Tax increment financing: Difference between revisions

m Fixed dead link |

|||

| (366 intermediate revisions by more than 100 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|Public financing method}} |

|||

'''Tax Increment Financing''', or '''TIF''', is a tool which has been used for [[redevelopment]] and community improvement projects throughout the [[United States]] for more than half a century. With [[Federal government of the United States|federal]] and [[U.S. state|state]] sources for redevelopment generally less available, TIF has become an often-used financing mechanism for [[municipalities]]. Similar or related approaches are used elsewhere in the world. See for example, [[Value capture]]. |

|||

'''Tax increment financing''' ('''TIF''') is a [[public financing]] method that is used as a [[subsidy]] for [[redevelopment]], infrastructure, and other community-improvement projects in many countries, including the [[United States]]. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization.<ref>{{Cite book|title=Encyclopedia of the City|last=Caves|first=R. W.|publisher=Routledge|year=2004|isbn=978-0-415-86287-5|page=659}}</ref> Similar or related [[value capture]] strategies are used around the world. |

|||

==What is tax increment financing?== |

|||

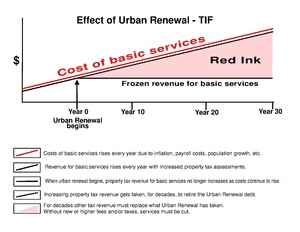

Through the use of TIF, municipalities typically divert future property tax revenue increases from a defined area or district toward an economic development project or public improvement project in the community. TIF subsidies are not appropriated directly from a city's budget, but the city incurs loss through forgone tax revenue.<ref name="TIF-Subsidized" /> The first TIF was used in California in 1952.<ref name="True Costs of TIF" /> By 2004, all U.S. states excepting Arizona had authorized the use of TIF. The first TIF in Canada was used in 2007.<ref name="CRL as developer subsidies" />[[File:TIF graph.pdf|thumb|300px|If the cost of basic services increases, with TIF in place, the result is a revenue shortfall that has to be paid from sources other than tax revenues of the TIF district to prevent service cuts.]] |

|||

TIF is a tool to use future gains in taxes to finance the current improvements that will create those gains. When a public project such as a road, school, or hazardous waste cleanup is carried out, there is an increase in the value of surrounding [[real estate]], and often new investment (new or rehabilitated buildings, for example). This increased site value and investment creates more taxable property, which increases tax revenues. The increased tax revenues are the "tax increment." Tax Increment Financing dedicates that increased revenue to finance debt issued to pay for the project. TIF is designed to channel funding toward improvements in distressed or underdeveloped areas where development would not otherwise occur. TIF creates funding for public projects that may otherwise be unaffordable to localities. |

|||

==Use== |

|||

Today 49 states and the [[District of Columbia]] have enabling legislation for tax increment financing. [[Arizona]] is now the only state without a tax increment financing law. While some states, such as [[California]] and [[Illinois]], have used TIF for decades, many others have only recently passed or amended state laws that allow them to use this tool. |

|||

Tax increment financing subsidies, which are used for both publicly subsidized economic development and municipal projects,<ref name="TIF-Subsidized" />{{rp|2}} have provided the means for cities and counties to gain approval of redevelopment of blighted properties or public projects such as city halls, parks, libraries etc. The definition of blight has taken on a broad inclusion of nearly every type of land including farmland, which has given rise to much of the criticism. "<ref name="TIF-Subsidized" />{{rp|2}} |

|||

*[[Arkansas]] (2000) |

|||

*[[Washington]] (2001) |

|||

*[[New Jersey]] (2002) |

|||

*[[Delaware]] (2003) |

|||

*[[Louisiana]] (2003) |

|||

*[[North Carolina]] (2005) |

|||

*[[New Mexico]] (2006) |

|||

To provide the needed subsidy, the urban renewal district, or TIF district, is often drawn around additional real estate beyond the project site to provide the needed borrowing capacity for the project or projects. The borrowing capacity is established by committing all normal yearly future real estate tax increases from every parcel in the TIF district (for 20–25 years, or more) along with the anticipated new tax revenue eventually coming from the project or projects themselves. If the projects are public improvements paying no real estate taxes, all of the repayment will come from the adjacent properties within the TIF district. |

|||

Since the [[1970s]], a reduction in federal funding for redevelopment-related activities including spending cuts, restrictions on [[tax-exempt]] [[Bond (finance)|bonds]] and an administrative transference of urban policy to local, lower-level governments, has led many cities to consider tax increment financing. State-imposed caps on municipal [[property tax]] collections and limits on the amounts and types of city expenditures have also caused local governments to adopt funding strategies like this. |

|||

Although questioned, it is often presumed that even public improvements trigger gains in taxes above what would occur in the district without the investment. In many jurisdictions yearly property tax increases are restricted and cannot exceed what would otherwise have occurred. |

|||

== The tax increment financing dispute== |

|||

TIF districts are not without criticism. Although tax increment financing is one mechanism for local governments that does not rely on federal funds or an overall increase in municipal taxes, many question whether TIF districts actually serve their resident populations. TIF districts are often implemented in blighted, lower-rent, areas. As investment in an area increases, it is not uncommon for real-estate values to rise and for [[gentrification]] to occur.[http://slingshot.tao.ca/displaybi.php?74002] |

|||

The completion of a public or private project can at times result in an increase in the value of surrounding [[real estate]], which generates additional tax revenue. Sales-tax revenue may also increase, and jobs may be added, although these factors and their multipliers usually do not influence the structure of TIF. |

|||

Currently, thousands of districts operate nationwide in the US, from small and mid-sized cities, such as [[Kenosha, Wisconsin]], and [[Akron, Ohio]] to the State of California, which invented tax increment financing in [[1952]]. California maintains hundreds of TIF districts and leads the nation in debt issued through tax increment financing.{{Fact|date=February 2007}} |

|||

The routine yearly increases district-wide, along with any increase in site value from the public and private investment, generate an increase in tax revenues. This is the "tax increment." Tax increment financing dedicates tax increments within a certain defined district to finance the debt that is issued to pay for the project. TIF was designed to channel funding toward improvements in distressed, underdeveloped, or underutilized parts of a jurisdiction where development might otherwise not occur. TIF creates funding for public or private projects by borrowing against the future increase in these property-tax revenues.<ref>Various, (2001). ''Tax Increment Financing and Economic Development, Uses, Structures and Impact.'' Edited by Craig L. Johnson and Joyce Y. Man. State University of New York Press.</ref> |

|||

The city of [[Chicago]] is a major urban area which has a significant number of TIF districts and has become a prime location for examining the benefits and disadvantages of TIF districts. The city runs 131 districts with tax receipts totaling upwards of $325 million per year{{Fact|date=February 2007}}, or about one-third of the city's total property tax revenue. [[Lori Healey]], appointed commissioner of the city's Planning and Development department in 2005, was instrumental in this process. [April 23, 2007, Mayor Daley of Chicago named Healey to be his eleventh chief of staff.] |

|||

==History== |

|||

Given the influence and power held by Mayor Daley of Chicago, various elected officials have been unwilling to seem critical of the city's tax increment financing program due to the mayor's unwavering support for these districts. Cook County Commissioner Michael Quigley has been the exception, questioning the wisdom of expanding tax increment financing districts, calling for substantive reforms, and putting accountability into the governance of such districts. His office recently released a report on TIFs titled: [http://www.commissionerquigley.com/library/taleoftwocities.pdf ''"A Tale of Two Cities: Reinventing Tax Increment Financing."''] |

|||

Tax increment financing was first used in California in 1952 and there are currently thousands of TIF districts operating in the US, from small and mid-sized cities to large urban areas. As of 2008, California had over four hundred TIF districts with an aggregate of over $10 billion per year in revenues, over $28 billion of long-term debt, and over $674 billion of assessed land valuation.<ref name="California_TIF">{{citation |url=http://www.sco.ca.gov/Files-ARD-Local/LocRep/redevelop_fy0708redev_reports.pdf |title=California State Controller's Annual Report on Redevelopment Agencies, 2007-2008 |access-date=2009-12-04 |archive-url=https://web.archive.org/web/20100105093005/http://www.sco.ca.gov/Files-ARD-Local/LocRep/redevelop_fy0708redev_reports.pdf |archive-date=2010-01-05 }}</ref> The state of California discontinued the use of TIF financing due to lawsuits in 2011, and enacted the California Fiscal Emergency Proclamation 2010, thereby ending the diversion of property tax revenues from public funding, including the use of TIFs for the funding of the nearly 400 redevelopment agencies in the state.<ref>[http://ti.org/antiplanner/?p=6059 "Urban Renewal Dead in California,"] ''The Antiplanner'', Thoreau Institute (2 January 2012).</ref><ref>See California Redevelopment Association v. Ana Matosantos.</ref> The RDAs appealed that decision, though they were eventually eliminated in February 2012 after the passage of the 2011 state budget.<ref name="lawsuit" /><ref>{{Cite web|url=http://www.dof.ca.gov/Programs/Redevelopment/|title=Redevelopment Agency Dissolution|website=www.dof.ca.gov|access-date=2019-10-08}}</ref> |

