FairTax: Difference between revisions

see talk |

replace cited content - discuss on the talk page if you have concerns |

||

| Line 1: | Line 1: | ||

{{short description|Proposal to reform US tax code}} |

|||

:''Throughout this article, the unqualified term "dollar" and the $ symbol refer to the [[United States dollar]].''<!-- Disclaimer is as per Wikipedia:Manual of Style (dates and numbers) #Currency --> |

|||

{{Distinguish|Illinois Fair Tax|Fairtex}} |

|||

[[Image:FairTaxBook.jpg|thumb|right|250px|''[[The FairTax Book]]'', co-authored by [[Neal Boortz]] and [[John Linder]], was published on [[August 2]], [[2005]], as a tool to increase public support and understanding for the FairTax plan.]] |

|||

{{pp-move-indef}} |

|||

<!-- FAIR USE of FairTaxBook.jpg: see image description page at http://en.wikipedia.org/wiki/Image:FairTaxBook.jpg for rationale --> |

|||

{{Unbalanced|date=March 2020}} |

|||

{{UStaxation}} |

|||

'''FairTax''' is a [[flat tax|fixed rate]] sales tax proposal introduced as bill H.R. 25 in the United States Congress every year since 2005. The ''Fair Tax Act'' calls for elimination of the [[Internal Revenue Service]]<ref>https://fairtax.org/faq FAQ:Is there any provision in the FAIRtax bill to prevent both an income tax and a sales tax?</ref> and repeal the 16th Amendment to the Constitution. H.R. 25 would eliminate all [[Income tax in the United States|federal income taxes]] (including the [[alternative minimum tax]], [[corporate tax in the United States|corporate income taxes]], and [[Capital gains tax in the United States|capital gains taxes]]), [[payroll tax#United States|payroll taxes]] (including [[Federal Insurance Contributions Act tax|Social Security and Medicare taxes]]), [[gift tax]]es, and [[Estate tax in the United States|estate taxes]], replacing federal taxes with a single [[consumption tax]] levied on retail sales. |

|||

The ''Fair Tax Act'' ({{USBill|115|HR|25}}/{{USBill|115|S|18}}) would apply a fixed rate sales tax at the point of sale on all new, final [[Goods (economics)|goods]] and [[Services (economics)|services]] purchased for household consumption. The proposal also specifies a monthly payment made to all households based on household size. Called a "prebate," the monthly payment offsets the [[regressive tax|regressive]] nature of a sales tax up to the poverty level.<ref name="billc3"/><ref name="Kotlikoff">[[#refKotlikoff2005|Kotlikoff, 2005]]</ref> First introduced into the [[United States Congress]] in 1999, a number of congressional committees have heard testimony on the [[Bill (proposed law)|bill]]; however, it did not move from committee. A campaign in 2005 for the FairTax proposal<ref name="movement">[[#refLinbeck2005|Linbeck statement, 2005]]</ref> involved Leo E. Linbeck and the Fairtax.org. [[Talk radio]] personality [[Neal Boortz]] and [[Georgia (U.S. state)|Georgia]] Congressman [[John Linder]] published ''[[The FairTax Book]]'' in 2005 and additional visibility was gained in the [[2008 United States presidential election|2008 presidential campaign]]. |

|||

The '''''Fair Tax Act''''' ({{USBill|110|HR|25}}/{{USBill|110|S|1025}}) is a [[Bill (proposed law)|bill]] in the [[United States Congress]] for changing tax laws to replace the [[Internal Revenue Service]] (IRS) and all [[Federal government of the United States|federal]] [[Income tax in the United States|income taxes]] (including [[Alternative Minimum Tax]]), [[payroll tax#United States|payroll taxes]] (including [[Federal Insurance Contributions Act tax|Social Security and Medicare taxes]]), [[corporate tax in the United States|corporate taxes]], [[capital gains tax]]es, [[gift tax]]es, and [[Estate tax in the United States|estate taxes]] with a national retail [[sales tax]], to be levied once at the point of purchase on all new [[Good (economics)|goods]] and [[Service (economics)|services]]. The proposal also calls for a monthly payment to all [[household]]s of citizens and legal resident aliens (based on family size) as an advance rebate of tax on purchases up to the poverty level.<ref name="billtext"/><ref name="Kotlikoff">{{cite news| url=http://people.bu.edu/kotlikoff/WSJ%20Op%20Ed%203-7-05.pdf| format = PDF | last=Kotlikoff| first=Laurence| coauthors=|title=The Case for the 'FairTax'| publisher=The Wall Street Journal| date=[[2005-03-07]]| accessdate=2006-07-23}}</ref> The sales tax rate, as defined in the legislation, is 23% of the "total register price." That is, 23¢ of every $1 spent in total, including the tax payment itself (calculated like income taxes), which is comparable to a 30% traditional [[Sales taxes in the United States|sales tax]] (30¢ on top of every $1).<ref name="money">{{cite news| url=http://money.cnn.com/2005/09/06/pf/taxes/consumptiontax_0510/| last=Regnier| first=Pat| title=Just how fair is the FairTax?| work=| publisher=Money Magazine| date=[[2005-09-07]]| accessdate=2006-07-20}}</ref> Because the U.S. tax system has a hidden [[Effect of taxes and subsidies on price|effect on prices]],<ref name="forbes">{{cite news| url=http://www.forbes.com/opinions/2007/03/20/american-dream-taxes-oped-cz_sf_dream0307_0322dream.html | last=Forbes | first=Steve | title=The American Dream Improving Our Lot | publisher=Forbes| date=[[2007-03-22]]| accessdate=2007-03-26}}</ref> it is expected that moving to the FairTax would decrease associated [[production costs]] due to the removal of business taxes and compliance costs, which is predicted to offset a portion of the FairTax effect on prices.<ref name="fairtaxbook">{{cite book | first=Neal | last=Boortz | coauthors=Linder, John | year=2006 | title=[[The FairTax Book]] | edition=Paperback | publisher=[[Regan Books]]|id=ISBN 0-06-087549-6 }}</ref> |

|||

As defined in the proposed legislation, the initial sales tax rate is 30% (i.e. a purchase of $100 would incur a sales tax of $30, resulting in a total price to the consumer of $130). Advocates promote this as a 23% ''tax inclusive'' rate based on the total amount paid including the tax, which is the method currently used to calculate income tax liability.<ref name="money">[[#refRegnier2005|Regnier, 2005]]</ref> In subsequent years the rate could adjust annually based on federal receipts in the previous fiscal year.<ref name="billc1">[[#refFairTaxAct|Fair Tax Act, 2009, Chapter 1]]</ref> With the rebate taken into consideration, the FairTax would be [[progressive tax|progressive]] on [[Consumption (economics)|consumption]],<ref name="Kotlikoff"/> but would still be [[regressive tax|regressive]] on [[income]] (since consumption as a percentage of income falls at higher income levels).<ref name="wgale">[[#refGale1998|Gale, 1998]]</ref><ref name="BHItaxburden"/> Opponents argue this would accordingly decrease the [[Tax incidence|tax burden]] on [[American upper class|high-income earners]] and increase it on the [[American middle class|lower class]] earners.<ref name="money"/><ref name="finalreport">[[#refTaxReformCh9|Tax Reform Panel Report, Ch. 9]]</ref> Supporters contend that the plan would effectively tax [[wealth]], increase [[purchasing power]]<ref name="comparerates">[[#refKotlikoff2006|Kotlikoff and Rapson, 2006]]</ref><ref name="dynamiceffects">[[#refKotlikoff2007|Kotlikoff and Jokisch, 2007]]</ref> and decrease tax burdens by broadening the tax base. |

