Social insurance number: Difference between revisions

SixTwoEight (talk | contribs) →Geography: add reference for temporary residents starting with 9 |

|||

| (45 intermediate revisions by 28 users not shown) | |||

| Line 1: | Line 1: | ||

{{Short description|9-digit number issued to Canadian residents}} |

|||

| ⚫ | |||

{{About|the Canadian SIN|other uses|Social insurance|and|National identification number}} |

|||

| ⚫ | |||

| ⚫ | |||

| ⚫ | |||

A '''social insurance number (SIN)''' is a number issued in |

A '''social insurance number (SIN)''' ({{langx|fr|numéro d'assurance sociale}} (NAS)) is a number issued in Canada to administer various government programs. The SIN was created in 1964 to serve as a client account number in the administration of the [[Canada Pension Plan]] and Canada's varied employment insurance programs. In 1967, Revenue Canada (now the [[Canada Revenue Agency]]) started using the SIN for tax reporting purposes. SINs are issued by [[Employment and Social Development Canada]] (previously [[Human Resources Development Canada]]). |

||

The SIN is formatted as three groups of three digits (e.g., 123-456-789). |

The SIN is formatted as three groups of three digits (e.g., 123-456-789). |

||

| Line 11: | Line 13: | ||

* Employment and Immigration Canada |

* Employment and Immigration Canada |

||

* Human Resources Development Canada |

* Human Resources Development Canada |

||

* Government of Canada |

* [[Government of Canada]] |

||

The [[2012 Canadian federal budget]] contained provisions to phase out the Social Insurance Number cards because they lacked modern security features and could be used for [[identity theft]].<ref>{{cite news |url=https://www.theglobeandmail.com/news/politics/ottawa-notebook/your-wallet-just-got-a-bit-lighter-ottawa-nixes-sin-cards/article4178723/ |title=Your wallet just got a bit lighter: Ottawa nixes SIN cards |last=Curry |first=Bill |newspaper=[[The Globe and Mail]] |date=15 May 2012 |accessdate=12 February 2020}}</ref> As of 31 March 2014, [[Service Canada]] no longer issues plastic SIN cards. Instead, an individual will receive a paper "Confirmation of SIN letter |

The [[2012 Canadian federal budget]] contained provisions to phase out the Social Insurance Number cards because they lacked modern security features and could be used for [[identity theft]].<ref>{{cite news |url=https://www.theglobeandmail.com/news/politics/ottawa-notebook/your-wallet-just-got-a-bit-lighter-ottawa-nixes-sin-cards/article4178723/ |title=Your wallet just got a bit lighter: Ottawa nixes SIN cards |last=Curry |first=Bill |newspaper=[[The Globe and Mail]] |date=15 May 2012 |accessdate=12 February 2020}}</ref> As of 31 March 2014, [[Service Canada]] no longer issues plastic SIN cards. Instead, an individual will receive a paper "Confirmation of SIN" letter.<ref>{{cite web |title=Social Insurance Number – Overview |url=https://www.canada.ca/en/employment-social-development/services/sin.html |website=Canada.ca |publisher=Employment and Social Development |accessdate=12 February 2020 |date=28 June 2019}}</ref> |

||

==Functionality== |

==Functionality== |

||

Through [[functionality creep]], the SIN has become a [[national identification number]], in much the same way that the [[Social Security number |

Through [[functionality creep]], the SIN has become a [[national identification number]], in much the same way that the [[Social Security number]] has in the United States. However, unlike in the US, in Canada there are specific legislated purposes for which a SIN can be requested. It is not an [[identity document]].<ref>{{cite web|url=http://www.servicecanada.gc.ca/eng/sin/employers/responsibilities.shtml|title=Information for Employers|publisher=[[Service Canada]]|date=3 December 2006}}</ref> |

||

Unless an organization can demonstrate that the reason it is requesting an individual's SIN is specifically permitted by law, or that no alternative identifiers would suffice to complete the transaction, it cannot deny or refuse a product or service on the grounds of a refusal to provide a SIN. Examples of organizations that legitimately require a SIN include employers, financial institutions that provide interest on deposits, and federal government agencies. Giving a SIN when applying for consumer credit, such as buying a car or electronics, or allowing it to be used as a general purpose identification number, such as by a cable company, is strongly discouraged.<ref>{{cite web |url=http://www.servicecanada.gc.ca/eng/sin/protect/provide.shtml |title=Protecting your SIN: Who can ask for my SIN |publisher=User guidance document from Service Canada website}}</ref> |

