CARES Act: Difference between revisions

No edit summary |

Citation bot (talk | contribs) Altered template type. | Use this bot. Report bugs. | Suggested by Spinixster | Category:First presidency of Donald Trump | #UCB_Category 51/263 |

||

| (52 intermediate revisions by 39 users not shown) | |||

| Line 1: | Line 1: | ||

{{ |

{{Short description|COVID-19 stimulus in the United States}} |

||

{{Distinguish|text = various laws called [[CARE Act (disambiguation)|CARE Act]]}} |

{{Distinguish|text = various laws called [[CARE Act (disambiguation)|CARE Act]]}} |

||

{{Use mdy dates|date=January 2022}} |

{{Use mdy dates|date=January 2022}} |

||

| Line 5: | Line 5: | ||

| name = Coronavirus Aid, Relief, and Economic Security Act |

| name = Coronavirus Aid, Relief, and Economic Security Act |

||

| image_seal = <!--Defaults to the Great Seal--> |

| image_seal = <!--Defaults to the Great Seal--> |

||

| fullname = To provide emergency assistance and health care response for individuals, families, and businesses affected by the COVID |

| fullname = To provide emergency assistance and health care response for individuals, families, and businesses affected by the COVID disease. |

||

| acronym = CARES Act |

| acronym = CARES Act |

||

| nickname = <!--Unofficial name used by the press or general public--> |

| nickname = <!--Unofficial name used by the press or general public--> |

||

| effective date = March 27, 2020 |

| effective date = March 27, 2020 |

||

| enacted by = 116th |

| enacted by = 116th |

||

| sponsored by = |

| sponsored by = |

||

| number of co-sponsors = <!--give a number; could add a time period such as "when introduced"--> |

| number of co-sponsors = <!--give a number; could add a time period such as "when introduced"--> |

||

| public law url = |

| public law url = |

||

| cite public law = {{USPL|116|136}}<!--{{USPL|XXX|YY}} where X is the congress number and Y is the law number--> |

| cite public law = {{USPL|116|136}}<!--{{USPL|XXX|YY}} where X is the congress number and Y is the law number--> |

||

| cite statutes at large = <!--{{usstat}} can be used--> |

| cite statutes at large = <!--{{usstat}} can be used--> |

||

| Line 23: | Line 23: | ||

| authorizationsofappropriations = <!--a dollar amount, with dollar sign, possibly including a time period--> |

| authorizationsofappropriations = <!--a dollar amount, with dollar sign, possibly including a time period--> |

||

| appropriations = <!--a dollar amount, with dollar sign, possibly including a time period--> |

| appropriations = <!--a dollar amount, with dollar sign, possibly including a time period--> |

||

| leghisturl = |

| leghisturl = |

||

| introducedin = House |

| introducedin = House |

||

| introducedbill = {{USBill|116|HR|748}} (Middle Class Health Benefits Tax Repeal Act of 2019) |

| introducedbill = {{USBill|116|HR|748}} (Middle Class Health Benefits Tax Repeal Act of 2019) |

||

| Line 36: | Line 36: | ||

| passeddate2 = March 25, 2020 |

| passeddate2 = March 25, 2020 |

||

| passedvote2 = [https://www.senate.gov/legislative/LIS/roll_call_lists/roll_call_vote_cfm.cfm?congress=116&session=2&vote=00080 96–0] |

| passedvote2 = [https://www.senate.gov/legislative/LIS/roll_call_lists/roll_call_vote_cfm.cfm?congress=116&session=2&vote=00080 96–0] |

||

| conferencedate = |

| conferencedate = |

||

| passedbody3 = |

| passedbody3 = |

||

| passeddate3 = |

| passeddate3 = |

||

| passedvote3 = |

| passedvote3 = |

||

| agreedbody3 = House |

| agreedbody3 = House |

||

| agreeddate3 = March 27, 2020 |

| agreeddate3 = March 27, 2020 |

||

| Line 46: | Line 46: | ||

| agreeddate4 = <!--used if agreedbody3 further amends legislation--> |

| agreeddate4 = <!--used if agreedbody3 further amends legislation--> |

||

| agreedvote4 = <!--used if agreedbody3 further amends legislation--> |

| agreedvote4 = <!--used if agreedbody3 further amends legislation--> |

||

| passedbody4 = |

| passedbody4 = |

||

| passeddate4 = |

| passeddate4 = |

||

| passedvote4 = |

| passedvote4 = |

||

| signedpresident = [[Donald Trump]] |

| signedpresident = [[Donald Trump]] |

||

| signeddate = March 27, 2020 |

| signeddate = March 27, 2020 |

||

| Line 62: | Line 62: | ||

| overriddenvote2 = <!--used when passed by overriding presidential veto--> |

| overriddenvote2 = <!--used when passed by overriding presidential veto--> |

||

| amendments = [[Paycheck Protection Program and Health Care Enhancement Act]] |

| amendments = [[Paycheck Protection Program and Health Care Enhancement Act]] |

||

| SCOTUS cases = ''[[Yellen v. Confederated Tribes of the Chehalis Reservation]]'', {{ussc|docket=20-543|volume=594|year=2021}} |

| SCOTUS cases = {{ubl|framestyle=line-height:1em|''[[Yellen v. Confederated Tribes of the Chehalis Reservation]]'', {{ussc|docket=20-543|volume=594|page=338|year=2021}}}} |

||

}} |

}} |

||

The '''Coronavirus Aid, Relief, and Economic Security Act''',{{efn|{{USPL|116|136}}, {{USBill|116|H.R.|748}}.}}<!--NOTE: H.R. 748 is the correct bill that was passed by the Senate. See [https://assets.documentcloud.org/documents/20059055/final-final-cares-act.pdf]--><ref>{{Cite web|url=https://www.fedweek.com/fedweek/house-coronavirus-relief-bill-would-boost-federal-employee-benefits/|title=House Coronavirus Relief Bill Would Boost Federal Employee Benefits|date=March 25, 2020|website=FEDweek|language=en-US|access-date=March 25, 2020|archive-date=October 6, 2020|archive-url=https://web.archive.org/web/20201006070709/https://www.fedweek.com/fedweek/house-coronavirus-relief-bill-would-boost-federal-employee-benefits//|url-status=live}}</ref> also known as the '''CARES Act''',<ref name="ABC News Senate scrambles">{{cite web |last1=Parkinson |first1=John |title=Senate scrambles to strike deal on $1T pandemic relief for businesses, families |url=https://abcnews.go.com/Politics/senate-scrambles-strike-deal-1t-pandemic-relief-business/story?id=69713460 |website=[[ABC News]] |location=New York City |date=March 20, 2020 |access-date=March 22, 2020 |archive-date=October 6, 2020 |archive-url=https://web.archive.org/web/20201006070712/https://abcnews.go.com/Politics/senate-scrambles-strike-deal-1t-pandemic-relief-business/story?id=69713460%2F |url-status=live }}</ref> is a $2.2{{nbsp}}trillion [[Stimulus (economics)|economic stimulus]] bill passed by the [[116th United States Congress|116th U.S. Congress]] and signed into law by President [[Donald Trump]] on March 27, 2020, in response to the [[COVID-19 recession|economic fallout]] of the [[COVID-19 pandemic in the United States]].<ref name="NY Times stimulus united senate">{{cite news |last1=Hulse |first1=Carl |last2=Cochrane |first2=Emily |title=As Coronavirus Spread, Largest Stimulus in History United a Polarized Senate |url=https://www.nytimes.com/2020/03/26/us/coronavirus-senate-stimulus-package.html |website=The New York Times |date=March 26, 2020 |access-date=July 11, 2020 |archive-date=October 6, 2020 |archive-url=https://web.archive.org/web/20201006070721/https://www.nytimes.com/2020/03/26/us/coronavirus-senate-stimulus-package.html/ |url-status=live }}</ref><ref name="AP Trump signs 2.2">{{cite web |last1=Taylor |first1=Andrew |last2=Fram |first2=Alan |last3=Kellman |first3=Laurie |last4=Superville |first4=Darlene |title=Trump signs $2.2T stimulus after swift congressional votes |url=https://apnews.com/2099a53bb8adf2def7ee7329ea322f9d |website=Associated Press |access-date=July 17, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175436/https://apnews.com/2099a53bb8adf2def7ee7329ea322f9d |url-status=live }}</ref> The spending primarily includes $300{{nbsp}}billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more<ref name="USA Today stimulus checks">{{cite web |last1=Sauter |first1=Michael |title=Coronavirus stimulus checks: Here's how many people will get $1,200 in every state |url=https://www.usatoday.com/story/money/2020/04/28/how-many-people-will-get-1200-in-every-state/111604090/ |website=USA Today |access-date=October 13, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175449/https://www.usatoday.com/story/money/2020/04/28/how-many-people-will-get-1200-in-every-state/111604090/ |url-status=live }}</ref>), $260{{nbsp}}billion in increased unemployment benefits, the creation of the [[Paycheck Protection Program]] that provides [[forgivable loan]]s to small businesses with an initial $350{{nbsp}}billion in funding (later increased to $669{{nbsp}}billion by [[Paycheck Protection Program and Health Care Enhancement Act|subsequent legislation]]), $500{{nbsp}}billion in loans for corporations, and $339.8 billion to state and local governments.<ref name="NPR What's in CARES">{{cite news |last1=Snell |first1=Kelsey |title=What's Inside The Senate's $2 Trillion Coronavirus Aid Package |url=https://www.npr.org/2020/03/26/821457551/whats-inside-the-senate-s-2-trillion-coronavirus-aid-package |website=NPR |date=March 26, 2020 |access-date=July 11, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175436/https://www.npr.org/2020/03/26/821457551/whats-inside-the-senate-s-2-trillion-coronavirus-aid-package |url-status=live }}</ref> |

