 2020}}</ref> Other industry observers criticized the lack of clarity about Rubin's role within the bank.<ref name="Reuters-Stempel-12-830">{{cite news |title=Citigroup settles shareholder CDO lawsuit for $590 million |last1=Stempel |first1=Jonathan |url=https://www.reuters.com/article/us-citigroup-settlement/citigroup-settles-shareholder-cdo-lawsuit-for-590-million-idUSBRE87S0UA20120830 |work=[[Reuters]] |date=August 30, 2012 |access-date=August 28, 2020}}</ref> The federal government spent $45 billion to acquire a stake in Citigroup in 2008 through the [[Troubled Asset Relief Program]]. Citigroup repaid $20 billion of the [[bailout]] money in December 2009 and the Treasury sold its remaining stake one year later, for a total net profit of $12 billion.<ref>{{cite news |last1=Petruno |first1=Tom |title=U.S. turns a $12-billion profit on Citigroup bailout |url=https://www.latimes.com/archives/la-xpm-2010-dec-08-la-fi-citigroup-treasury-20101208-story.html |access-date=February 17, 2022 |work=Los Angeles Times |date=December 8, 2010}}</ref> |

Following the 2008 financial crisis, critics argued Rubin increased risk-taking at Citigroup, thereby exposing the bank to greater losses, and that economic policies he promoted as Treasury secretary exacerbated the situation. According to ''The Wall Street Journal'', Rubin has stated that "he wasn't alone in failing to foresee the severity of the crisis that would emerge".<ref name="WSJ-Demos-180608">{{cite news |title=Robert Rubin's Legacy Up for Debate 10 Years After Citigroup Bailout |last1=Demos |first1=Telis |url=https://www.wsj.com/articles/robert-rubins-legacy-up-for-debate-10-years-after-citigroup-bailout-1528462800 |work=[[The Wall Street Journal]] |date=June 8, 2018 |access-date=August 18, 2020}}</ref> Other industry observers criticized the lack of clarity about Rubin's role within the bank.<ref name="Reuters-Stempel-12-830">{{cite news |title=Citigroup settles shareholder CDO lawsuit for $590 million |last1=Stempel |first1=Jonathan |url=https://www.reuters.com/article/us-citigroup-settlement/citigroup-settles-shareholder-cdo-lawsuit-for-590-million-idUSBRE87S0UA20120830 |work=[[Reuters]] |date=August 30, 2012 |access-date=August 28, 2020}}</ref> The federal government spent $45 billion to acquire a stake in Citigroup in 2008 through the [[Troubled Asset Relief Program]]. Citigroup repaid $20 billion of the [[bailout]] money in December 2009 and the Treasury sold its remaining stake one year later, for a total net profit of $12 billion.<ref>{{cite news |last1=Petruno |first1=Tom |title=U.S. turns a $12-billion profit on Citigroup bailout |url=https://www.latimes.com/archives/la-xpm-2010-dec-08-la-fi-citigroup-treasury-20101208-story.html |access-date=February 17, 2022 |work=Los Angeles Times |date=December 8, 2010}}</ref> |

||

In December 2008, investors filed a lawsuit contending that Citigroup executives, including Rubin, sold shares at inflated prices while concealing the firm's risks.<ref>{{cite news |last=Graybow |first=Martha |title=Investors accuse Citi execs of 'suspicious' trades |publisher=[[Reuters]] |date=December 3, 2008 |url=https://www.reuters.com/article/sppage012-n03301778-oisbn/investors-accuse-citi-execs-of-suspicious-trades-idUSN0330177820081204 |url-status=live |archive-url=https://web.archive.org/web/20081206071035/http://biz.yahoo.com/rb/081203/business_us_citigroup_lawsuit.html |archive-date=December 6, 2008 }}</ref> Citigroup settled the lawsuit in 2012, paying $590 million to claimants and denying any wrongdoing as part of the settlement.<ref name="Reuters-Stempel-12-830"/> Rubin resigned from Citigroup in 2009.<ref name="WSJ-Demos-180608"/><ref name="FT-Guerrera-091009">{{cite news |title=Rubin quits as Citi looks to sell brokerage |last1=Guerrera |first1=Francesco |last2=Farrell |first2=Greg |last3=Brewster |first3=Deborah |url=https://www.ft.com/content/9a3b4772-de8a-11dd-9464-000077b07658 |archive-url=https://ghostarchive.org/archive/20221210/https://www.ft.com/content/9a3b4772-de8a-11dd-9464-000077b07658 |archive-date=December 10, 2022 |url-access=subscription |url-status=live |work=[[Financial Times]] |date=January 9, 2009 |access-date=August 24, 2020}}</ref><ref name="Reuters-Stemple-090119">{{cite news |title=Robert Rubin quits Citigroup amid criticism |last1=Stempel |first1=Jonathan |last2=Wilchins |first2=Dan |url=https://www.reuters.com/article/us-citigroup-rubin/robert-rubin-quits-citigroup-amid-criticism-idUSN0930738020090109 |work=[[Reuters]] |date=January 9, 2009 |access-date=August 24, 2020}}</ref> Between 1999 and 2009, Rubin received total compensation, including [[employee stock option]]s, of $126 million from Citigroup.<ref name="bloomberg.com">[https://www.bloomberg.com/news/2012-09-20/rethinking-bob-rubin-from-goldman-sachs-star-to-crisis-scapegoat.html "Rethinking Bob Rubin From Goldman Sachs Star to Crisis Scapegoat"] [[Bloomberg News]]</ref> His compensation was criticized, with writer [[Nassim Nicholas Taleb]] noting that Rubin "collected more than $120 million in compensation from Citibank in the decade preceding the banking crash of 2008. When the bank, literally insolvent, was rescued by the taxpayer, he didn't write any check—he invoked uncertainty as an excuse."<ref>{{cite news |last1=Williams |first1=Zoe |title=Skin in the Game by Nassim Nicholas Taleb review – how risk should be shared |url=https://www.theguardian.com/books/2018/feb/22/skin-in-the-game-nassim-nicholas-taleb-review |access-date=14 July 2019 |work=The Guardian |date=22 February 2018}}</ref> In 2010, the [[Financial Crisis Inquiry Commission]] interviewed Rubin as part of their investigation into the causes of the [[financial crisis of 2007–2008]] and concluded that Rubin "may have violated the laws of the United States in relation to the financial crisis" related to his role at Citigroup. The commission unanimously voted to refer him to the [[United States Department of Justice]] for further investigation; however, the DOJ did not pursue any further investigation or actions against Rubin.<ref>{{cite news |last1=Gandel |first1=Stephen |title=Robert Rubin Was Targeted for DOJ Investigation by Financial Crisis Commission |url=https://fortune.com/2016/03/13/robert-rubin-financial-crisis-commission-justice-department/ |access-date= |