|||

With the rebate taken into consideration, the [[effective tax rate]] would be [[progressive tax|progressive]] on [[Consumption (economics)|consumption]] and could result in a tax burden of zero or less for some taxpayers.<ref name="Kotlikoff"/> However, opponents of the tax argue that while progressive on consumption, the tax could be [[regressive tax|regressive]] on [[income]],<ref name="wgale">{{cite web| url=http://www.brookings.edu/papers/1998/03taxes_gale.aspx| last=Gale| first=William| title=Don't Buy the Sales Tax| work=| publisher=The Brookings Institution|date=March 1998| accessdate=2007-12-22}}</ref> and would accordingly decrease the [[Tax incidence|tax burden]] on [[American upper class|high income earners]] and increase the tax burden on the [[American middle class|middle class]].<ref name="money"/><ref name="finalreport">{{cite web| url=http://www.taxreformpanel.gov/final-report/TaxReform_Ch9.pdf| format = PDF | title=National Retail Sales Tax| publisher=President's Advisory Panel for Federal Tax Reform| date=[[2005-11-01]]| accessdate=2006-07-23}}</ref> The plan's supporters in turn claim that it would increase [[purchasing power]],<ref name="dynamiceffects">{{cite web| url=http://people.bu.edu/kotlikoff/FairTax%20NTJ%20Final%20Version,%20April%2024,%202007.pdf| format = PDF | last=Kotlikoff| first=Laurence| coauthors=Jokisch, Sabine|title=Simulating the Dynamic Macroeconomic and Microeconomic Effects of the FairTax| publisher=Boston University & Centre for European Economic Research| date=[[2007-04-24]]| accessdate=2007-05-13}}</ref> and decrease tax burdens by broadening the tax base and effectively taxing [[wealth]].<ref name="comparerates">{{cite web| url=http://people.bu.edu/kotlikoff/Comparing%20Average%20and%20Marginal%20Tax%20Rates%2010-17-06.pdf| format = PDF | last=Kotlikoff| first=Laurence| coauthors=Rapson, David|title=Comparing Average and Marginal Tax Rates under the FairTax and the Current System of Federal Taxation|publisher=Boston University|date=November 2006| accessdate=2006-11-04}}</ref><ref name="Kotlikoff"/> Many mainstream economists and tax experts like the idea of a [[consumption tax]].<ref name="money"/> Economists argue that a consumption tax, such as the FairTax, would have a positive impact on [[Saving (money)|savings]] and [[investment]] (not taxed), ease of tax compliance, increased [[economic growth]], incentives for [[international business]] to locate in the U.S., and increased U.S. international competitiveness (border tax adjustment in [[International trade|global trade]]).<ref name="fairtaxbook"/><ref name="endorsement">{{cite web| url=http://www.fairtax.org/PDF/Open_Letter.pdf| format = PDF | title=An Open Letter to the President, the Congress, and the American people| publisher= Americans For Fair Taxation| accessdate=2006-07-23}}</ref> Others argue that a consumption tax of this kind could be difficult to collect, having challenges with [[tax evasion]],<ref name="wgale"/><ref name="money"/> and that it may not yield enough money for the government, resulting in cutbacks in [[Government spending|spending]], a larger [[deficit]], or a higher sales [[tax rate]].<ref name="money"/> |

|||

Advocates expect a consumption tax to increase [[Saving (money)|savings]] and [[investment]], ease [[compliance cost|tax compliance]] and increase [[economic growth]], increase incentives for [[international business]] to locate in the US and increase US competitiveness in [[international trade]].<ref name="fairtaxbook">[[#refFairTaxBook|The FairTax Book]]</ref><ref name="endorsement">[[#refOpenLetter|Open Letter to the President]]</ref><ref name="consumptiontax">[[#refAuerbach2005|Auerbach, 2005]]</ref> The plan would provide transparency for funding the federal government. Supporters believe it would increase [[Civil liberties of the United States|civil liberties]], benefit the [[Natural environment|environment]], and effectively tax [[Black market|illegal activity]] and [[Illegal immigration to the United States|undocumented immigrants]].<ref name="fairtaxbook"/><ref name="Sipos">[[#refSipos2007|Sipos, 2007]]</ref> Critics contend that a consumption tax of this size would be extremely difficult to collect, would lead to pervasive [[tax evasion]],<ref name="money" /><ref name="wgale" /> and raise less revenue than the current tax system, leading to an increased [[budget deficit]].<ref name="money" /><ref name="taxnotes">[[#refGale2005|Gale, 2005]]</ref> The proposed Fairtax might cause removal of [[tax deduction]] incentives, transition effects on after-tax savings, incentives on credit use and the loss of tax advantages to [[municipal bond|state and local bonds]]. It also includes a sunset clause if the [[Sixteenth Amendment to the United States Constitution|16th Amendment to the US Constitution]] is not repealed within seven years of its enactment. |

|||

==Legislative overview and history== |

|||

{{UStaxation}} |

|||

[[File:U.S. Rep. John Linder with the 2007 Tax code and complete set of Title 26 of the US Code of Federal Regulations.jpg|thumb|Rep [[John Linder]] holding the 133 page ''Fair Tax Act of 2007'' in contrast to the then-current U.S. [[Internal Revenue Code|tax code]] and [[Treasury regulations|IRS regulations]]]] |

|||

The legislation would remove the [[Internal Revenue Service]] (after three years), and establish Excise Tax and Sales Tax bureaus in the [[United States Department of the Treasury|Department of the Treasury]].<ref name="billtIII"/> The [[U.S. state|states]] are granted the primary authority for the collection of sales tax revenues and the remittance of such revenues to the Treasury. The plan was created by [[Americans For Fair Taxation]], an [[advocacy group]] formed to change the tax system. The group states that, together with economists, it developed the plan and the name "Fair Tax", based on interviews, polls, and focus groups of the general public.<ref name="money"/> The FairTax legislation has been introduced in the House by Georgia [[Republican Party (United States)|Republicans]] [[John Linder]] (1999–2010) and [[Rob Woodall]] (2011–2014),<ref>{{cite web|url=http://woodall.house.gov/issue/fairtax |title=The FairTax | Congressman Rob Woodall |access-date=2015-02-04 |archive-url=https://web.archive.org/web/20150205000339/http://woodall.house.gov/issue/fairtax |archive-date=2015-02-05 }}</ref> while being introduced in the Senate by Georgia Republican [[Saxby Chambliss]] (2003–2014). |

|||

Linder first introduced the ''Fair Tax Act'' ({{USBill|106|HR|2525}}) on July 14, 1999, to the [[106th United States Congress]] and a substantially similar bill has been reintroduced in each subsequent session of Congress. The bill attracted a total of 56 House and Senate cosponsors in the [[108th Congress]],<ref name="hrcosponsors2003">[[#refhr108|H.R.25 108th Cosponsors]]</ref><ref name="scosponsors2003">[[#refs108|S.1493 108th Cosponsors]]</ref> 61 in the [[109th United States Congress|109th]],<ref name="hrcosponsors">[[#refhr109|H.R.25 109th Cosponsors]]</ref><ref name="scosponsors">[[#refs109|S.25 109th Cosponsors]]</ref> 76 in the [[110th United States Congress|110th]],<ref name="hrcosponsors2007">[[#refhr110|H.R.25 110th Cosponsors]]</ref><ref name="s1025cosponsors2007">[[#refs110|S.1025 110th Cosponsors]]</ref> 70 in the [[111th United States Congress|111th]],<ref name="hrcosponsors2009">[[#refhr111|H.R.25 111th Cosponsors]]</ref><ref name="scosponsors2009">[[#refs111|S.296 111th Cosponsors]]</ref> 78 in the [[112th United States Congress|112th]],<ref name="hrcosponsors2011">[[#refhr112|H.R.25 112th Cosponsors]]</ref><ref name="scosponsors2011">[[#refs112|S.13 112th Cosponsors]]</ref> 83 in the [[113th United States Congress|113th]] ({{USBill|113|HR|25}}/{{USBill|113|S|122}}), 81 in the [[114th United States Congress|114th]] ({{USBill|114|HR|25}}/{{USBill|114|S|155}}), 51 in the [[115th United States Congress|115th]] ({{USBill|115|HR|25}}/{{USBill|115|S|18}}), 33 in the [[116th United States Congress|116th]] ({{USBill|116|HR|25}}), and 30 in the [[117th United States Congress|117th]] ({{USBill|117|HR|25}}). Former [[Speaker of the United States House of Representatives|Speaker of the House]] [[Dennis Hastert]] (Republican) had cosponsored the bill in the 109th–110th Congress, but it has not received support from the [[United States Democratic Party|Democratic]] leadership.<ref name="scosponsors"/><ref name="hrcosponsors2007"/><ref name="support">[[#refBender2005|Bender, 2005]]</ref> Democratic Representative [[Collin Peterson]] of Minnesota and Democratic Senator [[Zell Miller]] of Georgia cosponsored and introduced the bill in the 108th Congress, but Peterson has left the House of Representatives and Miller has left the Senate.<ref name="hrcosponsors2003"/><ref name="scosponsors2003"/> In the 109th–111th Congress, Representative [[Dan Boren]] was the only Democrat to cosponsor the bill.<ref name="hrcosponsors"/><ref name="hrcosponsors2007"/> A number of congressional committees have heard testimony on the FairTax, but it has not moved from committee since its introduction in 1999. The legislation was also discussed with President [[George W. Bush]] and his [[United States Secretary of the Treasury|Secretary of the Treasury]] [[Henry M. Paulson]].<ref name="thetruth"/> |