The '''Coronavirus Aid, Relief, and Economic Security Act''',{{efn|{{USPL|116|136}}, {{USBill|116|H.R.|748}}.}}<!--NOTE: H.R. 748 is the correct bill that was passed by the Senate. See [https://assets.documentcloud.org/documents/20059055/final-final-cares-act.pdf]--><ref>{{Cite web|url=https://www.fedweek.com/fedweek/house-coronavirus-relief-bill-would-boost-federal-employee-benefits/|title=House Coronavirus Relief Bill Would Boost Federal Employee Benefits|date=March 25, 2020|website=FEDweek|language=en-US|access-date=March 25, 2020|archive-date=October 6, 2020|archive-url=https://web.archive.org/web/20201006070709/https://www.fedweek.com/fedweek/house-coronavirus-relief-bill-would-boost-federal-employee-benefits//|url-status=live}}</ref> also known as the '''CARES Act''',<ref name="ABC News Senate scrambles">{{cite web |last1=Parkinson |first1=John |title=Senate scrambles to strike deal on $1T pandemic relief for businesses, families |url=https://abcnews.go.com/Politics/senate-scrambles-strike-deal-1t-pandemic-relief-business/story?id=69713460 |website=[[ABC News (United States)|ABC News]] |location=New York City |date=March 20, 2020 |access-date=March 22, 2020 |archive-date=October 6, 2020 |archive-url=https://web.archive.org/web/20201006070712/https://abcnews.go.com/Politics/senate-scrambles-strike-deal-1t-pandemic-relief-business/story?id=69713460%2F |url-status=live }}</ref> is a $2.2{{nbsp}}trillion [[Stimulus (economics)|economic stimulus]] bill passed by the [[116th United States Congress|116th U.S. Congress]] and signed into law by President [[Donald Trump]] on March 27, 2020, in response to the [[COVID-19 recession|economic fallout]] of the [[COVID-19 pandemic in the United States]].<ref name="NY Times stimulus united senate">{{cite news |last1=Hulse |first1=Carl |last2=Cochrane |first2=Emily |title=As Coronavirus Spread, Largest Stimulus in History United a Polarized Senate |url=https://www.nytimes.com/2020/03/26/us/coronavirus-senate-stimulus-package.html |website=[[The New York Times]] |date=March 26, 2020 |access-date=July 11, 2020 |archive-date=October 6, 2020 |archive-url=https://web.archive.org/web/20201006070721/https://www.nytimes.com/2020/03/26/us/coronavirus-senate-stimulus-package.html/ |url-status=live }}</ref><ref name="AP Trump signs 2.2">{{cite web |last1=Taylor |first1=Andrew |last2=Fram |first2=Alan |last3=Kellman |first3=Laurie |last4=Superville |first4=Darlene |title=Trump signs $2.2T stimulus after swift congressional votes |url=https://apnews.com/2099a53bb8adf2def7ee7329ea322f9d |website=[[Associated Press]] |date=March 28, 2020 |access-date=July 17, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175436/https://apnews.com/2099a53bb8adf2def7ee7329ea322f9d |url-status=live }}</ref> The spending primarily includes $300{{nbsp}}billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more<ref name="USA Today stimulus checks">{{cite web |last1=Sauter |first1=Michael |title=Coronavirus stimulus checks: Here's how many people will get $1,200 in every state |url=https://www.usatoday.com/story/money/2020/04/28/how-many-people-will-get-1200-in-every-state/111604090/ |website=[[USA Today]] |access-date=October 13, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175449/https://www.usatoday.com/story/money/2020/04/28/how-many-people-will-get-1200-in-every-state/111604090/ |url-status=live }}</ref>), $260{{nbsp}}billion in increased unemployment benefits, the creation of the [[Paycheck Protection Program]] that provides [[forgivable loan]]s to small businesses with an initial $350{{nbsp}}billion in funding (later increased to $669{{nbsp}}billion by [[Paycheck Protection Program and Health Care Enhancement Act|subsequent legislation]]), $500{{nbsp}}billion in loans for corporations, and $339.8 billion to state and local governments.<ref name="NPR What's in CARES">{{cite news |last1=Snell |first1=Kelsey |title=What's Inside The Senate's $2 Trillion Coronavirus Aid Package |url=https://www.npr.org/2020/03/26/821457551/whats-inside-the-senate-s-2-trillion-coronavirus-aid-package |website=[[NPR]] |date=March 26, 2020 |access-date=July 11, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175436/https://www.npr.org/2020/03/26/821457551/whats-inside-the-senate-s-2-trillion-coronavirus-aid-package |url-status=live }}</ref> |

||

The original CARES Act proposal included $500{{nbsp}}billion in direct payments to Americans, $208{{nbsp}}billion in loans to major industry, and $300{{nbsp}}billion in [[Small Business Administration]] loans.<ref name="The Hill McConnell introduces">Carney, Jordain (March 19, 2020). "[https://thehill.com/homenews/senate/488527-mcconnell-introduces-third-coronavirus-relief-proposal McConnell introduces third coronavirus relief proposal] {{Webarchive|url=https://web.archive.org/web/20201006071716/https://thehill.com/homenews/senate/488527-mcconnell-introduces-third-coronavirus-relief-proposal/ |date=October 6, 2020 }}". ''[[The Hill (newspaper)|The Hill]]''.</ref><ref>[https://www.jdsupra.com/legalnews/300-billion-sba-loan-program-expansion-14670/ 300 Billion SBA Loan Program Expansion Considered By Congress] {{Webarchive|url=https://web.archive.org/web/20201006071714/https://www.jdsupra.com/legalnews/300-billion-sba-loan-program-expansion-14670// |date=October 6, 2020 }}, ''JD Supra'' (March 23, 2020).</ref> As a result of bipartisan negotiations, the bill grew to $2{{nbsp}}trillion in the version unanimously passed by the [[United States Senate|Senate]] on March 25, 2020.<ref name=CochraneStolberg>Emily Cochrane & Sheryl Gay Stolberg, [https://www.nytimes.com/2020/03/27/us/politics/coronavirus-house-voting.html $2 Trillion Coronavirus Stimulus Bill Is Signed Into Law] {{Webarchive|url=https://web.archive.org/web/20201006071718/https://www.nytimes.com/2020/03/27/us/politics/coronavirus-house-voting.html/ |date=October 6, 2020 }}, ''New York Times'' (March 27, 2020).</ref><ref name="CNBC Senate passes $2 trillion">{{cite news |last1=Pramuk |first1=Jacob |title=Senate passes $2 trillion coronavirus stimulus package, sending it to the House |url=https://www.cnbc.com/2020/03/25/senate-passes-2-trillion-coronavirus-stimulus-package.html |work=CNBC |

The original CARES Act proposal included $500{{nbsp}}billion in direct payments to Americans, $208{{nbsp}}billion in loans to major industry, and $300{{nbsp}}billion in [[Small Business Administration]] loans.<ref name="The Hill McConnell introduces">Carney, Jordain (March 19, 2020). "[https://thehill.com/homenews/senate/488527-mcconnell-introduces-third-coronavirus-relief-proposal McConnell introduces third coronavirus relief proposal] {{Webarchive|url=https://web.archive.org/web/20201006071716/https://thehill.com/homenews/senate/488527-mcconnell-introduces-third-coronavirus-relief-proposal/ |date=October 6, 2020 }}". ''[[The Hill (newspaper)|The Hill]]''.</ref><ref>[https://www.jdsupra.com/legalnews/300-billion-sba-loan-program-expansion-14670/ 300 Billion SBA Loan Program Expansion Considered By Congress] {{Webarchive|url=https://web.archive.org/web/20201006071714/https://www.jdsupra.com/legalnews/300-billion-sba-loan-program-expansion-14670// |date=October 6, 2020 }}, ''JD Supra'' (March 23, 2020).</ref> As a result of bipartisan negotiations, the bill grew to $2{{nbsp}}trillion in the version unanimously passed by the [[United States Senate|Senate]] on March 25, 2020.<ref name=CochraneStolberg>Emily Cochrane & Sheryl Gay Stolberg, [https://www.nytimes.com/2020/03/27/us/politics/coronavirus-house-voting.html $2 Trillion Coronavirus Stimulus Bill Is Signed Into Law] {{Webarchive|url=https://web.archive.org/web/20201006071718/https://www.nytimes.com/2020/03/27/us/politics/coronavirus-house-voting.html/ |date=October 6, 2020 }}, ''New York Times'' (March 27, 2020).</ref><ref name="CNBC Senate passes $2 trillion">{{cite news |last1=Pramuk |first1=Jacob |title=Senate passes $2 trillion coronavirus stimulus package, sending it to the House |url=https://www.cnbc.com/2020/03/25/senate-passes-2-trillion-coronavirus-stimulus-package.html |work=[[CNBC]]|access-date=March 26, 2020 |archive-date=August 19, 2020 |archive-url=https://web.archive.org/web/20200819134431/https://www.cnbc.com/2020/03/25/senate-passes-2-trillion-coronavirus-stimulus-package.html |url-status=live }}</ref> It was passed by the [[United States House of Representatives|House]] via [[voice vote]] the next day, and was signed into law by President Donald Trump on March 27. It was originally introduced in the U.S. Congress on January 24, 2019, as {{USBill|116|H.R.|748}} ([[Middle Class Health Benefits Tax Repeal Act of 2019]]).{{efn|name="Bill2019"}} To comply with the [[Origination Clause]] of the [[Constitution of the United States|Constitution]],<ref name="FactCheck CARES Act History">{{cite web |last1=Spencer |first1=Saranac |title=Legislative History of CARES Act Doesn't Prove COVID-19 Conspiracy |date=May 4, 2020 |url=https://www.factcheck.org/2020/05/legislative-history-of-cares-act-doesnt-prove-covid-19-conspiracy/ |publisher=[[FactCheck.org]] |access-date=July 11, 2020 |archive-date=October 6, 2020 |archive-url=https://web.archive.org/web/20201006074709/https://www.factcheck.org/2020/05/legislative-history-of-cares-act-doesnt-prove-covid-19-conspiracy// |url-status=live }}</ref> the Senate then used H.R. 748 as a [[shell bill]] for the CARES Act,<ref name="Congress.gov shell bill">{{cite web |last1=United States Congress |title=MIDDLE CLASS HEALTH BENEFITS TAX REPEAL ACT OF 2019—MOTION TO PROCEED; Congressional Record Vol. 166, No. 54 |url=https://www.congress.gov/congressional-record/2020/03/20/senate-section/article/S1876-4 |access-date=July 11, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175431/https://www.congress.gov/congressional-record/2020/03/20/senate-section/article/S1876-4 |url-status=live }}</ref> changing the content of the bill and renaming it before passing it.<ref>{{cite web |title=Partly false claim: CARES Act bill introduced in January 2019, hinting at coronavirus conspiracy |url=https://www.reuters.com/article/uk-factcheck-cares-act-conspiracy/partly-false-claim-cares-act-bill-introduced-in-january-2019-hinting-at-coronavirus-conspiracy-idUSKBN22J31M |publisher=[[Reuters]] |author=Reuters Fact Check team |date=May 7, 2020 |access-date=May 27, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175429/https://www.reuters.com/article/uk-factcheck-cares-act-conspiracy/partly-false-claim-cares-act-bill-introduced-in-january-2019-hinting-at-coronavirus-conspiracy-idUSKBN22J31M |url-status=live }}</ref> |

