PNC Financial Services: Difference between revisions

Rescuing orphaned refs ("annualreport" from rev 490323067) |

image with better perspective |

||

| (638 intermediate revisions by more than 100 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|Major bank based in Pittsburgh}} |

|||

{{Infobox company |

{{Infobox company |

||

| name |

| name = The PNC Financial Services Group, Inc. |

||

| logo |

| logo = PNClogo.svg |

||

| image = [[File:Pittsburgh-Downtown-2019-06-13-Tower-at-PNC-Plaza-01.jpg|250px]] |

|||

| type = [[Public company|Public]] |

|||

| image_caption = [[Tower at PNC Plaza]] in [[Pittsburgh]] |

|||

| traded_as = {{NYSE|PNC}}<br />[[S&P 500|S&P 500 Component]] |

|||

| type = [[Public company|Public]] |

|||

| predecessor = Pittsburgh National Corporation |

|||

| traded_as = {{ubl|{{NYSE|PNC}}|[[S&P 500]] component}} |

|||

| foundation = 1852 |

|||

| predecessor = {{nowrap| Pittsburgh National Corporation<br>Provident National Corporation}} |

|||

| location_city = [[Pittsburgh]], [[Pennsylvania]] |

|||

| foundation = {{start date and age|1845|04|10}}<br>Operational: {{start date and age|1852|01|28}} |

|||

| location_country = [[United States|U.S.]] |

|||

| location_city = [[Tower at PNC Plaza]],<br>[[Pittsburgh, Pennsylvania]] |

|||

| locations = |

|||

| location_country = U.S. |

|||

| area_served = |

|||

| locations = 2,629 [[branch (banking)|branches]] 60,000 [[automated teller machine]]s (2021) |

|||

| key_people = [[Jim Rohr]] <small>([[Chairman]] and [[Chief executive officer|CEO]])</small> |

|||

| area_served = Worldwide |

|||

| industry = [[Financial services]] |

|||

| key_people = [[William S. Demchak]] ([[Chairperson|chairman]] and [[Chief executive officer|CEO]])<br>Michael P. Lyons ([[President (corporate title)|president]]) |

|||

| revenue = {{decrease}} [[United States dollar|US$]] 14.326 billion <small>(2011)</small><ref name=10K>{{cite web|url=http://sec.gov/Archives/edgar/data/713676/000119312512087345/d260760d10k.htm|title=2011 Form 10-K, PNC Financial Services Group, Inc.|publisher=United States Securities and Exchange Commission}}</ref> |

|||

| industry = {{hlist|[[Banking]]|[[Investment bank]]ing|[[Financial services]]}} |

|||

| operating_income = {{increase}} US$ 4.069 billion <small>(2011)</small><ref name=10K/> |

|||

| products = [[Retail banking|Consumer banking]], [[Commercial bank|Corporate banking]], [[Private banking]], [[Financial analysis]], [[Insurance]], [[Investment banking]], [[Mortgage loan]]s, [[Private equity]], [[Wealth management]], [[Credit card]]s |

|||

| net_income = {{decrease}} US$ 3.071 billion <small>(2011)</small><ref name=10K/> |

|||

| |

| revenue = {{up}} {{US$|link=yes}}21.1 billion |

||

| revenue_year = 2022 |

|||

| assets = {{nowrap|{{increase}} US$ 271.205 billion <small>(2011)</small><ref name=10K/>}} |

|||

| |

| operating_income = {{up}} US$7.9 billion (2022) |

||

| net_income = {{up}} {{US$}}6.1 billion (2022) |

|||

| num_employees = 51,891 <small>(2011)</small><ref name=10K/> |

|||

| assets = {{increase}} {{US$|557 billion}} (2022) |

|||

| homepage = [http://www.pnc.com/ PNC.com] |

|||

| aum = {{down}} {{US$}}325 billion (2021) |

|||

| equity = {{increase}} {{US$}}55.726 billion (2021) |

|||

| num_employees = 59,426 (2021) |

|||

| subsid = PNC Bank |

|||

| ratio = 10.3% [[Tier 1 capital]] (2021) |

|||

| website = {{URL|pnc.com}} |

|||

| footnotes = <ref name="10K">{{Cite web |title=The PNC Financial Services Group, Inc. 2020 Annual Report (Form 10-K) |url=https://www.sec.gov/ix?doc=/Archives/edgar/data/713676/000071367621000025/pnc-20201231.htm |publisher=[[U.S. Securities and Exchange Commission]]}}</ref> |

|||

}} |

}} |

||

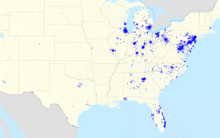

[[File:PNC footprint.png|thumb|right|PNC branch footprint, as of November 2021]] |

|||

[[File:PNC Bank Corporate footprint.jpg|thumbnail|right|PNC Bank Corporate Footprint]] |

|||

'''PNC Financial Services Group, Inc.''' is |

'''The PNC Financial Services Group, Inc.''' is an American [[bank holding company]] and [[financial services]] corporation based in [[Pittsburgh, Pennsylvania]]. Its [[banking ]] subsidiary, '''PNC Bank''', operates in 27 [[U.S. state|states]] and the [[District of Columbia]], with 2,629 [[branch (banking)|branches]] and 9,523 [[Automated teller machine|ATMs]]. PNC Bank is on the [[list of largest banks in the United States]] by assets and is one of the largest banks by number of branches, deposits, and number of ATMs. |

||

The company also provides financial services such as [[asset management]], [[wealth management]], [[estate planning]], loan servicing, and [[Business information processing|information processing]]. PNC is one of the largest [[Small Business Administration]] lenders and one of the largest [[credit card]] issuers. It also provides asset{{En dash}}based lending to [[private equity firm]]s and [[Middle-market company|middle market companies]]. PNC operates one of the largest [[treasury management]] businesses and the second largest lead arranger of asset{{En dash}}based [[loan syndication]]s in the United States. [[Harris Williams & Co.]], a subsidiary of the company, is one of the country's largest [[mergers and acquisitions]] advisory firms for [[middle-market companies]]. Midland Loan Services, a division of PNC Real Estate based in [[Overland Park, Kansas]] and founded in 1991, is ranked by [[Mortgage Bankers Association]] as the second largest master and primary servicer of commercial bank and savings institution loans.<ref>{{Cite press release |title=MBA Releases 2017 Year-End Commercial/Multifamily Servicer Rankings |date=February 11, 2018 |publisher=[[Mortgage Bankers Association]] |url=https://www.mba.org/2018-press-releases/february/mba-releases-2017-year-end-commercial/multifamily-servicer-rankings |access-date=March 25, 2018 |archive-date=April 7, 2022 |archive-url=https://web.archive.org/web/20220407005342/https://www.mba.org/2018-press-releases/february/mba-releases-2017-year-end-commercial/multifamily-servicer-rankings |url-status=dead }}</ref><ref name=10K/><ref>{{Cite web |title=Corporate Profile |url=https://www.pnc.com/content/dam/pnc-com/pdf/aboutpnc/Fact%20Sheets/CorporateProfile.pdf |website=PNC Bank}}</ref><ref name="Solution Centers">{{Cite web |title=PNC Solution Centers Provide a Space to Blend Physical and Digital Banking |url=https://www.pnc.com/insights/our-commitments/customers/pnc-solution-centers-blends-physical-digital-banking.html |website=PNC Bank}}</ref> |

|||

PNC is currently the seventh largest bank by deposits in the United States, as well as the sixth largest by total assets<ref>http://www2.fdic.gov/idasp/main_bankfind.asp: click ''More Search Options'', under ''Size or Performance'' choose ''Total Deposits'' and under ''Equal or Greater than'' enter $100,000,000,000. (It's necessary to perform the search manually on each occasion due to the website's configuration). Updated April 16, 2012.</ref>, fifth in total branches,<ref name="RBC">http://pittsburgh.cbslocal.com/2011/06/20/pnc-to-acquire-rbcs-united-states-unit/</ref> and is the third largest bank off-premise ATM provider.<ref>{{cite web|url=http://www.raterush.com/banks/view/PNC-Bank-6384/|title=PNC Bank Profile Information|year=2010|work=Rate Rush|publisher=Maugans Corp|accessdate=2010-06-13}}</ref> PNC is based in [[Pittsburgh]]. |

|||

The name "PNC" is derived from the initials of both of the bank's two predecessor companies: '''Pittsburgh National Corporation''' and '''Provident National Corporation''', which merged in 1983. PNC Mortgage (formerly National City Mortgage) is credited with funding the first mortgage in the [[United States]] and has offices across the country. |

|||

==History== |

==History== |

||

[[File:PNC Financial Services logo.gif|thumb|right|200px|1970s-era Pittsburgh National Bank logo, used until the 1982 merger to form PNC Bank]] |

|||

[[File:PNC headquarters.jpg|thumb|upright|PNC's corporate headquarters in [[Downtown Pittsburgh|Downtown]] [[Pittsburgh]].]] |

|||

PNC Financial Services traces its history to the '''Pittsburgh Trust and Savings Company''' which was founded in [[Pittsburgh, Pennsylvania]], on April 10, 1845.<ref name="firsthundred">{{Cite book |last=Thurston |first=George Henry |url=https://archive.org/details/alleghenycounty00thurgoog |title=Allegheny County's Hundred Years |date=January 1, 1888 |publisher=A. A. Anderson & Son |access-date=12 April 2017 |via=Internet Archive}}</ref><ref name="Thurston">{{Cite book |last=Thurston |first=George H. |url=http://digital.library.pitt.edu/cgi-bin/t/text/text-idx?idno=00adg8023m;view=toc;c=pitttext |title=Allegheny county's hundred years |publisher=University of Pittsburgh, Digital Research Library |year=1888 |location=Pittsburgh |page=258}}</ref> Due to the long recovery from the [[Great Fire of Pittsburgh]], Pittsburgh Trust and Savings was not fully operational until January 28, 1852.<ref>{{Cite news |date=January 29, 1909 |title=An Important Anniversary |work=[[Pittsburgh Press]] |url=https://news.google.com/newspapers?nid=1144&dat=19090128&id=Vy4bAAAAIBAJ&pg=5484,5936448&hl=en |via=[[Google]]}}</ref> It originally opened offices at [[Liberty Avenue (Pittsburgh)|Liberty Avenue]] and 12th Street. The bank was renamed The '''Pittsburgh Trust Company''' in 1853.<ref name="White">{{Cite book |last=White |first=Edward |url=http://digital.library.pitt.edu/cgi-bin/t/text/text-idx?idno=00afw8219m;view=toc;c=pitttext |title=A century of banking in Pittsburgh |publisher=University of Pittsburgh, Digital Research Library |year=1903 |location=Pittsburgh |page=19}}</ref> In 1858, the company located its corporate offices to the corner of [[Fifth Avenue (Pittsburgh)|Fifth Avenue]] and Wood Street in Pittsburgh, where they remain to this day. The bank changed its name to '''First National Bank of Pittsburgh''' in 1863 after it became the first bank in the country to apply for a national charter as part of that year's [[National Banking Act]].<ref name=firsthundred/> It received the 48th charter on August 5, 1863, with other later banks receiving charters sooner due to paperwork problems and the fact that the bank was already in business.<ref name=firsthundred/><ref name="White" /> |