|||

==Legislative history== |

|||

The FairTax plan was created by [[Americans For Fair Taxation]], an [[advocacy group]] formed for tax reform. The group developed the plan and the name "Fair Tax" with economists based on interviews, polls, and focus groups of the general public.<ref name="ABKS">{{cite book | first=Al | last=Ose | year=2002 | title=America's Best Kept Secret Fairtax: Give Yourself a 25% Raise | edition=Paperback | publisher=Authorhouse | id=ISBN 1-4033-9189-0 }}</ref><ref name="money"/> Since the term "fair" is subjective, the name of the plan has been considered an oxymoron by some and deceptive marketing by others. Georgia [[Republican Party (United States)|Republican]] [[John Linder]] first introduced the ''Fair Tax Act'' ({{USBill|106|HR|2525}}) in July 1999 to the [[106th United States Congress]]. He has reintroduced substantially the same bill in each subsequent session of Congress. While the bill attracted a total of 56 House and Senate cosponsors in the [[108th Congress]] ({{USBill|108|HR|25}}/{{USBill|108|S|1493}}),<ref name="hrcosponsors2003">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d108:HR00025:@@@P| title=H.R.25 108th Cosponsors| work=108th U.S. Congress| publisher=The Library of Congress| date=[[2003-01-07]]| accessdate=2006-08-22}}</ref><ref name="scosponsors2003">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d108:SN01493:@@@P| title=S.1493 108th Cosponsors| work=108th U.S. Congress| publisher=The Library of Congress| date=[[2003-07-30]]| accessdate=2006-08-22}}</ref> 61 in the [[109th Congress]] ({{USBill|109|HR|25}}/{{USBill|109|S|25}}),<ref name="hrcosponsors">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d109:HR00025:@@@P| title=H.R.25 109th Cosponsors| work=109th U.S. Congress| publisher=The Library of Congress| date=[[2005-01-04]]| accessdate=2006-08-22}}</ref><ref name="scosponsors">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d109:SN00025:@@@P| title=S.25 109th Cosponsors| work=109th U.S. Congress| publisher=The Library of Congress| date=[[2005-01-24]]| accessdate=2006-08-22}}</ref> and 72 in the [[110th United States Congress]] ({{USBill|110|HR|25}}/{{USBill|110|S|1025}}),<ref name="hrcosponsors2007">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d110:HR00025:@@@P| title=H.R.25 110th Cosponsors| work=110th U.S. Congress| publisher=The Library of Congress| date=[[2007-01-04]]| accessdate=2007-01-14}}</ref><ref name="s1025cosponsors2007">{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d110:SN01025:@@@P| title=S.1025 110th Cosponsors| work=110th U.S. Congress| publisher=The Library of Congress| date=[[2007-03-29]]| accessdate=2007-04-04}}</ref> it has not been voted on by either committee in the House or Senate. To become law, the bill will need to be included in a final version of tax legislation from the [[U.S. House Committee on Ways and Means]], pass both the House and the Senate, and finally be signed by the [[President of the United States|President]]. |

|||

To become law, the bill will need to be included in a final version of tax legislation from the [[U.S. House Committee on Ways and Means]], pass both the House and the Senate, and finally be signed by the [[President of the United States|President]]. In 2005, President Bush established an [[President's Advisory Panel for Federal Tax Reform|advisory panel on tax reform]] that examined several national sales tax variants including aspects of the FairTax and noted several concerns. These included uncertainties as to the revenue that would be generated, and difficulties of enforcement and administration, which made this type of tax undesirable to recommend in their final report.<ref name="finalreport" /> The panel did not examine the FairTax as proposed in the legislation. The FairTax received visibility in the [[2008 United States presidential election|2008 presidential election]] on the issue of taxes and the IRS, with several candidates supporting the bill.<ref name="2008election">[[#refDavis2007|Davis, 2007]]</ref><ref>[[#refMcCain2007|CBS News, 2007]]</ref> A poll in 2009 by [[Rasmussen Reports]] found that 43% of Americans would support a national sales tax replacement, with 38% opposed to the idea; the sales tax was viewed as fairer by 52% of Republicans, 44% of Democrats, and 49% of unaffiliateds.<ref name="rasmussen">[[#refRasmussen|Rasmussen Reports, 2009]]</ref> President [[Barack Obama]] did not support the bill,<ref name="Obama">[[#refObama2008|Obama, 2008]]</ref> arguing for more [[Barack Obama economic policy#Taxation|progressive changes]] to the income and payroll tax systems. President [[Donald Trump]] [[Economic policy of Donald Trump#Taxation|proposed]] to lower overall income taxation and reduce the number of [[tax brackets]] from seven to three. |

|||

The FairTax legislation has been introduced by Linder in the House and by Georgia Republican Senator [[Saxby Chambliss]] in the Senate. The legislation has been discussed with President [[George W. Bush]] and [[United States Secretary of the Treasury|Secretary of the Treasury]] [[Henry M. Paulson]].<ref name="ConfCall">{{cite web|url=http://www.fairtax.org/pdf/LinbeckConfCall02-100306.pdf| format = PDF | title=Grassroots Leadership Council Conference Call|publisher=Americans For Fair Taxation|last=Linbeck|first=Leo|date=[[2006-10-03]]|accessdate=2007-02-04}}</ref> A number of congressional committees have also heard testimony on the FairTax. The bill is cosponsored by former [[Speaker of the House]] [[Dennis Hastert]] but has not received support from the [[United States Democratic Party|Democratic]] leadership, which now controls Congress.<ref name="hrcosponsors2007"/><ref name="scosponsors"/><ref name="support">{{cite news| url=http://www.heartland.org/Article.cfm?artId=17042| last=Bender| first=Merrill| title=Economists Back FairTax Proposal| work=Budget & Tax News| publisher=The Heartland Institute| date=[[2005-06-01]]| accessdate=2006-07-20}}</ref> Democratic Representative [[Collin Peterson]] of Minnesota and Democratic Senator [[Zell Miller]] of Georgia cosponsored and introduced the bill in the 108th Congress, but Peterson is no longer cosponsoring the bill and Miller has left the Senate.<ref name="hrcosponsors2003"/><ref name="scosponsors2003"/> In the 109th and 110th Congress, Representative [[Dan Boren]] has been the only Democrat to cosponsor the bill.<ref name="hrcosponsors"/><ref name="hrcosponsors2007"/> Linder claims that [[Nancy Pelosi]] has instructed House Democrats against cosponsoring the bill.<ref name="americansolutions">{{cite web|url=http://www.webcastgroup.com/client/start.asp?wid=0840929073673| title=The Fair Tax: Saying Goodbye to the Income Tax and the IRS[[Image:Film reel.svg|20px]]| last=Linder | first=John | coauthors=Boortz, Neal | publisher=American Solutions |date=2007-09-27 | accessdate=2007-10-04}}</ref> Other attempts to replace the U.S. tax system have attracted fewer cosponsors. The ''[[flat tax|Freedom Flat Tax]]'' ({{USBill|110|HR|1040}}), sponsored by Texas Republican [[Michael C. Burgess]], has 6 cosponsors, with no other proposal in Congress having as many.<ref>{{cite web| url=http://thomas.loc.gov/cgi-bin/bdquery/z?d110:h.r.01040:| title=H.R. 1040 110th Cosponsors| work=110th U.S. Congress| publisher=The Library of Congress| date=[[2007-02-14]]| accessdate=2007-03-14}}</ref> |

|||

==Tax rate== |

==Tax rate== |

||

The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S. sales tax ($23 on top of every $77 spent—$100 total, or $30 on top of every $100 spent—$130 total).<ref name="money"/> After the first year of implementation, this rate is automatically adjusted annually using a predefined formula reflecting actual federal receipts in the previous fiscal year. |

|||

The sales tax rate, as defined in the legislation, is 23% of the total amount paid, which includes the tax payment itself. U.S. state sales taxes have historically been expressed as a percentage of the original sale price or pre-tax amount, which would be a tax rate of 30%.<ref name="money"/> The [[effective tax rate]] for any household would be variable due to the fixed monthly [[tax refund|tax rebates]] that are used to "untax" purchases up to the poverty level.<ref name="Kotlikoff"/> The tax would be levied on all U.S. retail sales for personal consumption on new [[Good (economics)|goods]] and [[Service (economics)|services]]. Critics argue that the sales tax rate defined in the legislation may not be revenue neutral (that is, it would collect less for the government than the current tax regime), and thus would not yield enough money for the government.<ref name="money"/> |

|||

The [[effective tax rate]] for any household would be variable due to the fixed monthly tax rebate that are used to rebate taxes paid on purchases up to the poverty level.<ref name="Kotlikoff"/> The tax would be levied on all U.S. retail sales for personal consumption on new [[Good (economics)|goods]] and [[Service (economics)|services]]. Critics argue that the sales tax rate defined in the legislation would not be revenue neutral (that is, it would collect less for the government than the current tax system), and thus would increase the [[budget deficit]], unless government spending were equally reduced.<ref name="money"/> |

|||

===Sales tax rate=== |

===Sales tax rate=== |

||

During the first year of implementation, the FairTax legislation would apply a 23% federal [[Retailing|retail]] sales tax on the total transaction value of a purchase; in other words, consumers pay to the government 23 cents of every dollar spent in total (sometimes called ''[[tax-inclusive]]'', and presented this way to provide a direct comparison with individual income and employment taxes which reduce a person's available money ''before'' they can make purchases). The equivalent assessed tax rate is 30% if the FairTax is applied to the pre-tax price of a good like traditional [[Sales taxes in the United States|U.S. state sales taxes]] (sometimes called ''[[tax-exclusive]]''; this rate is not directly comparable with existing income and employment taxes).<ref name="money"/> After the first year of implementation, this tax rate would be automatically adjusted annually using a formula specified in the legislation that reflects actual federal receipts in the previous fiscal year.<ref name="billc1"/> |