||

Unprecedented in size and scope,<ref name=CochraneStolberg/> the legislation was the largest economic stimulus package in U.S. history,<ref>Wire, Sarah D. (March 25, 2020) "[https://www.latimes.com/politics/story/2020-03-25/vote-senate-on-2-trillion-economic-stimulus-package-coronavirus Senate passes $2-trillion economic stimulus package] {{Webarchive|url=https://web.archive.org/web/20201006074713/https://www.latimes.com/politics/story/2020-03-25/vote-senate-on-2-trillion-economic-stimulus-package-coronavirus/ |date=October 6, 2020 }}". ''The Los Angeles Times''.</ref> amounting to 10% of total U.S. gross domestic product.<ref name=Kambhampati>Kambhampati, Sandhya (March 26, 2020). "[https://www.latimes.com/politics/story/2020-03-26/coronavirus-stimulus-package-versus-recovery-act The coronavirus stimulus package versus the Recovery Act] {{Webarchive|url=https://web.archive.org/web/20200808105228/https://www.latimes.com/politics/story/2020-03-26/coronavirus-stimulus-package-versus-recovery-act |date=August 8, 2020 }}". ''The Los Angeles Times''.</ref> The bill is much larger than the $831{{nbsp}}billion [[American Recovery and Reinvestment Act of 2009|stimulus act]] passed in 2009 as part of the response to the [[Great Recession]].<ref name=Kambhampati/> The [[Congressional Budget Office]] estimates that it will add $1.7{{nbsp}}trillion to the deficits over the 2020–2030 period, with nearly all the impact in 2020 and 2021.<ref name="CBO_Score1"/> |

Unprecedented in size and scope,<ref name=CochraneStolberg/> the legislation was the largest economic stimulus package in U.S. history,<ref>Wire, Sarah D. (March 25, 2020) "[https://www.latimes.com/politics/story/2020-03-25/vote-senate-on-2-trillion-economic-stimulus-package-coronavirus Senate passes $2-trillion economic stimulus package] {{Webarchive|url=https://web.archive.org/web/20201006074713/https://www.latimes.com/politics/story/2020-03-25/vote-senate-on-2-trillion-economic-stimulus-package-coronavirus/ |date=October 6, 2020 }}". ''The Los Angeles Times''.</ref> amounting to 10% of total U.S. gross domestic product.<ref name=Kambhampati>Kambhampati, Sandhya (March 26, 2020). "[https://www.latimes.com/politics/story/2020-03-26/coronavirus-stimulus-package-versus-recovery-act The coronavirus stimulus package versus the Recovery Act] {{Webarchive|url=https://web.archive.org/web/20200808105228/https://www.latimes.com/politics/story/2020-03-26/coronavirus-stimulus-package-versus-recovery-act |date=August 8, 2020 }}". ''The Los Angeles Times''.</ref> The bill is much larger than the $831{{nbsp}}billion [[American Recovery and Reinvestment Act of 2009|stimulus act]] passed in 2009 as part of the response to the [[Great Recession]].<ref name=Kambhampati/> The [[Congressional Budget Office]] estimates that it will add $1.7{{nbsp}}trillion to the deficits over the 2020–2030 period, with nearly all the impact in 2020 and 2021.<ref name="CBO_Score1"/> |

||

Lawmakers refer to the bill as "Phase 3" of Congress's coronavirus response.<ref name="Vox What we know">{{cite web |last1=Nilsen |first1=Ella |last2=Zhou |first2=Li |title=What we know about Congress' potential $1 trillion coronavirus stimulus package |url=https://www.vox.com/2020/3/17/21183846/congress-coronavirus-stimulus-package |website=[[Vox (website)|Vox]] |publisher=[[Vox Media]] |location=New York City |date=March 17, 2020 |access-date=March 22, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175431/https://www.vox.com/2020/3/17/21183846/congress-coronavirus-stimulus-package |url-status=live }}</ref><ref name="Axios the growing stimulus">{{cite web |last1=Treene |first1=Alayna |title=The growing coronavirus stimulus packages |url=https://www.axios.com/coronavirus-stimulus-packages-compared-7613a16f-56d3-4522-a841-23a82fffcb46.html |website=[[Axios (website)|Axios]] |

Lawmakers refer to the bill as "Phase 3" of Congress's coronavirus response.<ref name="Vox What we know">{{cite web |last1=Nilsen |first1=Ella |last2=Zhou |first2=Li |title=What we know about Congress' potential $1 trillion coronavirus stimulus package |url=https://www.vox.com/2020/3/17/21183846/congress-coronavirus-stimulus-package |website=[[Vox (website)|Vox]] |publisher=[[Vox Media]] |location=New York City |date=March 17, 2020 |access-date=March 22, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175431/https://www.vox.com/2020/3/17/21183846/congress-coronavirus-stimulus-package |url-status=live }}</ref><ref name="Axios the growing stimulus">{{cite web |last1=Treene |first1=Alayna |title=The growing coronavirus stimulus packages |url=https://www.axios.com/coronavirus-stimulus-packages-compared-7613a16f-56d3-4522-a841-23a82fffcb46.html |website=[[Axios (website)|Axios]] |location=Arlington, Virginia |date=March 19, 2020 |access-date=March 22, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175441/https://www.axios.com/coronavirus-stimulus-packages-compared-7613a16f-56d3-4522-a841-23a82fffcb46.html |url-status=live }}</ref> The first phase was the [[Coronavirus Preparedness and Response Supplemental Appropriations Act]] that provided for vaccine research and development. The [[Families First Coronavirus Response Act]], which focused on unemployment and sick leave compensation, was phase 2. All three phases were enacted the same month.<ref name="Vox What we know" /> |

||

An additional $900 billion in relief was attached to the [[Consolidated Appropriations Act, 2021]], which was passed by Congress on December 21, 2020, and signed by President Trump on December 27, after some CARES Act programs being renewed had already expired. |

An additional $900 billion in relief was attached to the [[Consolidated Appropriations Act, 2021]], which was passed by Congress on December 21, 2020, and signed by President Trump on December 27, after some CARES Act programs being renewed had already expired. |

||

| Line 82: | Line 82: | ||

In response to the COVID-19 pandemic, dramatic global [[Economic impact of the COVID-19 pandemic|reduction in economic activity]] occurred as a result of the [[social distancing]] measures meant to curb the virus. These measures included working from home, widespread cancellation of events, [[Impact of the COVID-19 pandemic on education|cancellation of classes]] (or moving in-person to online classes), [[Travel restrictions related to the COVID-19 pandemic|reduction of travel]], and the closure of businesses. |