|||

[[File:Topoftroy2007.JPG|thumb|upright|PNC's offices in [[Troy, Michigan]].]] |

|||

PNC Financial Services traces its history to the '''Pittsburgh Trust and Savings Company''' which was founded in [[Pittsburgh]], [[Pennsylvania]], in 1852. In 1858, the company located its corporate offices at the corner of [[Fifth Avenue (Pittsburgh)|Fifth Avenue]] and Wood Street in Pittsburgh where they remain to this day. The bank changed its name to '''[[First National Bank of Pittsburgh]]''' in 1863, after it became the first bank to receive a national charter as part of that year's [[National Banking Act]].<ref name="corphist">{{cite web |url=https://www.pnc.com/webapp/unsec/NCProductsAndService.do?siteArea=/pnccorp/PNC/Home/About+PNC/Our+Organization/Corporate+History|title= Corporate History|year= 2010|publisher=PNC Financial Services Group, Inc|accessdate=2010-06-12}}</ref> |

|||

In 1946, First National merged with Peoples-Pittsburgh Trust Company – with whom it had worked closely since the 1930s – to form '''Peoples First National Bank & Trust'''. In 1959, Peoples First merged with Fidelity Trust Company to form '''Pittsburgh National Bank'''. At this time, the bank adopted the first version of its present logo{{snd}}a stylized triangle representing the city's [[Golden Triangle (Pittsburgh)|Golden Triangle]].<ref>{{Cite web |title=Corporate History |url=https://www.pnc.com/en/about-pnc/company-profile/legacy-project/corporate-history.html |access-date=March 23, 2022 |website=PNC}}</ref><ref>{{Cite news |last=Sabatini |first=Patricia |date=August 10, 1999 |title=Obituaries: Ex-bank executive and hospital trustee |page=C6 |work=[[Pittsburgh Post-Gazette]] |url=https://news.google.com/newspapers?nid=1129&dat=19990810&id=L4VSAAAAIBAJ&pg=6600,7822868&hl=en |via=[[Google]]}}</ref> |

|||

By 1959, after a series of mergers, the bank had evolved into the '''Pittsburgh National Corporation'''. Another branch of the current bank, the [[Philadelphia]] based '''Provident National Corporation''', dates back to the mid-19th century.<ref name="corphist"/> |

|||

{{anchor|Provident National Bank}}Another branch of the current bank, the [[Philadelphia]]{{En dash}}based Provident National Corporation, dates back to 1865.<ref>{{Cite web |title=PNC Predecessor Banks: Provident National Corporation |url=https://www.pnclegacyproject.com/provident.html |url-status=dead |archive-url=https://web.archive.org/web/20190216175559/https://www.pnclegacyproject.com/provident.html |archive-date=2019-02-16 |access-date=2017-04-13}}</ref> |

|||

In 1982, Pittsburgh National Corporation and Provident National Corporation merged into a new entity named '''PNC Financial Corporation'''.<ref name="corphist"/> Between 1991 and 1996, PNC purchased over ten smaller banks and financial institutions that broadened its market base from [[Kentucky]] to the [[Greater New York metropolitan area]].<ref name="corphist"/> In 2005, PNC acquired [[Washington, D.C.]] based '''[[Riggs Bank]]'''.<ref name="corphist"/> PNC completed the acquisition of Maryland-based '''Mercantile Bankshares''' on March 2, 2007.<ref name="corphist"/> On June 7, 2007, PNC announced the acquisition of '''Yardville National Bancorp''', a small commercial bank centered in central New Jersey and eastern Pennsylvania. The transaction was completed in March 2008.<ref name="corphist"/> On July 19, 2007, PNC announced the acquisition of '''Sterling Financial Corporation''', a commercial and consumer bank with accounts and branches in central Pennsylvania, northeastern Maryland and Delaware. The transaction was also completed in 2008.<ref name="corphist"/> |

|||

In 1982, Pittsburgh National Corporation and Provident National Corporation, both with PNC as their abbreviations, merged into a new entity named '''PNC Financial Corporation'''. It was the largest bank merger in American history at the time and created a company with $10.3 billion in assets.<ref>{{Cite news |date=November 3, 1982 |title=Banking Mergers Flourish |work=[[The New York Times]] |url=https://www.nytimes.com/1982/11/03/business/banking-mergers-flourish.html |url-access=subscription}}</ref><ref>{{Cite news |date=April 19, 1982 |title=The merger of two bank holding companies was announced |work=[[United Press International]] |url=http://www.upi.com/Archives/1982/04/19/The-merger-of-two-bank-holding-companies-was-announced/4882388040400/}}</ref> Between 1991 and 1996, PNC purchased more than ten smaller banks and financial institutions, including the $30 billion dollar merger of Midlantic Bank of Edison New Jersey in 1996, that at the time, was one-third the size of PNC. That broadened its market base from [[Kentucky]] to the [[New York metropolitan area]].{{Citation needed|date=March 2020}} |

|||

===National City acquisition=== |

|||

{{details|National City acquisition by PNC}} |

|||

In an October 9, 2008 article in the [[Wall Street Journal]], PNC was cited by unnamed sources as one of the leading contenders to acquire Cleveland based '''[[National City Corp.|National City Bank]]'''. On October 24, 2008, PNC announced that it would acquire [[Cleveland]] based [[National City Corp.|National City Bank]] for {{US$|5.2}} billion in PNC Stock.<ref>[[KDKA-TV|kdka.com]] [http://kdka.com/business/PNC.Financial.Services.2.847872.html PNC Financial Services To Buy National City]</ref> The acquisition, which helped PNC double in size and to become the sixth largest bank in the United States by deposit and fifth largest by branches, came hours after PNC sold 15% of its stake to the [[United States Treasury]] as part of the [[Emergency Economic Stabilization Act of 2008|$700 billion bailout plan]], which it repurchased within 2 years. The deal was approved by shareholders of both banks on December 23, 2008,<ref>http://kdka.com/business/National.City.PNC.2.894007.html</ref> and completed on December 31, 2008.<ref>[http://biz.yahoo.com/ap/081231/pnc_national_city.html?.v=2 PNC completes National City acquisition], [[Associated Press]] via Yahoo! News, December 31, 2008</ref> |

|||

{| class="wikitable" |

|||

The deal made PNC the largest bank in [[Pennsylvania]], [[Ohio]], and [[Kentucky]], as well as the second largest bank in [[Maryland]] and [[Indiana]]. It also greatly expanded PNC's presence in the [[Midwestern United States|Midwest]] as well as entering the [[Florida]] market. National City complemented PNC's presence, as Western Pennsylvania, [[Cincinnati|Cincinnati, Ohio]] and [[Louisville, Kentucky]] were among the few markets before the acquisition deal in which both banks had a major presence.<ref>{{cite press release |title= PNC to Acquire National City|url= http://pnc.mediaroom.com/index.php?s=43&item=591|publisher= PNC Financial Services Group, Inc.|date= 2008-10-24|accessdate=2010-06-12}}</ref> |

|||

|+Financial Summary<ref>{{Cite web |title=Financial Information |url=https://investor.pnc.com/financial-information |access-date=2023-02-16 |website=The PNC Financial Services Group, Inc. |language=en}}</ref> |

|||

| '''($ millions)''' |

|||

|'''2017''' |

|||

|'''2018''' |

|||

|'''2019''' |

|||

|'''2020''' |

|||

|'''2021''' |

|||

|'''2022''' |

|||

|'''2023''' |

|||

|- |

|||

|Total Revenue |

|||

|$ 15,252 |

|||

|$ 16,190 |

|||

|$ 16,839 |

|||

|$ 16,901 |

|||

|$ 19,211 |

|||

|$ 21,120 |

|||

|$21,490 |

|||

|- |

|||

|Net Income |

|||

|$ 4,598 |

|||

|$ 4,558 |

|||

|$ 4,591 |

|||

|$ 3,003 |

|||

|$ 5,725 |

|||

|$ 6,113 |

|||

|$5,647 |

|||

|- |

|||

|Assets |

|||

|$ 380,768 |

|||

|$ 382,315 |

|||

|$ 410,295 |

|||

|$ 466,679 |

|||

|$ 557,191 |

|||

|$ 557,263 |

|||

|$561,580 |

|||

|- |

|||

|Loans |

|||

|$ 220,458 |

|||

|$ 226,245 |

|||

|$ 239,843 |

|||

|$ 241,928 |

|||

|$ 288,372 |

|||

|$ 326,025 |

|||

|$321,508 |

|||

|- |

|||

|Deposits |

|||

|$ 265,053 |

|||

|$ 267,839 |

|||

|$ 288,540 |

|||

|$ 365,345 |

|||

|$ 457,278 |

|||

|$ 436,282 |

|||

|$421,418 |

|||

|} |

|||

Since 1984, PNC has compiled the [[Christmas Price Index]], a humorous [[economic indicator]] which estimates the prices of the items found in the song "[[The Twelve Days of Christmas (song)|The Twelve Days of Christmas]]".<ref>{{Cite web |title=PNC Christmas Price Index |url=https://www.pncchristmaspriceindex.com/}}</ref> |

|||

PNC completed the conversion of the National City branches on June 14, 2010, having its footprint stretch from [[New York City]] to [[St. Louis, Missouri|St. Louis]], with branches as far south as [[Miami]] and as far north as the [[Upper Peninsula of Michigan]]. |

|||

In 1998, PNC acquired [[Hilliard Lyons]] for $275 million in cash and stock.<ref>{{Cite news |last=Murray |first=Matt |date=August 21, 1998 |title=PNC Bank to Buy Hilliard-Lyons For $275 Million in Cash and Stock |work=[[The Wall Street Journal]] |url=https://www.wsj.com/articles/SB903656883392614000 |url-access=subscription}}</ref> Hilliard Lyons was sold in 2008.<ref>{{Cite news |date=April 1, 2008 |title=PNC's sale of Hilliard Lyons completed |work=[[American City Business Journals|Pittsburgh Business Times]] |url=https://www.bizjournals.com/pittsburgh/stories/2008/03/31/daily9.html}}</ref> |