|||

===Effective tax rate=== |

|||

The tax would be levied on all U.S. retail sales for personal consumption on new goods and services. A good would be considered "used" and not taxable if a consumer already owns it before the FairTax takes effect or if the FairTax has been paid previously on the good,<ref name="ABKS" /> which may be different than the item being sold previously. [[Export]]s and the purchase of intermediate business sales would not be taxed, nor would [[Saving (economics)|savings]], [[investments]], or [[Tuition|education tuition]] expenses as they would be considered an investment (rather than final consumption).<ref name="billtext">{{cite web| title=H.R. 25: Fair Tax Act of 2007| work=110th U.S. Congress| publisher=The Library of Congress| date=[[2007-01-04]]| url=http://thomas.loc.gov/cgi-bin/query/zRetailing?c110:H.R.25:|accessdate=2007-01-14}}</ref> Personal services such as [[health care]], legal services, [[financial services]], haircuts, and auto repairs would be subject to the FairTax, as would renting apartments and other [[real property]].<ref name="money"/> In comparison, the current tax system also taxes such consumption indirectly by taxing the income used for purchase. [[U.S. state|State]] sales taxes generally exempt these services in an effort to reduce the tax burden on low-income families. The FairTax would use a monthly rebate system instead of the common state exclusions. The FairTax would apply to Internet purchases and would tax retail international purchases (such as a boat or car) that are imported to the United States (collected by the [[United States Customs Service|U.S. Customs Service]]).<ref name="billtext"/> |

|||

{{further|Distribution of the FairTax burden}} |

|||

A household's [[effective tax rate]] on consumption would vary with the annual expenditures on taxable items and the fixed monthly tax rebate. The rebate would have the greatest effect at low spending levels, where they could lower a household's effective rate to zero or below.<ref name="comparerates"/> The lowest effective tax rate under the FairTax could be negative due to the rebate for households with annual spending amounts below [[Poverty in the United States#Measuring poverty|poverty level spending]] for a specified household size. At higher spending levels, the rebate has less impact, and a household's effective tax rate would approach 23% of total spending.<ref name="comparerates"/> A person spending at the poverty level would have an effective tax rate of 0%, whereas someone spending at four times the poverty level would have an effective tax rate of 17.2%. Buying or otherwise receiving items and services not subject to federal taxation (such as a used home or car) can contribute towards a lower effective tax rate. The total amount of spending and the proportion of spending allocated to taxable items would determine a household's effective tax rate on consumption. If a rate is calculated on income, instead of the tax base, the percentage could exceed the statutory tax rate in a given year. |

|||

=== |

===Monthly tax rebate=== |

||

{| class="wikitable" align="right" style="margin:0 0 1em 1em; font-size: 80%;" |

|||

{{details|Distribution of the FairTax burden}} |

|||

|- |

|||

The [[effective tax rate]] for any household would be variable due to the fixed monthly tax rebates. The rebates would have the greatest impact at low spending levels, where they could lower a household's effective rate to zero or a negative rate. At higher spending levels, the rebate has less impact, and a household's effective tax rate would approach 23% of total spending.<ref name="NRSACalc">{{cite web| url=http://www.salestax.org/FairTaxCalculator.htm| title=The FairTax Calculator| publisher=National Retail Sales Tax Alliance| accessdate=2006-07-23}}</ref> For example, a household of three spending $30,000 a year on taxable items would devote about 6% of total spending to the FairTax after the rebate. A household spending $125,000 on taxable items would spend around 19% on the FairTax.<ref name="money"/> The lowest effective tax rate under the FairTax could be negative due to the rebate. This could occur when a household spends less and pays less in taxes than the average [[Poverty in the United States#Current poverty rate and guidelines|poverty level spending]] for a similar household size. The household's rebate would exceed actual taxes paid by that household. Buying or otherwise receiving used items can also contribute towards a lower rate. The total amount of spending and the proportion of spending allocated to taxable items would determine a household's effective tax rate.<ref name="fairtaxfaq">{{cite web| url=http://www.fairtax.org/PDF/FairTaxFAQ.pdf| format = PDF | title=FairTax Frequently Asked Questions|publisher=Americans For Fair Taxation| accessdate=2006-10-18}}</ref> |

|||

|+ Proposed 2015 FairTax Prebate Schedule<ref name="prebate">[[#refprebate|2015 prebate]]</ref> |

|||

|- |

|||

! colspan=4 align="center"|One adult household |

|||

! colspan=4 align="center"|Two adult household |

|||

|- |

|||

! Family <br />Size |

|||

! Annual <br />Consumption <br />Allowance |

|||

! Annual <br />Prebate |

|||

! Monthly <br />Prebate |

|||

! Family <br />Size |

|||

! Annual <br />Consumption <br />Allowance |

|||

! Annual <br />Prebate |

|||

! Monthly <br />Prebate |

|||

|- |

|||

| 1 person |

|||

| align=center|$11,770 |

|||

| align=center|$2,707 |

|||

! align=center|$226 |

|||

| couple |

|||

| align=center|$23,540 |

|||

| align=center|$5,414 |

|||

! align=center|$451 |

|||

|- |

|||

| and 1 child |

|||

| align=center|$15,930 |

|||

| align=center|$3,664 |

|||

! align=center|$305 |

|||

| and 1 child |

|||

| align=center|$27,700 |

|||

| align=center|$6,371 |

|||

! align=center|$531 |

|||

|- |

|||

| and 2 children |

|||

| align=center|$20,090 |

|||

| align=center|$4,621 |

|||

! align=center|$385 |

|||

| and 2 children |

|||

| align=center|$31,860 |

|||

| align=center|$7,328 |

|||

! align=center|$611 |

|||

|- |

|||

| and 3 children |

|||

| align=center|$24,250 |

|||

| align=center|$5,578 |

|||

! align=center|$465 |

|||

| and 3 children |

|||

| align=center|$36,020 |

|||

| align=center|$8,285 |

|||

! align=center|$690 |

|||

|- |

|||

| and 4 children |

|||

| align=center|$28,410 |

|||

| align=center|$6,534 |

|||

! align=center|$545 |

|||

| and 4 children |

|||

| align=center|$40,180 |

|||

| align=center|$9,241 |

|||

! align=center|$770 |

|||

|- |

|||

| and 5 children |

|||

| align=center| $32,570 |

|||

| align=center| $7,491 |

|||

! align=center| $624 |

|||

| and 5 children |

|||

| align=center| $44,340 |

|||

| align=center| $10,198 |

|||

! align=center| $850 |

|||

|- |

|||

| and 6 children |

|||

| align=center| $36,490 |

|||

| align=center| $8,393 |

|||

! align=center| $699 |

|||

| and 6 children |

|||

| align=center| $48,500 |

|||

| align=center| $11,155 |

|||

! align=center| $930 |

|||

|- |

|||

| and 7 children |

|||

| align=center| $40,890 |

|||

| align=center| $9,405 |

|||

! align=center| $784 |

|||

| and 7 children |

|||

| align=center| $52,660 |

|||

| align=center| $12,112 |

|||

! align=center| $1,009 |

|||

|- |

|||

| colspan=8 style="font-size: 90%; width: 250px;"|The annual consumption allowance is based on the 2015 [[Poverty in the United States#Measuring poverty|DHHS Poverty Guidelines]] as published in the ''Federal Register'', January 22, 2015. There is no [[marriage penalty]] as the couple amount is twice the amount that a single adult receives. For families/households with more than 8 persons, add $4,160 to the annual consumption allowance for each additional person. The annual consumption allowance is the amount of spending that is "untaxed" under the FairTax. |

|||

|} |

|||

Under the FairTax, [[family]] [[household]]s of lawful U.S. residents would be eligible to receive a "Family Consumption Allowance" (FCA) based on family size (regardless of income) that is equal to the estimated total FairTax paid on [[poverty]] level spending according to the [[Poverty in the United States#Measuring poverty|poverty guidelines]] published by the [[U.S. Department of Health and Human Services]].<ref name="billc3">[[#refFairTaxAct|Fair Tax Act, 2009, Chapter 3]]</ref> The FCA is a tax rebate (known as a "prebate" as it would be an advance) paid in twelve monthly installments, adjusted for [[inflation]]. The rebate is meant to eliminate the taxation of household necessities and make the plan [[Progressive tax|progressive]].<ref name="money" /> Households would register once a year with their sales tax administering authority, providing the names and social security numbers of each household member.<ref name="billc3" /> The [[Social Security Administration]] would disburse the monthly rebate payments in the form of a paper check via U.S. Mail, an [[electronic funds transfer]] to a bank account, or a "smartcard" that can be used like a [[debit card]].<ref name="billc3" /> |

|||

Opponents of the plan criticize this tax rebate due to its costs. Economists at the [[Beacon Hill Institute]] estimated the overall rebate cost to be $489 billion (assuming 100% participation).<ref name="taxpanelrebuttal">[[#refRebuttal2006|Rebuttal to Tax Panel Report, 2006]]</ref> In addition, economist [[Bruce Bartlett]] has argued that the rebate would create a large opportunity for [[fraud]],<ref name="TFBarlett">[[#refBartlett2007|Bartlett, 2007]]</ref> treats children disparately, and would constitute a [[Social welfare provision|welfare]] payment regardless of need.<ref name="Bartletttaxnotes">[[#refBartlettTaxNotes|Bartlett, 2007, Tax Notes]]</ref> |