|||

However, in 2015, the California Community Revitalization and Investment Authority Act was made law, providing for the creation of Community Revitalization and Investment Authorities (CRIAs), funded by Tax-Increment Financing. The primary purposes of CRIAs are the development or preservation of affordable housing for low and moderate income households (a minimum of 25% of TIF funding must be placed in an affordable housing fund) and creation or upgrading of public infrastructure in economically disadvantaged areas as defined under the provisions of the law.<ref name=":0">{{Cite web|url=http://www.scag.ca.gov/Documents/HousingPlanningGuide2016.pdf|title=Mission Impossible? Meeting California's Housing Challenge|last=Southern California Association of Governments|date=October 2016|page=29|access-date=2019-09-20|archive-date=2019-12-12|archive-url=https://web.archive.org/web/20191212051031/http://www.scag.ca.gov/Documents/HousingPlanningGuide2016.pdf|url-status=dead}}</ref><ref name=":1">{{Cite web|url=https://katten.com/Recent_Affordable_Housing_Developments_in_California_and_the_Los_Angeles_Region|title=Recent Affordable Housing Developments in California and the Los Angeles Region|website=katten.com|access-date=2019-09-20}}</ref> Additionally, Enhanced Infrastructure Financing Districts (EIFDs) may be created and financed by TIFs in California.<ref name=":2">{{Cite web|url=http://www.scag.ca.gov/Documents/HousingPlanningGuide2016.pdf|title=Mission Impossible? Meeting California's Housing Challenge|last=Southern California Association of Governments|date=October 2016|page=27|access-date=2019-09-20|archive-date=2019-12-12|archive-url=https://web.archive.org/web/20191212051031/http://www.scag.ca.gov/Documents/HousingPlanningGuide2016.pdf|url-status=dead}}</ref> |

|||

The Neighborhood Capital Budget Group of Chicago, Illinois, a non-profit organization (that consisted of various member organizations and employed outreach and research staff), advocated for area resident participation in capital programs. The group also researched and analyzed the expansion of Chicago's TIF districts. Though the organization closed on February 1, 2007, their research will be available on their website for six months. [http://www.ncbg.org/research.htm] |

|||

With the exception of [[Arizona]], every state and the [[District of Columbia]] has enabled legislation for tax increment financing.<ref>[http://www.cdfa.net/cdfa/cdfaweb.nsf/0/8ee94afeece08bc988257936006747c5/$FILE/CDFA-2008-TIF-State-By-State-Report.pdf Council of Development Finance Agencies 2008 TIF State-By-State Report accessed 2014-3-21.]</ref> Some states, such as [[Illinois]], have used TIF for decades, but others have only recently embraced TIF.<ref>Arkansas (2000), Washington (2001), New Jersey (2002), Delaware (2003), Louisiana (2003), North Carolina (2005), and New Mexico (2006).</ref> The state of Maine has a program named TIF; however, this title refers to a process very different than in most states.<ref name="Maine voices">{{cite web | url=http://www.pressherald.com/2013/05/26/tif-helps-communities-that-dont-need-it_2013-05-26/ | title=Maine Voices: TIF helps communities that don't need it: State economic development support should go to towns that can't now take advantage of complex property tax schemes | publisher=Portland Press Herald | date=25 May 2013 | access-date=28 August 2015 | author=Michael Havlin | location=Hampton, Maine}}</ref> |

|||

The [[Chicago Reader]], a [[Chicago]] [[alternative newspaper]] published weekly, has published [http://www.chicagoreader.com/tifarchive/ articles] regarding tax increment financing districts in Chicago and in [[Cook County, Illinois]] written by staff writer Ben Joravsky. Joravsky's articles are critical of tax increment financing districts as implemented in Chicago. |

|||

Since the 1970s, the following factors have led local governments (cities, townships, etc.) to consider tax increment financing: lobbying by developers, a reduction in federal funding for redevelopment-related activities (including spending increases), restrictions on [[municipal bonds]] (which are [[tax-exempt]] [[Bond (finance)|bonds]]), the transfer of urban policy to local governments, State-imposed caps on municipal [[property tax]] collections, and State-imposed limits on the amounts and types of city expenditures. Considering these factors, many local governments have chosen TIF as a way to strengthen their tax bases, attract private investment, and increase economic activity. |

|||

Currently, the largest TIF project in America is located in Albuquerque, New Mexico: the $500 million [[Mesa del Sol]] development. Mesa del Sol is controversial in that the proposed development would be built upon a "green field" that presently generates little tax revenue and any increase in tax revenue would be diverted into a tax increment financing fund. This "increment" thus would leave governmental bodies without funding from the developed area that is necessary for the governmental bodies' operation. |

|||

==Urban regeneration== |

|||

For examples of academic books and articles on tax increment financing or interest group reports or papers on tax increment financing districts, see this entry's [[Tax increment financing#External Links|External Links]] |

|||

In a 2015 literature review on best practices in urban regeneration, cities across the United States are seeking ways to reverse trends of unemployment, declining population and disinvestment in their core downtown areas, as developers continue to expand into suburban areas. Re-investment in downtown core areas include mixed-use development and new or improved transit systems. With successful revitalization comes [[gentrification]] with higher property values and taxes, and the exodus of lower income earners.<ref name="Journalists Resource">{{cite web | url=http://journalistsresource.org/studies/government/municipal/legacy-cities-challenges-opportunities-urban-regeneration | title=Urban regeneration: What recent research says about best practices| publisher=Journalists Resource | work=Harvard Kennedy School's Shorenstein Center and the Carnegie-Knight Initiative | date=January 29, 2015 | access-date=28 August 2015}}</ref><ref name="lincolninst">{{cite book |author1=Alan Mallach |author2=Lavea Brachman |date=May 2013 |title=Regenerating America's Legacy Cities |url=http://www.lincolninst.edu/pubs/2215_Regenerating-America-s-Legacy-Cities |location=Cambridge, MA; Phoenix, AZ |publisher=Lincoln Institute of Land Policy |page=52 |isbn=978-1-55844-279-5 |access-date=28 August 2015}}</ref> |

|||

{{Blockquote|Successful city revitalization can't be achieved by megaprojects alone—signature buildings, stadiums or other such concentrated development efforts. Instead, "it must be multifaceted and encompass improvements to the cities' physical environments, their economic bases, and the social and economic conditions of their residents.|Mallach and Brachman 2013}} |

|||

==Applications and administration== |

|||

Cities use TIF to finance [[public infrastructure]], land acquisition, [[demolition]], [[utilities]] and planning costs, and other improvements including: |

|||

== Unintended consequences == |

|||

*[[Sewer]] expansion and repair |

|||

Like any economic tool, TIF comes with drawbacks. Organizations such as Municipal Officials for Redevelopment Reform (MORR) use to hold regular conferences on redevelopment abuse, as well as local organizations like Chicago's 33 Ward Working Families.<ref>{{Cite web |last=Burt |first=Nicholas |date=Nov 18, 2019 |title=The Case for Abolishing the Tax Increment Financing (TIF) Program |url=https://www.workingfamilies33.org/wf33_policy_paper_abolish_tif |url-status=live |archive-url=https://web.archive.org/web/20240303230146/https://www.workingfamilies33.org/wf33_policy_paper_abolish_tif |archive-date=Mar 3, 2024 |access-date=Mar 3, 2024 |website=www.workingfamilies33.org}}</ref><ref>{{cite web|url=http://www.redevelopment.com/|title=Redevelopment.com website|access-date=2009-12-04|archive-url=https://web.archive.org/web/20100502023337/http://redevelopment.com/|archive-date=2010-05-02}}</ref> |

|||

*[[Curb (road)|Curb]] and [[sidewalk]] work |

|||

*Storm drainage |

|||

*[[Traffic control]] |

|||

*Street construction & expansion |

|||

*[[Street lighting]] |

|||

*Water supply |

|||

*[[Landscaping]] |

|||

*Park improvements |

|||

*Environmental remediation |

|||

*[[Bridge]] construction & repair |

|||

*[[Parking garage|Parking structures]] |

|||

* Land Acquisition |

|||

*As efficient market theory predicts, and now empirical evidence from economic studies suggests cities that adopt TIF grow more slowly than those that do not.<ref>{{Cite journal |last=Dye |first=Richard |last2=Merriman |first2=David |date=March 2000 |title=The Effects of Tax Increment Financing on Economic Development |url=https://www.sciencedirect.com/science/article/abs/pii/S0094119099921496 |journal=[[Journal of Urban Economics]] |volume=47 |issue=2 |pages=306–328 |via=Elsevier Science Direct}}</ref> A literature review by David Merriman, a professor at the University of Illinois at Chicago found TIF "may be moving development from one part of the city to another, and changing the timing of the development, but there's not more development than would have otherwise been made."<ref>{{Cite book |last=Merriman |first=David |url=https://www.lincolninst.edu/publications/policy-focus-reports/improving-tax-increment-financing-tif-economic-development |title=Improving Tax Increment Financing (TIF) for Economic Development |publisher=[[Columbia University Press]] |year=2018 |isbn=978-1-55844-378-5 |location=113 Brattle Street, Cambridge, MA 02138-3400 USA |language=English}}</ref> |