|||

===Recent acquisitions=== |

|||

A report in the December 15, 2010 issue of the ''[[American City Business Journals]]'' reported that PNC was looking to expand its Florida presence and that it was in talks to acquire [[Birmingham, Alabama|Birmingham]], [[Alabama]]-based [[Regions Financial Corporation]], which would have greatly increased PNC's presence in the [[Southern United States]].<ref name="Regions">{{cite news| url=http://www.bizjournals.com/orlando/news/2010/12/16/pnc-looking-at-regions-bankatlantic.html | first=Brian | last=Bandell | title=PNC looking at Regions, BankAtlantic | date=December 16, 2010}}</ref> Since the December 15 report, the [[Dow Jones]] has reported through the [[Wall Street Journal]], that Regions Financial was never in talks to be acquired by PNC.<ref name="Regions not in talks with PNC">{{cite news| url=http://online.wsj.com/article/BT-CO-20101215-709795.html?mod=wsjcrmain | work=The Wall Street Journal | title=2nd UPDATE: PNC Not In Discussions To Buy Regions -Sources | date=December 15, 2010}} {{Dead link|date=May 2011|bot=RjwilmsiBot}}</ref> After PNC moved into Regions home market of Birmingham through the [[RBC Bank]] deal in March 2012, rumors of a potential PNC-Regions deal down the road came up again.<ref>http://blog.al.com/businessnews/2012/02/pnc_bank_buys_rbc_branches_in.html</ref> |

|||

In 1998, PNC sold its credit card business to Metris (now [[HSBC Finance]])<ref>{{Cite news |date=September 9, 1998 |title=COMPANY NEWS; Metris To Buy $1 Billion In Credit Card Loans From PNC |work=The New York Times |agency=[[Bloomberg News]] |url=https://www.nytimes.com/1998/09/09/business/company-news-metris-to-buy-1-billion-in-credit-card-loans-from-pnc.html |url-access=subscription}}</ref> and [[MBNA]].<ref>{{Cite news |date=December 24, 1998 |title=COMPANY NEWS; MBNA Ix Buying PNC Bank's Credit Card Operations |work=[[The New York Times]] |agency=[[Dow Jones & Company|Dow Jones]] |url=https://www.nytimes.com/1998/12/24/business/company-news-mbna-is-buying-pnc-bank-s-credit-card-operations.html |url-access=subscription}}</ref> |

|||

It has also been reported that PNC has been in discussions with [[BankAtlantic]],<ref name="Regions" /> which later came to be on January 31, 2011 when PNC bought BankAtlantic's [[Tampa Bay Area]] branches.<ref>http://www.pittsburghlive.com/x/pittsburghtrib/business/s_720631.html</ref> The BankAtlantic deal, which will not include its [[South Florida metropolitan area|South Florida]] branches where PNC already has a presence, closed in June 2011. |

|||

In 2000, the company adopted a new brand image and changed its name to PNC Financial Services Group.<ref>{{Cite news |date=July 16, 2002 |title=Battle of the banks: Key dates in PNC and Dollar's history |work=[[Pittsburgh Post-Gazette]] |url=https://old.post-gazette.com/businessnews/20020716oldestbanksidep9.asp}}</ref> |

|||

====Flagstar Bank==== |

|||

On July 26, 2011, it was announced that PNC would acquire 27 branches in the northern [[Atlanta]] suburbs from [[Flagstar Bank]].<ref name=Flagstar>{{cite news | url=http://www.ajc.com/business/pnc-to-buy-atlanta-1049259.html | Atlanta Journal-Constitution | title = PNC to buy Atlanta Flagstar Bank branches | date = June 26, 2011}}</ref> The deal is estimated to be worth about $42 million, and PNC will assume about $240 million in deposit accounts. The deal is complete as of December 2011. |

|||

In 2001, PNC sold the original PNC Mortgage to [[Washington Mutual]] due to volatility in the market.<ref>{{Cite news |date=February 1, 2001 |title=PNC sells mortgage division |work=Pittsburgh Business Times |url=https://www.bizjournals.com/cincinnati/stories/2001/01/29/daily36.html}}</ref> |

|||

====RBC Bank==== |

|||

On June 19, 2011, PNC agreed to purchase [[RBC Bank]] from [[Royal Bank of Canada]] for $3.45 billion.<ref name="RBC Centura">{{cite news|url=http://www.pittsburghlive.com/x/pittsburghtrib/business/s_742948.html | Pittsburgh Tribune-Review | title=Reuters: PNC to buy RBC unit for $3.45 billion | date=June 19, 2011}}</ref> With 426 branches total, RBC Bank has a significant presence in southern [[Virginia]], [[North Carolina]], [[South Carolina]], [[Georgia (U.S. state)|Georgia]], [[Alabama]], and [[Florida]]. Of these regions, PNC had existing branches only in Florida which were rebranded when the National City merger occurred. Although announced over a month before the Flagstar Bank deal, the sale of RBC Bank didn't close until on March 2, 2012, three months after the Flagstar deal. [[BB&T]], which later acquired the parts of [[BankAtlantic]] that PNC didn't buy, was also in talks to acquire RBC Bank.<ref name="RBC Centura" /> |

|||

In 2004, PNC acquired United National Bancorp based in [[Bridgewater, New Jersey]], for $321 million in cash and 6.6 million shares of its common stock.<ref>{{Cite news |date=January 2, 2004 |title=PNC buys United National Bancorp |work=Pittsburgh Business Times |url=https://www.bizjournals.com/pittsburgh/stories/2003/12/29/daily17.html}}</ref> |

|||

The acquisition allowed PNC to enter the growing markets in the Southeastern U.S. such as [[Birmingham, Alabama|Birmingham]], [[Charlotte, North Carolina|Charlotte]], [[Norfolk, VA|Norfolk]]/[[Virginia Beach]] ([[Hampton Roads]]), [[Mobile, Alabama|Mobile]], [[North Florida]], [[Richmond, Virginia|Richmond]], [[Greensboro, NC|Greensboro]]/[[Winston-Salem]] ([[Piedmont Triad]]), and [[Raleigh, North Carolina|Raleigh]]/[[Durham, NC|Durham]] ([[Research Triangle]]). At the same time, it expands PNC's presence in [[South Florida metropolitan area|South Florida]], [[Tampa Bay Area]] to [[Orlando, Florida|Orlando]], and [[Atlanta]]. This acquisition filled a gap in PNC's market footprint between northern Virginia and central Florida, adding about 900,000 customers and 483 ATM locations. It made PNC the fifth-largest bank by branches behind [[Wells Fargo]], [[Bank of America]], [[Chase (bank)|Chase]], and [[U.S. Bancorp|U.S. Bank]] and the sixth-largest by total assets behind the aforementioned four banks and [[Citibank]].<ref name="RBC" /> |

|||

In 2005, PNC acquired [[Riggs Bank|Riggs National Corporation]] of [[Washington, D. C.]] Riggs had been fined after aiding Chilean dictator [[Augusto Pinochet]] in [[money laundering]].<ref>{{Cite news |last=O'Hara |first=Terence |date=February 11, 2005 |title=Riggs, PNC Reach New Merger Agreement |newspaper=[[The Washington Post]] |url=https://www.washingtonpost.com/wp-dyn/articles/A13829-2005Feb10.html}}</ref><ref name="acquired">{{Cite web |title=PNC: Acquired Companies |url=http://phx.corporate-ir.net/phoenix.zhtml%3Fc%3D107246%26p%3Dirol-acquired |url-status=dead |archive-url=https://web.archive.org/web/20170310060326/http://phx.corporate-ir.net/phoenix.zhtml?c=107246&p=irol-acquired |archive-date=2017-03-10 |access-date=2017-04-13}}</ref> PNC became one of the largest banks in the [[Washington metropolitan area]]. |

|||

===New corporate headquarters=== |

|||

On May 23, 2011, PNC unveiled plans for a new $400M corporate headquarters building in downtown Pittsburgh.<ref name="multivu.prnewswire.com">http://multivu.prnewswire.com/mnr/pnc/42893/</ref> The new building, known as the [[Tower at PNC Plaza]], will be a 40-story, {{convert|800,000|sqft|m2|adj=on}} skyscraper approximately 600' tall at the intersection of Fifth Avenue and Wood Street. PNC will own the building and occupy all the space except for street-level storefronts which it will lease to retail tenants. |

|||

In 2005, PNC began [[outsourcing]] mortgages to [[Wells Fargo]].<ref>{{Cite news |last=Killian |first=Erin |date=September 15, 2005 |title=Wells Fargo, PNC partner in local home-mortgage venture |work=[[American City Business Journals|Washington Business Journal]] |url=https://www.bizjournals.com/washington/stories/2005/09/12/daily25.html}}</ref> |

|||

The Tower at PNC Plaza plans to be one of the world's most environmentally friendly skyscrapers. Some of its features will include a double glass facade to reduce cooling costs and promote natural airflow into the building, a high-efficiency climate-control system to heat or cool specific zones of the building as needed, and a pair of living rooftops to collect and channel rainwater and reduce heat gain. Alternative energy sources such as fuel cells, and solar and geothermal power, are being considered in an effort to reduce carbon emissions.<ref>https://www.pncsites.com/pnctower/</ref> |

|||

In August 2006, PNC got back into the credit card business by marketing and issuing credit cards under the [[MasterCard]] brand in partnership with [[U.S. Bancorp]] (U.S. Bank) .<ref>{{Cite news |last=Sabatini |first=Patricia |date=August 29, 2006 |title=PNC tries new credit cards, old strategy |work=Pittsburgh Post-Gazette |url=http://www.post-gazette.com/pg/06241/717054-28.stm}}</ref> After the National City merger (see below) in 2008, the [[U.S. Bancorp]] (U.S. Bank) products were converted to PNC Bank products. |

|||

==PNC Bank == |

|||

[[Image:National Bank of Washington 301 7th Street, NW in Washington, D.C.JPG|thumb|PNC Bank branch, located in the historic National Bank of Washington building, in [[Washington, D.C.]]]] |