|||

:To determine the effective tax rate on consumption: |

|||

The [[President's Advisory Panel for Federal Tax Reform]] cited the rebate as one of their chief concerns when analyzing their national sales tax, stating that it would be the largest [[entitlement program]] in American history, and contending that it would "make most American families dependent on monthly checks from the federal government".<ref name="finalreport"/><ref name="Yin">[[#refYin|Yin, 2006, Fla. L. Rev.]]</ref> Estimated by the advisory panel at approximately $600 billion, "the Prebate program would cost more than all budgeted spending in 2006 on the Departments of Agriculture, Commerce, Defense, Education, Energy, Homeland Security, Housing and Urban Development, and Interior combined."<ref name="finalreport"/> Proponents point out that income [[tax deduction]]s, tax preferences, [[tax avoidance|loopholes]], [[tax credit|credits]], etc. under the current system was estimated at $945 billion by the [[United States Congress Joint Committee on Taxation|Joint Committee on Taxation]].<ref name="taxpanelrebuttal"/> They argue this is $456 billion more than the FairTax "entitlement" (tax refund) would spend to cover each person's tax expenses up to the poverty level. In addition, it was estimated for 2005 that the Internal Revenue Service was already sending out $270 billion in refund checks.<ref name="taxpanelrebuttal"/> |

|||

* Let <math>t</math> be the statutory tax rate. For a 23% rate, then <math>t = 0.23</math> |

|||

===Presentation of tax rate=== |

|||

* Let <math>i</math> be the annual income spent on new goods and services. |

|||

[[File:FairTax Rate Presentation.png|thumb|Mathematically, a 23% tax out of $100 yields approximately the same as a 30% tax on $77.|180px]] |

|||

Sales and income taxes behave differently due to differing definitions of tax base, which can make comparisons between the two confusing. Under the existing individual income plus employment (Social Security; Medicare; Medicaid) tax formula, taxes to be paid are included in the base on which the tax rate is imposed (known as ''[[tax-inclusive]]''). If an individual's gross income is $100 and the sum of their income plus employment tax rate is 23%, taxes owed equals $23. Traditional state sales taxes are imposed on a tax base equal to the pre-tax portion of a good's price (known as ''[[tax-exclusive]]''). A good priced at $77 with a 30% sales tax rate yields $23 in taxes owed. To adjust an inclusive rate to an exclusive rate, divide the given rate by one minus that rate (i.e. <math>0.23/(1 - 0.23) = 0.23/0.77 = 0.30</math> ). |

|||

The FairTax [[statutory rate]], unlike most U.S. [[Sales taxes in the United States|state-level sales taxes]], is presented on a tax base that includes the amount of FairTax paid. For example, a final after-tax price of $100 includes $23 of taxes. Although no such requirement is included in the text of the legislation, Congressman John Linder has stated that the FairTax would be implemented as an inclusive tax, which would include the tax in the retail price, not added on at checkout—an item on the shelf for five dollars would be five dollars total.<ref name="thetruth">[[#refBoortz2008|Boortz and Linder, 2008]]</ref><ref name="americansolutions">[[#refLinder2007|Linder and Boortz, 2007]]</ref> The legislation requires the receipt to display the tax as 23% of the total.<ref name="billc5"/> Linder states the FairTax is presented as a 23% tax rate for easy comparison to income and employment tax rates (the taxes it would be replacing). The plan's opponents call the [[semantics]] deceptive. [[FactCheck]] called the presentation misleading, saying that it hides the real truth of the tax rate.<ref name="FactCheck">[[#refMiller2007|Miller, 2007]]</ref> [[Bruce Bartlett]] stated that polls show tax reform support is extremely sensitive to the proposed rate,<ref name="Bartletttaxnotes"/> and called the presentation confusing and deceptive based on the conventional method of calculating sales taxes.<ref name="BartlettWSJ">[[#refBartlettWSJ|Bartlett, 2007, Wall Street Journal]]</ref> Proponents believe it is both inaccurate and misleading to say that an income tax is 23% and the FairTax is 30% as it implies that the sales tax burden is higher. |

|||

* Let <math>r</math> be the annual rebate. |

|||

===Revenue neutrality=== |

|||

::<math>\frac{t \times (i - r)}{i}</math> |

|||

{{Main|Revenue neutrality of the FairTax}} |

|||

A key question surrounding the FairTax is whether the tax has the ability to be revenue-neutral; that is, whether the tax would result in an increase or reduction in overall federal tax revenues. Economists, advisory groups, and political advocacy groups disagree about the tax rate required for the FairTax to be truly revenue-neutral. Various analysts use different assumptions, time-frames, and methods resulting in dramatically different [[tax rates]] making direct comparison among the studies difficult. The choice between [[Static analysis|static]] or [[dynamic scoring]] further complicates any estimate of revenue-neutral rates.<ref name="scoring">[[#refGingrich2005|Gingrich and Ferrara, 2005]]</ref> |

|||

A 2006 study published in ''[[Tax Notes]]'' by the [[Beacon Hill Institute]] at Suffolk University and Dr. [[Laurence Kotlikoff]] estimated the FairTax would be revenue-neutral for the tax year 2007 at a rate of 23.82% (31.27% tax-exclusive).<ref name="beaconhill">[[#refBachman2006|Bachman et al., 2006]]</ref> The study states that [[purchasing power]] is transferred to state and local taxpayers from state and local governments. To recapture the lost revenue, state and local governments would have to raise tax rates or otherwise change tax laws in order to continue collecting the same [[Real versus nominal value (economics)|real revenues]] from their taxpayers.<ref name="Yin"/><ref name="beaconhill"/> The [[Argus Group]] and [[Arduin, Laffer & Moore Econometrics]] each published an analysis that defended the 23% rate.<ref name="galerebuttal">[[#refBurton1998|Burton and Mastromarco, 1998]]</ref><ref name="jctrebuttal">[[#refBurton1998JCT|Burton and Mastromarco, 1998a]]</ref><ref name="ALME">[[#refALME2006|Arduin, Laffer & Moore Econometrics, 2006]]</ref> While proponents of the FairTax concede that the above studies did not explicitly account for [[tax evasion]], they also claim that the studies did not altogether ignore tax evasion under the FairTax. These studies presumably incorporated some degree of tax evasion in their calculations by using [[National Income and Product Accounts|National Income and Product Account]] based figures, which is argued to understate total household consumption.<ref name="beaconhill"/> The studies also did not account for capital gains that may be realized by the U.S. government if consumer prices were allowed to rise, which would reduce the real value of nominal [[U.S. government debt]].<ref name="beaconhill"/> Nor did these studies account for any increased [[economic growth]] that many economists researching the plan believe would occur.<ref name="beaconhill"/><ref name="ALME"/><ref name="simulating">[[#refAltig2001|Altig et al., 2001]]</ref><ref name="BHIeconomic"/> |

|||

=== Monthly tax rebate === |

|||

[[Image:FTRebate.png|thumb|right|400px|2007 FairTax prebate schedule based on poverty level spending according to the [[Poverty in the United States#Current poverty rate and guidelines|poverty guidelines]].]] Under the FairTax, households of citizens and legal resident aliens would receive a "Family Consumption Allowance" (FCA) based on family size (regardless of income) that is equal to the estimated total FairTax paid on poverty level spending according to the [[Poverty in the United States#Current poverty rate and guidelines|poverty guidelines]] published by the [[U.S. Department of Health and Human Services]].<ref name="billtext" /> The poverty level guidelines vary by family size and represent the cost to purchase household necessities. The FCA is a tax rebate (known as a "prebate" as it would be paid in advance) paid in twelve monthly installments equal to 23% of poverty level spending for each household size. The rebate is meant to eliminate the taxation of necessities and make the plan [[progressive tax|progressive]].<ref name="money" /> The formula used to calculate rebate amounts would be adjusted for [[inflation]]. To become eligible for the rebate, households would register once a year with their sales tax administering authority, providing the names and social security numbers of each household member. The [[Social Security Administration]] would disburse the monthly rebate payments in the form of a paper check via U.S. Mail, an [[electronic funds transfer]] to a bank account, or a “[[smartcard]]” that can be used much like a bank debit card.<ref name="billtext" /> Economists at [[Suffolk University]] and [[Boston University]] estimated the overall rebate cost to be $489 billion (assuming 100% participation).<ref name="taxpanelrebuttal">{{cite web| title=Rebuttal to the tax panel report and recommendations|publisher=Americans for Fair Taxation|date=November 2006| url=http://www.fairtax.org/PDF/Excerpts_from_response_to_tax_panel-103006.pdf| format = PDF | accessdate=2006-11-02}}</ref> |