In response to the COVID-19 pandemic, dramatic global [[Economic impact of the COVID-19 pandemic|reduction in economic activity]] occurred as a result of the [[social distancing]] measures meant to curb the virus. These measures included working from home, widespread cancellation of events, [[Impact of the COVID-19 pandemic on education|cancellation of classes]] (or moving in-person to online classes), [[Travel restrictions related to the COVID-19 pandemic|reduction of travel]], and the closure of businesses. |

||

In March, it was predicted that, without government intervention, most airlines around the world would go bankrupt.<ref name="CNN Most airlines could be bankrupt">{{cite web |last1=Ziady |first1=Hanna |title=Most airlines could be bankrupt by May. Governments will have to help |url=https://www.cnn.com/2020/03/16/business/airlines-bailouts/index.html |website=CNN Business |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175434/https://www.cnn.com/2020/03/16/business/airlines-bailouts/index.html |url-status=live }}</ref> On March 16, the trade group representing the U.S. airline industry requested a $50{{nbsp}}billion federal bailout.<ref name="airline industry seeks $50 billion">{{cite web |last1=Wallace |first1=Gregory |last2=Mattingly |first2=Phil |last3=Isidore |first3=Chris |title=US airline industry seeks about $50 billion in federal help |url=https://www.cnn.com/2020/03/16/business/us-airlines-federal-bailout/index.html |website=CNN Business |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175443/https://www.cnn.com/2020/03/16/business/us-airlines-federal-bailout/index.html |url-status=live }}</ref> |

In March, it was predicted that, without government intervention, most airlines around the world would go bankrupt.<ref name="CNN Most airlines could be bankrupt">{{cite web |last1=Ziady |first1=Hanna |title=Most airlines could be bankrupt by May. Governments will have to help |url=https://www.cnn.com/2020/03/16/business/airlines-bailouts/index.html |website=[[CNN Business]] |date=March 16, 2020 |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175434/https://www.cnn.com/2020/03/16/business/airlines-bailouts/index.html |url-status=live }}</ref> On March 16, the trade group representing the U.S. airline industry requested a $50{{nbsp}}billion federal bailout.<ref name="airline industry seeks $50 billion">{{cite web |last1=Wallace |first1=Gregory |last2=Mattingly |first2=Phil |last3=Isidore |first3=Chris |title=US airline industry seeks about $50 billion in federal help |url=https://www.cnn.com/2020/03/16/business/us-airlines-federal-bailout/index.html |website=[[CNN Business]] |date=March 16, 2020 |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175443/https://www.cnn.com/2020/03/16/business/us-airlines-federal-bailout/index.html |url-status=live }}</ref> |

||

On March 18, the [[National Restaurant Association]] wrote the President and Congress with an estimate that "the industry's sales will decline by $225{{nbsp}}billion during the next three months, which will prompt the loss of between five and seven million jobs," accompanied by a request of $145{{nbsp}}billion of aid to restaurants.<ref name="The Hill Restaurant industry estimates">{{cite web|title=Restaurant industry estimates $225B in losses from coronavirus|url=https://thehill.com/business-a-lobbying/business-a-lobbying/488223-restaurant-industry-estimates-225b-in-losses-from|last1=Gangitano|first1=Alex|website=The Hill|date=March 18, 2020|access-date=March 28, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175443/https://thehill.com/business-a-lobbying/business-a-lobbying/488223-restaurant-industry-estimates-225b-in-losses-from|url-status=live}}</ref> |

On March 18, the [[National Restaurant Association]] wrote the President and Congress with an estimate that "the industry's sales will decline by $225{{nbsp}}billion during the next three months, which will prompt the loss of between five and seven million jobs," accompanied by a request of $145{{nbsp}}billion of aid to restaurants.<ref name="The Hill Restaurant industry estimates">{{cite web|title=Restaurant industry estimates $225B in losses from coronavirus|url=https://thehill.com/business-a-lobbying/business-a-lobbying/488223-restaurant-industry-estimates-225b-in-losses-from|last1=Gangitano|first1=Alex|website=[[The Hill (newspaper)|The Hill]]|date=March 18, 2020|access-date=March 28, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175443/https://thehill.com/business-a-lobbying/business-a-lobbying/488223-restaurant-industry-estimates-225b-in-losses-from|url-status=live}}</ref> |

||

In an effort to gain Republican support for a large stimulus package that, at the time, was envisioned to be about $1{{nbsp}}trillion, United States Secretary of the Treasury [[Steven Mnuchin]] told Republican Senators the United States unemployment rate could reach 20% if no government action was taken.<ref name="Mnuchin warns senators of 20%">{{cite news |title=Mnuchin warns senators of 20% U.S. unemployment without coronavirus rescue—source |url=https://www.reuters.com/article/us-health-coronavirus-usa-unemployment/mnuchin-warns-senators-of-20-us-unemployment-without-coronavirus-rescue-source-idUSKBN21502N |website=Reuters |

In an effort to gain Republican support for a large stimulus package that, at the time, was envisioned to be about $1{{nbsp}}trillion, United States Secretary of the Treasury [[Steven Mnuchin]] told Republican Senators the United States unemployment rate could reach 20% if no government action was taken.<ref name="Mnuchin warns senators of 20%">{{cite news |title=Mnuchin warns senators of 20% U.S. unemployment without coronavirus rescue—source |url=https://www.reuters.com/article/us-health-coronavirus-usa-unemployment/mnuchin-warns-senators-of-20-us-unemployment-without-coronavirus-rescue-source-idUSKBN21502N |website=[[Reuters]]|date=March 18, 2020 |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175442/https://www.reuters.com/article/us-health-coronavirus-usa-unemployment/mnuchin-warns-senators-of-20-us-unemployment-without-coronavirus-rescue-source-idUSKBN21502N |url-status=live }}</ref> Almost 3.3{{nbsp}}million Americans filed for unemployment in the week ending March 21, "nearly five times more than the previous record of 695,000 set in 1982".<ref name="BBC News unemployment">{{cite news |title=Coronavirus: Record number of Americans file for unemployment |work=[[BBC News]] |date=March 26, 2020 |url=https://www.bbc.com/news/business-52050426 |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175454/https://www.bbc.com/news/business-52050426 |url-status=live }}</ref> |

||

On March 20, [[Goldman Sachs]] predicted the U.S. gross domestic product would "decline by 24% in the second quarter of 2020 because of the coronavirus pandemic".<ref name="Insider GS prediction">{{cite web |last1=Reinicke |first1=Carmen |title=Goldman Sachs now says US GDP will shrink 24% next quarter amid the coronavirus pandemic—which would be 2.5 times bigger than any decline in history |url=https://markets.businessinsider.com/news/stocks/us-gdp-drop-record-2q-amid-coronavirus-recession-goldman-sachs-2020-3-1029018308 |

On March 20, [[Goldman Sachs]] predicted the U.S. gross domestic product would "decline by 24% in the second quarter of 2020 because of the coronavirus pandemic".<ref name="Insider GS prediction">{{cite web |last1=Reinicke |first1=Carmen |title=Goldman Sachs now says US GDP will shrink 24% next quarter amid the coronavirus pandemic—which would be 2.5 times bigger than any decline in history |url=https://markets.businessinsider.com/news/stocks/us-gdp-drop-record-2q-amid-coronavirus-recession-goldman-sachs-2020-3-1029018308 |website=Markets Insider |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175445/https://markets.businessinsider.com/news/stocks/us-gdp-drop-record-2q-amid-coronavirus-recession-goldman-sachs-2020-3-1029018308 |url-status=live }}</ref> [[Deutsche Bank]] predicted the U.S. economy would shrink by 12.9% in the second quarter of 2020.<ref name="Deutsche Bank forecast">{{cite web |last1=Winck |first1=Ben |title=The worst global recession since World War II: Deutsche Bank just unveiled a bleak new forecast as the coronavirus rocks economies worldwide |url=https://markets.businessinsider.com/news/stocks/coronavirus-recession-worst-wwii-economic-recovery-global-deutsche-bank-2020-3-1029012757 |website=Markets Insider |access-date=March 28, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175446/https://markets.businessinsider.com/news/stocks/coronavirus-recession-worst-wwii-economic-recovery-global-deutsche-bank-2020-3-1029012757 |url-status=live }}</ref> |

||

===Initial proposals=== |

===Initial proposals=== |

||

Two relief bills were signed by |

Two relief bills were signed by President Trump early in 2020: $8 billion on March 6,<ref>{{Cite web|last1=Hirsch|first1=Lauren|last2=Breuninger|first2=Kevin|date=March 6, 2020|title=Trump signs $8.3 billion emergency coronavirus spending package|url=https://www.cnbc.com/2020/03/06/trump-signs-8point3-billion-emergency-coronavirus-spending-package.html|access-date=October 5, 2020|website=[[CNBC]]|language=en|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175449/https://www.cnbc.com/2020/03/06/trump-signs-8point3-billion-emergency-coronavirus-spending-package.html|url-status=live}}</ref> and $192 billion on March 18.<ref>{{Cite news|last=Grisales|first=Claudia|date=March 18, 2020|title=President Trump Signs Coronavirus Emergency Aid Package|url=https://www.npr.org/2020/03/18/817737690/senate-passes-coronavirus-emergency-aid-sending-plan-to-president|access-date=October 5, 2020|newspaper=[[NPR]]|language=en|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175451/https://www.npr.org/2020/03/18/817737690/senate-passes-coronavirus-emergency-aid-sending-plan-to-president|url-status=live}}</ref> It was apparent to Congress that these would not be sufficient. A much larger third package, which was to become the CARES Act, was negotiated.<ref>{{Cite news|last=Whoriskey|first=Peter|date=October 5, 2020|title='Doomed to fail': Why a $4 trillion bailout couldn't revive the American economy|newspaper=[[The Washington Post]]|url=https://www.washingtonpost.com/graphics/2020/business/coronavirus-bailout-spending/|access-date=October 5, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175506/https://www.washingtonpost.com/graphics/2020/business/coronavirus-bailout-spending/|url-status=live}}</ref> |

||

In mid-March 2020, Democratic politicians [[Andrew Yang]], [[Alexandria Ocasio-Cortez]], and [[Tulsi Gabbard]] advocated for universal [[basic income]] in response to the [[COVID-19 pandemic in the United States]];<ref>{{cite news |last1=Clifford |first1=Catherine |title=Andrew Yang, AOC, Harvard professor: Free cash payments would help during coronavirus pandemic |url=https://www.cnbc.com/2020/03/13/andrew-yang-aoc-free-ubi-cash-can-help-during-coronavirus-pandemic.html |access-date=March 16, 2020 |work=CNBC |