|||

'''PNC Bank NA.''' is the principal [[subsidiary]] of the PNC Financial Services Group, Inc. Based in [[Pittsburgh]], [[Pennsylvania]], PNC Bank offers consumer and corporate services in over 2,500 branches in [[Alabama]], [[Delaware]], the [[District of Columbia]], [[Florida]], [[Georgia (U.S. state)|Georgia]], [[Kentucky]], [[Indiana]], [[Illinois]], [[Maryland]], [[Michigan]], [[Missouri]], [[New Jersey]], [[New York]], [[North Carolina]], [[Ohio]], [[Pennsylvania]], [[South Carolina]], [[Virginia]], [[West Virginia]], & [[Wisconsin]].<ref name="annualreport">{{cite web |url=http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9Mzc0Mzk5fENoaWxkSUQ9MzcyNTE1fFR5cGU9MQ==&t=1 |title= Annual Report 2009|date=2010-03-11|publisher= PNC Financial Services Group|accessdate=2010-06-12}}</ref> PNC owns about 35% of publicly traded fund manager [[BlackRock]], which specializes in fixed-income products. BlackRock merged with [[Merrill Lynch]] Investment Managers in October 2006, and is now co-owned between PNC, [[Bank of America]], and [[Barclays]]. BlackRock's ties to PNC are evident in that company's logo, as they use the same typeface as PNC does in its own logo. |

|||

On March 2, 2007, PNC acquired Maryland-based Mercantile Bankshares, making PNC the eighth largest bank in the United States by deposits.<ref name=acquired/><ref name="Postgazette">{{Cite news |last=Fitzpatrick |first=Dan |date=October 10, 2006 |title=PNC buying Maryland bank in $6 billion deal |work=Pittsburgh Post-Gazette |url=http://www.pittsburghpostgazette.com/pg/06283/728754-28.stm}}</ref><ref>{{Cite press release |title=The PNC Financial Services Group Completes Acquisition of Mercantile Bankshares Corporation |date=March 2, 2007 |publisher=PNC Financial |url=https://pnc.mediaroom.com/index.php?s=3473&item=74138}}</ref> |

|||

In June 2003, PNC Bank agreed to pay $115 million to settle federal securities fraud charges after one of its subsidiaries fraudulently transferred $762 million in bad loans and other venture-capital investments to an AIG entity in order to conceal them from investors.<ref>{{cite web|url=http://www.enquirer.com/editions/2003/06/04/biz_notes04.html|title=Cincinnati Enquirer|accessdate=2006-09-17}}</ref> PNC acquired the former United National Bancorp based in [[Bridgewater, New Jersey]] in 2004, and later announced that it would buy the [[Riggs Bank|Riggs National Bank]] which operated in the [[Washington, DC]] area. Among other offenses, Riggs had aided Chilean dictator Augusto Pinochet in laundering money. PNC successfully completed the acquisition of Riggs in 2005 after the banks resolved a disagreement on the acquisition price.<ref>{{cite news|url=http://www.washingtonpost.com/wp-dyn/articles/A13829-2005Feb10.html|title=Washington Post|accessdate=2006-10-27 | work=The Washington Post | first=Terence | last=O'Hara | date=February 11, 2005}}</ref> |

|||

On October 26, 2007, PNC acquired Yardville National Bancorp, a small commercial bank centered in central New Jersey and eastern Pennsylvania.<ref name=acquired/><ref>{{Cite press release |title=PNC Completes Acquisition Of Yardville National Bancorp |date=October 26, 2007 |publisher=PNC Financial |url=https://pnc.mediaroom.com/index.php?s=3473&item=74174}}</ref> |

|||

PNC Bank was forced to reissue hundreds of debit cards to customers in March, 2006 when their account information was compromised.<ref>{{cite news|url=http://www.usatoday.com/tech/columnist/andrewkantor/2006-03-16-debit-card_x.htm|title=USA Today|accessdate=2006-09-17 | date=March 16, 2006}}</ref> In the same month, PNC Bank was sued by Paul Bariteau who was an investor in the [[Military Channel]]. Bariteau claimed PNC let the channel’s chairman make unauthorized withdrawals of millions of dollars from the channel's account for personal use. The counter-claim is that Bariteau was only trying to recoup losses from a bad investment.<ref>{{cite web|url=http://www.courier-journal.com/apps/pbcs.dll/article?AID=/20060324/BUSINESS/603240339/1003/ARCHIVES|title=Louisville Courier-Journal|accessdate=2006-09-17}} {{Dead link|date=September 2010|bot=H3llBot}}</ref> |

|||

On September 15, 2007, PNC Bank acquired [[Citizens National Bank (Laurel, Maryland)|Citizens National Bank]] of [[Laurel, Maryland]].<ref name="NIC-citizens">{{Cite web |title=Institution History for Laurel Main Street Branch (229427) |url=https://www.ffiec.gov/nicpubweb/nicweb/InstitutionHistory.aspx?parID_RSSD=229427&parDT_END=99991231 |website=[[Federal Financial Institutions Examination Council]]}}</ref> |

|||

[[Image:Farmers and Mechanics National Bank.JPG|thumb|left|PNC Bank branch, located in [[Georgetown, Washington, D.C.|Georgetown]], Washington, D.C.]] |

|||

In April 2006, the J.D. Power Consumer Center released the results of its [[New York]] Retail Banking Satisfaction Study indicating that PNC Bank had an average number of satisfied customers.<ref>{{cite web|url=http://consumercenter.jdpower.com/cc/rd/cc/finance/ratings/banking/ny/index.asp|title=J.D. Power|accessdate=2006-09-17}}</ref> PNC has also subcontracted with [[American Express]], Discover, ABN-AMRO, and Washington Federal to do home equity loans. The operation sends out bulk mailings with offers and has a call center in Pennsylvania to handle this business. |

|||

On April 4, 2008, PNC acquired Sterling Financial Corporation, a commercial and consumer bank with accounts and branches in central Pennsylvania, northeastern Maryland and Delaware.<ref name=acquired/><ref>{{Cite press release |title=PNC Completes Acquisition of Sterling Financial Corporation |date=April 4, 2008 |publisher=PNC Financial |url=https://pnc.mediaroom.com/index.php?s=3473&item=74208}}</ref> |

|||

In the fall of 2006, PNC announced its purchase of Mercantile Bankshares, a Maryland bank with an extensive branch network throughout suburban D.C., Baltimore and northern Virginia. On September 17, 2007, PNC successfully completed the merger with Mercantile, making PNC the 8th largest bank in the United States by deposits.<ref name=Postgazette>{{cite web|url=http://www.pittsburghpostgazette.com/pg/06283/728754-28.stm|title=Pittsburgh Post-Gazette|accessdate=2006-10-27}}</ref> |

|||

On October 24, 2008, during the [[2007–2008 financial crisis]], the [[National City acquisition by PNC]] for $5.2 billion in stock was completed.<ref>{{Cite news |last=Dash |first=Eric |date=October 24, 2008 |title=PNC Gets National City in Latest Bank Acquisition |work=[[The New York Times]] |url=https://www.nytimes.com/2008/10/25/business/25bank.html |url-access=subscription}}</ref> The acquisition was financed with [[preferred stock]] sold to the [[United States Treasury]] as part of the [[Troubled Asset Relief Program]] implemented as part of the [[Emergency Economic Stabilization Act of 2008]].<ref>{{Cite news |last1=Fitzpatrick |first1=Dan |last2=Enrich |first2=David |last3=Paletta |first3=Damian |date=October 25, 2008 |title=PNC Buys National City in Bank Shakeout |work=The Wall Street Journal |url=https://www.wsj.com/articles/SB122485472991366463 |url-access=subscription}}</ref> The stock issued to the U.S. Treasury was repurchased in 2010.<ref>{{Cite news |date=February 2, 2010 |title=PNC to Repay TARP Money After Sale of Unit |work=[[The New York Times]] |url=https://dealbook.nytimes.com/2010/02/02/pnc-to-repay-tarp-money-after-sale-of-unit/}}</ref> PNC then became the 5th largest bank in the United States by deposit and fourth largest by branches.<ref>{{Cite press release |title=PNC to Acquire National City |date=October 24, 2008 |publisher=PNC Financial |url=https://pnc.mediaroom.com/index.php?s=3473&item=74230 |via=[[PR Newswire]]}}</ref><ref>{{Cite news |last=Gordon |first=Paul |date=June 22, 2010 |title=National City conversion to PNC is complete |work=[[Journal Star (Peoria)|Journal Star]] |location=Peoria, Ill |url=http://www.pjstar.com/article/20100622/News/306229856}}</ref> |

|||

On August 14, 2009, PNC took over Dwelling House Savings & Loan and its only location in Pittsburgh's [[Hill District]] after Dwelling House [[Bank failure|failed]] and was placed under receivership by the [[Federal Deposit Insurance Corporation]].<ref>{{cite news| url=http://www.post-gazette.com/pg/09226/990937-100.stm | work=Pittsburgh Post-Gazette | title=PNC to take over troubled Dwelling House | first=Len | last=Boselovic | date=August 14, 2009}}</ref> Although PNC was still in the process of integrating [[National City Corp.|National City]] into its own system at the time, the bank agreed to assume all of Dwelling House's assets, and the branch became a PNC branch on August 17. Dwelling House had been known in Pittsburgh to provide low-income [[African American]]s loans that other banks would deny, and had fended off receivership from the FDIC as recent as June 2009 through community fundraisers. PNC closed the former Dwelling House branch shortly after assuming Dwelling House's assets, with accounts transferred to the pre-existing PNC branch in the Hill District.<ref>{{cite news| url=http://www.post-gazette.com/pg/09230/991500-28.stm | work=Pittsburgh Post-Gazette | title=Dwelling House accounts moved to PNC | first=Tim | last=Grant | date=August 18, 2009}}</ref> The failure of Dwelling House is the only bank failure in [[Pennsylvania]]--a state otherwise relatively stable with banks—since the beginning of the [[financial crisis of 2007–2010]],<ref>http://www.fdic.gov/bank/individual/failed/banklist.html</ref> although two out-of-state banks with strong Pennsylvania ties (National City and [[Wachovia]]) were reportedly close to failing at the time they were acquired by PNC and [[Wells Fargo]], respectively. |