In December 2008, investors filed a lawsuit contending that Citigroup executives, including Rubin, sold shares at inflated prices while concealing the firm's risks.<ref>{{cite news |last=Graybow |first=Martha |title=Investors accuse Citi execs of 'suspicious' trades |publisher=[[Reuters]] |date=December 3, 2008 |url=https://www.reuters.com/article/sppage012-n03301778-oisbn/investors-accuse-citi-execs-of-suspicious-trades-idUSN0330177820081204 |url-status=live |archive-url=https://web.archive.org/web/20081206071035/http://biz.yahoo.com/rb/081203/business_us_citigroup_lawsuit.html |archive-date=December 6, 2008 }}</ref> Citigroup settled the lawsuit in 2012, paying $590 million to claimants and denying any wrongdoing as part of the settlement.<ref name="Reuters-Stempel-12-830"/> Rubin resigned from Citigroup in 2009.<ref name="WSJ-Demos-180608"/><ref name="FT-Guerrera-091009">{{cite news |title=Rubin quits as Citi looks to sell brokerage |last1=Guerrera |first1=Francesco |last2=Farrell |first2=Greg |last3=Brewster |first3=Deborah |url=https://www.ft.com/content/9a3b4772-de8a-11dd-9464-000077b07658 |archive-url=https://ghostarchive.org/archive/20221210/https://www.ft.com/content/9a3b4772-de8a-11dd-9464-000077b07658 |archive-date=December 10, 2022 |url-access=subscription |url-status=live |work=[[Financial Times]] |date=January 9, 2009 |access-date=August 24, 2020}}</ref><ref name="Reuters-Stemple-090119">{{cite news |title=Robert Rubin quits Citigroup amid criticism |last1=Stempel |first1=Jonathan |last2=Wilchins |first2=Dan |url=https://www.reuters.com/article/us-citigroup-rubin/robert-rubin-quits-citigroup-amid-criticism-idUSN0930738020090109 |work=[[Reuters]] |date=January 9, 2009 |access-date=August 24, 2020}}</ref> Between 1999 and 2009, Rubin received total compensation, including [[employee stock option]]s, of $126 million from Citigroup.<ref name="bloomberg.com">[https://www.bloomberg.com/news/2012-09-20/rethinking-bob-rubin-from-goldman-sachs-star-to-crisis-scapegoat.html "Rethinking Bob Rubin From Goldman Sachs Star to Crisis Scapegoat"] [[Bloomberg News]]</ref> His compensation was criticized, with writer [[Nassim Nicholas Taleb]] noting that Rubin "collected more than $120 million in compensation from Citibank in the decade preceding the banking crash of 2008. When the bank, literally insolvent, was rescued by the taxpayer, he didn't write any check—he invoked uncertainty as an excuse."<ref>{{cite news |last1=Williams |first1=Zoe |title=Skin in the Game by Nassim Nicholas Taleb review – how risk should be shared |url=https://www.theguardian.com/books/2018/feb/22/skin-in-the-game-nassim-nicholas-taleb-review |access-date=14 July 2019 |work=The Guardian |date=22 February 2018}}</ref> In 2010, the [[Financial Crisis Inquiry Commission]] interviewed Rubin as part of their investigation into the causes of the [[financial crisis of 2007–2008]] and concluded that Rubin "may have violated the laws of the United States in relation to the financial crisis" related to his role at Citigroup. The commission unanimously voted to refer him to the [[United States Department of Justice]] for further investigation; however, the DOJ did not pursue any further investigation or actions against Rubin.<ref>{{cite news |last1=Gandel |first1=Stephen |title=Robert Rubin Was Targeted for DOJ Investigation by Financial Crisis Commission |url=https://fortune.com/2016/03/13/robert-rubin-financial-crisis-commission-justice-department/ |access-date=September 10, 2022 |work=Fortune |date=March 13, 2016}}</ref> |