|||

State enabling legislation gives local governments the authority to designate tax increment financing districts. The district usually lasts 20 years, or enough time to pay back the bonds issued to fund the improvements. While structures vary, it is common to have a city government assuming the administrative role. This entity is governed by a [[city council]] which makes decisions about how and where the tool is applied. |

|||

*TIF increases the property taxes of the areas next to a TIF district by reducing the [Total Taxable Property Value].<ref name=":3">{{Cite web |last=Quigley |first=Mike |date=April 2, 2007 |title=A Tale of Two Cities: Reinventing Tax Increment Financing |url=https://quigley.house.gov/sites/quigley.house.gov/files/migrated/images/user_images/gt/stories/reinventingTaxIncrementFinancing.pdf |url-status=dead |archive-url=https://web.archive.org/web/20141229061321/https://quigley.house.gov/sites/quigley.house.gov/files/migrated/images/user_images/gt/stories/reinventingTaxIncrementFinancing.pdf |archive-date=Dec 29, 2014 |access-date=Mar 15, 2024 |website=house.gov}}</ref> [[Congressman]] [[Mike Quigley]] simplified the math and showed if a [Tax Rate] = [Revenue to be Raised] / [Total Taxable Property Value], then reducing the denominator, [Total Taxable Property Value], increases the [Tax Rate].<ref name=":3" /><ref name=":4">{{Cite web |last=Nordtvedt |first=Kenneth |date=Nov 1, 2015 |title=The Dark Side of Tax Increment Financing |url=https://leg.mt.gov/content/Committees/Interim/2015-2016/Revenue-and-Transportation/Meetings/Nov-2015/nordtvedt-tif-dark-side.pdf |url-status=live |archive-url=https://web.archive.org/web/20151213071500/https://leg.mt.gov/content/Committees/Interim/2015-2016/Revenue-and-Transportation/Meetings/Nov-2015/nordtvedt-tif-dark-side.pdf |archive-date=Dec 13, 2015 |access-date=Mar 15, 2024 |website=leg.mt.gov}}</ref><ref name=":5">{{Cite news |last=Joravsky |first=Ben |date=Nov 1, 2007 |title=TIFs for Dummies |url=https://chicagoreader.com/news-politics/tifs-for-dummies/ |url-status=live |archive-url=https://web.archive.org/web/20211018201232/https://chicagoreader.com/news-politics/tifs-for-dummies/ |archive-date=Oct 18, 2021 |access-date=Mar 15, 2024 |work=[[Chicago Reader]] |volume=37 |issue=6}}</ref> A property owner's [Tax Bill] is typically [Tax Rate] x [Assessed Property Value], thus as a new TIF district reduces the [Total Taxable Property], the [Tax Rate] and [Tax Bill] increases for property owners near the TIF district.<ref name=":3" /><ref name=":4" /><ref name=":5" /> State [[Kenneth Nordtvedt|Representative Keneth Nordtvedt]] of Montana paraphrased the scheme this way, "''All property taxes --- city, county, school, state --- are exempted on TIF districts’ incremental properties, and then districts put a monetarily equal fee on those properties. Though collected by county treasurer as a tax, that fee is given to TIF district development boards to spend. The adversely affected taxing jurisdictions like school districts, county government, even city government's general fund, are then quietly directed by law to make themselves whole by raising their levies on properties outside of the TIF districts so as to compensate for revenues lost from the TIF district incremental properties."''<ref name=":4" /> |

|||

*As investment in an area increases, it is not uncommon for real estate values to rise and for [[gentrification]] to occur. |

|||

* Although generally sold to legislatures as a tool to redevelop [[Blight (urban)|blighted]] areas, some districts are drawn up where development would happen anyway, such as ideal development areas at the edges of cities. [[California]] has passed legislation designed to curb this abuse.<ref>{{cite web|url=http://www.coalitionforredevelopmentreform.org/references/morrreport.php|title=Redevelopment: The unknown government|publisher=Coalition for Redevelopment Reform|access-date=2009-12-04|archive-date=2008-07-25|archive-url=https://web.archive.org/web/20080725190116/http://www.coalitionforredevelopmentreform.org/references/morrreport.php|url-status=dead}}</ref><ref>{{cite web|url=http://www.ppic.org/content/pubs/report/R_298MDR.pdf|title=Subsidizing Redevelopment in California| publisher=Public Policy Institute of California|access-date=2009-12-04}}</ref> |

|||

* The designation of urban areas as "blighted,"<ref name="Community Revitalization Levy">{{cite web | url=http://www.ffwdweekly.com/news--views/news/blighted-streets-no-more-10253/ | title=Blighted streets, no more | publisher=Fast Forward Weekly | date=10 January 2013 | access-date=26 August 2015 | author=James Wilt }}{{dead link|date=December 2017 |bot=InternetArchiveBot |fix-attempted=yes }}</ref> essential to most TIF implementation, can allow governmental condemnation of property through eminent domain laws. The famous [[Kelo v. City of New London]] United States Supreme Court case, where homes were condemned for a private development, arose over actions within a TIF district. |

|||

*The TIF process arguably leads to favoritism for politically connected developers, implementing attorneys, economic development officials, and others involved in the processes. However, most Urban Renewal Authorities require public notice and have competitive bidding requirements. |

|||

* In some cases, school districts within communities using TIF are experiencing larger increases in state aid than districts not in such communities. This may be creating an incentive for governments to "over-TIF," consequently taking on riskier development projects. Local governments are under no obligation to recognize when TIF designation would adversely affect a school district's financial condition, and consequently the quality of some schools can be compromised. |

|||

* Normal inflationary increases in property values can be captured with districts in poorly written TIFs, representing money that would have gone into the public coffers even without the financed improvements. |

|||

* Districts can be drawn excessively large thus capturing revenue from areas that would have appreciated in value regardless of TIF designation. |

|||

* Approval of districts can sometimes capture one entity's future taxes without its ''official'' input, i.e. a school districts taxes will be frozen on action of a city. |

|||

* Capturing the full tax increment and directing it to repay the development bonds ignores the fact that the incremental increase in property value likely requires an increase in the provision of public services, which will now have to be funded from elsewhere, often from subsidies from less economically thriving areas. The use of tax increment financing to create a large residential development means that public services from schools to public safety will need to be expanded, yet if the full tax increment is captured to repay the development bonds, other money will have to be used.<ref name="TIF 1">{{cite web | url=http://americandreamcoalition-org.adcblog.org/landuse/TIFsinIllinois.pdf | title=The Effects of Tax-Increment Financing on Economic Development | publisher=American Dream Coalition | date=September 1999 | access-date=28 August 2015 | author1=Richard Dye | author2=David Merriman | page=47 | editor=James H. Kuklinski | archive-date=4 March 2016 | archive-url=https://web.archive.org/web/20160304064036/http://americandreamcoalition-org.adcblog.org/landuse/TIFsinIllinois.pdf | url-status=dead }}</ref><ref name="Journal of Urban Economics">{{cite journal | title=The Effects of Tax-Increment Financing on Economic Development |author1=Richard Dye |author2=David Merriman | journal=Journal of Urban Economics | year=2000 | volume=47 | issue=2 | pages=306–328|doi=10.1006/juec.1999.2149 |s2cid=54771066 }}</ref> For example, a study in Saint Louis Missouri found low-income students lost 91 times more than wealthier students in the suburbs due to TIF, and students with disabilities as the second hardest hit group.<ref>{{Cite news |last=Wimbley |first=Lacretia |date=Jan 25, 2024 |title=St. Louis-area TIF districts cost public schools' minority students over $260 million, report finds |url=https://www.stlpr.org/education/2024-01-25/st-louis-area-tif-districts-cost-public-schools-minority-students-over-260-million-report-finds |url-status=live |archive-url=https://web.archive.org/web/20240126030353/https://www.stlpr.org/education/2024-01-25/st-louis-area-tif-districts-cost-public-schools-minority-students-over-260-million-report-finds |archive-date=Jan 26, 2024 |access-date=Mar 17, 2024 |work=[[STLPR]]}}</ref> |

|||

==Examples== |

|||

===Chicago=== |

|||

The city of [[Chicago]], in [[Cook County, Illinois]], has a significant number of TIF districts and has become a prime location for examining the benefits and disadvantages of TIF districts. The city runs 131 districts with tax receipts totaling upwards of $500 million for 2006.<ref>{{cite web|url=http://www.cookcountyclerk.com/tsd/documentlibrary/chicago%20tif%20revenue%20totals%20by%20year.pdf|title=City of Chicago TIF Revenue Totals by Year 1986-2013|publisher=Cook County Clerk's Office|access-date=2014-08-19|archive-url=https://web.archive.org/web/20140821173248/http://www.cookcountyclerk.com/tsd/documentlibrary/chicago%20tif%20revenue%20totals%20by%20year.pdf|archive-date=2014-08-21}}</ref> [[Lori Healey]], appointed commissioner of the city's Planning and Development department in 2005 was instrumental in the process of approving TIF districts as first deputy commissioner. |