|||

On August 14, 2009, PNC took over Dwelling House Savings & Loan and its only branch location in Pittsburgh's [[Hill District]] after Dwelling House [[bank failure|failed]] and was placed in receivership by the [[Federal Deposit Insurance Corporation]] (FDIC).<ref>{{Cite news |last=Boselovic |first=Len |date=August 14, 2009 |title=PNC to take over troubled Dwelling House |work=Pittsburgh Post-Gazette |url=http://www.post-gazette.com/pg/09226/990937-100.stm}}</ref> Dwelling House had been known in Pittsburgh to provide loans to low{{En dash}}income [[African American]]s that other banks would deny. The branch was closed and accounts were transferred to the existing PNC branch in the Hill District.<ref>{{Cite news |last=Grant |first=Tim |date=August 18, 2009 |title=Dwelling House accounts moved to PNC |work=Pittsburgh Post-Gazette |url=http://www.post-gazette.com/business/businessnews/2009/08/18/Dwelling-House-accounts-moved-to-PNC/stories/200908180243}}</ref> |

|||

==Primary operations== |

|||

[[File:PNC Bank - Pennsylvania Avenue.JPG|thumb|PNC Bank branch, located in the former headquarters of [[Riggs Bank]] on [[Pennsylvania Avenue]], Washington, D.C.]] |

|||

In July 2010, PNC sold its Global Investment Servicing (GIS) subsidiary to [[The Bank of New York Mellon]] to repay funds from the [[Troubled Asset Relief Program]], which had been used for the National City acquisition (see above) in 2008.<ref>{{Cite press release |title=BNY Mellon Completes Acquisition of PNC's Global Investment Servicing Business |date=July 1, 2010 |publisher=PNC Financial |url=http://www.prnewswire.com/news-releases/bny-mellon-completes-acquisition-of-pncs-global-investment-servicing-business-97580209.html |via=PR Newswire}}</ref> GIS, established in 1973 and with 4,700 employees, was the second{{En dash}}largest full{{En dash}}service [[mutual fund]] transfer agent in the U.S and the second{{En dash}}largest full{{En dash}}service accounting and administration provider to U.S. mutual funds. GIS serviced $1.9 trillion in total assets and 58 million shareholder accounts. It was known as PFPC until July 2008.<ref>{{Cite press release |title=PFPC Becomes PNC Global Investment Servicing |date=July 14, 2008 |publisher=PNC Financial |url=https://www.businesswire.com/news/home/20080714005561/en/PFPC-PNC-Global-Investment-Servicing |via=[[Business Wire]]}}</ref> |

|||

===Retail banking=== |

|||

The corporation operates a leading community bank in its major [[markets]] and is a top-ten [[Small Business Administration]] lender. Operations include the third-largest bank [[automated teller machine]] network in the U.S. The corporation claims to operate [[natural environment|environmentally]] friendly "green" bank branches and is a major [[wealth management]] firm. |

|||

In January 2011, PNC acquired BankAtlantic's [[Tampa Bay Area]] branches.<ref>{{Cite news |last=Harrington |first=Jeff |date=January 31, 2011 |title=PNC enters Tampa Bay market, buying 19 BankAtlantic branches |work=[[Tampa Bay Times]] |url=http://www.tampabay.com/news/business/banking/pnc-enters-tampa-bay-market-buying-19-bankatlantic-branches/1148697 |access-date=April 6, 2017 |archive-date=April 7, 2017 |archive-url=https://web.archive.org/web/20170407054318/http://www.tampabay.com/news/business/banking/pnc-enters-tampa-bay-market-buying-19-bankatlantic-branches/1148697 |url-status=dead }}</ref><ref>{{Cite news |last=Sharma |first=Abhinav |date=January 31, 2011 |title=BankAtlantic to sell 19 branches to PNC Bank |work=[[Reuters]] |url=https://www.reuters.com/article/bankatlantic-pncbank/update-1-bankatlantic-to-sell-19-branches-to-pnc-bank-idINSGE70U0B320110131}}</ref> |

|||

===PNC Merchant Services=== |

|||

In 1998, PNC sold its credit card business to Metris Companies<ref name=twsDecG32>{{cite news |

|||

|title= COMPANY NEWS; METRIS TO BUY $1 BILLION IN CREDIT CARD LOANS FROM PNC |

|||

|publisher= ''The New York Times'' |

|||

|quote= The Metris Companies, a credit card concern, agreed to buy $1 billion of credit card loans from the PNC Bank Corporation... |

|||

|date= September 9, 1998 |

|||

|url= http://www.nytimes.com/1998/09/09/business/company-news-metris-to-buy-1-billion-in-credit-card-loans-from-pnc.html |

|||

|accessdate= 2010-12-07 |

|||

}}</ref> and [[MBNA]].<ref name=twsDecG34>{{cite news |

|||

|title= COMPANY NEWS; MBNA IS BUYING PNC BANK'S CREDIT CARD OPERATIONS |

|||

|publisher= ''The New York Times: Business Day'' |

|||

|quote= The MBNA Corporation, the nation's third-largest credit card lender, said yesterday that it would buy the credit card operations of the PNC Bank Corporation, which is exiting the business. MBNA will pay $443 million, a 15 percent premium, for PNC's $2.9 billion in credit card receivables. |

|||

|date= December 24, 1998 |

|||

|url= http://www.nytimes.com/1998/12/24/business/company-news-mbna-is-buying-pnc-bank-s-credit-card-operations.html |

|||

|accessdate= 2010-12-07 |

|||

}}</ref> In 2003, PNC's check cards (not credit cards), which had a ''Visa'' logo, were reportedly hacked in February, causing PNC to deactivate 16,000 cards.<ref name=twsDecG33>{{cite news |

|||

|title= PNC Bank cancels check cards following hacker incident |

|||

|publisher= ''USA Today'' |

|||

|quote= PNC Bank deactivated about 16,000 check cards tied to the Visa brand after it was notified that a hacker gained access to millions of credit card numbers nationwide by breaking into a processing company's computer system. |

|||

|date= 2003-02-21 |

|||

|url= http://www.usatoday.com/tech/news/2003-02-21-hack-attack_x.htm |

|||

|accessdate= 2010-12-07 |

|||

}}</ref> In 2006, PNC got back into the credit card business by marketing and issuing credit cards, including one for small business, under the [[MasterCard]] brand<ref name=twsDecG31>{{cite news |

|||

|author= Patricia Sabatini |

|||

|title= PNC tries new credit cards, old strategy |

|||

|publisher= ''Pittsburgh Post-Gazette'' |

|||

|quote= Starting Friday, PNC will market and issue credit cards -- including one for small businesses under the MasterCard brand -- in partnership with Minneapolis-based U.S. Bank, w... Mr. Tucillo said using U.S. Bank, a leader in the field, will help PNC control costs. |

|||

|date= August 29, 2006 |

|||

|url= http://www.post-gazette.com/pg/06241/717054-28.stm |

|||

|accessdate= 2010-12-07 |

|||

}}</ref> by using a third-party vendor to handle its credit card business,<ref name=twsDecG35>{{cite news |

|||

|author= Bill Toland |

|||

|title= PNC races to wrap up National City takeover |

|||

|publisher= ''Pittsburgh Post-Gazette'' |

|||

|quote= PNC sold its mortgage-origination business to Washington Mutual in 2002, and likewise uses a third-party vendor to issue credit cards. |

|||

|date= December 21, 2008 |

|||

|url= http://www.post-gazette.com/pg/08356/936678-28.stm |

|||

|accessdate= 2010-12-07 |

|||

}}</ref> partnering with [[Minneapolis, Minnesota|Minneapolis]]-based [[U.S. Bancorp|U.S. bank]].<ref name=twsDecG31/> PNC offers small business owners who have accounts at PNC bank a chance to let customers pay with credit cards, but requires business owners to sign three–year contracts with substantial penalties for early termination, often in excess of the standard $15 monthly fees, sometimes with criticism for lack of transparency.<ref name=twsDecG35/> PNC's director Dan Tuccillo planned to offer the service in eight states plus Washington, D.C., according to a report in the ''[[Pittsburgh Post-Gazette]]'' in 2006.<ref name=twsDecG31/> |

|||

In December 2011, PNC acquired 27 branches in the northern [[Atlanta]] suburbs with $240 million in deposits and $42 million in book value from [[Flagstar Bank]].<ref>{{Cite news |last=Peters |first=Andy |date=July 26, 2011 |title=PNC Completes Deal for Flagstar's Atlanta Branches |work=[[American Banker]] |url=https://www.americanbanker.com/news/pnc-completes-deal-for-flagstars-atlanta-branches}}</ref><ref>{{Cite news |date=July 26, 2011 |title=PNC Bank to acquire 27 metro ATL Flagstar branches |work=[[American City Business Journals|Atlanta Business Chronicle]] |url=https://www.bizjournals.com/atlanta/news/2011/07/26/pnc-bank-to-acquire-27-metro-atl.html}}</ref><ref>{{Cite press release |title=PNC Announces Agreement to Acquire 27 Branches from Flagstar |date=July 26, 2011 |publisher=PNC Financial |url=http://www.prnewswire.com/news-releases/pnc-announces-agreement-to-acquire-27-branches-from-flagstar-126206663.html |via=PR Newswire}}</ref> |

|||

===Corporate and institutional banking=== |

|||

PNC operates a top-ten [[treasury]] management business and the U.S.'s second-largest lead arranger of asset-based [[loan]] syndications. Its [[subsidiary]] [[Harris Williams & Co.]] is one of the U.S.'s largest [[mergers and acquisitions]] advisory firms for [[middle-market companies]].{{Citation needed|date=June 2011}} |

|||

In 2012, PNC acquired [[RBC Bank]] from [[Royal Bank of Canada]] for $3.45 billion.<ref name="RBC">{{Cite news |last=Delano |first=Jon |date=June 20, 2011 |title=PNC To Acquire RBC's United States Unit |work=[[CBS News]] |url=http://pittsburgh.cbslocal.com/2011/06/20/pnc-to-acquire-rbcs-united-states-unit}}</ref><ref>{{Cite news |date=June 19, 2011 |title=PNC to Buy R.B.C. Unit for $3.5 Billion |work=The New York Times |url=https://dealbook.nytimes.com/2011/06/20/pnc-agrees-to-buy-r-b-c-unit/ |url-access=subscription}}</ref><ref>{{Cite news |last=Bansal |first=Paritosh |date=June 19, 2011 |title=PNC to buy RBC unit for $3.45 billion |work=Reuters |url=https://www.reuters.com/article/us-rbc-pnc/pnc-to-buy-rbc-unit-for-3-45-billion-sources-idUSTRE75I2V520110619}}</ref> RBC Bank had a 426 branches in southern [[Virginia]], [[North Carolina]], [[South Carolina]], [[Georgia (U.S. state)|Georgia]], [[Alabama]], and [[Florida]]. Prior to the acquisition, PNC had slipped (due to mergers and growth in other firms) from its ranking following the 2008 National acquisition; this 2012 acquisition made PNC the fifth largest bank by branches behind [[Wells Fargo]], [[Bank of America]], [[Chase (bank)|Chase]], and [[U.S. Bancorp|U.S. Bank]] and the sixth largest by total assets behind the aforementioned four banks and [[Citibank]].<ref name=RBC/> |