||

===Other work=== |

===Other work=== |

||

On July 1, 2002, Rubin became a member of [[Harvard Corporation]], the executive governing board of [[Harvard University]].<ref>{{cite news|url=http://news.harvard.edu/gazette/2002/04.11/09-rubin.html|publisher=[[Harvard Gazette]]|date=2002-04-11|access-date=2008-02-02|title=Rubin '60 is newest Corporation member}}</ref> He served as a member of the Harvard Corporation board until June 2014, and as of 2018, served on its finance committee.<ref>{{cite news|url=http://harvardmagazine.com/2014/01/brevia|work=Harvard Magazine|date=January 2014|access-date=2015-05-26|title=Reischauer, Rubin leave Harvard Corporation, Rhodes Scholars, Nobelists}}</ref><ref name="Wapo-Rubin-120702">{{cite news |title=Robert Rubin |url=https://www.washingtonpost.com/postlive/robert-rubin/2012/07/02/gJQAMmMADY_story.html |newspaper=[[The Washington Post]] |date=July 2, 2012 |access-date=August 19, 2020}}</ref><ref name="WSJ-Demos-180608" |

On July 1, 2002, Rubin became a member of [[Harvard Corporation]], the executive governing board of [[Harvard University]].<ref>{{cite news|url=http://news.harvard.edu/gazette/2002/04.11/09-rubin.html|publisher=[[Harvard Gazette]]|date=2002-04-11|access-date=2008-02-02|title=Rubin '60 is newest Corporation member}}</ref> He served as a member of the Harvard Corporation board until June 2014, and as of 2018, served on its finance committee.<ref>{{cite news|url=http://harvardmagazine.com/2014/01/brevia|work=Harvard Magazine|date=January 2014|access-date=2015-05-26|title=Reischauer, Rubin leave Harvard Corporation, Rhodes Scholars, Nobelists}}</ref><ref name="Wapo-Rubin-120702">{{cite news |title=Robert Rubin |url=https://www.washingtonpost.com/postlive/robert-rubin/2012/07/02/gJQAMmMADY_story.html |newspaper=[[The Washington Post]] |date=July 2, 2012 |access-date=August 19, 2020}}</ref><ref name="WSJ-Demos-180608"/> |

||

| ⚫ | As of 2024, Rubin is involved in the [[Hamilton Project]], an economic policy think tank he co-founded in 2006.<ref name="Meyerson-WaPo">{{cite news |title=Hamiltonian Democrats |last1=Meyerson |first1=Harold |url=https://www.washingtonpost.com/archive/opinions/2006/04/19/hamiltonian-democrats/085f0020-57d8-4fdd-9d65-871343e0ff15/ |newspaper=The Washington Post |date=April 19, 2006 |accessdate=February 20, 2023}}</ref><ref name="Politico-Smith-070204">{{cite news |title=Strategists Bank on Budget-Neutral Policies |last1=Smith |first1=Ben |url=https://www.politico.com/story/2007/04/strategists-bank-on-budget-neutral-policies-003407 |work=[[Politico]] |date=March 6, 2017 |access-date=February 16, 2023}}</ref><ref>{{cite web |title=Robert E. Rubin |url=https://www.hamiltonproject.org/people/robert_e._rubin |website=The Hamilton Project |access-date=December 21, 2022}}</ref> He is co-chairman emeritus of the [[Council on Foreign Relations]]. He serves as a trustee of [[Mount Sinai Health System]] and as co-chair of the advisory board of the [[Peter G. Peterson Foundation]].<ref name="Wapo-Rubin-120702" /><ref name="PGPF-021623">{{cite web |url=https://www.pgpf.org/about |title=About the Peter G. Peterson Foundation |author=<!--Not stated--> |date= |website=Peter G. Peterson Foundation |publisher= |access-date=February 16, 2023 |quote=}}</ref> Additionally, Rubin serves as a senior counselor at [[Centerview Partners]], an investment banking advisory firm based in New York City.<ref name="WSJ-Demos-180608" /> |

||

| ⚫ | |||

| ⚫ | As of |

||

Rubin was a member of the [[Africa Progress Panel]] (APP), a group of ten individuals who advocated for equitable and sustainable development in Africa by publishing seven annual reports between 2009 and 2015.<ref name="Reuters-APP">{{cite news |title=France "bad", Italy "useless" on aid goals - Geldof |url=https://www.reuters.com/article/idINIndia-54920020110215 |access-date=December 21, 2022 |work=Reuters |date=February 15, 2011 |language=en}}</ref> Rubin also served on the Global Citizenship Commission, convened by former British Prime Minister [[Gordon Brown]], which reexamined and proposed an update to the United Nations' 1948 [[Universal Declaration on Human Rights]].<ref name="WEF-Waldron-160422">{{cite news |title=Why we all need to begin thinking like global citizens |last1=Waldron |first1=Jeremy |url=https://www.weforum.org/agenda/2016/04/why-we-all-need-to-begin-thinking-like-global-citizens |work=[[World Economic Forum]] |date=April 22, 2016 |access-date=August 19, 2020}}</ref><ref name="BelfastTelegraph-131001">{{cite news |title=Malala to attend rights commission |url=https://www.belfasttelegraph.co.uk/news/uk/malala-to-attend-rights-commission-29622320.html |work=[[Belfast Telegraph]] |date=October 1, 2013 |access-date=August 19, 2020}}</ref> |