In mid-March 2020, Democratic politicians [[Andrew Yang]], [[Alexandria Ocasio-Cortez]], and [[Tulsi Gabbard]] advocated for universal [[basic income]] in response to the [[COVID-19 pandemic in the United States]];<ref>{{cite news |last1=Clifford |first1=Catherine |title=Andrew Yang, AOC, Harvard professor: Free cash payments would help during coronavirus pandemic |url=https://www.cnbc.com/2020/03/13/andrew-yang-aoc-free-ubi-cash-can-help-during-coronavirus-pandemic.html |access-date=March 16, 2020 |work=[[CNBC]]|date=March 13, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175450/https://www.cnbc.com/2020/03/13/andrew-yang-aoc-free-ubi-cash-can-help-during-coronavirus-pandemic.html |url-status=live }}</ref><ref>{{cite news |last1=Relman |first1=Eliza |title=Alexandria Ocasio-Cortez demands the government distribute a universal basic income and implement 'Medicare for all' to fight the coronavirus |url=https://www.businessinsider.com/coronavirus-aoc-demands-universal-basic-income-other-radical-measures-2020-3 |access-date=March 14, 2020 |work=[[Business Insider]] |date=March 12, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175456/https://www.businessinsider.com/coronavirus-aoc-demands-universal-basic-income-other-radical-measures-2020-3 |url-status=live }}</ref> Gabbard suggested that it be a temporary measure until the crisis subsides.<ref>{{cite news |last1=Garcia |first1=Victor |title=Gabbard pitches 'emergency, temporary' $1,000 payment to every adult as coronavirus outbreak spreads |url=https://www.foxnews.com/media/tulsi-gabbard-coronavirus-emergency-temporary-payment |access-date=March 14, 2020 |work=[[Fox News]] |date=March 12, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175450/https://www.foxnews.com/media/tulsi-gabbard-coronavirus-emergency-temporary-payment |url-status=live }}</ref> On March 13, Democratic representatives [[Ro Khanna]] and [[Tim Ryan (Ohio politician)|Tim Ryan]] introduced legislation to provide payments to low-income citizens during the crisis via an [[earned income tax credit]].<ref>{{cite news |last1=Moreno |first1=J. Edward |title=Lawmakers call for universal basic income amid coronavirus crisis |url=https://thehill.com/homenews/house/487485-lawmakers-call-for-economic-stimulus-ubi-amid-coronavirus-crisis |access-date=March 16, 2020 |work=[[The Hill (newspaper)|The Hill]] |date=March 13, 2020 |archive-date=July 12, 2020 |archive-url=https://web.archive.org/web/20200712144525/https://thehill.com/homenews/house/487485-lawmakers-call-for-economic-stimulus-ubi-amid-coronavirus-crisis |url-status=live }}</ref><ref>{{cite news |last1=Corbett |first1=Jessica |title=House Democrats Propose Sending Checks of Up to $6,000 to Help Ease Workers' Pain During Coronavirus Pandemic |url=https://www.commondreams.org/news/2020/03/13/house-democrats-propose-sending-checks-6000-help-ease-workers-pain-during |access-date=March 16, 2020 |work=Common Dreams |date=March 13, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175510/https://www.commondreams.org/news/2020/03/13/house-democrats-propose-sending-checks-6000-help-ease-workers-pain-during |url-status=live }}</ref> On March 16, Republican senators [[Mitt Romney]] and [[Tom Cotton]] stated their support for a $1,000 basic income, Romney saying it should be a one-time payment to help with short-term costs.<ref>{{cite news |last1=Lahut |first1=Jake |title=Tom Cotton is calling for Americans to get cash payments through the coronavirus outbreak |url=https://www.businessinsider.com/tom-cotton-calling-for-americans-to-get-100-month-coronavirus-2020-3 |access-date=March 18, 2020 |work=[[Business Insider]] |date=March 16, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175500/https://www.businessinsider.com/tom-cotton-calling-for-americans-to-get-100-month-coronavirus-2020-3 |url-status=live }}</ref> On March 17, the [[First presidency of Donald Trump|Trump administration]] indicated that some payment would be given to non-millionaires as part of a stimulus package.<ref name="Singman">{{cite news |last1=Singman |first1=Brooke |title=Trump wants to send Americans checks 'immediately' in response to coronavirus, Mnuchin says |url=https://www.foxnews.com/politics/trump-wants-to-send-money-to-americans-in-next-two-weeks-amid-coronavirus-outbreak |access-date=March 18, 2020 |work=[[Fox News]] |date=March 17, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175458/https://www.foxnews.com/politics/trump-wants-to-send-money-to-americans-in-next-two-weeks-amid-coronavirus-outbreak |url-status=live }}</ref><ref name="trillion"/> |

||

With guidance from the White House, Senate Majority Leader [[Mitch McConnell]] proposed a third stimulus package, amounting to more than $1{{nbsp}}trillion.{{efn|This included $300{{nbsp}}billion to help small businesses with forgivable loans up to $10{{nbsp}}million<ref name=hurdles/> and $200{{nbsp}}billion to support industries such as airlines, cruise companies, and hotels through loans and other measures.<ref>{{cite news |last1=Stone |first1=Peter |title=Washington lobbyists in frenzied battle to secure billion-dollar coronavirus bailouts |url=https://www.theguardian.com/world/2020/mar/20/coronavirus-washington-lobbyists-bailout |work=The Guardian |date=March 20, 2020 |access-date=March 27, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175502/https://www.theguardian.com/world/2020/mar/20/coronavirus-washington-lobbyists-bailout |url-status=live }}</ref> Democrats advocated for banning stock {{nowrap|buy-backs}} to prevent these funds from being used to make a profit.<ref>{{cite news | |

With guidance from the White House, Senate Majority Leader [[Mitch McConnell]] proposed a third stimulus package, amounting to more than $1{{nbsp}}trillion.{{efn|This included $300{{nbsp}}billion to help small businesses with forgivable loans up to $10{{nbsp}}million<ref name=hurdles/> and $200{{nbsp}}billion to support industries such as airlines, cruise companies, and hotels through loans and other measures.<ref>{{cite news |last1=Stone |first1=Peter |title=Washington lobbyists in frenzied battle to secure billion-dollar coronavirus bailouts |url=https://www.theguardian.com/world/2020/mar/20/coronavirus-washington-lobbyists-bailout |work=[[The Guardian]] |date=March 20, 2020 |access-date=March 27, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175502/https://www.theguardian.com/world/2020/mar/20/coronavirus-washington-lobbyists-bailout |url-status=live }}</ref> Democrats advocated for banning stock {{nowrap|buy-backs}} to prevent these funds from being used to make a profit.<ref>{{cite news |agency=[[Associated Press]] |title=Congress and White House resume talks on $1tn pandemic rescue deal |url=https://www.theguardian.com/world/2020/mar/21/us-coronavirus-economic-rescue-trump |access-date=March 22, 2020 |work=[[The Guardian]] |date=March 21, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175510/https://www.theguardian.com/world/2020/mar/21/us-coronavirus-economic-rescue-trump |url-status=live }}</ref>}} It was suggested that $200–500{{nbsp}}billion would fund tax rebate checks to Americans who made between $2,500 and $75,000 in 2018 to help cover short-term costs<ref name="trillion">{{cite news |last1=Hunt |first1=Kasie |last2=Caldwell |first2=Leigh Ann |last3=Tsirkin |first3=Julie |last4=Shabad |first4=Rebecca |title=White House eyeing $1 trillion coronavirus stimulus package |url=https://www.nbcnews.com/politics/congress/senate-democrats-have-prepped-third-coronavirus-aid-package-n1161506 |access-date=March 18, 2020 |work=[[NBC News]] |date=March 17, 2020}}</ref><ref name = "Singman"/> via one or two payments of $600–1,200 per adult and $500 per child.<ref>{{cite news |last1=Breuninger |first1=Kevin |title=Trump wants direct payments of $1,000 for adults, $500 for kids in coronavirus stimulus bill, Mnuchin says |url=https://www.cnbc.com/2020/03/19/coronavirus-trump-wants-payments-of-1000-for-adults-500-for-kids.html |access-date=March 20, 2020 |work=[[CNBC]]|date=March 19, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175509/https://www.cnbc.com/2020/03/19/coronavirus-trump-wants-payments-of-1000-for-adults-500-for-kids.html |url-status=live }}</ref><ref>{{cite news |last1=Re |first1=Gregg |title=McConnell's coronavirus stimulus plan would provide payments of $1,200 per person, $2,400 for couples |url=https://www.foxnews.com/politics/mcconnell-coronavirus-stimulus-plan-payments |access-date=March 20, 2020 |work=[[Fox News]] |date=March 19, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175513/https://www.foxnews.com/politics/mcconnell-coronavirus-stimulus-plan-payments |url-status=live }}</ref><ref name=rebate/> Democrats prepared a $750{{nbsp}}billion package as a {{nowrap|counter-offer}},<ref>{{cite news |last1=Carney |first1=Jordain |title=McConnell takes reins of third coronavirus bill |url=https://thehill.com/homenews/senate/488338-mcconnell-takes-reins-of-third-coronavirus-bill |access-date=March 18, 2020 |work=[[The Hill (newspaper)|The Hill]] |date=March 18, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175511/https://thehill.com/homenews/senate/488338-mcconnell-takes-reins-of-third-coronavirus-bill |url-status=live }}</ref><ref>{{cite news |last1=Caygle |first1=Heather |last2=Bresnahan |first2=John |last3=Ferris |first3=Sarah |title=Pelosi looks to lay down marker on next stimulus plan |url=https://www.politico.com/news/2020/03/18/nancy-pelosi-coronavirus-stimulus-plan-136142 |access-date=March 18, 2020 |work=[[Politico]]|date=March 18, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175511/https://www.politico.com/news/2020/03/18/nancy-pelosi-coronavirus-stimulus-plan-136142 |url-status=live }}</ref> which focused on expanding [[unemployment benefits]] instead of tax rebates.<ref name=rebate>{{cite news |last1=Bolton |first1=Alexander |title=Democrats balk at $1,200 rebate checks in stimulus plan |url=https://thehill.com/homenews/senate/488677-democrats-balk-at-1200-rebate-checks-in-stimulus-plan |access-date=March 20, 2020 |work=[[The Hill (newspaper)|The Hill]] |date=March 20, 2020 |archive-date=February 15, 2021 |archive-url=https://web.archive.org/web/20210215175518/https://thehill.com/homenews/senate/488677-democrats-balk-at-1200-rebate-checks-in-stimulus-plan |url-status=live }}</ref> A compromise plan was made to set aside $250{{nbsp}}billion for tax rebates and the same amount for unemployment.<ref name=hurdles>{{cite news |last1=Mattingly |first1=Phil |title=Stimulus package could top $2 trillion as negotiators look to clear final major hurdles |url=https://www.cnn.com/2020/03/21/politics/stimulus-package-negotiations-congress-coronavirus/index.html |access-date=March 22, 2020 |work=[[CNN]]|date=March 21, 2020 |archive-date=March 22, 2020 |archive-url=https://web.archive.org/web/20200322043902/https://www.cnn.com/2020/03/21/politics/stimulus-package-negotiations-congress-coronavirus/index.html |url-status=live }}</ref> |