|||

[[File:PNC footprint 2012-03.png|thumb|left|PNC footprint, as of March 2012]] |

|||

On July 30, 2012, PNC announced plans to put ATMs in 138 [[Harris Teeter]] grocery stores in the [[Carolinas]], plus 53 other stores.<ref>{{Cite press release |title=PNC Bank Expands ATM Access to 191 Harris Teeter stores |date=July 30, 2012 |publisher=PNC Financial |url=https://www.prnewswire.com/news-releases/pnc-bank-expands-atm-access-to-191-harris-teeter-stores-164244066.html |via=PR Newswire}}</ref><ref>{{Cite news |date=July 30, 2012 |title=PNC Bank adds ATMs in 191 Harris Teeter stores |work=Washington Business Journal |url=https://www.bizjournals.com/washington/breaking_ground/2012/07/pnc-bank-adds-atms-in-191-harris.html}}</ref> |

|||

===PNC Mortgage=== |

|||

'''PNC Mortgage''' (formerly '''National City Mortgage''') is the [[Mortgage loan|mortgage]] division of PNC. Acquired through the [[National City Corp.|National City]] deal, PNC Mortgage is credited with the first mortgage in the [[United States]], and has offices across the country. |

|||

In September 2014, PNC acquired Solebury Capital Group, a capital markets advisory firm, for $50 million.<ref name="Tascarella">{{Cite news |last=Tascarell |first=Patty |date=September 30, 2014 |title=PNC buying IPO consulting firm |work=Pittsburgh Business Times |url=https://www.bizjournals.com/pittsburgh/blog/financial-district/2014/09/pnc-buying-ipo-consulting-firm.html}}</ref> |

|||

This is the second mortgage division to be named PNC Mortgage. PNC had sold off the original PNC Mortgage to [[Washington Mutual]] in 2001 due to volatility in the market despite the fact that the market was in a "[[Boom and bust|boom]]" period at the time,<ref>http://www.allbusiness.com/banking-finance/banking-lending-credit-services-mortgage/6048203-1.html</ref> then subsequently [[outsourcing]] mortgages to [[Wells Fargo]] until the National City deal.<ref>{{cite press release |title=PNC Bank and Wells Fargo Home Mortgage Form Joint Venture To Make Homeownership Easier|url= http://pnc.mediaroom.com/index.php?s=43&item=364|publisher= PNC Financial Services Group, Inc.|date= 2005-09-14|accessdate=2010-06-12}}</ref> PNC has no plans to enter the [[subprime lending]] market that plagued National City Mortgage.<ref>{{cite news| url=http://www.post-gazette.com/pg/07255/816635-28.stm | work=Pittsburgh Post-Gazette | title=CEO says PNC 'not a player' in subprime loan fallout | first=Dan | last=Fitzpatrick | date=September 12, 2007}}</ref> |

|||

On October 2, 2015, the bank opened [[Tower at PNC Plaza]], its new headquarters on the corner of Fifth Avenue and Wood Street in [[downtown Pittsburgh]].<ref>{{Cite news |last=Belko |first=Mark |date=October 1, 2015 |title=PNC shows off tower, its crown jewel |work=Pittsburgh Post-Gazette |url=http://www.post-gazette.com/business/development/2015/10/01/PNC-opens-new-400-million-Downtown-headquarters-pittsburgh/stories/201510010199}}</ref> It was first announced in 2011.<ref>{{Cite press release |title=PNC Announces Plans For World's Greenest Skyscraper |date=May 23, 2011 |publisher=PNC Financial |url=http://multivu.prnewswire.com/mnr/pnc/42893/}}</ref> The [[LEED Platinum]] building, owned by PNC and designed by [[Gensler]], won awards for its [[environmentally friendly]] features.<ref>{{Cite news |last=Berg |first=Nate |date=July 15, 2016 |title=Award: The Tower at PNC Plaza |work=[[American Institute of Architects#Magazine|Architect]] |url=http://www.architectmagazine.com/awards/r-d-awards/award-the-tower-at-pnc-plaza_o}}</ref> |

|||

===PNC Global Investment Servicing=== |

|||

The corporation's Global Investment Servicing subsidiary was the second-largest full-service [[mutual fund]] transfer agent in the U.S and the second-largest full service accounting & administration provider to U.S. mutual funds. PNC Global Investment Servicing had provided services to the global investment industry since 1973. With 4,700 employees, PNC Global Investment Servicing operates from [[Republic of Ireland|Ireland]], the United States and the [[Cayman Islands]], PNC International Bank Limited operates from [[Luxembourg]]. PNC Global Investment Servicing services $1.9 trillion in total assets and 58 million shareholder accounts. In 2007 PNC Global Investment Servicing Trustee & Custodial Services Limited was awarded a banking licence by financial regulators allowing it to expand further into Europe. As a result the name changed to PNC Global Investment Servicing. PNC Global Investment Servicing was formally known as PFPC until July 2008. |

|||

In April 2017, the company acquired the U.S. equipment finance business of [[ECN Capital]] for $1.3 billion.<ref>{{Cite press release |title=ECN Capital Completes Sale of US Equipment Finance Business to PNC |date=April 3, 2017 |publisher=[[Marketwired]] |url=http://www.marketwired.com/press-release/ecn-capital-completes-sale-of-us-equipment-finance-business-to-pnc-tsx-ecn-2207246.htm}}</ref><ref>{{Cite news |last=Fleisher |first=Chris |date=September 29, 2014 |title=With acquisition, PNC set to enter IPO market |work=[[Pittsburgh Tribune-Review]] |url=http://triblive.com/business/headlines/6883328-74/pnc-advisory-services}}</ref> |

|||

On February 2, 2010, longtime crosstown rival [[The Bank of New York Mellon]] announced a definitive agreement to acquire PNC’s Global Investment Servicing.<ref>{{cite web|url=http://www.bnymellon.com/pressreleases/2010/pdf/pr020210.pdf|title=BNY Mellon to Acquire PNC’s Global Investment Servicing}}</ref> PNC sold it off in order to pay back its [[Troubled Asset Relief Program|TARP funds]], which were used to [[National City acquisition by PNC|buy]] [[National City Corp.]], which PNC at the time was still in the process of converting branches over to PNC. |

|||

In November 2017, the company acquired The Trout Group, an [[investor relations]] and strategic advisory firm servicing the [[healthcare industry]].<ref>{{Cite press release |title=PNC Bank Announces Definitive Agreement to Acquire The Trout Group, LLC |date=November 27, 2017 |publisher=PNC Financial |url=https://www.prnewswire.com/news-releases/pnc-bank-announces-definitive-agreement-to-acquire-the-trout-group-llc-300561754.html |via=PR Newswire}}</ref><ref>{{Cite news |last=Tascarella |first=Patty |date=November 27, 2017 |title=Why PNC reeled in Trout |work=Pittsburgh Business Times |url=https://www.bizjournals.com/pittsburgh/news/2017/11/27/why-pnc-reeled-in-trout.html}}</ref> |

|||

BNY Mellon closed the purchase of PNC Global Investment Servicing on July 1, 2010. |

|||

In 2018, the company acquired Fortis Advisors, which provides post{{En dash}}merger shareholder services.<ref>{{Cite press release |title=PNC Bank Announces Definitive Agreement To Acquire Fortis Advisors |date=December 20, 2017 |publisher=PNC Financial |url=https://www.prnewswire.com/news-releases/pnc-bank-announces-definitive-agreement-to-acquire-fortis-advisors-300573883.html |via=PR Newswire}}</ref><ref>{{Cite news |last=Tascarella |first=Patty |date=December 20, 2017 |title=PNC buying Fortis Advisors |work=Pittsburgh Business Times |url=https://www.bizjournals.com/pittsburgh/news/2017/12/20/pnc-buying-fortis-advisors.html}}</ref> The company ranked one hundred sixty fifth on the 2018 [[Fortune 500]] list of the largest United States corporations by revenue.<ref>{{Cite magazine |title=Fortune 500 Companies 2018: Who Made the List |url=http://fortune.com/fortune500/list |magazine=[[Fortune (magazine)|Fortune]] |language=en-US |access-date=2018-11-21 |archive-date=2019-05-02 |archive-url=https://web.archive.org/web/20190502115903/http://fortune.com/fortune500/list/ |url-status=dead }}</ref> |

|||

===BlackRock=== |

|||

PNC has an equity stake of around 21.7%<ref name="BlackRock">{{cite web |url=http://www2.blackrock.com/global/home/AboutUs/index.htm |title= About Us|publisher= BlackRock, Inc.|accessdate=2011-06-18}}</ref> in [[BlackRock]], the world's largest [[publicly traded]] asset management firm by AUM. |

|||

In 2018, PNC began opening "Solution Centers", a hybrid between traditional bank branches and ATM{{En dash}}only services, mostly serving new markets. Through this method, PNC expanded its retail footprint into [[Boston]], [[Denver]], [[Kansas City, Missouri|Kansas City]], [[Nashville]], and several markets in Texas including [[Austin, Texas|Austin]], [[Dallas]], [[Houston]], and [[San Antonio]].<ref name="Solution Centers" /> Two of PNC's [[Big Four (banking)|"Big Four"]] competitors, [[Bank of America]] and [[Chase Bank]], have both also been expanding into new markets through this method, including into PNC's home market of Pittsburgh. |

|||

===Midland Loan Services=== |

|||

Midland Loan Services is a third-party provider of service and technology for the commercial real estate finance industry. It specializes in commercial loan and [[Commercial mortgage-backed security|CMBS]] portfolio servicing. Founded in 1991, its headquarters are in [[Overland Park, Kansas]]. |

|||

In August 2019, PNC launched a [[Fintech]] incubator subsidiary called "numo" that functions as an internal startup. Its first development included indi, an instant payment and mobile banking company for gig workers.<ref>{{Cite magazine |last=Groenfeldt |first=Tom |date=August 29, 2019 |title=PNC Launches A Fintech Startup Inside The Bank |url=https://www.forbes.com/sites/tomgroenfeldt/2019/08/29/pnc-launches-a-fintech-startup-inside-the-bank/ |magazine=[[Forbes]] |language=en |access-date=2021-12-10}}</ref> |