Rubin was a member of the [[Africa Progress Panel]] (APP), a group of ten individuals who advocated for equitable and sustainable development in Africa by publishing seven annual reports between 2009 and 2015.<ref name="Reuters-APP">{{cite news |title=France "bad", Italy "useless" on aid goals - Geldof |url=https://www.reuters.com/article/idINIndia-54920020110215 |access-date=December 21, 2022 |work=Reuters |date=February 15, 2011 |language=en}}</ref> Rubin also served on the Global Citizenship Commission, convened by former British Prime Minister [[Gordon Brown]], which reexamined and proposed an update to the United Nations' 1948 [[Universal Declaration on Human Rights]].<ref name="WEF-Waldron-160422">{{cite news |title=Why we all need to begin thinking like global citizens |last1=Waldron |first1=Jeremy |url=https://www.weforum.org/agenda/2016/04/why-we-all-need-to-begin-thinking-like-global-citizens |work=[[World Economic Forum]] |date=April 22, 2016 |access-date=August 19, 2020}}</ref><ref name="BelfastTelegraph-131001">{{cite news |title=Malala to attend rights commission |url=https://www.belfasttelegraph.co.uk/news/uk/malala-to-attend-rights-commission-29622320.html |work=[[Belfast Telegraph]] |date=October 1, 2013 |access-date=August 19, 2020}}</ref> |

||

=== Books === |

|||

| ⚫ | |||

Rubin's second book, ''The Yellow Pad: Making Better Decisions in an Uncertain World'', was published in May 2023. In it, he writes about his approach to "probabilistic thinking", or understanding that every decision carries risk.<ref name="Bobrow">{{cite news |last1=Bobrow |first1=Emily |title=Robert Rubin Warns That the U.S. Is Failing to Face Its Problems |url=https://www.wsj.com/articles/robert-rubin-warns-that-the-u-s-is-failing-to-face-its-problems-16c7dcdb |access-date=May 17, 2023 |work=The Wall Street Journal |date=May 12, 2023}}</ref> The book was named one of the "Best Books of 2023" by ''[[Bloomberg News]]''.<ref>{{cite news |title=The Best Books of 2023: Top Business Leaders Pick the Year's 58 Must-Reads |url=https://www.bloomberg.com/features/2023-best-books/ |work=Bloomberg News |date=December 14, 2023 |access-date=January 26, 2024}}</ref> |

|||

==Policy views== |

==Policy views== |

||

===Economic policies=== |

|||

In January 2014, Secretary Rubin joined former Senator [[Olympia Snowe]], former Education Secretary Donna Shalala, former Secretary of State George Shultz, former Housing and Urban Affairs Secretary Henry Cisneros, Gregory Page the Chair of Cargill, and Al Sommer, the Dean Emeritus of the Bloomberg School of Public Health as members of the U.S. Climate Risk Committee. They oversaw the development of an analysis of the economic risks of [[climate change in the United States]] that was published on June 24, 2014.<ref>[http://rhg.com/reports/climate-prospectus]. Climate Prospectus. Retrieved 2015-10-08.</ref> |

|||

Rubin has advocated for fiscal discipline and public investment, and worked to turn the federal budget deficit to a surplus while Treasury Secretary.<ref name="Fortune-Loomis-160313">{{cite news |title=The Larger-Than-Life Life of Robert Rubin |last1=Loomis |first1=Carol J. |url=https://fortune.com/2016/03/13/robert-rubin-life/ |work=[[Fortune (magazine)|Fortune]] |date=March 13, 2016 |access-date=August 31, 2020}}</ref> He has advocated against high budget deficits and has been credited with developing the [[strong dollar policy]] that has been a cornerstone of U.S. economic policy since his tenure at Treasury.<ref>{{cite news |last1=Wolk |first1=Martin |title=Rubin warns of a deficit's ripples |work=NBC News |date=January 13, 2004 |access-date=February 6, 2023 |url=https://www.nbcnews.com/id/wbna3948923|archive-url=https://web.archive.org/web/20210725180830/https://www.nbcnews.com/id/wbna3948923|url-status=dead|archive-date=July 25, 2021}}</ref><ref name="Reuters-Wroughton-180124">{{cite news |title=U.S. 'strong dollar' policy in question |last1=Wroughton |first1=Lesley |last2=Lange |first2=Jason |url=https://www.reuters.com/article/global-forex-dollar/u-s-strong-dollar-policy-in-question-idUSL2N1PJ2EO |work=[[Reuters]] |date=January 24, 2018 |access-date=August 31, 2020}}</ref> |