||

=== Subsequent initiatives === |

=== Subsequent initiatives === |

||

On April 21, 2020, the Senate approved the [[Paycheck Protection Program and Health Care Enhancement Act|Paycheck Protection Program and Healthcare Enhancement Act]], providing $484 billion in additional funding to the existing Paycheck Protection Program, and President Trump signed it into law three days later.<ref>{{Cite news|last1=Cochrane|first1=Emily|last2=Tankersley|first2=Jim|date=April 21, 2020|title=Senate Approves Aid for Small-Business Loan Program, Hospitals and Testing|language=en-US|work=The New York Times|url=https://www.nytimes.com/2020/04/21/us/politics/congress-business-relief-ppp.html|access-date=December 21, 2020|issn=0362-4331|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175521/https://www.nytimes.com/2020/04/21/us/politics/congress-business-relief-ppp.html|url-status=live}}</ref> On May 15, 2020, the Democratic-controlled House passed a $3 trillion relief bill called the [[HEROES Act]], but the Republican-controlled Senate never brought it to a vote.<ref>{{Cite news|last=Werner|first=Erica|date=May 15, 2020|title=House Democrats pass $3 trillion coronavirus relief bill despite Trump's veto threat| |

On April 21, 2020, the Senate approved the [[Paycheck Protection Program and Health Care Enhancement Act|Paycheck Protection Program and Healthcare Enhancement Act]], providing $484 billion in additional funding to the existing Paycheck Protection Program, and President Trump signed it into law three days later.<ref>{{Cite news|last1=Cochrane|first1=Emily|last2=Tankersley|first2=Jim|date=April 21, 2020|title=Senate Approves Aid for Small-Business Loan Program, Hospitals and Testing|language=en-US|work=[[The New York Times]]|url=https://www.nytimes.com/2020/04/21/us/politics/congress-business-relief-ppp.html|access-date=December 21, 2020|issn=0362-4331|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175521/https://www.nytimes.com/2020/04/21/us/politics/congress-business-relief-ppp.html|url-status=live}}</ref> On May 15, 2020, the Democratic-controlled House passed a $3 trillion relief bill called the [[HEROES Act]], but the Republican-controlled Senate never brought it to a vote.<ref>{{Cite news|last=Werner|first=Erica|date=May 15, 2020|title=House Democrats pass $3 trillion coronavirus relief bill despite Trump's veto threat|newspaper=[[The Washington Post]]|url=https://www.washingtonpost.com/us-policy/2020/05/15/democrats-pelosi-congress-coronavirus-3-trillion-trump/|url-status=live|access-date=December 23, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175530/https://www.washingtonpost.com/us-policy/2020/05/15/democrats-pelosi-congress-coronavirus-3-trillion-trump/}}</ref> There was no other significant economic relief bill until late December 2020 when Congress reached an agreement on a $900 billion stimulus.<ref>{{Cite news|last=Cochrane|first=Emily|date=December 20, 2020|title=Congress Strikes Long-Sought Stimulus Deal to Provide $900 Billion in Aid|language=en-US|work=[[The New York Times]]|url=https://www.nytimes.com/2020/12/20/us/politics/congress-stimulus-deal.html|access-date=December 21, 2020|issn=0362-4331|archive-date=January 21, 2021|archive-url=https://web.archive.org/web/20210121140014/https://www.nytimes.com/2020/12/20/us/politics/congress-stimulus-deal.html|url-status=live}}</ref> |

||

==Relief to healthcare |

==Relief to healthcare corporations: hospitals, manufacturers, and distributors== |

||

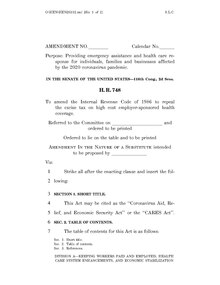

[[File:CARES ACT - Relief Amounts.png|thumb|upright=1.1|CARES Act relief amounts by category (in billions of dollars), totaling $2.1{{nbsp}}trillion |

[[File:CARES ACT - Relief Amounts.png|thumb|upright=1.1|CARES Act relief amounts by category (in billions of dollars), totaling $2.1{{nbsp}}trillion<ref>{{Cite web|url=https://www.wsj.com/articles/relief-package-would-limit-coronavirus-damage-not-restore-economy-11585215006|title=Relief Package Would Limit Coronavirus Damage, Not Restore Economy|website=www.wsj.com|publisher=[[The Wall Street Journal]]|date=March 26, 2020|access-date=March 27, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175515/https://www.wsj.com/articles/relief-package-would-limit-coronavirus-damage-not-restore-economy-11585215006|url-status=live}}</ref>]] |

||

[[File:CARES_Act_Sankey_Diagram.png|thumb|upright=1.1|[[Sankey diagram]] of CARES Act relief amounts |

[[File:CARES_Act_Sankey_Diagram.png|thumb|upright=1.1|[[Sankey diagram]] of CARES Act relief amounts]] |

||

===Provisions=== |

===Provisions=== |

||

| Line 111: | Line 111: | ||

* Allocates $130 billion to the medical and hospital industries. Also including medical equipment manufacturers.<ref name="supports">Goodrich, Kate (March 30, 2020). "[https://www.jw.com/news/insights-cares-act-healthcare-provisions-covid19/ How the CARES Act Supports America's Healthcare System in the Fight Against COVID-19] {{Webarchive|url=https://web.archive.org/web/20210215175608/https://www.jw.com/news/insights-cares-act-healthcare-provisions-covid19/ |date=February 15, 2021 }}". ''Jackson Walker''</ref> |

* Allocates $130 billion to the medical and hospital industries. Also including medical equipment manufacturers.<ref name="supports">Goodrich, Kate (March 30, 2020). "[https://www.jw.com/news/insights-cares-act-healthcare-provisions-covid19/ How the CARES Act Supports America's Healthcare System in the Fight Against COVID-19] {{Webarchive|url=https://web.archive.org/web/20210215175608/https://www.jw.com/news/insights-cares-act-healthcare-provisions-covid19/ |date=February 15, 2021 }}". ''Jackson Walker''</ref> |

||

* Reauthorizes and allocates funding to public health programs.<ref name="supports" /> |

* Reauthorizes and allocates funding to public health programs.<ref name="supports" /> |

||

* Authorizes the [[Food and Drug Administration]] to approve rule changes for [[over-the |

* Authorizes the [[Food and Drug Administration]] to approve rule changes for [[over-the-counter drug]]s without full advanced public notice and public comments.<ref name="supports" /> |

||

* Requires an examination, report, and recommendations regarding the security of the United States' supply chain of medical products.<ref name="supports" /> |

* Requires an examination, report, and recommendations regarding the security of the United States' supply chain of medical products.<ref name="supports" /> |

||

* Adds [[personal protective equipment]], medical devices, diagnostic tests, and medical supplies that administer drugs, vaccines, and other biological products to the [[Strategic National Stockpile]].<ref name="supports" /> |