Unless an organization can demonstrate that the reason it is requesting an individual's SIN is specifically permitted by law, or that no alternative identifiers would suffice to complete the transaction, it cannot deny or refuse a product or service on the grounds of a refusal to provide a SIN. Examples of organizations that legitimately require a SIN include employers, financial institutions that provide interest on deposits, and federal government agencies. Giving a SIN when applying for consumer credit, such as buying a car or electronics, or allowing it to be used as a general purpose identification number, such as by a cable company, is strongly discouraged.<ref>{{cite web |url=http://www.servicecanada.gc.ca/eng/sin/protect/provide.shtml |title=Protecting your SIN: Who can ask for my SIN |date=12 November 2020 |publisher=User guidance document from Service Canada website}}</ref> |

||

The Canadian military used the SIN as a form of unique identifier from the 1960s until the 1980s, when service numbers were reintroduced. Military identification, including ID cards and [[dogtag|identity discs]] were marked with the SIN during this period. |

The Canadian military used the SIN as a form of unique identifier from the 1960s until the 1980s, when service numbers were reintroduced. Military identification, including ID cards and [[dogtag|identity discs]] were marked with the SIN during this period. |

||

==Temporary SINs== |

==Temporary SINs== |

||

Social Insurance Numbers that begin with the number "9" are issued to [[ |

Social Insurance Numbers that begin with the number "9" are issued to [[Temporary residency in Canada|temporary residents who are not Canadian citizens]] or [[Permanent residency in Canada|Canadian permanent residents]] (e.g., foreign students, individuals on work [[visa (document)|visas]]). Often, these individuals must have an employment authorization in order to work in Canada. SINs beginning with a "9" are different from SINs assigned to citizens and permanent residents, because they have an expiry date (which usually coincides with the expiration of the holder's work permit). These SINs are invalid unless there is an expiry date listed on the card and the date has not passed. |

||

== Permanent |

== Permanent resident SINs == |

||

* Issued by |

* Issued by the federal government to each Canadian citizen or permanent resident; |

||

* The SIN is unique and assigned to only one citizen |

* The SIN is unique and assigned to only one citizen |

||

| Line 33: | Line 35: | ||

Social Insurance Numbers can be validated through a simple check digit process called the [[Luhn algorithm]]. |

Social Insurance Numbers can be validated through a simple check digit process called the [[Luhn algorithm]]. |

||

046 454 286 <--- A fictitious, but valid SIN |

046 454 286 <--- A fictitious, but valid, SIN. |

||

121 212 121 <--- Multiply |

121 212 121 <--- Multiply every second digit by 2. |

||

The result of the multiplication is: |

|||

0 8 6 8 5 8 2 16 6 |

0 8 6 8 5 8 2 16 6 |

||

Then, add all of the digits together (note that 16 is 1+6): |

Then, add all of the digits together (note that 16 is summed as the individual digits 1+6): |

||

0 + 8 + 6 + 8 + 5 + 8 + 2 + 1+6 + 6 = 50 |

0 + 8 + 6 + 8 + 5 + 8 + 2 + 1+6 + 6 = 50 |

||

| Line 48: | Line 50: | ||

==Geography== |

==Geography== |

||

The first digit of a SIN usually identifies the province in which it was registered, as listed below. However, the government has found it necessary in the past to supply certain regions with |

The first digit of a SIN usually identifies the province in which it was registered, as listed below. However, the government has found it necessary in the past to supply certain regions with SINs assigned to other regions. {{Citation needed|reason=No Reliable Source|date=June 2014}} |

||

:1: [[Nova Scotia]], [[New Brunswick]], [[Prince Edward Island]], and [[Newfoundland and Labrador]] |