|||

| ⚫ | In |

||

He has been described as a centrist, pro-business, "pro-growth Democrat" by ''The New York Times''.<ref name="Greenhouse">{{cite news |title=When Robert Rubin Talks… |url=https://www.nytimes.com/1993/07/25/business/when-robert-rubin-talks.html |last1=Greenhouse |first1=Steven |work=The New York Times |date=July 25, 1993 |access-date=March 22, 2023}}</ref> The ''Chicago Tribune'' and [[Associated Press]] have stated that Rubin's policies as Treasury Secretary helped drive American economic growth in the 1990s.<ref name="Goozner-091799">{{cite news |last1=Goozner |first1=Merrill |title=Rubin puts expertise to work for poor areas |url=https://www.chicagotribune.com/news/ct-xpm-1999-09-17-9909170143-story.html |access-date=May 4, 2023 |work=Chicago Tribune |date=September 17, 1999}}</ref><ref name="Fournier-051299">{{cite news |last1=Fournier |first1=Ron |title=Treasury Secretary Rubin resigns |url=https://www.washingtonpost.com/wp-srv/politics/govt/admin/stories/rubin051299.htm |access-date=May 4, 2023 |newspaper=The Washington Post |agency=Associated Press |date=May 12, 1999}}</ref> However, his policies have also been criticized by some Republicans for not cutting taxes enough, while some Democrats have said that Rubin's policies contributed to the 2008 financial crisis.<ref name="WSJ-Demos-180608"/> Rubin has supported [[progressive tax]] measures and expanding earned income tax credits to benefit low- and middle-income Americans.<ref name="TaxNotes-Thorndike-141201"/> He has also opposed tax cuts that disproportionately benefit high earners, including those enacted during the administrations of [[Presidency of George W. Bush#Bush_tax_cuts|George W. Bush]] and [[First presidency of Donald Trump#Taxation|Donald Trump]].<ref name="CNN-Alesci-170306">{{cite news |title=Former Treasury secretary: Trump will hurt the economy |last1=Alesci |first1=Cristina |url=https://money.cnn.com/2017/03/06/news/economy/robert-rubin-interview-trump-economy/ |work=[[CNN Money]] |date=March 6, 2017 |access-date=August 31, 2020}}</ref><ref name="Bloomberg-Stimulus-100809">{{cite news |title=Two former Treasury chiefs wary of another stimulus |url=https://archive.triblive.com/local/local-news/two-former-treasury-chiefs-wary-of-another-stimulus/ |work=[[Bloomberg News]] |date=August 9, 2010 |access-date=August 31, 2020}}</ref><ref>{{cite news |last1=Warner |first1=Margaret |title=Tax cuts: Robert Rubin |work=PBS Newshour |url=https://www.pbs.org/newshour/show/tax-cuts-robert-rubin |date=February 21, 2001 |access-date=February 6, 2023}}</ref> During the [[Presidency of Joe Biden|Biden administration]], Rubin joined with four former Treasury secretaries to support the [[Inflation Reduction Act]] and supported a permanent refundable child tax credit with former Treasury Secretary [[Jacob Lew]].<ref>{{cite news |last1=Lawder |first1=David |title=Former U.S. Treasury secretaries back drugs, climate, tax bill |work=Reuters |url=https://www.reuters.com/markets/us/former-us-treasury-secretaries-back-drugs-climate-tax-bill-2022-08-03/ |date=August 3, 2022 |access-date=February 6, 2023}}</ref><ref>{{cite news |last1=Konish |first1=Lorie |work=CNBC |date=May 5, 2022 |access-date=February 6, 2023 |url=https://www.cnbc.com/2022/05/05/why-the-child-tax-credit-has-not-been-expanded-despite-democrats-support.html |title=Democrats are pushing to renew the expanded child tax credit. Here's why that hasn't happened yet}}</ref> |

|||

In April 2016, he was one of eight former Treasury secretaries who called on the United Kingdom to remain a member of the [[European Union]] ahead of the [[2016 United Kingdom European Union membership referendum|June 2016 Referendum]].<ref>{{cite news|title=Staying in EU 'best hope' for UK's future say ex-US Treasury secretaries|url=https://www.bbc.co.uk/news/uk-politics-eu-referendum-36087583|work=[[BBC News]]|date=April 20, 2016}}</ref> |

In April 2016, he was one of eight former Treasury secretaries who called on the United Kingdom to remain a member of the [[European Union]] ahead of the [[2016 United Kingdom European Union membership referendum|June 2016 Referendum]].<ref>{{cite news|title=Staying in EU 'best hope' for UK's future say ex-US Treasury secretaries|url=https://www.bbc.co.uk/news/uk-politics-eu-referendum-36087583|work=[[BBC News]]|date=April 20, 2016}}</ref> |