|||

==Community initiatives== |

|||

The corporation has sponsored a number of initiatives to improve [[education]], [[health]] and human services, and [[cultural]] and [[the arts|arts]] activities. These include a "PNC Grow Up Great" commitment to early childhood development, the "PNC Foundation", and community development investments.<ref>{{cite web |url= http://www.pncgrowupgreat.com/about/index.html|title=About PNC Grow Up Great|year= 2010|publisher=PNC Financial Services Group, Inc|accessdate=2010-06-12}}</ref> |

|||

In May 2020, the company sold its stake in [[BlackRock]].<ref>{{Cite news |last=Sabatini |first=Patricia |date=May 15, 2020 |title=PNC sells Blackrock stake for $14.4 billion |work=Pittsburgh Post-Gazette |url=https://www.post-gazette.com/business/pittsburgh-company-news/2020/05/15/PNC-sells-Blackrock-stake-for-14-4-billion/stories/202005150123}}</ref> |

|||

Since 1984, PNC Financial Services has compiled the [[Christmas Price Index]], a humorous [[economic indicator]] which estimates the prices of the items found in the song [[The Twelve Days of Christmas]]. |

|||

On June 1, 2021, PNC acquired [[BBVA USA]] for $11.6 billion in cash.<ref>{{Cite news |date=November 16, 2020 |title=PNC to buy BBVA's U.S. banking arm for $11.6 billion in cash |work=Reuters |url=https://www.reuters.com/article/us-bbva-usa-m-a-pnc-finl-svc-cash-idUKKBN27W0JN}}</ref> The acquisition significantly boosted its presence in Colorado and Texas, complemented its presence in Alabama and Florida, and introduced the bank to the [[Arizona]], [[California]], and [[New Mexico]] markets.<ref>{{Cite web |last=Cocheo |first=Steve |date=November 18, 2020 |title=PNC to Vault to #5 Ahead of U.S. Bank in BBVA Deal Embracing Branches |url=https://thefinancialbrand.com/104331/pnc-bbva-merger-acquisition-branch-expansion-trend-digital-demchak/ |website=The Financial Brand}}</ref> |

|||

==Controversy== |

|||

{{Criticism section|date=April 2011}} |

|||

{{Unreferenced section|date=May 2011}} |

|||

In regard to PNC's Midland Loan Services, in late 2001 commercial mortgage loans held by First Chicago Capital Corporation were transferred to Midland Loan Services and Lennar Partners, Miami, Florida. Lennar Partners [Arne L. Shulkin], on behalf of Midland, proceeded to declare commercial loans in default by calling in such loans for full payment, without giving borrowers ample opportunity to secure new financing. Most borrowers had been previously assured by Midland that their loans would continue as they had prior to the acquisition of First Chicago Capital Corporation. When borrowers made their usual mortgage payment to Midland, they soon after received notices of default and foreclosure. |

|||

In 2021, PNC originated nearly 95,000 mortgages worth $34.8 billion.<ref>{{Cite web |title=PNC Bank Mortgages |url=https://originationdata.com/institution/AD6GFRVSDT01YPT1CS68 |access-date=October 23, 2022}}</ref> This is a 23% increase vs prior year and stands as their highest origination volume to date. |

|||

In October 2011, PNC temporarily closed two of its branches in [[Downtown Pittsburgh]] as a result of protesters going into those branches to protest. The protesters were part of the [[Occupy Wall Street]] movement.<ref>http://www.wnep.com/sns-ap-pa--wallstreetprotest-pittsburgh,0,1272125.story</ref> |

|||

==Legal issues== |

|||

== Notable corporate buildings == |

|||

===Overcharging of Black and Hispanic borrowers by National City=== |

|||

* The [[Tower at PNC Plaza]] in [[Pittsburgh|Pittsburgh, PA]]<ref name="multivu.prnewswire.com"/> |

|||

In December 2013, the Department of Justice and the Consumer Financial Protection Bureau announced that they had reached an agreement with National City Bank to resolve allegations that the bank had charged Black and Hispanic borrowers higher prices for mortgages between 2002 and 2008, before the acquisition by PNC. Regulators claimed that National City had violated the [[Fair Housing Act]] and [[Equal Credit Opportunity Act]] by charging more than 75,000 borrowers higher loan rates based on their race or ethnicity rather than their risk level. National City's lack of pricing guidelines resulted in black borrowers being charged an average of $159 more in extra upfront fees or higher interest than white borrowers. Black borrowers also paid an average of $228 more annually over the life of the loan than white borrowers. Hispanics paid $125 more upfront and $154 more annually than white borrowers. Under the terms of the settlement, PNC was required to pay victims $35 million.<ref>{{Cite press release |title=CFPB and DOJ Take Action Against National City Bank for Discriminatory Mortgage Pricing |date=December 23, 2013 |publisher=[[Consumer Financial Protection Bureau]] |url=http://www.consumerfinance.gov/about-us/newsroom/cfpb-and-doj-take-action-against-national-city-bank-for-discriminatory-mortgage-pricing/}}</ref> |

|||

:: Future corporate headquarters |

|||

:: Site preparation to begin in fall 2011, with construction to start in spring 2012 and finish in summer 2015 |

|||

*[[One PNC Plaza]] in Pittsburgh, PA |

|||

:: Current corporate headquarters |

|||

*[[Two PNC Plaza]] in Pittsburgh, PA |

|||

*[[Three PNC Plaza]] in Pittsburgh, PA |

|||

*[[U.S. Steel Tower]] in Pittsburgh, PA |

|||

:: PNC is currently a major tenant |

|||

*[[PNC Bank Building]] at 1600 Market Street, [[Philadelphia|Philadelphia, PA]] |

|||

*[[Eastwick Operations Center]], Philadelphia, PA |

|||

*[[PNC Bank Building (Washington, D.C.)|PNC Bank Building]] in [[Washington, D.C.|Washington, DC]] |

|||

*[[PNC Bank Building (Columbus)|PNC Bank Building]] in [[Columbus, Ohio|Columbus, OH]] |

|||

*[[PNC Center (Akron)|PNC Center]] in [[Akron, Ohio|Akron, OH]] |

|||

*[[PNC Center (Cincinnati)|PNC Center]] in [[Cincinnati|Cincinnati, OH]] |

|||

*[[PNC Center (Cleveland)|PNC Center]] in [[Cleveland|Cleveland, OH]] |

|||

:: Former headquarters of National City Bank |

|||

*[[PNC Center (Indianapolis)|PNC Center]] in [[Indianapolis, Indiana|Indianapolis, IN]] |

|||

*[[PNC Plaza]] in [[Louisville, Kentucky|Louisville, KY]] |

|||

*[[PNC Tower]] in Cincinnati, OH |

|||

*[[National City Tower]] in Louisville, KY |

|||

:: PNC is a major tenant |

|||

*[[Top of Troy]] in [[Troy, Michigan|Troy, MI]] |

|||

:: PNC is a major tenant |

|||

*PNC Bank Building in [[Orlando, Florida|Orlando, FL]][http://www.costar.com/News/Article/PNC-Bank-Moves-to-Capital-Plaza-One-in-Orlando/121815?ref=1&src=rss] at Capital Plaza One - 201 E. Pine Street. |

|||

=== Retailer breach forced PNC to reissue customer cards === |

|||

== Naming rights == |

|||

In March 2006, PNC and other large banks were forced to reissue hundreds of debit cards to customers after card numbers were disclosed by a breach at an unspecified retailer.<ref>{{Cite news |last=Kantor |first=Andrew |date=March 16, 2006 |title=USA Today Cyberspeak |work=[[USA Today]] |url=https://usatoday30.usatoday.com/tech/columnist/andrewkantor/2006-03-16-debit-card_x.htm}}</ref> |

|||

PNC owns corporate [[naming rights]] to the following: |

|||

*[[PNC Park]], home of the [[Pittsburgh Pirates]] baseball team |

|||

===Lawsuit from Military Channel=== |

|||

*[[PNC Field]], home of the [[Scranton/Wilkes-Barre Yankees]] AAA baseball team |

|||

Also in March 2006, PNC Bank was sued by Paul Bariteau, an investor in the [[Military Channel]]. Bariteau claimed PNC let the chairman of the Military Channel make unauthorized withdrawals of millions of dollars from the company's account for personal use.<ref>{{Cite web |date=October 30, 2006 |title=BARITEAU V. PNC FINANCIAL SERVICES GROUP, INC. (W.D.KY. 10-30-2006) |url=https://casetext.com/case/bariteau-v-pnc-financial-services-group |website=casetext}}</ref> |

|||

*[[PNC Bank Arts Center]] in [[Holmdel Township, New Jersey]] |

|||

*[[PNC Arena]] in [[Raleigh, NC]]. Home of the NHL's [[Carolina Hurricanes]] and the [[NC State]] men's basketball team |

|||

===Securities fraud settlement=== |

|||

[[File:PNC Center, Troy, MI.jpg|thumb|[[PNC Center (Troy, Michigan)|PNC Center]], [[Troy, Michigan]]]] |

|||

In June 2003, PNC Bank agreed to pay $115 million to settle federal securities fraud charges after one of its subsidiaries fraudulently transferred $762 million in bad loans and other venture capital investments to an AIG entity in order to conceal them from investors.<ref>{{Cite news |date=November 24, 2004 |title=AIG Agrees to Settle Fraud Cases |work=[[Los Angeles Times]] |agency=[[Associated Press]] |url=https://www.latimes.com/archives/la-xpm-2004-nov-24-fi-aig24-story.html}}</ref> |

|||

===Overtime claim by loan officers=== |

|||

In 2017, PNC agreed to pay $16 million to settle claims of overtime wages by loan officers under the [[Fair Labor Standards Act]].<ref>{{Cite news |last=Lee |first=Suevon |date=January 5, 2017 |title=APNC To Pay $16M To Settle Loan Officers' Wage Claims |work=[[Law360]] |url=https://www.law360.com/articles/878133/pnc-to-pay-16m-to-settle-loan-officers-wage-claims}}</ref> |