|||

In contrast to the above studies, [[William G. Gale]] of the [[Brookings Institution]] published a study in ''Tax Notes'' that estimated a rate of 28.2% (39.3% tax-exclusive) for 2007 assuming full taxpayer compliance and an average rate of 31% (44% tax-exclusive) from 2006 to 2015 (assumes that the [[Bush tax cuts]] expire on schedule and accounts for the replacement of an additional $3 trillion collected through the [[Alternative Minimum Tax]]).<ref name="money"/><ref name="taxnotes"/><ref name="CBO">[[#refEsenwein2005|Esenwein, 2005]]</ref> The study also concluded that if the tax base were eroded by 10% due to tax evasion, tax avoidance, and/or legislative adjustments, the average rate would be 34% (53% tax-exclusive) for the 10-year period. A dynamic analysis in 2008 by the [[Baker Institute For Public Policy]] concluded that a 28% (38.9% tax-exclusive) rate would be revenue neutral for 2006.<ref name="Baker">[[#refDiamond2008|Diamond and Zodrow, 2008]]</ref> The [[President's Advisory Panel for Federal Tax Reform]] performed a 2006 analysis to replace the individual and corporate [[Income tax in the United States|income tax]] with a retail sales tax and estimated the rate to be 25% (34% tax-exclusive) assuming 15% tax evasion, and 33% (49% tax-exclusive) with 30% tax evasion.<ref name="finalreport"/> The rate would need to be substantially higher to replace the additional taxes replaced by the FairTax (payroll, estate, and gift taxes). [[Beacon Hill Institute]], FairTax.org, and Kotlikoff criticized the President's Advisory Panel's study as having allegedly altered the terms of the FairTax, using unsound methodology, and/or failing to fully explain their calculations.<ref name="taxpanelrebuttal"/><ref name="beaconhill"/><ref name="KotlikoffBartlett">[[#refKotlikoff2008|Kotlikoff, 2008]]</ref> |

|||

Economist [[Bruce Bartlett]] has criticized that the rebate would create a large opportunity for fraud,<ref name="TFBarlett">{{cite web | url=http://www.taxfoundation.org/blog/show/22815.html | title=FairTax Podcast with Bruce Bartlett | last=Bartlett | first=Bruce | publisher=[[The Tax Foundation]] |date=2007-12-08 | accessdate=2007-12-20}}</ref> treats children disparately, and would constitute a welfare payment regardless of need.<ref name="Bartletttaxnotes">{{cite web|url=http://taxprof.typepad.com/taxprof_blog/files/bartlett_fair_tax.pdf | title=Why the FairTax Won’t Work | last=Bartlett | first=Bruce | publisher=[[Tax Analysts]] | date=2007-12-24 | accessdate=2007-12-30}}</ref> The [[President's Advisory Panel for Federal Tax Reform]] cited the rebate as one of their chief concerns when analyzing their national sales tax, stating that it would be "the largest (entitlement program) in American history", and contending that it would "make most American families dependent on monthly checks from the federal government".<ref name="finalreport"/> Based on the advisory panel's tax rate (which differs from the FairTax legislation),<ref name="taxpanelrebuttal" /> "the Prebate program would cost more than all budgeted spending in 2006 on the Departments of Agriculture, Commerce, Defense, Education, Energy, Homeland Security, Housing and Urban Development, and Interior combined."<ref name="finalreport"/> Proponents point out that income [[tax deduction]]s, tax preferences, [[tax avoidance|loopholes]], [[tax credit|credits]], etc. under the current system was estimated at $945 billion by the [[United States Congress Joint Committee on Taxation|Joint Committee on Taxation]].<ref name="taxpanelrebuttal"/> This is $456 billion more than the FairTax "[[entitlement]]" (tax refund) would spend to cover each person's tax expenses up to the poverty level. In addition, it was estimated for 2005 that the Internal Revenue Service was already sending out $270 billion in refund checks.<ref name="taxpanelrebuttal"/> |

|||

==Taxable items and exemptions== |

|||

===Presentation of tax rate=== |

|||

The tax would be levied once at the final retail sale for personal consumption on new goods and services. Purchases of used items, [[export]]s and [[business-to-business|all business]] transactions would not be taxed. Also excluded are investments, such as purchases of [[stock]], corporate [[mergers and acquisitions]] and [[capital investments]]. [[Saving (economics)|Savings]] and [[Tuition payments|education tuition]] expenses would be exempt as they would be considered an investment (rather than final consumption).<ref name="billtext">[[#refFairTaxAct|Fair Tax Act, 2009]]</ref> |

|||

Sales and income taxes behave differently due to differing definitions of tax base, which can make comparisons between the two confusing. For direct rate comparisons between sales and income taxes, one rate must be manipulated to look like the other. A 30% sales tax rate approximates a 23% income tax rate after adjustment. The current U.S. tax system imposes taxes primarily on income. The tax base is a household's pre-tax income. The appropriate income tax rate is applied to the tax base to calculate taxes owed. Under this formula, taxes to be paid are included in the base on which the tax rate is imposed (known as ''tax-inclusive''). If an individual's gross income is $100 and income tax rate is 23%, taxes owed equals $23. The tax base of $100 can be treated as two parts—$77 of after-tax spending money and $23 of income taxes owed. The income tax is taken "off the top", so the individual is left with $77 in after-tax money.<ref name="ABKS" /> Traditional state sales tax laws impose taxes on a tax base equal to the pre-tax portion of a good's price (known as ''tax-exclusive''). Unlike income taxes, U.S. sales taxes do not include actual taxes owed as part of the base. A good priced at $77 with a 30% sales tax rate yields $23 in taxes owed. Since the sales tax is added "on the top", the individual pays $23 of tax on $77 of pre-tax goods.<ref name="ABKS" /> By including taxes owed in the tax base, a sales tax rate can be directly compared to an income tax rate. |

|||

A good would be considered "used" and not taxable if a consumer already owns it before the FairTax takes effect or if the FairTax has been paid previously on the good, which may be different from the item being sold previously. Personal services such as [[health care]], legal services, [[financial services]], and auto repairs would be subject to the FairTax, as would renting apartments and other [[real property]].<ref name="money"/> Food, clothing, prescription drugs, and medical services would be taxed. ([[U.S. state|State]] sales taxes generally exempt these types of basic-need items in an effort to reduce the tax burden on low-income families. The FairTax would use a monthly rebate system instead of the common state exclusions.) [[Internet]] purchases would be taxed, as would retail international purchases (such as a boat or car) that are imported to the United States (collected by the [[U.S. Customs and Border Protection]]).<ref name="billtext"/> |

|||

The FairTax [[statutory rate]], unlike most U.S. [[Sales taxes in the United States|state-level sales taxes]], is calculated on a tax base that includes the amount of FairTax paid. In this manner, the FairTax, like [[Value added tax#European Union|European sales taxes]], more closely resembles an income tax calculation. A final price of $100 includes $23 of taxes. Like the income tax example above, the taxes to be paid would be included in the base on which the FairTax is imposed. Neal Boortz has stated that the FairTax would be implemented as an inclusive tax, which would include the tax in the retail price (not added on at checkout) and display the tax on the receipt as 23% of the total.<ref name="ftnote">{{cite web|title=A FairTax Note| url=http://boortz.com/nuze/200708/08312007.html |last=Boortz |first=Neal |publisher=Cox Radio | date=[[2007-08-31]]| accessdate=2007-09-01}}</ref><ref name="americansolutions"/> The FairTax is presented as a 23% tax rate for easy comparison to income tax rates (the taxes it would be replacing). Proponents believe it is both inaccurate and misleading to say that an income tax is 23% and the FairTax is 30% as it implies that the sales tax burden is higher, when in fact the burden of the two taxes is precisely the same—either both taxes are 23% or both taxes are 30%. The plan's opponents call the semantics deceptive. [[FactCheck]] called the presentation misleading, saying that it hides the real truth of the tax rate.<ref name="FactCheck"/> Laurence Vance, writing for the [[Ludwig von Mises Institute]], goes so far as to call the rate presentation a "lie".<ref name="ludwigvonmises" /> [[Bruce Bartlett]] stated that polls show tax reform support is extremely sensitive to the proposed rate,<ref name="Bartletttaxnotes"/> and called the presentation confusing and deceptive based on the conventional method of calculating sales taxes.<ref name="BartlettWSJ">{{cite news|url=http://www.opinionjournal.com/extra/?id=110010523 | title=Fair Tax, Flawed Tax| publisher=Wall Street Journal | date=[[2007-08-26]]| accessdate=2007-08-30 |last=Bartlett |first=Bruce}}</ref> |

|||

==Distribution of tax burden== |

|||

:Comparison to a typical sales rate: |

|||

{{Main|Distribution of the FairTax burden}} |

|||

[[File:FairTax married.png|thumb|[[Working paper]] by Kotlikoff and Rapson<ref name="comparerates"/> of the FairTax. Lower rates claimed on workers from a larger tax base, replacing regressive taxes, and [[wealth tax]]ation.]] |

|||

[[File:NRST-percentile.png|thumb|[[President's Advisory Panel for Federal Tax Reform|President's Advisory Panel's]] analysis of a hybrid National Sales Tax. Higher rates claimed on the middle-class for an income tax replacement (excludes payroll, estate, and gift taxes replaced under the FairTax).]] |