|||

The [[Chicago Reader]], a [[Chicago]] [[alternative newspaper]] published weekly, has published articles regarding tax increment financing districts in and around Chicago. Written by staff writer Ben Joravsky, the articles are critical of tax increment financing districts as implemented in Chicago.<ref>{{cite web|url=http://www.chicagoreader.com/tifarchive/|title=articles by Reader staff writer Ben Joravsky on Chicago's TIF (tax increment financing) districts|publisher=Chicago Reader|access-date=2008-05-29}}</ref> |

|||

Cook County Clerk [[David Orr]], in order to bring transparency to Chicago and Cook County tax increment financing districts, began to feature information regarding Chicago area districts on his office's website.<ref>{{cite web|url=http://www.cookcountyclerk.com/tsd/tifs/Pages/TIFs101.aspx|title=TIFs 101: A taxpayer's primer for understanding TIFs|access-date=2008-05-29|publisher=Cook County Clerk's Office|archive-url=https://web.archive.org/web/20091215164012/http://www.cookcountyclerk.com/tsd/tifs/Pages/TIFs101.aspx|archive-date=2009-12-15}}</ref> The information featured includes City of Chicago TIF revenue by year, maps of Chicago and Cook County suburban municipalities' TIF districts. |

|||

The Neighborhood Capital Budget Group of Chicago, Illinois, a non-profit organization, advocated for area resident participation in capital programs. The group also researched and analyzed the expansion of Chicago's TIF districts.<ref>{{cite web|url=http://www.ncbg.org/research.htm|title=Research|publisher=Neighborhood Capital Budget Group of Chicago, Illinois|access-date=2008-05-29|archive-url=https://web.archive.org/web/20080509133111/http://www.ncbg.org/research.htm|archive-date=2008-05-09}}</ref> |

|||

In April 2009, the "TIF Sunshine Ordinance" introduced by Alderman Scott Waguespack and Alderman Manuel Flores (then 1st Ward Alderman) passed City Council. The ordinance made all TIF Redevelopment Agreements and attachments available on the city's website in a searchable electronic format. The proposal intended to improve the overall transparency of TIF Agreements, thereby facilitating significantly increased public accountability.<ref>{{cite web|url=http://ward32.org/about/legislation/tif/|title=Research|publisher=32ND WARD SERVICE OFFICE|access-date=2015-05-13}}</ref> |

|||

According to an article published in the ''Journal of Property Tax Assessment & Administration'' in 2009, the increase in the use of TIF in Chicago resulted in a "substantial portion of Chicago's property tax base and the land area" being subsumed by these levy zones—"26 percent of the city's land area and almost a quarter of the total value of commercial property is in TIF districts" by 2007. The study notes the difficulties in establishing how effective TIF are.<ref name="True Costs of TIF">{{cite journal | url=http://www.cookcountyassessor.com/forms/creationvscapture.pdf | title=Creation vs. Capture: Evaluating the True Costs of Tax Increment Financing | date=2008 | access-date=28 August 2015 | author1=Sherri Farris | author2=John Horbas | journal=Journal of Property Tax Assessment & Administration | volume=6 | issue=4 | archive-url=https://web.archive.org/web/20150923210409/http://www.cookcountyassessor.com/forms/creationvscapture.pdf | archive-date=23 September 2015 | df=dmy-all }}</ref> |

|||

===Albuquerque=== |

|||

Currently, the 2nd largest TIF project in America is located in [[Albuquerque, New Mexico]]: the $500 million [[Mesa del Sol]] development. Mesa del Sol is controversial in that the proposed development would be built upon a "green field" that presently generates little tax revenue and any increase in tax revenue would be diverted into a tax increment financing fund. This "increment" thus would leave governmental bodies without funding from the developed area that is necessary for the governmental bodies' operation. |

|||

===Detroit=== |

|||

In July 2014, Detroit's Downtown Development Authority announced TIF financing to build [[Little Caesars Arena|a new arena]] for the [[Detroit Red Wings]]. The total project cost, including additional private investments in retail and housing, is estimated at $650 million, of which $250 million will be financed using TIF capture to repay 30-year tax exempt bonds purchased by the Michigan Strategic Fund, the state's economic development arm. |

|||

===California=== |

|||

In an article published in 1998 by Public Policy Institute of California, Michael Dardia challenged the governing [[Redevelopment agency|redevelopment agencies']] (RDAs) assumption "that redevelopment pays for itself through tax increment financing. The claim is that RDAs "receive any increase in property tax revenues (above a two percent inflation factor) in project areas because their investment in area improvements is responsible for increasing property values."<ref name="ppic_1998">{{citation |author=Michael Dardia |url=http://www.ppic.org/content/pubs/report/R_298MDR.pdf |title=Subsidizing Redevelopment in California |date=January 1998 |publisher=Public Policy Institute of California |access-date=28 August 2015}}</ref>{{rp|ii}} Dardia argued that property tax revenues channeled to tax increment financing results in revenues lost to "other local jurisdictions—the county, schools, and special districts"<ref name="ppic_1998" /> and if the RDAs "are not largely responsible for the increase in property values, those jurisdictions are, in effect, subsidizing redevelopment, with no say in how the revenues are used."<ref name="ppic_1998" /> |

|||

{{Blockquote|In fiscal year 1994–1995—the most recent year for which figures are available—redevelopment agencies (RDAs) received 8 percent of the property tax revenues collected in the state of California, amounting to $1.5 billion. These are revenues that, absent the RDAs, would have gone to other public agencies such as the state and counties.|Michael Dardia 1998}} |

|||

By December 6, 2010, Governor [[Arnold Schwarzenegger]] issued a fiscal emergency<ref name="fiscalER">{{cite web | url=http://gov.ca.gov/news.php?id=16882 | title=Fiscal Emergency Proclamation by the Governor of the State of California | publisher=Governor of the State of California | date=20 January 2011 | access-date=28 August 2015 | archive-date=6 September 2015 | archive-url=https://web.archive.org/web/20150906174734/http://gov.ca.gov/news.php?id=16882 | url-status=dead }}</ref> which was reaffirmed by Governor [[Jerry Brown]] in December 2011 to underscore "the need for immediate legislative action to address California's massive budget deficit." Governor Brown enacted measures to stabilize school funding by reducing or eliminating the diversion of property taxes from the public sector including, school districts, to RDAs. New legislation including Assembly Bill 26 and Assembly Bill 27 were passed, which led to the elimination of California's nearly 400 redevelopment agencies thereby stopping the diversion of property tax revenues from public funding. The RDAs appealed the decision, however they were eventually eliminated.<ref name="lawsuit">{{Cite court |litigants=City of Cerritos v. State of California |vol=239 Cal. App. 4th 1020 |reporter=Cal: Court of Appeal, 3rd Appellate Dist. 2015 |opinion= |pinpoint= |court=California Courts - State of California |date=25 August 2015 |url=https://scholar.google.com/scholar_case?case=1420299108184705098&hl=en&as_sdt=6&as_vis=1&oi=scholarr}}</ref> The state reintroduced the option of tax-increment financing for the funding of Community Revitalization and Investment Authorities (CRIAs) in 2015, the latter being authorities created by local governments to create or upgrade infrastructure and create or preserve affordable housing for low and moderate income households.<ref name=":0" /><ref name=":1" /> Enhanced Infrastructure Financing Districts (EIFDs) in the state are also financed by a tax-increment bond and their purposes are largely similar, though the requirement for use and the projects covered are somewhat different.<ref name=":2" /> |

|||

====Alameda==== |

|||

In 2009, SunCal Companies, an Irvine, California-based developer, introduced a ballot initiative that embodied a redevelopment plan for the former [[Naval Air Station Alameda]] and a financial plan based in part on roughly $200 million worth of tax increment financing to pay for public amenities. SunCal structured the initiative so that the provision of public amenities was contingent on receiving tax increment financing, and on the creation of a community facilities (Mello-Roos) district, which would levy a special (extra) tax on property owners within the development.<ref>{{cite web|url=http://www.ci.alameda.ca.us/news/pdf/0905_latest_report.pdf|title=Alameda Point Development Initiative Election Report Executive Summary Part I|publisher=City of Alameda|access-date=2009-12-04|archive-url=https://web.archive.org/web/20091229044820/http://www.ci.alameda.ca.us/news/pdf/0905_latest_report.pdf|archive-date=2009-12-29}}</ref> Since Alameda City Council did not extend the Exclusive Negotiation Agreement with Suncal, this project will not move forward. In California, Community Redevelopment Law governs the use of tax increment financing by public agencies.<ref>{{cite web|url=http://www.hcd.ca.gov/hpd/rda/rdalaw.html|title=California Community Redevelopment Law|access-date=2009-12-05|archive-date=2010-01-10|archive-url=https://web.archive.org/web/20100110045224/http://www.hcd.ca.gov/hpd/rda/rdalaw.html|url-status=dead}}</ref> |