||

===Climate change policies=== |

|||

| ⚫ | Among Rubin's policy interests is [[climate change]].<ref name="WSJ-Demos-180608"/> In 2014, Rubin served as a member of the U.S. Climate Risk Committee, which oversaw the development of an analysis of the economic risks of [[climate change in the United States]].<ref>{{cite web |last1=Larsen |first1=Kate |last2=Delgado |first2=Michael |last3=Mohan |first3=Shashank |last4=Houser |first4=Trevor |title=American Climate Prospectus: Economic Risks in the United States |url=https://rhg.com/research/american-climate-prospectus-economic-risks-in-the-united-states/ |website=Rhodium Group |date=June 24, 2014 |access-date=February 6, 2023}}</ref> In an address at the Climate Leadership Conference on March 4, 2015, Rubin spoke about the [[economic impacts of climate change|economic effects of climate change]] and the costs of inaction.<ref>{{cite web |title=Robert Rubin: Speech at the Climate Leadership Conference |url=http://riskybusiness.org/blog/robert-rubin-climate-leadership-conference-speech |website=Risky Business |access-date=February 6, 2023 |archive-url=https://web.archive.org/web/20150907091834/http://riskybusiness.org/blog/robert-rubin-climate-leadership-conference-speech |archive-date=September 7, 2015 |date=March 4, 2015 |url-status=dead}}</ref> Calling climate change "the existential threat of our age," he called for the adoption of three proposals—revising estimates of the [[gross domestic product]] to reflect climate change externalities, disclosure to investors by companies of the costs of carbon they emit that they might be required to absorb, and including in the U.S. government's fiscal projections the future costs of dealing with climate change—to help catalyze a more active response to climate change risks. He first outlined these proposals in a ''Washington Post'' op-ed column titled "How Ignoring Climate Change Could Sink the U.S. Economy."<ref>{{cite news |last1=Rubin |first1=Robert |url=https://www.washingtonpost.com/opinions/robert-rubin-how-ignoring-climate-change-could-sink-the-us-economy/2014/07/24/b7b4c00c-0df6-11e4-8341-b8072b1e7348_story.html |newspaper=[[The Washington Post]] |date=July 24, 2014 |access-date=October 10, 2015 |title=How Ignoring Climate Change Could Sink the U.S. Economy}}</ref> |

||

In 2016, former Treasury secretaries Rubin, [[Henry Paulson]], and [[George Shultz]], members of the climate research group the Risky Business Project, penned a letter to the [[United States Securities and Exchange Commission]], urging regulators to manage financial disclosures regarding climate change.<ref name="ClimateWire-Hulac-160722">{{cite news |title=Former Treasury Chiefs Tell SEC to Crack Down on Climate |last1=Hulac |first1=Benjamin |url=https://www.scientificamerican.com/article/former-treasury-chiefs-tell-sec-to-crack-down-on-climate/ |work=ClimateWire |date=July 22, 2016 |access-date=August 24, 2020}}</ref> |

|||

== Personal life == |

== Personal life == |

||

| Line 128: | Line 140: | ||

== See also == |

== See also == |

||

*[[Rubinomics]] |

* [[Rubinomics]] |

||

*[[Skin in the Game (book)#Examples|Bob Rubin Trade]] |

* [[Skin in the Game (book)#Examples|Bob Rubin Trade]] |

||

* [[List of Jewish United States Cabinet members]] |

|||

== References == |

== References == |

||

| Line 135: | Line 148: | ||

== Sources == |

== Sources == |

||

*[http://clinton6.nara.gov/2001/01/2001-01-05-president-clinton-recipients-of-presidential-citizens-medal.html The White House - Office of the Press Secretary] |

*[http://clinton6.nara.gov/2001/01/2001-01-05-president-clinton-recipients-of-presidential-citizens-medal.html The White House - Office of the Press Secretary] {{Webarchive|url=https://web.archive.org/web/20160805211909/http://clinton6.nara.gov/2001/01/2001-01-05-president-clinton-recipients-of-presidential-citizens-medal.html |date=August 5, 2016 }} |

||

== Further reading == |

== Further reading == |

||

| Line 143: | Line 156: | ||

== External links == |

== External links == |

||

{{Commons category}} |

{{Commons category}} |

||

*[https://www.robertrubin.com Robert Rubin official site] |

|||

*[http://www.cfr.org/experts/world/robert-e-rubin/b292 Profile] {{Webarchive|url=https://web.archive.org/web/20140402163730/http://www.cfr.org/experts/world/robert-e-rubin/b292 |date=April 2, 2014 }} at [[Council on Foreign Relations]] |

*[http://www.cfr.org/experts/world/robert-e-rubin/b292 Profile] {{Webarchive|url=https://web.archive.org/web/20140402163730/http://www.cfr.org/experts/world/robert-e-rubin/b292 |date=April 2, 2014 }} at [[Council on Foreign Relations]] |