|||

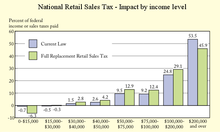

The FairTax's effect on the distribution of taxation or [[tax incidence]] (the effect on the distribution of [[Welfare economics|economic welfare]]) is a point of dispute. The plan's supporters argue that the tax would broaden the tax base, that it would be [[progressive tax|progressive]], and that it would decrease tax burdens and start taxing wealth (reducing the [[economic inequality|economic gap]]).<ref name="comparerates"/> Opponents argue that a national sales tax would be inherently [[regressive tax|regressive]] and would decrease tax burdens paid by high-income individuals.<ref name="money"/><ref name="Taranto"/> A person earning $2 million a year could live well spending $1 million, and as a result pay a mere 11% of that year's income in taxes.<ref name="money"/> Households at the lower end of the income scale spend almost all their income, while households at the higher end are more likely to devote a portion of income to saving. Therefore, according to economist [[William G. Gale]], the percentage of [[income]] taxed is regressive at higher income levels (as consumption falls as a percentage of income).<ref name="wgale"/> |

|||

*Let <math>t</math> be the FairTax rate. For a 23% rate, then <math>t = 0.23</math> |

|||

Income earned and saved would not be taxed until spent under the proposal. Households at the extreme high end of consumption often finance their purchases out of savings, not income.<ref name="wgale" /><ref name="Bartletttaxnotes"/> Economist [[Laurence Kotlikoff]] states that the FairTax could make the tax system much more progressive and generationally equitable,<ref name="Kotlikoff" /> and argues that taxing consumption is effectively the same as taxing [[wages]] plus taxing [[wealth]].<ref name="Kotlikoff" /> A household of three persons (this example will use two adults plus one child; the rebate does not consider marital status) spending $30,000 a year on taxable items would devote about 3.4% of total spending ([$6,900 tax minus $5,888 rebate]/$30,000 spending) to the FairTax after the rebate. The same household spending $125,000 on taxable items would spend around 18.3% ([$28,750 tax minus $5,888 rebate]/$125,000 spending) on the FairTax. At higher spending levels, the rebate has less impact and the rate approaches 23% of total spending. Thus, according to economist [[Laurence Kotlikoff]], the effective tax rate is progressive on [[Consumption (economics)|consumption]].<ref name="Kotlikoff" /> |

|||

*Let <math>a</math> be the rate in terms of a typical sales tax. |

|||

An unreviewed paper by Kotlikoff and David Rapson states that the FairTax would significantly reduce marginal taxes on work and saving, lowering overall average remaining lifetime tax burdens on current and future workers.<ref name="comparerates"/><ref name="Kotlikoff2">[[#refKotlikoffRapson2006|Kotlikoff and Rapson, 2006]]</ref> A study by Kotlikoff and Sabine Jokisch concluded that the long-term effects of the FairTax would reward low-income households with 26.3% more [[purchasing power]], middle-income households with 12.4% more purchasing power, and high-income households with 5% more purchasing power.<ref name="dynamiceffects"/> The [[Beacon Hill Institute]] reported that the FairTax would make the federal tax system more progressive and would benefit the average individual in almost all expenditures deciles.<ref name="BHItaxburden">[[#refTuerk2007|Tuerk et al., 2007]]</ref> In another study, they state the FairTax would offer the broadest tax base (an increase of over $2 trillion), which allows the FairTax to have a lower tax rate than current tax law.<ref name="TaxComparisonChart">[[#refTuerk2007Chart|Tuerk et al., 2007]]</ref> |

|||

*Let <math>p</math> be the price of the good (including the tax). |

|||

Gale analyzed a national sales tax (though different from the FairTax in several aspects<ref name="BHItaxburden"/><ref name="galerebuttal"/>) and reported that the overall tax burden on middle-income Americans would increase while the tax burden on the top 1% would drop.<ref name="wgale"/> A study by the Beacon Hill Institute reported that the FairTax may have a negative effect on the well-being of mid-income earners for several years after implementation.<ref name="BHIeconomic" /> According to the [[President's Advisory Panel for Federal Tax Reform]] report, which compared the individual and corporate income tax (excluding other taxes the FairTax replaces) to a sales tax with rebate,<ref name="finalreport"/><ref name="taxpanelrebuttal"/> the percentage of federal taxes paid by those earning from $15,000–$50,000 would rise from 3.6% to 6.7%, while the burden on those earning more than $200,000 would fall from 53.5% to 45.9%.<ref name="finalreport" /> The report states that the top 5% of earners would see their burden decrease from 58.6% to 37.4%.<ref name="finalreport" /><ref name="bakerreview">[[#refZodrow2006|Zodrow and McClure, 2006]]</ref> FairTax supporters argue that replacing the regressive [[Federal Insurance Contributions Act tax|payroll tax]] (a 15.3% total tax not included in the Tax Panel study;<ref name="finalreport"/> payroll taxes include a 12.4% [[Social Security (United States)|Social Security]] tax on wages up to $97,500 and a 2.9% [[Medicare (United States)|Medicare]] tax, a 15.3% total tax that is often split between employee and employer) greatly changes the tax distribution, and that the FairTax would relieve the tax burden on middle-class workers.<ref name="Kotlikoff"/><ref name="KotlikoffBartlett"/> |

|||

:The revenue that would go to the government: |

|||

==Predicted effects== |

|||

::<math>t \times p</math> |

|||

{{Main|Predicted effects of the FairTax}} |

|||

The predicted effects of the FairTax are a source of disagreement among economists and other analysts.<ref name="FactCheck"/><ref name="BartlettWSJ"/><ref name="Taranto">[[#refTaranto2007|Taranto, 2007]]</ref> According to ''[[Money (magazine)|Money]]'' magazine, while many economists and tax experts support the idea of a [[consumption tax]], many of them view the FairTax proposal as having serious problems with evasion and revenue neutrality.<ref name="money"/> Some economists argue that a consumption tax (the FairTax is one such tax) would have a positive effect on [[economic growth]], incentives for international business to locate in the U.S., and increased U.S. international competitiveness (border tax adjustment in [[International trade|global trade]]).<ref name="fairtaxbook"/><ref name="endorsement"/><ref name="consumptiontax" /> The FairTax would be tax-free on mortgage interest (up to a basic interest rate) and donations, but some lawmakers have concerns about losing tax incentives on [[home ownership]] and charitable contributions.<ref name="Giuliani">[[#refGiuliani|Giuliani, 2007]]</ref> There is also concern about the effect on the income tax industry and the difficulty of repealing the [[Sixteenth Amendment to the United States Constitution|Sixteenth Amendment]] (to prevent Congress from re-introducing an income tax).<ref name="Vance2005b">[[#refVance2005b|Vance, 2005]]</ref> |

|||

:The revenue remaining for the seller of the good: |

|||

===Economic=== |

|||

::<math>p - t \times p</math> |

|||

{{further|Predicted effects of the FairTax#Economic effects}} |

|||

Americans For Fair Taxation states the FairTax would boost the United States economy and offers a letter signed by eighty economists, including [[Nobel Prize in Economics|Nobel Laureate]] [[Vernon L. Smith]], that have endorsed the plan.<ref name="endorsement" /> The [[Beacon Hill Institute]] estimated that within five years real GDP would increase 10.7% over the current system, domestic investment by 86.3%, capital stock by 9.3%, employment by 9.9%, [[real wage]]s by 10.2%, and consumption by 1.8%.<ref name="BHIeconomic">[[#refTuerk2007Economic|Tuerk et al., 2007]]</ref> [[Arduin, Laffer & Moore Econometrics]] projected the economy as measured by GDP would be 2.4% higher in the first year and 11.3% higher by the 10th year than it would otherwise be.<ref name="ALME" /> Economists [[Laurence Kotlikoff]] and Sabine Jokisch reported the incentive to work and save would increase; by 2030, the economy's [[capital stock]] would increase by 43.7% over the current system, output by 9.4%, and [[real wage]]s by 11.5%.<ref name="dynamiceffects" /> Economist John Golob estimates a consumption tax, like the FairTax, would bring long-term interest rates down by 25–35%.<ref name="interestrate">[[#refGolob1995|Golob, 1995]]</ref> An analysis in 2008 by the [[Baker Institute For Public Policy]] indicated that the plan would generate significant overall [[macroeconomic]] improvement in both the short and long-term, but warned of transitional issues.<ref name="Baker" /> |

|||

FairTax proponents argue that the proposal would provide tax burden visibility and reduce compliance and efficiency costs by 90%, returning a large share of money to the productive economy.<ref name="Kotlikoff"/> The Beacon Hill Institute concluded that the FairTax would save $346.51 billion in administrative costs and would be a much more efficient taxation system.<ref name="BHItaxcosts">[[#refTuerk2007Costs|Tuerk et al., 2007]]</ref> [[William Reynolds Archer, Jr.|Bill Archer]], former head of the [[House Ways and Means Committee]], asked [[Princeton University]] Econometrics to survey 500 [[Europe]]an and [[Asia]]n companies regarding the effect on their business decisions if the United States enacted the FairTax. 400 of those companies stated they would build their next plant in the United States, and 100 companies said they would move their corporate headquarters to the United States.<ref name="billarcher">[[#refGaver2006|Gaver, 2006]]</ref> Supporters argue that the U.S. has the highest combined statutory corporate income tax rate among [[OECD]] countries along with being the only country with no border adjustment element in its tax system.<ref name="LeoTestimony">[[#refLinbeck2006a|Linbeck, 2006a]]</ref> Proponents state that because the FairTax eliminates corporate income taxes and is automatically border adjustable, the competitive tax advantage of foreign producers would be eliminated, immediately boosting U.S. competitiveness overseas and at home.<ref name="linbeck2007b">[[#reflinbeck2007b|Linbeck, 2007]]</ref> |