:1: [[Nova Scotia]], [[New Brunswick]], [[Prince Edward Island]], and [[Newfoundland and Labrador]]; new Ontario SINs are now being issued with the 1 series |

||

:2–3: [[Quebec]] |

:2–3: [[Quebec]] |

||

:4–5: [[Ontario]] (excluding [[Northwestern Ontario]]), and overseas forces |

:4–5: [[Ontario]] (excluding [[Northwestern Ontario]]), and overseas forces |

||

:6: [[Northwestern Ontario]], [[Manitoba]], [[Saskatchewan]], [[Alberta]], [[Northwest Territories]], and [[Nunavut]] |

:6: [[Northwestern Ontario]], [[Manitoba]], [[Saskatchewan]], [[Alberta]], [[Northwest Territories]], and [[Nunavut]] |

||

:7: [[British Columbia]], [[Yukon]], and new business numbers. |

:7: [[British Columbia]], [[Yukon]], and new business numbers. |

||

:8: Used exclusively for the BN (Business Number) assigned to business owners and corporations. Due to the limited number of BNs available new BNs can start with a 7. |

:8: Used exclusively for the BN (Business Number) assigned to business owners and corporations. Due to the limited number of BNs available, new BNs can start with a 7. |

||

:9: Temporary resident<ref>{{Cite web|last=Canada|first=Employment and Social Development|date=2016-06-13|title=Social Insurance Number that begins with a |

:9: Temporary resident<ref>{{Cite web|last=Canada|first=Employment and Social Development|date=2016-06-13|title=Social Insurance Number that begins with a "9"|url=https://www.canada.ca/en/employment-social-development/programs/sin/temporary.html|access-date=2020-09-25|website=Canada.ca}}</ref> |

||

:0: CRA-assigned |

:0: CRA-assigned individual tax numbers, temporary tax numbers or adoption tax numbers |

||

==See also== |

==See also== |

||

* [[National Insurance number]] (NINO) – British equivalent |

|||

* [[Canada Revenue Agency]] |

|||

* [[Death Master File]], a database of deaths maintained by the Social Security Administration in the |

* [[Death Master File]], a database of deaths maintained by the Social Security Administration in the US |

||

* [[Service number#Canada|Canada service numbers]], military identification numbers for the Canadian Armed Forces introduced in the 1990s. |

|||

* [[Government of Canada]] |

|||

* [[National identification number]] |

|||

* [[Service number (United States armed forces)|Service number]] (formerly used by the U.S. armed forces, which now use the Social Security number) |

|||

==References== |

==References== |

||

| Line 70: | Line 70: | ||

==External links== |

==External links== |

||

*[ |

*[https://www.canada.ca/en/employment-social-development/services/sin/apply.html Social Insurance Number – Overview] at the [[Government of Canada]] |

||

*[https://www.canada.ca/en/employment-social-development/services/sin/reports/code-of-practice.html The Social Insurance Number (SIN) Code of Practice] at the Government of Canada |

|||

| ⚫ | |||

*[https://www.tbs-sct.canada.ca/pol/doc-eng.aspx?id=13342 Directive on Social Insurance Number] at the Government of Canada |

|||

*[https://laws.justice.gc.ca/eng/regulations/SOR-2013-82/FullText.html Social Insurance Number Regulations] at [[Department of Justice (Canada)|Department of Justice]] |

|||

*[https://www.priv.gc.ca/en/privacy-topics/sins-and-drivers-licences/social-insurance-numbers/02_05_d_21/ Best Practices for the use of Social Insurance Numbers in the private sector] at the office of the [[Privacy Commissioner of Canada]] |

|||

*[https://www.canada.ca/en/employment-social-development/services/sin/protection.html Protecting your SIN] at the Government of Canada |

|||

*[https://www.priv.gc.ca/en/privacy-topics/sins-and-drivers-licences/social-insurance-numbers/protecting-your-social-insurance-number/ Protecting your Social Insurance Number] at the office of the Privacy Commissioner of Canada |