|||

===National Prearranged Services fraud=== |

|||

According to a lawsuit, funds entrusted to National Prearranged Services (NPS), a St. Louis{{En dash}}based company that sold prepaid funerals, were diverted and embezzled. PNC Bank is the successor to Allegiant Bank, which served as a trustee for NPS from 1998 to 2004. In 2015, a jury ordered PNC to pay $391 million.<ref>{{Cite news |last=Kurane |first=Supriya |date=March 10, 2015 |title=U.S. jury orders PNC Bank to pay $391 million in funeral scam case |work=Reuters |url=https://www.reuters.com/article/us-pnc-bank-settlement/u-s-jury-orders-pnc-bank-to-pay-391-million-in-funeral-scam-case-idUSKBN0M60CG20150310}}</ref> In 2017, a federal judge overturned the decision.<ref>{{Cite news |last=Patrick |first=Robert |date=August 17, 2017 |title=Federal appeals court overturns $491 million jury award in prepaid funeral company fraud |work=[[St. Louis Post-Dispatch]] |url=http://www.stltoday.com/news/local/crime-and-courts/federal-appeals-court-overturns-million-jury-award-in-prepaid-funeral/article_0c9768e3-a6be-51be-ad46-9a820d043639.html}}</ref> |

|||

===Municipal bonds disclosure violations=== |

|||

In 2015, PNC was one of 22 companies that violated disclosure requirements for [[municipal bond]]s by failing to divulge that the issuers had filed late financial reports. It was fined $500,000.<ref>{{Cite press release |title=SEC Sanctions 22 Underwriting Firms for Fraudulent Municipal Bond Offerings |date=September 30, 2015 |publisher=Securities and Exchange Commission |url=https://www.sec.gov/news/pressrelease/2015-220.html}}</ref> |

|||

==Controversies== |

|||

===Funding of mountaintop removal mining=== |

|||

Beginning in 2010, until it changed its policy in February 2015, PNC was the subject of protests by the Earth Quaker Action Team, led by [[George Lakey]], and the [[Rainforest Action Network]] due to its funding of companies engaged in [[mountaintop removal mining]] in [[Appalachia]]. The protests included [[political demonstration]]s at branches and offices and the [[annual general meeting]], fasting, and boycotts.<ref>{{Cite news |date=May 7, 2012 |title=Quaker group, walking from Philadelphia to Pittsburgh, protests in front of PNC Bank |work=[[The Patriot-News]] |url=https://www.pennlive.com/midstate/2012/05/quaker_group_walking_from_phil.html}}</ref><ref>{{Cite news |last=Sorkin |first=Andrew Ross |date=March 10, 2015 |title=A New Tack in the War on Mining Mountains |work=[[The New York Times]] |url=https://www.nytimes.com/2015/03/10/business/dealbook/pnc-joins-banks-not-financing-mountaintop-coal-removal.html |authorlink=Andrew Ross Sorkin}}</ref> |

|||

===Cancelling MxM News Financial Accounts=== |

|||

On Mar 2, 2023, [[Donald Trump Jr.]], cofounder of news aggregator MxM News, tweeted that PNC had abruptly cancelled all financial services for MxM without explanation.<ref>{{Cite news |date=March 2, 2023 |title=Donald Trump Jr Twitter account |url=https://twitter.com/DonaldJTrumpJr/status/1631414696501706754}}</ref> Trump and cofounder Taylor Budowich alleged that PNC disapproved of Trump’s political leanings since no reason was given for the closure. PNC claimed it was a “good faith error” and reopened the account.<ref>{{Cite news |date=March 3, 2023 |title=PNC Bank reopens Donald Trump Jr's MxM News app account, blames 'good faith error' |url=https://www.msn.com/en-us/news/politics/pnc-bank-reopens-donald-trump-jrs-mxm-news-app-account-blames-good-faith-error/ar-AA18bMQe}}</ref> |

|||

==Notable corporate buildings== |

|||

<!-- To be listed below, buildings must be notable enough to have Wikipedia articles --> |

|||

[[File:PNC headquarters.jpg|thumb|upright|[[One PNC Plaza]]. PNC's former corporate headquarters in [[Downtown Pittsburgh]].]] |

|||

[[File:Freeport, Pennsylvania (4884055568).jpg|thumb|right|200px|Outside a branch in [[Freeport, Pennsylvania]].]] |

|||

* The [[Tower at PNC Plaza]] in [[Pittsburgh, Pennsylvania]] (current corporate headquarters) |

|||

* [[One PNC Plaza]] in Pittsburgh, Pennsylvania |

|||

* [[Two PNC Plaza]] in Pittsburgh, Pennsylvania |

|||

* [[Three PNC Plaza]] in Pittsburgh, Pennsylvania |

|||

* [[U.S. Steel Tower]] in Pittsburgh, Pennsylvania (PNC is a major tenant) |

|||

* [[PNC Bank Building (Philadelphia)|PNC Bank Building]] at 1600 Market Street, [[Philadelphia, Pennsylvania]] |

|||

* [[PNC Bank Building (Columbus, Ohio)|PNC Bank Building]] in [[Columbus, Ohio]] |

|||

* [[PNC Bank Building (Toledo, Ohio)|PNC Bank Building]] in [[Toledo, Ohio]] |

|||

* [[PNC Bank Building (Washington, D.C.)|PNC Bank Building]] in [[Washington, D.C.]] |

|||

* [[PNC Center (Cincinnati)|PNC Center]] in [[Cincinnati, Ohio]] |

|||

* [[PNC Center (Cleveland)|PNC Center]] in [[Cleveland, Ohio]] (former headquarters of [[National City Corp.]]) |

|||

* PNC Center and [[Hyatt Regency Indianapolis]] in [[Indianapolis, Indiana]] |

|||

* [[PNC Center (Troy, Michigan)|PNC Center]] in [[Troy, Michigan]] |

|||

* [[500 West Jefferson|PNC Plaza]] in [[Louisville, Kentucky]] |

|||

* [[PNC Plaza (Raleigh)|PNC Plaza]] in [[Raleigh, North Carolina]] |

|||

* [[Fourth and Vine Tower|PNC Tower]] in [[Cincinnati, Ohio]] |

|||

* [[PNC Tower (Louisville)|PNC Tower]] in [[Louisville, Kentucky]] (PNC is a major tenant) |

|||

* [[One Tampa City Center]] in [[Tampa, Florida]] (PNC holds the naming rights and is a major tenant) |

|||

* [[American Airlines Center#PNC Plaza|PNC Plaza]] in [[Dallas, Texas]] |

|||

<gallery align="center" widths="200px" heights="200px"> |

|||

File:3 pnc plaza.jpg|[[Three PNC Plaza]], Pittsburgh, Pennsylvania |

|||

File:Two PNC Plaza.jpg|[[Two PNC Plaza]], Pittsburgh, Pennsylvania |

|||

File:PNC Tower new.JPG|[[Fourth and Vine Tower|PNC Tower]], [[Cincinnati, Ohio]] |

|||

File:Rbcplaza.JPG|[[PNC Plaza (Raleigh)|PNC Plaza]], [[Raleigh, North Carolina]] |

|||

File:PNC Plaza.JPG|[[500 West Jefferson|PNC Plaza]], [[Louisville, Kentucky]] |

|||

File:PNClev.jpg|[[PNC Center (Cleveland)|PNC Center]], [[Cleveland, Ohio]] |

|||

File:WTP D10 AMP 1.jpg|[[PNC Bank Building (Philadelphia)|PNC Bank Building]], [[Philadelphia, Pennsylvania]] |

|||

File:PNCColumbus.JPG|[[PNC Bank Building (Columbus)|PNC Bank Building]], [[Columbus, Ohio]] |

|||

File:USA-Cincinnati-PNC Center.JPG|[[PNC Center (Cincinnati)|PNC Center]], [[Cincinnati, Ohio]] |

|||

File:National City Bank Building, Toledo.JPG|[[PNC Bank Building (Toledo, Ohio)|PNC Bank Building]], [[Toledo, Ohio]] |

|||

</gallery> |

|||

==Naming rights and sponsorships== |

|||

{{div col}}PNC owns corporate [[naming rights]] to the following: |

|||

* [[PNC Park]], a [[ballpark]] in [[Pittsburgh, Pennsylvania]], home of the [[MLB]]'s [[Pittsburgh Pirates]]. |

|||

* [[PNC Field]], a [[ballpark]] in [[Moosic, Pennsylvania]], home of the [[Scranton/Wilkes-Barre RailRiders]] the [[Triple-A (baseball)|Triple-A]] [[minor league baseball]] affiliate of the [[New York Yankees]]. |

|||

* [[PNC Bank Arts Center]], an [[outdoor amphitheatre]] in [[Holmdel Township, New Jersey]]. |

|||

* [[PNC Music Pavilion]], an [[outdoor amphitheatre]] in [[Charlotte, North Carolina]]. |

|||

* PNC Sports Complex at the [[Knott Arena]] in [[Emmitsburg, Maryland]], home of the [[Mount St. Mary's Mountaineers]] [[Mount St. Mary's Mountaineers men's basketball|men's basketball]] and [[Mount St. Mary's Mountaineers women's basketball|women's basketball]] teams.<ref>{{Cite news |last=Bernstein |first=Rachel |date=August 21, 2011 |title=PNC Gets Naming Rights for Mount St Mary's Sports Complex |work=[[Daily Record (Maryland)|Daily Record]] |location=[[Baltimore]] |url=http://thedailyrecord.com/2011/08/21/pnc-gets-naming-rights-for-mount-st-mary’s-sports-complex/}}</ref> |

|||

* [[American Airlines Center|PNC Plaza]] at the [[American Airlines Center]] in [[Dallas, Texas]], home of the [[NBA]]'s [[Dallas Mavericks]], and [[NHL]]'s [[Dallas Stars]].<ref>{{Cite press release |title=Stars, American Airlines Center, PNC Bank announce multi-year partnership |date=December 1, 2020 |publisher=National Hockey League |url=https://www.nhl.com/stars/news/dallas-stars-american-airlines-center-pnc-bank-announce-multi-year-partnership/c-319737284}}</ref> |

|||

{{div col end}} |

|||

PNC is a sponsor of the following: |

|||

{{div col}} |

|||

* [[American Airlines Center]] {{En dash}} Official Partner of the American Airlines Center. |

|||

* [[Carolina Hurricanes]] {{En dash}} Official Bank of the Carolina Hurricanes. |

|||

* [[Chicago Bears]] {{En dash}} Official Bank of the Chicago Bears. |

|||

* [[Chip Ganassi Racing]] {{En dash}} Primary sponsor on the No. 9 [[Dallara DW12]]-[[Honda]] of driver [[Scott Dixon]] in the [[NTT IndyCar Series]]. |

|||

* [[Cincinnati Reds]] {{En dash}} Official Bank of the Cincinnati Reds. |

|||

* [[Dallas Stars]] {{En dash}} Official Partner of the Dallas Stars. |

|||

* [[NASCAR]] {{En dash}} Official Bank of NASCAR |

|||

* [[North Carolina State University]] {{En dash}} Official Bank of North Carolina State. |

|||