|||

===Iowa=== |

|||

In 2002 economists at Department of Economics Iowa State University, claimed that "existing taxpayers, its householders, wage earners, and retirees are aggressively subsidizing business growth and population" TIF designated zones in Iowa.<ref name="IAstate">{{cite web |author1=David Swenson |author2=Liesl Eathington |name-list-style=amp |date=2002 |title=* David Swenson and Liesl Eathington, "Do Tax Increment Finance Districts in Iowa Spur Regional Economic and Demographic Growth?" (2002). |url=http://www.americandreamcoalition.org/landuse/TIFsinIowa.pdf |archive-url=https://web.archive.org/web/20071020000417/http://www.americandreamcoalition.org/landuse/TIFsinIowa.pdf |archive-date=Oct 20, 2007 |access-date=9 June 2016 |work=Department of Economics Iowa State University}}</ref> |

|||

===Wisconsin=== |

|||

TIFs were established in Wisconsin in 1975. In 2001 critics argued that TIF supported developers to develop in green spaces citing a 2000 ''1,000 Friends of Wisconsin'' report which stated that 45% of tax incremental financing districts were used to develop open space land.<ref>{{citation |work=Center on Wisconsin Strategy, University of Wisconsin–Madison |url=http://www.cows.org/pdf/rp-stumps.pdf |title=From Stumps to Dumps: Wisconsin's Anti-Environmental Subsidies |access-date=28 August 2015 |author=David E. Wood |author2=Mary Beth Hughes |date=April 2001 |archive-url=https://web.archive.org/web/20120301121920/http://www.cows.org/pdf/rp-stumps.pdf |archive-date=1 March 2012 |df=dmy-all }}</ref><ref>{{cite report |author=Matthew Mayrl |work=Center on Wisconsin Strategy, University of Wisconsin–Madison) titled |url=http://www.cows.org/pdf/econdev/tif/rp-tif_2005.pdf |title=Refocusing Wisconsin's TIF System On Urban Redevelopment: Three Reforms |date=2005 |access-date=2006-09-09 |archive-url=https://web.archive.org/web/20060812104229/http://www.cows.org/pdf/econdev/tif/rp-tif_2005.pdf |archive-date=2006-08-12 }}</ref> |

|||

===Denver=== |

|||

From 1995 through 2005 Denver tax payers were able to leverage over $5 billion in private investment by committing to over half a billion dollars of TIF subsidies. At that time new TIF subsidized projects under consideration included the "redevelopment of the old Gates Rubber Factory complex at I-25 and Broadway, and the realization of Denver's ambitious plans for the downtown Union Station area."<ref name="TIF-Subsidized" />{{rp|6}} Denver's urban landscape was transformed from 1995 through 2005 through TIF-subsidized projects such as "the landmark resurrection" of the Denver Dry Goods building, the Adams Mark hotel, [[Denver Pavilions]], and REI flagship store, Broadway Marketplace shopping area and the demolition of the old Woolworth's building, the relocation and expansion of Elitch's into the Six Flags Elitch Gardens Amusement park, the redevelopment of Lowry Air Force Base and the redevelopment of the old Stapleton airport – "the largest urban infill project in the nation."<ref name="TIF-Subsidized" />{{rp|6}} |

|||

By 2005 the City Denver had already "mortgaged over $500 million in future tax revenue to pay off existing TIF subsidies to private developers" and was preparing to "increase that sum substantially with several new TIF projects in the next five years." In 2005 the "diversions of tax revenue to pay for TIF subsidies [represented] an annual cost of almost $30 million to Denver taxpayers, and [were] rising rapidly."<ref name="TIF-Subsidized">{{cite web |author1=Tony Robinson |author2=Chris Nevitt |author3=Robin Kniech |date=2005 |title=Are We Getting Our Money's Worth? Tax-Increment Financing and New Ideas New Priorities New Economy Urban Redevelopment in Denver Part III: Are We Building a Better Denver?: Job Quality & Housing Affordability at TIF-Subsidized Projects |url=http://fresc.org/wp-content/uploads/2013/12/TIF-III.pdf |archive-url=https://web.archive.org/web/20170921125358/http://fresc.org:80/wp-content/uploads/2013/12/TIF-III.pdf |archive-date=21 September 2017 |location=Denver, CO |publisher=Front Range Economic Strategy Center |access-date=1 February 2024}}</ref>{{rp|57}} By 2007 TIF tax expenditures in the form of forgone tax revenue totaled nearly "$30 million annually – equal to almost 7% of Denver's entire annual General Fund revenues" and at that time the amount was rapidly increasing.<ref name="TIF-Subsidized" />{{rp|6}} In a 2005 study it was revealed through wage surveys at TIF projects "that jobs there pay substantially less than Denver average wages, and 14%-27% less even than average wages for comparable occupational categories."<ref name="TIF-Subsidized" />{{rp|2}} |

|||

In part 1 of a three part series researchers "explained the history and mechanics of TIF, and analyzed the total cost of TIF to Denver taxpayers, including "hidden" costs from increased public service burdens that TIF projects do not pay for."<ref name="TIF_Denver_1">{{cite web |author1=Tony Robinson |author2=Chris Nevitt |author3=Robin Kniech |date=2005 |title=Are We Getting Our Money's Worth? Tax-Increment Financing and Urban Redevelopment in Denver Part I: What Do TIF Subsidies Cost Denver?: The Increasing Scale of TIF and Its Budget Impacts |url=https://www.readkong.com/page/are-we-getting-our-money-s-worth-tax-increment-financing-4785115 |archive-url=https://web.archive.org/web/20240201064127/https://www.readkong.com/page/are-we-getting-our-money-s-worth-tax-increment-financing-4785115 |archive-date=1 February 2024 |url-status=live |location=Denver, CO |publisher=Front Range Economic Strategy Center}}</ref> In "Who Profits from TIF Subsidies?" researchers "examined the types of businesses Denver attracts through TIF, and the profit rates of developers with whom Denver partners to bring TIF projects into existence, and the transparency of the TIF approval process."<ref name="TIF_Denver_2">{{cite web |author1=Tony Robinson |author2=Chris Nevitt |author3=Robin Kniech |date=2005 |title=Are We Getting Our Money's Worth? Tax-Increment Financing and Urban Redevelopment in Denver Part II: Who Profits from TIF Subsidies? |url=http://fresc.org/wp-content/uploads/2013/12/TIF-II.pdf |archive-url=https://web.archive.org/web/20170921170646/http://fresc.org/wp-content/uploads/2013/12/TIF-II.pdf |archive-date=21 September 2017 |url-status=dead |location=Denver, CO |publisher=Front Range Economic Strategy Center}}</ref> In part three of the study researchers examined "quality and housing affordability at TIF-subsidized projects."<ref name="TIF-Subsidized" />{{rp|2}} |

|||

==Applications and administration== |

|||

Cities use TIF to finance [[public infrastructure]], land acquisition, [[demolition]], [[utilities]] and planning costs, and other improvements including [[sanitary sewer|sewer]] expansion and repair, [[Curb (road)|curb]] and [[sidewalk]] work, storm drainage, traffic control, street construction and expansion, [[street lighting]], water supply, [[landscaping]], park improvements, environmental remediation, [[bridge]] construction and repair, and [[Parking garage|parking structures]]. |

|||

State enabling legislation gives local governments the authority to designate tax increment financing districts. The district usually lasts 20 years, or enough time to pay back the bonds issued to fund the improvements. While arrangements vary, it is common to have a city government assuming the administrative role, making decisions about how and where the tool is applied.<ref>{{cite web|url=http://www.opr.ca.gov/planning/docs/79515.pdf|title=Growth Within Bounds: Report of the Commission on Local Governance for the 21st Century|publisher=State of California|access-date=2009-12-04}}</ref> |

|||

==See also== |

|||

*[[Public finance]] |

|||

Most jurisdictions only allow bonds to be floated based upon a portion (usually capped at 50%) of the assumed increase in tax revenues. For example, if a $5,000,000 annual tax increment is expected in a development, which would cover the financing costs of a $50,000,000 bond, only a $25,000,000 bond would be typically allowed. If the project is moderately successful, this would mean that a good portion of the expected annual tax revenues (in this case over $2,000,000) would be dedicated to other public purposes other than paying off the bond. |

|||

==External links== |

|||

==Community revitalization levy (CRL) in Canada== |

|||

'''A Proposed Development Project''' |

|||

By 2015 major Canadian cities had already implemented community revitalization levies (CRL)—the term used for TIFs in Canada.<ref name="CRL as developer subsidies">{{cite web | url=https://www.cbc.ca/amp/1.3079392 | title=Risky business as Canadian cities turn to neighbourhood levies: Expert warns the levies can be 'direct subsidies for the developers' | publisher=CBC News | date=May 22, 2015 | access-date=28 August 2015 | author=Kyle Bakx}}</ref> |