* Adds [[personal protective equipment]], medical devices, diagnostic tests, and medical supplies that administer drugs, vaccines, and other biological products to the [[Strategic National Stockpile]].<ref name="supports" /> |

||

| Line 128: | Line 128: | ||

=== Outcomes === |

=== Outcomes === |

||

* The $175 billion Provider Relief Fund began disbursing funds to healthcare providers in April 2020. Funds do not have to be repaid if the healthcare provider meets specified criteria. An August 2020 ''Washington Post'' analysis found that for-profit nursing homes accused of "Medicare fraud and kickbacks, labor violations and widespread failures in patient care" had received hundreds of millions of dollars from this fund.<ref>{{Cite web|last=Affairs (ASPA)|first=Assistant Secretary for Public|date=July 14, 2020|title=Provider Relief Fund General Information (FAQs)|url=https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/provider-relief-fund-general-info/index.html|access-date=August 4, 2020|website=HHS.gov|language=en|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175552/https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/provider-relief-fund-general-info/index.html|url-status=live}}</ref><ref>{{Cite news|last1=Cenziper|first1=Debbie|last2=Jacobs|first2=Joel|last3=Mulcahy|first3=Shawn|date=August 4, 2020|title=Nursing home companies accused of misusing federal money received hundreds of millions of dollars in pandemic relief| |

* The $175 billion Provider Relief Fund began disbursing funds to healthcare providers in April 2020. Funds do not have to be repaid if the healthcare provider meets specified criteria. An August 2020 ''Washington Post'' analysis found that for-profit nursing homes accused of "Medicare fraud and kickbacks, labor violations and widespread failures in patient care" had received hundreds of millions of dollars from this fund.<ref>{{Cite web|last=Affairs (ASPA)|first=Assistant Secretary for Public|date=July 14, 2020|title=Provider Relief Fund General Information (FAQs)|url=https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/provider-relief-fund-general-info/index.html|access-date=August 4, 2020|website=HHS.gov|language=en|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175552/https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/faqs/provider-relief-fund-general-info/index.html|url-status=live}}</ref><ref>{{Cite news|last1=Cenziper|first1=Debbie|last2=Jacobs|first2=Joel|last3=Mulcahy|first3=Shawn|date=August 4, 2020|title=Nursing home companies accused of misusing federal money received hundreds of millions of dollars in pandemic relief|newspaper=[[The Washington Post]]|url=https://www.washingtonpost.com/business/2020/08/04/nursing-home-companies-accused-misusing-federal-money-received-hundreds-millions-dollars-pandemic-relief/|access-date=August 4, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175538/https://www.washingtonpost.com/business/2020/08/04/nursing-home-companies-accused-misusing-federal-money-received-hundreds-millions-dollars-pandemic-relief/|url-status=live}}</ref> |

||

* The CARES Act allocated $1 billion to the Defense Department to manufacture personal protective equipment (PPE) and other health products under the [[Defense Production Act of 1950|Defense Production Act]] (DPA). Defense Department lawyers determined that the money did not have to be used for pandemic-related purposes, and, within weeks, hundreds of millions of dollars had been spent for other military uses.<ref>{{Cite web|last=Coleman|first=Justine|date=September 22, 2020|title=Pentagon redirected pandemic funds to defense contractors: report|url=https://thehill.com/policy/defense/517520-pentagon-redirected-pandemic-funds-to-defense-contractors-report|access-date=September 22, 2020|website= |

* The CARES Act allocated $1 billion to the Defense Department to manufacture personal protective equipment (PPE) and other health products under the [[Defense Production Act of 1950|Defense Production Act]] (DPA). Defense Department lawyers determined that the money did not have to be used for pandemic-related purposes, and, within weeks, hundreds of millions of dollars had been spent for other military uses.<ref>{{Cite web|last=Coleman|first=Justine|date=September 22, 2020|title=Pentagon redirected pandemic funds to defense contractors: report|url=https://thehill.com/policy/defense/517520-pentagon-redirected-pandemic-funds-to-defense-contractors-report|access-date=September 22, 2020|website=[[The Hill (newspaper)|The Hill]]|language=en|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175529/https://thehill.com/policy/defense/517520-pentagon-redirected-pandemic-funds-to-defense-contractors-report|url-status=live}}</ref> |

||

==Relief to businesses and organizations== |

==Relief to businesses and organizations== |

||

| Line 135: | Line 135: | ||

===Loans=== |

===Loans=== |

||

The Act: |

The Act: |

||

* Allocates up to $500{{nbsp}}billion to the |

* Allocates up to $500{{nbsp}}billion to the [[Exchange Stabilization Fund]] for assistance to eligible businesses, states, and municipalities. A business is eligible if it has significant operations in the United States, a majority of its employees based in the United States, and it either has fewer than 10,000 employees or has less than $2.5{{nbsp}}billion of revenue. Each loan is a minimum of $1{{nbsp}}million, has a four-year [[maturity (finance)|maturity]], and restrictions on compensation of highly paid employees.<ref name= cb-nfp/> The program is limited to $25{{nbsp}}billion for passenger air carriers, $4{{nbsp}}billion for air cargo carriers, and $17{{nbsp}}billion for businesses critical to maintaining national security.<ref name=":0">{{Cite web|url=https://www.foley.com/en/insights/publications/2020/03/senate-passes-coronavirus-cares-act|title=Senate Passes the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") |work= Foley & Lardner LLP| access-date=March 27, 2020 }}</ref><ref>Coronavirus Aid, Relief, and Economic Security Act, Section 4003(b)</ref> |

||

* Creates a $669 billion small-business loan program called the [[Paycheck Protection Program]] (PPP). (Originally $349{{nbsp}}billion, the [[Paycheck Protection Program and Health Care Enhancement Act|Paycheck Protection Program and Healthcare Enhancement Act]] added $320{{nbsp}}billion.) Funds are made available for loans originated between February 15 and June 30, 2020.<ref name=":0" /><ref>Coronavirus Aid, Relief, and Economic Security Act, Section 1102, amending the Small Business Act {{USC|15|636}}(a)</ref> Most firms with at most 500 employees are eligible for the PPP funds. There are exceptions for all firms whose North American Industry Classification System (NAICS) code starts with 72, which includes hotels and restaurants.<ref name="Meier">{{Cite journal|last1=Meier|first1=Jean-Marie|last2=Smith|first2=Jake|date=May 29, 2020|title=The COVID-19 Bailouts|url=https://papers.ssrn.com/abstract=3585515|journal=Working Paper. University of Texas at Dallas|ssrn=3585515|access-date=June 19, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175527/https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3585515|url-status=live}}</ref> If each location of a business with a NAICS code starting with 72 has at most 500 employees, such a business is also eligible for PPP funds.<ref name="Meier"/> In addition, a NAICS 72-code-business is eligible for PPP funds if each separate legal entity (even if affiliated through 100% ownership) has at most 500 employees.<ref name="Meier"/> |

* Creates a $669 billion small-business loan program called the [[Paycheck Protection Program]] (PPP). (Originally $349{{nbsp}}billion, the [[Paycheck Protection Program and Health Care Enhancement Act|Paycheck Protection Program and Healthcare Enhancement Act]] added $320{{nbsp}}billion.) Funds are made available for loans originated between February 15 and June 30, 2020.<ref name=":0" /><ref>Coronavirus Aid, Relief, and Economic Security Act, Section 1102, amending the Small Business Act {{USC|15|636}}(a)</ref> Most firms with at most 500 employees are eligible for the PPP funds. There are exceptions for all firms whose North American Industry Classification System (NAICS) code starts with 72, which includes hotels and restaurants.<ref name="Meier">{{Cite journal|last1=Meier|first1=Jean-Marie|last2=Smith|first2=Jake|date=May 29, 2020|title=The COVID-19 Bailouts|url=https://papers.ssrn.com/abstract=3585515|journal=Working Paper. University of Texas at Dallas|ssrn=3585515|access-date=June 19, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175527/https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3585515|url-status=live}}</ref> If each location of a business with a NAICS code starting with 72 has at most 500 employees, such a business is also eligible for PPP funds.<ref name="Meier"/> In addition, a NAICS 72-code-business is eligible for PPP funds if each separate legal entity (even if affiliated through 100% ownership) has at most 500 employees.<ref name="Meier"/> |

||

* Expands the [[U.S. Small Business Administration|Small Business Administration]]'s Economic Injury Disaster Loans (EIDL) to cover most nonprofit organizations, including [[faith-based organization]]s. An [[unsecured loan|unsecured]] EIDL can be for up to $25,000, while a [[secured loan|secured]] EIDL may be for up to $2{{nbsp}}million. The applicant must have an acceptable credit history and be able to repay the EIDL. Each EIDL has a low interest rate and has a term of up to 30 years. An EIDL applicant may receive a $10,000 advance payment that is not required to be repaid. Proceeds from an EIDL may be used to pay for ordinary and necessary operating expenses, liabilities, and other bills not able to be paid because of a decrease in revenue. An EIDL may not replace lost revenue or lost profits. An EIDL may not be used for business expansion.<ref name= cb-nfp/> |