||

*{{C-SPAN|12018}} |

|||

*{{Charlie Rose view|46}} |

|||

*{{IMDb name|2614981}} |

*{{IMDb name|2614981}} |

||

*{{Worldcat id|lccn-no95-48218}} |

|||

*{{NYTtopic|people/r/robert_e_rubin}} |

*{{NYTtopic|people/r/robert_e_rubin}} |

||

| Line 199: | Line 210: | ||

[[Category:Jewish American members of the Cabinet of the United States]] |

[[Category:Jewish American members of the Cabinet of the United States]] |

||

[[Category:Presidential Citizens Medal recipients]] |

[[Category:Presidential Citizens Medal recipients]] |

||

[[Category:United States |

[[Category:United States secretaries of the treasury]] |

||

[[Category:Yale Law School alumni]] |

[[Category:Yale Law School alumni]] |

||

[[Category:People associated with Cleary Gottlieb Steen & Hamilton]] |

[[Category:People associated with Cleary Gottlieb Steen & Hamilton]] |

||

Latest revision as of 09:57, 23 November 2024

Robert Rubin | |

|---|---|

Rubin in 2014 | |

| Chairman of the Council on Foreign Relations | |

| In office June 30, 2007 – July 1, 2017 Serving with Carla Hills | |

| President | Richard Haass |

| Preceded by | Peter George Peterson |

| Succeeded by | David Rubenstein |

| 70th United States Secretary of the Treasury | |

| In office January 11, 1995 – July 2, 1999 | |

| President | Bill Clinton |

| Deputy | Frank N. Newman Larry Summers |

| Preceded by | Lloyd Bentsen |

| Succeeded by | Larry Summers |

| 1st Director of the National Economic Council | |

| In office January 25, 1993 – January 11, 1995 | |

| President | Bill Clinton |

| Preceded by | Position established |

| Succeeded by | Laura Tyson |

| Personal details | |

| Born | Robert Edward Rubin August 29, 1938 New York City, New York, U.S. |

| Political party | Democratic |

| Spouse | Judith Oxenberg |

| Children | 2 |

| Education | |

| Signature | |

| Website | robertrubin.com |

Robert Edward Rubin (born August 29, 1938) is an American retired banking executive, lawyer, and former government official. He served as the 70th U.S. Secretary of the Treasury during the Clinton administration. Before his government service, he spent 26 years at Goldman Sachs, eventually serving as a member of the board and co-chairman from 1990 to 1992.

Rubin is credited as a force behind Clinton-era economic prosperity, including the 1993 Deficit Reduction Act and Balanced Budget Act of 1997. However, critics of Rubin have since argued that the bank-friendly policies he supported contributed to the financial crisis of 2007–2008.

As of 2024, Rubin is active in several organizations, including as a co-founder of The Hamilton Project, as co-chair emeritus of the Council on Foreign Relations, and as a senior counselor at Centerview Partners.

Early life and education

[edit]Rubin was born on August 29, 1938, in New York City[1] to Jewish parents Sylvia (née Seiderman) and Alexander Rubin.[2][3] He moved to Miami Beach, Florida, at an early age and graduated from Miami Beach Senior High School.[4][5] In 1960, Rubin graduated with a Bachelor of Arts, summa cum laude, in economics from Harvard College.[6] He then attended Harvard Law School for three days before leaving to travel the world.[7] He later attended the London School of Economics and received an LL.B. from Yale Law School in 1964.[6]

Early career

[edit]Rubin was an attorney at the firm of Cleary, Gottlieb, Steen & Hamilton in New York City from 1964 to 1966 before joining Goldman Sachs in 1966 as an associate in the risk arbitrage department. He later served as co-chief operating officer, and became co-senior partner and co-chairman in 1990.[6][7][8]

Rubin served as New York finance chairman for the Walter Mondale presidential campaign in 1984[9] and headed the host committee for the 1992 Democratic National Convention in New York.[10]

He served on the board of directors of the New York Stock Exchange, the U.S. Securities and Exchange Commission Market Oversight and Financial Services Advisory Committee, and advisory panels for New York Gov. Mario Cuomo and Mayor David Dinkins.[11]

Clinton administration

[edit]From January 25, 1993, to January 10, 1995, Rubin served in the White House as Assistant to the President for Economic Policy. In that capacity, he directed the National Economic Council, which Bill Clinton created after winning the presidency.[12] The National Economic Council, or NEC, enabled the White House to coordinate closely the workings of the Cabinet departments and agencies on policies ranging from budget and tax to international trade and alleviating poverty. The NEC coordinated policy recommendations going into the President's office, and monitored implementation of the decisions that came out.[13] Robert S. Strauss credited Rubin with making the system work. "He's surely the only man or woman in America that I know who could make the NEC succeed," Strauss said in 1994. "Anyone else would have been a disruptive force, and the council wouldn't have worked."[14]

1993 Deficit Reduction Act

[edit]Rubin encouraged Clinton to focus on deficit reduction[15] and he was "one of the chief architects" of Clinton's 1993 Deficit Reduction Act plan.[16] Supporters said the Act helped create the late 1990s budget surplus and strong economic growth, while opponents noted it raised taxes.[16][17] As officials deliberated the deficit reduction plan, Rubin advocated for tax increases on those in the upper-income tax bracket.[18] The Baltimore Sun said that the budget deal "was critical" and "convinced nervous bond traders that the new Democratic president was serious about the deficit, lowering long-term interest rates, spurring economic growth and, ultimately, helping to balance the budget."[15]

Secretary of the Treasury

[edit]

Clinton nominated Rubin as Treasury secretary in December 1994. On January 10, 1995, Rubin was sworn in as the 70th United States Secretary of the Treasury after the U.S. Senate confirmed him in a 99-0 vote.[19][20] Rubin's tenure with the Clinton administration, especially as the head of Treasury, was marked by economic prosperity in the U.S. Rubin is credited as one of the main individuals behind U.S. economic growth, creating near full-employment and bullish stock markets while avoiding inflation.[7] From the time he joined the White House until he announced his resignation from Treasury in 1999, U.S. unemployment fell from 6.9 percent to 4.3 percent; the U.S. budget went from a $255 billion deficit to a $70 billion surplus, and inflation fell.[15][21] Rubin was succeeded in early July 1999 as Treasury secretary by his deputy, Lawrence Summers.[22]