|||

*[http://www.mesadelsolnm.com/ Forest City Covington's Mesa del Sol website (Albuquerque, New Mexico).] |

|||

===Alberta=== |

|||

'''Academic Books''' |

|||

In April 2012, it was proposed that the Alberta government change regulations so that the Community Revitalization Levy (CRL) could be applied to remediation costs "incurred by a private developer."<ref name="brownfield CRL 2012">{{cite web | url=http://esrd.alberta.ca/lands-forests/land-industrial/documents/BrownfieldCommunityUse-Jun19-2014A.pdf | title=Alberta Brownfield Redevelopment: practical approaches to achieve productive community used | publisher=Alberta Brownfield Redevelopment Working Group | work=Alberta Environment and Sustainable Resource Development (ESRD) | date=13 April 2012 | access-date=5 September 2015 | author=Alberta Brownfield Redevelopment Working Group | page=48 | archive-url=https://web.archive.org/web/20150326062529/http://esrd.alberta.ca/lands-forests/land-industrial/documents/BrownfieldCommunityUse-Jun19-2014A.pdf | archive-date=26 March 2015 | df=dmy-all }}</ref>{{rp|18}} |

|||

{{Blockquote|The CRL does not currently allow the levy to be used for remediation costs incurred by a private developer. While the CRL is quite a comprehensive approach that is not widely used, it is suggested that a change in regulation to allow the levy to apply to remediation costs would provide incentive to brownfield redevelopment in applicable circumstances.|13 April 2012 Alberta Brownfield Redevelopment Working Group}} |

|||

*[http://www.sunypress.edu/details.asp?id=60354 Johnson & Man edited ''Tax Increment Financing and Economic Development: Uses, Structures, and Impact'' (State University of New York Press, 2001)] |

|||

The Calgary Municipal Land Corporation (CMLC)—an arms-length a subsidiary of the City of Calgary, established in 2007, to revisit land use in the longtime deserted chunk of land in the east downtown core along the [[Bow River]]<ref name="Crebnow">{{cite web | url=http://www.crebnow.com/calgarys-urban-influencer-series-michael-brown/#sthash.E0aarzKe.dpuf | title=Calgary's urban influencer series: Michael Brown | work=CREB | date=14 August 2015 | access-date=28 August 2015 | author=Barb Livingstone}}</ref>—used a CRL to develop [[Downtown East Village, Calgary]] making Calgary the first Canadian city to use the CRL.<ref name="CRL as developer subsidies" /> The CMLC "committed approximately $CDN 357 million to East Village infrastructure and development" and claims that it "has attracted $CDN 2.4 billion of planned development that is expected to return $CDN 725 million of revenue to the CRL."<ref name="CRL as developer subsidies" /> The designated levy zone for the Rivers District CRL is wider than the East Village, making it financially sound since it collects taxes for twenty years on its anchor building, the 58-storey [[Bow tower]], and from developments in nearby [[Victoria Park (Calgary)]].<ref name="Community Revitalization Levy" /> |

|||

'''Board Link:''' |

|||

*[http://www.cyburbia.org/forums/showthread.php?t=20591 Cyurbia's forum on ''Tax increment financing and special improvement districts'' (1998) with mentions of professional group articles on these two topics.] |

|||

In an interview with the ''Calgary Sun'' in February 2015, Michael Brown, CRL president and CEO said they were looking into a CRL<ref name="Community Revitalization Levy" /> for the development of the West Village similar to that used to finance the remediation of the East Village. In August [[CalgaryNEXT]] sports complex was proposed as a potential anchor to the levy zone. Local politicians expressed concern about the funding model, which proposed that the city would front between $440 and $690 million of the projected cost, most which would only be recouped over a long period of time.<ref name="CHCourtship">{{cite news |last=Johnson |first=George |title=Let King begin the courtship |work=Calgary Herald |date=2015-08-19 |page=C1}}</ref> Mayor [[Naheed Nenshi]] commented that one of a number of challenges to the CalgaryNEXT proposal was the requirement of a community revitalization levy, along with the need for a land contribution from the city, "and significant investments in infrastructure to make the West Village a complete and vibrant community."<ref name="Nenshi statement">{{cite web | url=http://calgarymayor.ca/stories/mayor-nenshis-statement-on-a-new-arena-stadium-fieldhouse-proposal | title=Statement from Mayor Naheed Nenshi regarding the "CalgaryNext" | publisher=Office of the Mayor, City of Calgary | date=18 August 2015 | access-date=27 August 2015}}</ref> Edmonton, Alberta creating a CRL to revitalize the downtown with a massive development project including a new arena, park development and upgrades including sewers which total approximately $CDN 500 million.<ref name="CRL as developer subsidies" /> The city hopes to "generate approximately $941 million in revenue in a medium-growth scenario."<ref name="CRL as developer subsidies" /> |

|||

'''Interest Group Links:''' |

|||

*More information about tax increment financing is available through the [http://www.cdfa.net/cdfa/cdfaweb.nsf/pages/tifcoverview.html Tax Increment Finance Coalition] (TIFC), a national initiative dedicated to professionals and organizations working in the tax increment finance industry. |

|||

*[http://www.realtor.org/smart_growth.nsf/docfiles/TIFreport.pdf/$FILE/TIFreport.pdf National Association of Realtors's "''TIF Primer''"--which is quite comprehensive (2002)] |

|||

*[http://www.nea.org/newsreleases/2003/nr030122.html Press Release for National Education Association's Research Working Paper ''Protecting Public Education From Tax Giveaways to Corporations: Property Tax Abatements, Tax Increment Financing, and Funding for Schools'' (2003) with links.] |

|||

===Ontario=== |

|||

'''Groups Advocating Public Engagement and Transparency or TIF Reform ''' |

|||

As of 2015, Toronto's mayor [[John Tory]] plans on creating a levy zone to finance a C$2.7 billion SmartTrack surface rail line project spanning 53 kilometres.<ref name="CRL as developer subsidies" /> |

|||

*[http://www.newrules.org/retail/tifreform.html The New Rules Project's ''TIF Reform'' website, with links to several publications about TIFs (see ''More'')] |

|||

*[http://www.ncbg.org/tifs/tifs.htm Neighborhood Capital Budget Group's explanation on TIF in Chicago] and [http://www.ncbg.org/research.htm their research] |

|||

* [http://www.samadamsalliance.org The Sam Adams Alliance] |

|||

* [http://www.syllc.com Stone & Youngberg LLC] |

|||

== See also == |

|||

* [[Corporate welfare]] |

|||

* [[Public finance]] |

|||

* [[Value capture]] |

|||

== References == |

|||

'''Governmental Websites''' |

|||

{{Reflist}} |

|||

*[http://www.mass.gov/envir/smart_growth_toolkit/pages/mod-diftif.html Massachusetts's Smart Growth website on District Improvement Financing (DIF) and Tax Increment Financing (TIF) districts] |

|||

*[http://www.house.leg.state.mn.us/hrd/issinfo/tifmech.htm How TIF Works: Basic Mechanics] Minnesota House of Representatives Research Department. |

|||

*[http://www.calgary.ca/docgallery/bu/corporateproperties/final_report_tif.pdf Calgary's report ''The U.S. Experience with Tax Increment Financing (TIF): A Survey of Selected U.S. Cities'' (2005)] |

|||

== External links == |

|||

'''Newsletters, Opinion Websites, and Short Policy Briefs or Papers''' |

|||

<!-- ==============================({{NoMoreLinks}})============================== --> |

|||

* [http://www.johnlocke.org/spotlights/display_story.html?id=187 ''Debt is Debt: Taxpayers on hook for TIFs despite rhetoric''], Joseph Coletti, [[John Locke Foundation]], November 2007. |

|||

<!-- DO NOT ADD MORE LINKS TO THIS ARTICLE. WIKIPEDIA IS NOT A COLLECTION OF LINKS --> |

|||

*[http://www.reason.com/0601/fe.dm.giving.shtml ''Tax Increment Financing: A Bad Bargain for Taxpayers''], Daniel McGraw, Reason Magazine, Jan. 2006. |

|||

<!-- If you think that your link might be useful, instead of placing it here, put --> |

|||

*[http://www.tompaine.com/articles/2005/11/09/walmarts_tax_on_us.php Greg LeRoy's article ''Wal-Mart's Tax On Us''] |

|||

<!-- it on this article's discussion page first. Links that have not been verified --> |

|||

*1000 Friends of Wisconsin's [http://www.1kfriends.org/Publications/Online_Documents/TIF.htm report] ''Tax Incremental Finance [sic] Law: Lending a Hand to Blighted Areas of [sic] Turning Cornfields into Parking Lots?'' |

|||

<!-- WILL BE DELETED --> |

|||

*[http://www.heartland.org/PolicyBotTopic.cfm?artTopic=305 Heartland Institute PolicyBot on TIFs] |