* Expands the [[U.S. Small Business Administration|Small Business Administration]]'s Economic Injury Disaster Loans (EIDL) to cover most nonprofit organizations, including [[faith-based organization]]s. An [[unsecured loan|unsecured]] EIDL can be for up to $25,000, while a [[secured loan|secured]] EIDL may be for up to $2{{nbsp}}million. The applicant must have an acceptable credit history and be able to repay the EIDL. Each EIDL has a low interest rate and has a term of up to 30 years. An EIDL applicant may receive a $10,000 advance payment that is not required to be repaid. Proceeds from an EIDL may be used to pay for ordinary and necessary operating expenses, liabilities, and other bills not able to be paid because of a decrease in revenue. An EIDL may not replace lost revenue or lost profits. An EIDL may not be used for business expansion.<ref name= cb-nfp/> |

||

| Line 143: | Line 143: | ||

The Act: |

The Act: |

||

* Allows employers to defer payment of the employers' share of [[FICA tax|social security tax]] for up to two years. Payment of the portion of self-employment tax corresponding to the employer's share of social security tax may also be deferred for up to two years. Payment of these taxes incurred after having a [[Paycheck Protection Program]] loan forgiven cannot be deferred, but taxes incurred before the loan forgiveness may continue to be deferred.<ref name="cb-nfp" /> |

* Allows employers to defer payment of the employers' share of [[FICA tax|social security tax]] for up to two years. Payment of the portion of self-employment tax corresponding to the employer's share of social security tax may also be deferred for up to two years. Payment of these taxes incurred after having a [[Paycheck Protection Program]] loan forgiven cannot be deferred, but taxes incurred before the loan forgiveness may continue to be deferred.<ref name="cb-nfp" /> |

||

* Provides a refundable employee retention tax credit for employers whose operations were suspended due to COVID-19 or whose revenue has significantly decreased due to COVID-19. The tax credit is equal to 50% of qualified wages paid between March 13, 2020, and December 31, 2020. Maximum credit is $5,000 per employee. Qualified wages include the cost of qualified health care. Qualified wages do not include wages paid for [[Families First Coronavirus Response Act#Paid sick leave|Emergency Paid Sick Leave]] or [[Families First Coronavirus Response Act#Paid family medical leave|Emergency Family Medical Leave]]. A business |

* Provides a refundable [[Employee Retention Credit|employee retention tax credit]] for employers whose operations were suspended due to COVID-19 or whose revenue has significantly decreased due to COVID-19. The tax credit is equal to 50% of qualified wages paid between March 13, 2020, and December 31, 2020. Maximum credit is $5,000 per employee. Qualified wages include the cost of qualified health care. Qualified wages do not include wages paid for [[Families First Coronavirus Response Act#Paid sick leave|Emergency Paid Sick Leave]] or [[Families First Coronavirus Response Act#Paid family medical leave|Emergency Family Medical Leave]]. A business was originally not eligible for the credit if it receives a [[Paycheck Protection Program]] loan, although that was later amended by Congress.<ref name="cb-nfp" /> |

||

* Increases the tax deduction for [[net operating loss]]es from 80% to 100%, for 2018, 2019, and 2020. Suspends the $500,000 limitation on tax-deductible net operating losses until 2021. Allows net operating losses from 2018, 2019, and 2020 to be carried back to up to five years, resulting in retroactive tax refunds.<ref name="cb-nfp">Socha, Matthew; McGregor, Sara; Adams, Amanda M.; Walker, Deborah (April 13, 2020). "COVID-19 Federal Stimulus and Not-For-Profit Organizations". ''Cherry Bekaert LLP''.</ref> |

* Increases the tax deduction for [[net operating loss]]es from 80% to 100%, for 2018, 2019, and 2020. Suspends the $500,000 limitation on tax-deductible net operating losses until 2021. Allows net operating losses from 2018, 2019, and 2020 to be carried back to up to five years, resulting in retroactive tax refunds.<ref name="cb-nfp">Socha, Matthew; McGregor, Sara; Adams, Amanda M.; Walker, Deborah (April 13, 2020). "COVID-19 Federal Stimulus and Not-For-Profit Organizations". ''Cherry Bekaert LLP''.</ref> |

||

* Increases the limit for most [[Charitable contribution deductions in the United States|tax-deductible charitable contributions]] from 10% to 25% of income for corporations. Increases the limit for tax-deductions for charitable contributions of food inventory from 15% to 25% of income.<ref name="cb-nfp" /> |

* Increases the limit for most [[Charitable contribution deductions in the United States|tax-deductible charitable contributions]] from 10% to 25% of income for corporations. Increases the limit for tax-deductions for charitable contributions of food inventory from 15% to 25% of income.<ref name="cb-nfp" /> |

||

| Line 149: | Line 149: | ||

===Businesses connected to politicians and political donors=== |

===Businesses connected to politicians and political donors=== |

||

Businesses owned by the president, senior government officials, and their immediate families are ineligible for funds distributed through the $500{{nbsp}}billion Economic Stabilization Fund. A business falls into this category if it is at least 20% owned or controlled by a person in the restricted group.<ref name="Lipton">{{Cite news|last1=Lipton|first1=Eric|last2=Vogel|first2=Kenneth P.|date=March 25, 2020|title=Fine Print of Stimulus Bill Contains Special Deals for Industries|work=The New York Times|url=https://www.nytimes.com/2020/03/25/us/politics/virus-fineprint-stimulus-bill.html|access-date=May 3, 2020|issn=0362-4331|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175528/https://www.nytimes.com/2020/03/25/us/politics/virus-fineprint-stimulus-bill.html|url-status=live}}</ref> Such businesses may nonetheless still be eligible for funds distributed through the $669{{nbsp}}billion [[Paycheck Protection Program]] or through the $15{{nbsp}}billion change to the tax code.<ref>{{Cite web|title=PolitiFact – Trump hotels would be barred from getting coronavirus money|url=https://www.politifact.com/factchecks/2020/mar/26/facebook-posts/trump-hotels-would-be-barred-getting-coronavirus-m/|date=March 26, 2020|website=PolitiFact: The Poynter Institute|access-date=May 3, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175534/https://www.politifact.com/factchecks/2020/mar/26/facebook-posts/trump-hotels-would-be-barred-getting-coronavirus-m/|url-status=live}}</ref> |

Businesses owned by the president, senior government officials, and their immediate families are ineligible for funds distributed through the $500{{nbsp}}billion Economic Stabilization Fund. A business falls into this category if it is at least 20% owned or controlled by a person in the restricted group.<ref name="Lipton">{{Cite news|last1=Lipton|first1=Eric|last2=Vogel|first2=Kenneth P.|date=March 25, 2020|title=Fine Print of Stimulus Bill Contains Special Deals for Industries|work=[[The New York Times]]|url=https://www.nytimes.com/2020/03/25/us/politics/virus-fineprint-stimulus-bill.html|access-date=May 3, 2020|issn=0362-4331|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175528/https://www.nytimes.com/2020/03/25/us/politics/virus-fineprint-stimulus-bill.html|url-status=live}}</ref> Such businesses may nonetheless still be eligible for funds distributed through the $669{{nbsp}}billion [[Paycheck Protection Program]] or through the $15{{nbsp}}billion change to the tax code.<ref>{{Cite web|title=PolitiFact – Trump hotels would be barred from getting coronavirus money|url=https://www.politifact.com/factchecks/2020/mar/26/facebook-posts/trump-hotels-would-be-barred-getting-coronavirus-m/|date=March 26, 2020|website=[[PolitiFact]]: The Poynter Institute|access-date=May 3, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175534/https://www.politifact.com/factchecks/2020/mar/26/facebook-posts/trump-hotels-would-be-barred-getting-coronavirus-m/|url-status=live}}</ref> |

||

Jared Kushner's businesses may generally be eligible for relief under the Economic Stabilization Fund because, according to ''The New York Times'', he usually owns less than 20% of his family's real estate projects.<ref name="Lipton"/> |

Jared Kushner's businesses may generally be eligible for relief under the Economic Stabilization Fund because, according to ''The New York Times'', he usually owns less than 20% of his family's real estate projects.<ref name="Lipton"/> |

||

On April 21, the Trump Organization said it would not seek a [[Small Business Administration]] federal loan. (It |

On April 21, the Trump Organization said it would not seek a [[Small Business Administration]] federal loan. (It was, however, seeking relief from the [[General Services Administration]] to which it normally pays rent of about $268,000 per month to operate the Trump International Hotel in a [[Old Post Office (Washington, D.C.)|federal building in Washington, D.C.]] Eric Trump said he hoped the General Services Administration would treat the Trump Organization "the same" as its other tenants.)<ref>{{Cite news|last1=Protess|first1=Ben|last2=Eder|first2=Steve|last3=Enrich|first3=David|date=April 21, 2020|title=Trump (the Company) Asks Trump (the Administration) for Hotel Relief|work=[[The New York Times]]|url=https://www.nytimes.com/2020/04/21/business/trump-hotel-coronavirus.html|access-date=May 3, 2020|issn=0362-4331|archive-date=April 22, 2020|archive-url=https://archive.today/20200422115519/https://www.nytimes.com/2020/04/21/business/trump-hotel-coronavirus.html|url-status=live}}</ref><ref>{{Cite web|title=Trump DC hotel reportedly seeking government relief amid lost revenue from coronavirus pandemic|url=https://www.cnbc.com/2020/04/21/coronavirus-trump-dc-hotel-seeking-government-relief-nyt.html|last=Dzhanova|first=Yelena|date=April 21, 2020|website=[[CNBC]]|access-date=May 3, 2020|archive-date=February 15, 2021|archive-url=https://web.archive.org/web/20210215175526/https://www.cnbc.com/2020/04/21/coronavirus-trump-dc-hotel-seeking-government-relief-nyt.html|url-status=live}}</ref> |

||