|||

:To convert the tax, divide the money going to the government by the money the company nets: |

|||

Opponents point to a study commissioned by the [[National Retail Federation]] in 2000 that found a national sales tax bill filed by [[Billy Tauzin]], the ''Individual Tax Freedom Act'' ({{USBill|107|HR|2717}}), would bring a three-year decline in the economy, a four-year decline in employment and an eight-year decline in [[consumer spending]].<ref name="NRFarticle">[[#refVargas2005|Vargas, 2005]]</ref> ''[[The Wall Street Journal]]'' columnist [[James Taranto]] states the FairTax is unsuited to take advantage of [[supply-side]] effects and would create a powerful disincentive to spend money.<ref name="Taranto"/> John Linder states an estimated $11 trillion is held in foreign accounts (largely for tax purposes), which he states would be repatriated back to U.S. banks if the FairTax were enacted, becoming available to U.S. [[capital market]]s, bringing down interest rates, and otherwise promoting economic growth in the United States.<ref name="fairtaxbook"/> Attorney Allen Buckley states that a tremendous amount of wealth was already repatriated under law changes in 2004 and 2005.<ref name="buckley">[[#refBuckley2008|Buckley, 2008]]</ref> Buckley also argues that if the tax rate was significantly higher, the FairTax would discourage the consumption of new goods and hurt economic growth.<ref name="buckley"/> |

|||

::<math>a = \frac{t \times p}{p - t \times p} = \frac{t}{1 - t}</math> |

|||

===Transition=== |

|||

:Therefore, to adjust any rate below to that of a traditional sales tax, divide the given rate by 1 minus that rate. |

|||

{{further|Predicted effects of the FairTax#Transition effects}} |

|||

[[File:TaxbaseStability.png|thumb|Stability of the tax base: a comparison of [[personal consumption expenditure]]s and [[adjusted gross income]]]] |

|||

During the transition, many or most of the employees of the IRS (105,978 in 2005)<ref name="irslabor">[[#refirslabor|IRS Labor Force, 2005]]</ref> would face loss of employment.<ref name="beaconhill"/> The Beacon Hill Institute estimate is that the federal government would be able to cut $8 billion from the IRS budget of $11.01 billion (in 2007), reducing the size of federal tax administration by 73%.<ref name="beaconhill"/> In addition, income tax preparers (many seasonal), tax lawyers, tax compliance staff in medium-to-large businesses, and software companies which sell tax preparation software could face significant drops, changes, or loss of employment. The bill would maintain the IRS for three years after implementation before completely decommissioning the agency, providing employees time to find other employment.<ref name="billtIII"/> |

|||

===Revenue neutrality=== |

|||

{{main|Revenue neutrality of the FairTax}} |

|||

A key question surrounding the FairTax rate is the ability to be revenue-neutral; that is, whether it would result in an increase or reduction in overall federal tax revenues.<ref name="ABKS"/> Economists, advisory groups, and political advocacy groups disagree about the tax rate required for the FairTax to be truly revenue-neutral. Various analysts use different assumptions, time-frames, and methods that result in dramatically different [[tax rates]] making direct comparison among the studies difficult. The choice between [[Static analysis|static]] or [[dynamic scoring]] further complicates any estimate of revenue-neutral rates,<ref name="scoring">{{cite press release| url=http://www.ipi.org/ipi/IPIPressReleases.nsf/0/34899156780cc5fe85257088005d0294?OpenDocument| last=Gingrich| first=Newt| coauthors=Ferrara, Peter |title=Doesn't Anyone Know the Score?| work=Institute for Policy Innovation| publisher=Institute for Policy Innovation| date=[[2005-09-26]]| accessdate=2006-07-20}}</ref> with the rates presented below based on a static scoring analysis. |

|||

In the period before the FairTax is implemented, there could be a strong incentive for individuals to buy goods without the sales tax using credit. After the FairTax is in effect, the credit could be paid off using untaxed payroll. If credit incentives do not change, opponents of the FairTax worry it could exacerbate an existing consumer debt problem. Proponents of the FairTax state that this effect could also allow individuals to pay off their existing (pre-FairTax) debt more quickly,<ref name="fairtaxbook" /> and studies suggest lower interest rates after FairTax passage.<ref name="interestrate" /> |

|||

One of the leading economists supporting the FairTax is Dr. [[Laurence Kotlikoff]] of Boston University. A detailed 2006 study published in ''[[Tax Notes]]'' by the fiscally conservative [[Beacon Hill Institute]] at Suffolk University and Kotlikoff concluded the FairTax would be revenue-neutral for the tax year 2007 at a rate of 23.82% (31.27% tax-exclusive) assuming full taxpayer compliance.<ref name="beaconhill">{{cite web| url=http://www.beaconhill.org/FairTax2006/TaxingSalesundertheFairTaxWhatRateWorks061005.pdf| format = PDF |last=Bachman| first=Paul| coauthors=Haughton, Jonathan; Kotlikoff, Laurence J.; Sanchez-Penalver, Alfonso; Tuerck, David G.| title=Taxing Sales under the FairTax – What Rate Works?| work=Beacon Hill Institute| publisher=Tax Analysts|date=November 2006| accessdate=2007-03-06}}</ref> The study states that [[purchasing power]] is transferred to state and local taxpayers from state and local governments. To recapture the lost revenue, state and local governments may raise taxes in order to continue collecting the same real revenues from their taxpayers.<ref name="beaconhill"/> The [[Argus Group]] and [[Arduin, Laffer & Moore Econometrics]] each published an analysis that defended the 23% rate.<ref name="galerebuttal">{{cite web| url=http://www.fairtax.org/PDF/GaleRebuttal.pdf| format = PDF | last=Burton| first=David| coauthors=Mastromarco, Dan| title=Rebuttal of the William Gale papers| publisher=The Argus Group| date=[[1998-03-16]]| accessdate=2006-10-26}}</ref><ref name="jctrebuttal">{{cite web| url=http://www.fairtax.org/PDF/JCTRebuttal.pdf| format = PDF | last=Burton| first=David| coauthors=Mastromarco, Dan| title=Rebuttal of the Joint Committee on Taxation (JCT) letter| publisher=The Argus Group| date=[[1998-02-04]]| accessdate=2006-10-26}}</ref><ref name="ALME">{{cite web| url=http://www.fairtax.org/PDF/MacroeconomicAnalysisofFairTax.pdf| format = PDF | title=A Macroeconomic Analysis of the FairTax Proposal| publisher=Arduin, Laffer & Moore Econometrics |date=February 2006| accessdate=2006-11-07}}</ref> While proponents of the FairTax concede that the above studies did not explicitly account for [[tax evasion]], they also claim that the studies did not altogether ignore tax evasion under the FairTax. These studies implicitly incorporated some degree of tax evasion in their calculations simply by using [[National Income and Product Accounts|National Income and Product Account]] based figures that presumably understate total household consumption.<ref name="beaconhill"/> Moreover, these studies did not account for the expected capital gains that would result from a reduction in the real nominal value of [[U.S. government debt]] and the increased [[economic growth]] that most economists believe would occur.<ref name="money"/><ref name="endorsement" /><ref name="beaconhill"/><ref name="AFFTeconomicgrowth">{{cite web | url=http://www.fairtax.org/PDF/TheFairTaxAndEconomicGrowth.pdf | publisher=Americans For Fair Taxation | title=The FairTax and economic growth | format=PDF | last=Walby | first=Karen | date=2006-04-18 | accessdate=2007-01-21}}</ref> |

|||

Individuals under the current system who accumulated savings from ordinary income (by choosing not to spend their money when the income was earned) paid taxes on that income before it was placed in savings (such as a [[Roth IRA]] or [[Certificate of deposit|CD]]). When individuals spend above the poverty level with money saved under the current system, that spending would be subject to the FairTax. People living through the transition may find both their earnings and their spending taxed.<ref name="Taranto2">[[#refTaranto2007a|Taranto, 2007a]]</ref> Critics have stated that the FairTax would result in unfair double taxation for savers and suggest it does not address the transition effect on some taxpayers who have accumulated significant savings from after-tax dollars, especially retirees who have finished their careers and switched to spending down their life savings.<ref name="Yin"/><ref name="Taranto2"/> Supporters of the plan argue that the current system is no different, since compliance costs and "hidden taxes" embedded in the prices of goods and services cause savings to be "taxed" a second time already when spent.<ref name="Taranto2"/> The rebate would supplement accrued savings, covering taxes up to the poverty level. The income taxes on capital gains, estates, social security and pension benefits would be eliminated under FairTax. In addition, the FairTax legislation adjusts [[Social Security (United States)|Social Security]] benefits for changes in the price level, so a percentage increase in prices would result in an equal percentage increase to Social Security income.<ref name="billtIII">[[#refFairTaxAct|Fair Tax Act, 2009, Title III]]</ref> Supporters suggest these changes would offset paying the FairTax under transition conditions.<ref name="fairtaxbook" /> |

|||