|||

<!-- ============================================================================= --> |

|||

*[http://www.luc.edu/curl/prag/Summer99.pdf ''PRAGmatics'' (a newsletter published by PRAG--a consortium of Chicago academics, research & advocacy organizations, and community non-profits based at Loyola University Chicago) issue with articles on TIFs (1999)], see also [http://www.luc.edu/curl/prag/final_summer02.pdf''PRAGmatics'' Looking into Tax Increment Financing (2002)] |

|||

*[http://www.igpa.uiuc.edu/lib/data/pdf/PF13-4_tiff.pdf University of Illinois' Institute of Government and Public Affairs Policy Forum paper by Dye & Merriman titled ''TIF districts hinder growth: Study finds that cities without TIFs grow faster'' (2000)] See also [http://www.igpa.uillinois.edu/publications/workingPapers/WP75-TIF.pdf ''The Effects of Tax Increment Financing on Economic Development'', a working paper (1999)]. |

|||

*[http://www.gfoa.org/services/dfl/ed/documents/UrbanRevitalizationandTIFinChicago.pdf Healey & McCormick's ''Urban Revitalization and Tax Increment Financing in Chicago'' (1999), an idealized paper regarding TIFs by two City of Chicago officials.] |

|||

*[http://www.gfoa.org/services/dfl/ed/documents/FinancingEconomicDevelopment.pdf Eisinger's ''Financing Economic Development: A Survey of Techniques'' (2002)] |

|||

*[http://nynv.aiga.org/pdfs/NYNV_TaxIncrementFinancing.pdf Sam Casella's paper ''Tax Increment Financing: A Tool for Rebuilding New York'' from the AIGA's New York New Visions website] |

|||

*[http://planning.org/planning/member/2007mar/contents.htm "At the Tipping Point: Has tax increment become too much of a good thing?'' by James Krohe, Jr., Planning Magazine, March 2007, American Planning Association. Information on article at www.planning.org website; member or non-member registration required.] |

|||

* Scott, Brendan S. (2013). [https://digital.library.txstate.edu/bitstream/handle/10877/4589/ScottBrendan.pdf?sequence=1 ''Factors that Influence the Size of Tax Increment Financing Districts in Texas'']. San Marcos, TX: Texas State University. |

|||

'''Academic Papers or Reports''' |

|||

* An abstract of Weber's [http://uar.sagepub.com/cgi/content/abstract/38/5/619 ''Equity and Entrepreneurialism: The Impact of Tax Increment Financing on School Finance''] ({{Webarchive|url=https://web.archive.org/web/20061017223336/http://uar.sagepub.com/cgi/content/abstract/38/5/619 |date=2006-10-17 }}; 2003). |

|||

* Weber, Dev Bhatta & Merriman's ''Spillovers from tax increment financing districts: Implications for housing price appreciation'' (2007). In March, 2007, Regional Science and Urban Economics, pages 259-281. (No link) |

|||

* An abstract of Weber, et al.'s [https://www.researchgate.net/publication/228151576_Does_Tax_Increment_Financing_Raise_Urban_Industrial_Property_Values "Does Tax Increment Financing Raise Urban Industrial Property Values?"] (2003). |

|||

*[http://publishing.yudu.com/Freedom/Acvui/TaxIncrementFinancin/ Nathan A. Benefield's academic paper titled ''The Effects of Tax Increment Financing on Home Values in the City of Chicago'' (2003). Benefield's paper was prepared for presentation at the annual meeting of the Midwest Political Science Association.] |

|||

* {{Cite report |title=Tax Increment Financing in the State of Missouri MSCDC Economic Report |number=9703 |date=June 1997 |author=Kenneth Hubbell |author2=Peter J. |publisher=Eaton Center for Economic Information, University of Missouri–Kansas City |url=http://cei.umkc.edu/Library/ERS/June97/9703.pdf }} |

|||

*[http://www.econ.iastate.edu/research/webpapers/paper_4094_N0138.pdf Swenson & Eathington's ''Do Tax Increment Finance Districts in Iowa Spur Regional Economic and Demographic Growth?'' (2002)] |

|||

* [https://www.youtube.com/watch?v=I-eNlPeiQ50 Corporate Welfare: Where's the Outrage? – A Personal Exploration by Johan Norberg]—Film includes detailed segment addressing TIFs |

|||

*[http://www.uic.edu/cuppa/gci/pdf/TIF.pdf Weber's paper titled ''Making Tax Increment Financing (TIF) Work for Workforce Development: The Case of Chicago'' (1999)] |

|||

*[http://uar.sagepub.com/cgi/content/abstract/38/5/619 An abstract of Weber's ''Equity and Entrepreneurialism: The Impact of Tax Increment Financing on School Finance'' (2003).] |

|||

*[http://taylorandfrancis.metapress.com/(4omkl055n0gkpu55zvrirvvu)/app/home/contribution.asp?referrer=parent&backto=issue,6,12;journal,38,265;linkingpublicationresults,1:100403,1 An abstract of Weber, et al's ''Does Tax Increment Financing Raise Urban Industrial Property Values?'' (2003)] |

|||

*[http://uar.sagepub.com/cgi/content/abstract/40/2/246 An abstract of Robinson's ''Hunger Discipline and Social Parasites: The Political Economy of the Living Wage'' (2004).] |

|||

*[http://taylorandfrancis.metapress.com/link.asp?id=pt1puwu8jtbc37uk An abstract of Man's ''Fiscal Pressure, Tax Competition and the Adoption of Tax Increment Financing'' (1999).] |

|||

*[http://cei.haag.umkc.edu/cei/EconRep/June97/ Hubbell & Eaton's ''Tax Increment Financing in the State of Missouri'' (University of Missouri-Kansas City, 1997)] |

|||

*[http://www.cows.org/pdf/rp-stumps.pdf Wood & Hughes' report for Center on Wisconsin Strategy (at University of Wisconsin-Madison) titled ''From Stumps to Dumps: Wisconsin's Anti-Environmental Subsidies'' (2001)] |

|||

*[http://www.cows.org/pdf/econdev/tif/rp-tif_2005.pdf Matthew Mayrl's report for Center on Wisconsin Strategy (at University of Wisconsin-Madison) titled ''Refocusing Wisconsin’s TIF System On Urban Redevelopment: Three Reforms'' (2005)] and the[http://www.cows.org/pdf/ex-tif_2005.pdf Executive Summary] |

|||

{{Authority control}} |

|||

'''Other Reports:''' |

|||

*[http://www.alleghenyinstitute.org/reports/99_06.pdf The Allegheny Institute's report ''A Primer on Tax Increment Financing in Pittsburgh'' by Haulk and Montarti (1999)] |

|||

*[http://www.goodjobsfirst.org/pdf/wmtstudy.pdf Good Jobs First's report ''Shopping for Subsidies: How Wal-Mart Uses Taxpayer Money to Finance Its Never-Ending Growth'' (2004)] |

|||

*[http://www.goodjobsfirst.org/pdf/balt.pdf Good Jobs First's report ''Subsidizing the Low Road: Economic Development in Baltimore'' (2002)] |

|||

[[Category: |

[[Category:Tax policy]] |

||

[[Category:Taxation]] |

|||

[[Category:Government]] |

|||

Latest revision as of 13:56, 15 December 2024

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization.[1] Similar or related value capture strategies are used around the world.

Through the use of TIF, municipalities typically divert future property tax revenue increases from a defined area or district toward an economic development project or public improvement project in the community. TIF subsidies are not appropriated directly from a city's budget, but the city incurs loss through forgone tax revenue.[2] The first TIF was used in California in 1952.[3] By 2004, all U.S. states excepting Arizona had authorized the use of TIF. The first TIF in Canada was used in 2007.[4]

Use

[edit]Tax increment financing subsidies, which are used for both publicly subsidized economic development and municipal projects,[2]: 2 have provided the means for cities and counties to gain approval of redevelopment of blighted properties or public projects such as city halls, parks, libraries etc. The definition of blight has taken on a broad inclusion of nearly every type of land including farmland, which has given rise to much of the criticism. "[2]: 2

To provide the needed subsidy, the urban renewal district, or TIF district, is often drawn around additional real estate beyond the project site to provide the needed borrowing capacity for the project or projects. The borrowing capacity is established by committing all normal yearly future real estate tax increases from every parcel in the TIF district (for 20–25 years, or more) along with the anticipated new tax revenue eventually coming from the project or projects themselves. If the projects are public improvements paying no real estate taxes, all of the repayment will come from the adjacent properties within the TIF district.

Although questioned, it is often presumed that even public improvements trigger gains in taxes above what would occur in the district without the investment. In many jurisdictions yearly property tax increases are restricted and cannot exceed what would otherwise have occurred.

The completion of a public or private project can at times result in an increase in the value of surrounding real estate, which generates additional tax revenue. Sales-tax revenue may also increase, and jobs may be added, although these factors and their multipliers usually do not influence the structure of TIF.