According to CNN Money, Rubin was "one of the architects of the Clinton administration's economic policy, and is often credited—along with Federal Reserve Chairman Alan Greenspan—for the booming eight-year economic expansion, the second-longest in U.S. history".[23]

Senator Chuck Hagel (R-NE) called Rubin "an ideal public servant who put policy before politics."[24] At the time of Rubin's resignation, Clinton called Rubin the "greatest secretary of the Treasury since Alexander Hamilton."[25]

1990s international crises

[edit]Upon being sworn into office as Treasury secretary in January 1995, Rubin was confronted with the Mexican peso crisis, which threatened to result in Mexico defaulting on its foreign obligations.[26] President Bill Clinton, with the advice of Rubin and Greenspan, provided $20 billion in U.S. loan guarantees to the Mexican government through the Exchange Stabilization Fund.[17][26][27] Mexico recovered and the U.S. Treasury made a $580 million profit as a result of the loan agreement.[27][28]

In 1997 and 1998, Rubin, Greenspan, and Deputy Treasury Secretary Summers worked with the International Monetary Fund and others to promote U.S. policy in response to financial crises in Russian, Asian, and Latin American financial markets. On the cover of its February 15, 1999, edition, Time Magazine dubbed the three policymakers "The Committee to Save the World".[17]

Balanced budget agreement

[edit]

Early in the Clinton administration, Rubin touted a balanced budget and a strong dollar as a way for the Fed to lower interest rates.[29] He also argued that a balanced federal budget's broad benefits to society outweighed concerns that one group could benefit more than others.[30] Rubin was the Clinton administration's chief negotiator with a Republican-controlled Congress on the balanced-budget deal.[15][31] The Balanced Budget Act of 1997 has been referred to as the "capstone" of Rubin's tenure as Treasury secretary.[32]

Regulation of derivatives

[edit]In 1998, Rubin and Federal Reserve chairman Alan Greenspan opposed giving the Commodity Futures Trading Commission (CFTC) oversight of over-the-counter credit derivatives when this was proposed by Brooksley Born, then head of the CFTC. Rubin and other senior officials recommended Congress relieve the CFTC of regulatory authority over derivatives in November 1999.[33] Over-the-counter credit derivatives were eventually excluded from regulation by the CFTC by the Commodity Futures Modernization Act of 2000.[34] According to a PBS Frontline report, derivatives played a key role in the financial crisis of 2007–2008.[35]

Arthur Levitt Jr., a former chairman of the Securities and Exchange Commission, has said in explaining Rubin's strong opposition to the regulations proposed by Born that Greenspan and Rubin were "joined at the hip on this. They were certainly very fiercely opposed to this and persuaded me that this would cause chaos."[33] However, in Rubin's autobiography, he notes that he believed derivatives could pose significant problems and that many people who used derivatives did not fully understand the risks they were taking.[36] In 2008, The New York Times reported that the proposal in 1997 would not have improved oversight of derivatives. Rubin said the financial system "could benefit from better regulation of derivatives". However, "the politics would have made this impossible," he said.[37] Rubin said he had been concerned about derivatives' potential to create systemic risk since his time at Goldman Sachs.[38]

In an interview on ABC's This Week program in April 2010, former President Clinton said Rubin was wrong in the advice he gave him not to regulate derivatives, which was by then seen as one of the underlying causes of the 2007–08 financial crisis.[39] Clinton adviser Doug Band later said Clinton "inadvertently conflated an analysis he received on a specific derivatives proposal with then-Federal Reserve Chairman Alan Greenspan's arguments against any regulation of derivatives". He said Clinton still wished he had pursued legislation to regulate derivatives while confirming that he still believed he had received excellent advice on the economy and the financial system from Rubin and others during his presidency.[40]

Urban policy

[edit]Rubin was a leading advocate for investment in distressed rural and urban communities in the Clinton administration, from his time with the NEC, leading the effort to expand the Community Reinvestment Act, to his time at Treasury, where he advocated for more community development financial institutions (CDFI) to invest in inner cities and increase the CDFI Fund.[41][42][43] Addressing the needs of the urban poor was a top priority for Rubin during his tenure in the Clinton administration.[44] Rubin also assisted with the Clinton administration's plan to increase empowerment and enterprise zones across the U.S. The initiative offered tax breaks for businesses investing in those zones.[42]

Decline of the Glass-Steagall Act

[edit]As Treasury Secretary, Robert Rubin was on the record for stating that the Glass-Steagall Act was obsolete and outdated, and indeed its provisions had become less effective over time. However, it was not until the late 1990s that the Congress and the Clinton administration finally came round to repealing the act. This resulted in part from lobbying pressure exercised by Sanford I. Weill on Congress and the White House to repeal the Act, and so allow the mega-merger he had organized between Travelers Group and Citicorp in 1998 to stand.[45] Rubin resigned from the Clinton administration in July 1999.[22] In October 1999, Rubin joined the leadership at Citigroup.[46] Glass–Steagall was eventually repealed by the Gramm–Leach–Bliley Act under Rubin's successor, Lawrence Summers, and was signed by Clinton in November 1999.[37][47]

Post-government career

[edit]Local Initiatives Support Corporation