The routine yearly increases district-wide, along with any increase in site value from the public and private investment, generate an increase in tax revenues. This is the "tax increment." Tax increment financing dedicates tax increments within a certain defined district to finance the debt that is issued to pay for the project. TIF was designed to channel funding toward improvements in distressed, underdeveloped, or underutilized parts of a jurisdiction where development might otherwise not occur. TIF creates funding for public or private projects by borrowing against the future increase in these property-tax revenues.[5]

History

[edit]Tax increment financing was first used in California in 1952 and there are currently thousands of TIF districts operating in the US, from small and mid-sized cities to large urban areas. As of 2008, California had over four hundred TIF districts with an aggregate of over $10 billion per year in revenues, over $28 billion of long-term debt, and over $674 billion of assessed land valuation.[6] The state of California discontinued the use of TIF financing due to lawsuits in 2011, and enacted the California Fiscal Emergency Proclamation 2010, thereby ending the diversion of property tax revenues from public funding, including the use of TIFs for the funding of the nearly 400 redevelopment agencies in the state.[7][8] The RDAs appealed that decision, though they were eventually eliminated in February 2012 after the passage of the 2011 state budget.[9][10]

However, in 2015, the California Community Revitalization and Investment Authority Act was made law, providing for the creation of Community Revitalization and Investment Authorities (CRIAs), funded by Tax-Increment Financing. The primary purposes of CRIAs are the development or preservation of affordable housing for low and moderate income households (a minimum of 25% of TIF funding must be placed in an affordable housing fund) and creation or upgrading of public infrastructure in economically disadvantaged areas as defined under the provisions of the law.[11][12] Additionally, Enhanced Infrastructure Financing Districts (EIFDs) may be created and financed by TIFs in California.[13]

With the exception of Arizona, every state and the District of Columbia has enabled legislation for tax increment financing.[14] Some states, such as Illinois, have used TIF for decades, but others have only recently embraced TIF.[15] The state of Maine has a program named TIF; however, this title refers to a process very different than in most states.[16]

Since the 1970s, the following factors have led local governments (cities, townships, etc.) to consider tax increment financing: lobbying by developers, a reduction in federal funding for redevelopment-related activities (including spending increases), restrictions on municipal bonds (which are tax-exempt bonds), the transfer of urban policy to local governments, State-imposed caps on municipal property tax collections, and State-imposed limits on the amounts and types of city expenditures. Considering these factors, many local governments have chosen TIF as a way to strengthen their tax bases, attract private investment, and increase economic activity.

Urban regeneration

[edit]In a 2015 literature review on best practices in urban regeneration, cities across the United States are seeking ways to reverse trends of unemployment, declining population and disinvestment in their core downtown areas, as developers continue to expand into suburban areas. Re-investment in downtown core areas include mixed-use development and new or improved transit systems. With successful revitalization comes gentrification with higher property values and taxes, and the exodus of lower income earners.[17][18]

Successful city revitalization can't be achieved by megaprojects alone—signature buildings, stadiums or other such concentrated development efforts. Instead, "it must be multifaceted and encompass improvements to the cities' physical environments, their economic bases, and the social and economic conditions of their residents.

— Mallach and Brachman 2013

Unintended consequences

[edit]Like any economic tool, TIF comes with drawbacks. Organizations such as Municipal Officials for Redevelopment Reform (MORR) use to hold regular conferences on redevelopment abuse, as well as local organizations like Chicago's 33 Ward Working Families.[19][20]

- As efficient market theory predicts, and now empirical evidence from economic studies suggests cities that adopt TIF grow more slowly than those that do not.[21] A literature review by David Merriman, a professor at the University of Illinois at Chicago found TIF "may be moving development from one part of the city to another, and changing the timing of the development, but there's not more development than would have otherwise been made."[22]

- TIF increases the property taxes of the areas next to a TIF district by reducing the [Total Taxable Property Value].[23] Congressman Mike Quigley simplified the math and showed if a [Tax Rate] = [Revenue to be Raised] / [Total Taxable Property Value], then reducing the denominator, [Total Taxable Property Value], increases the [Tax Rate].[23][24][25] A property owner's [Tax Bill] is typically [Tax Rate] x [Assessed Property Value], thus as a new TIF district reduces the [Total Taxable Property], the [Tax Rate] and [Tax Bill] increases for property owners near the TIF district.[23][24][25] State Representative Keneth Nordtvedt of Montana paraphrased the scheme this way, "All property taxes --- city, county, school, state --- are exempted on TIF districts’ incremental properties, and then districts put a monetarily equal fee on those properties. Though collected by county treasurer as a tax, that fee is given to TIF district development boards to spend. The adversely affected taxing jurisdictions like school districts, county government, even city government's general fund, are then quietly directed by law to make themselves whole by raising their levies on properties outside of the TIF districts so as to compensate for revenues lost from the TIF district incremental properties."[24]

- As investment in an area increases, it is not uncommon for real estate values to rise and for gentrification to occur.

- Although generally sold to legislatures as a tool to redevelop blighted areas, some districts are drawn up where development would happen anyway, such as ideal development areas at the edges of cities. California has passed legislation designed to curb this abuse.[26][27]

- The designation of urban areas as "blighted,"[28] essential to most TIF implementation, can allow governmental condemnation of property through eminent domain laws. The famous Kelo v. City of New London United States Supreme Court case, where homes were condemned for a private development, arose over actions within a TIF district.

- The TIF process arguably leads to favoritism for politically connected developers, implementing attorneys, economic development officials, and others involved in the processes. However, most Urban Renewal Authorities require public notice and have competitive bidding requirements.

- In some cases, school districts within communities using TIF are experiencing larger increases in state aid than districts not in such communities. This may be creating an incentive for governments to "over-TIF," consequently taking on riskier development projects. Local governments are under no obligation to recognize when TIF designation would adversely affect a school district's financial condition, and consequently the quality of some schools can be compromised.

- Normal inflationary increases in property values can be captured with districts in poorly written TIFs, representing money that would have gone into the public coffers even without the financed improvements.

- Districts can be drawn excessively large thus capturing revenue from areas that would have appreciated in value regardless of TIF designation.

- Approval of districts can sometimes capture one entity's future taxes without its official input, i.e. a school districts taxes will be frozen on action of a city.

- Capturing the full tax increment and directing it to repay the development bonds ignores the fact that the incremental increase in property value likely requires an increase in the provision of public services, which will now have to be funded from elsewhere, often from subsidies from less economically thriving areas. The use of tax increment financing to create a large residential development means that public services from schools to public safety will need to be expanded, yet if the full tax increment is captured to repay the development bonds, other money will have to be used.[29][30] For example, a study in Saint Louis Missouri found low-income students lost 91 times more than wealthier students in the suburbs due to TIF, and students with disabilities as the second hardest hit group.[31]

Examples

[edit]Chicago

[edit]The city of Chicago, in Cook County, Illinois, has a significant number of TIF districts and has become a prime location for examining the benefits and disadvantages of TIF districts. The city runs 131 districts with tax receipts totaling upwards of $500 million for 2006.[32] Lori Healey, appointed commissioner of the city's Planning and Development department in 2005 was instrumental in the process of approving TIF districts as first deputy commissioner.

The Chicago Reader, a Chicago alternative newspaper published weekly, has published articles regarding tax increment financing districts in and around Chicago. Written by staff writer Ben Joravsky, the articles are critical of tax increment financing districts as implemented in Chicago.[33]

Cook County Clerk David Orr, in order to bring transparency to Chicago and Cook County tax increment financing districts, began to feature information regarding Chicago area districts on his office's website.[34] The information featured includes City of Chicago TIF revenue by year, maps of Chicago and Cook County suburban municipalities' TIF districts.

The Neighborhood Capital Budget Group of Chicago, Illinois, a non-profit organization, advocated for area resident participation in capital programs. The group also researched and analyzed the expansion of Chicago's TIF districts.[35]

In April 2009, the "TIF Sunshine Ordinance" introduced by Alderman Scott Waguespack and Alderman Manuel Flores (then 1st Ward Alderman) passed City Council. The ordinance made all TIF Redevelopment Agreements and attachments available on the city's website in a searchable electronic format. The proposal intended to improve the overall transparency of TIF Agreements, thereby facilitating significantly increased public accountability.[36]

According to an article published in the Journal of Property Tax Assessment & Administration in 2009, the increase in the use of TIF in Chicago resulted in a "substantial portion of Chicago's property tax base and the land area" being subsumed by these levy zones—"26 percent of the city's land area and almost a quarter of the total value of commercial property is in TIF districts" by 2007. The study notes the difficulties in establishing how effective TIF are.[3]

Albuquerque

[edit]Currently, the 2nd largest TIF project in America is located in Albuquerque, New Mexico: the $500 million Mesa del Sol development. Mesa del Sol is controversial in that the proposed development would be built upon a "green field" that presently generates little tax revenue and any increase in tax revenue would be diverted into a tax increment financing fund. This "increment" thus would leave governmental bodies without funding from the developed area that is necessary for the governmental bodies' operation.

Detroit