|||

| ⚫ | |||

{{National identification numbers}} |

{{National identification numbers}} |

||

| Line 80: | Line 86: | ||

[[Category:National identification numbers]] |

[[Category:National identification numbers]] |

||

[[Category:Social security in Canada]] |

[[Category:Social security in Canada]] |

||

[[Category:Employment and Social Development Canada]] |

|||

Latest revision as of 15:36, 24 October 2024

This article needs additional citations for verification. (February 2011) |

A social insurance number (SIN) (French: numéro d'assurance sociale (NAS)) is a number issued in Canada to administer various government programs. The SIN was created in 1964 to serve as a client account number in the administration of the Canada Pension Plan and Canada's varied employment insurance programs. In 1967, Revenue Canada (now the Canada Revenue Agency) started using the SIN for tax reporting purposes. SINs are issued by Employment and Social Development Canada (previously Human Resources Development Canada).

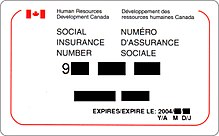

The SIN is formatted as three groups of three digits (e.g., 123-456-789).

The top of the card has changed over the years as the departments that are responsible for the card have changed:

- Manpower and Immigration

- Employment and Immigration Canada

- Human Resources Development Canada

- Government of Canada

The 2012 Canadian federal budget contained provisions to phase out the Social Insurance Number cards because they lacked modern security features and could be used for identity theft.[1] As of 31 March 2014, Service Canada no longer issues plastic SIN cards. Instead, an individual will receive a paper "Confirmation of SIN" letter.[2]

Functionality

[edit]Through functionality creep, the SIN has become a national identification number, in much the same way that the Social Security number has in the United States. However, unlike in the US, in Canada there are specific legislated purposes for which a SIN can be requested. It is not an identity document.[3]

Unless an organization can demonstrate that the reason it is requesting an individual's SIN is specifically permitted by law, or that no alternative identifiers would suffice to complete the transaction, it cannot deny or refuse a product or service on the grounds of a refusal to provide a SIN. Examples of organizations that legitimately require a SIN include employers, financial institutions that provide interest on deposits, and federal government agencies. Giving a SIN when applying for consumer credit, such as buying a car or electronics, or allowing it to be used as a general purpose identification number, such as by a cable company, is strongly discouraged.[4]

The Canadian military used the SIN as a form of unique identifier from the 1960s until the 1980s, when service numbers were reintroduced. Military identification, including ID cards and identity discs were marked with the SIN during this period.

Temporary SINs

[edit]Social Insurance Numbers that begin with the number "9" are issued to temporary residents who are not Canadian citizens or Canadian permanent residents (e.g., foreign students, individuals on work visas). Often, these individuals must have an employment authorization in order to work in Canada. SINs beginning with a "9" are different from SINs assigned to citizens and permanent residents, because they have an expiry date (which usually coincides with the expiration of the holder's work permit). These SINs are invalid unless there is an expiry date listed on the card and the date has not passed.

Permanent resident SINs

[edit]- Issued by the federal government to each Canadian citizen or permanent resident;

- The SIN is unique and assigned to only one citizen

Validation

[edit]Social Insurance Numbers can be validated through a simple check digit process called the Luhn algorithm.

046 454 286 <--- A fictitious, but valid, SIN. 121 212 121 <--- Multiply every second digit by 2.

The result of the multiplication is:

0 8 6 8 5 8 2 16 6

Then, add all of the digits together (note that 16 is summed as the individual digits 1+6):

0 + 8 + 6 + 8 + 5 + 8 + 2 + 1+6 + 6 = 50

If the SIN is valid, this number will be evenly divisible by 10.

Geography

[edit]The first digit of a SIN usually identifies the province in which it was registered, as listed below. However, the government has found it necessary in the past to supply certain regions with SINs assigned to other regions. [citation needed]

- 1: Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador; new Ontario SINs are now being issued with the 1 series

- 2–3: Quebec

- 4–5: Ontario (excluding Northwestern Ontario), and overseas forces

- 6: Northwestern Ontario, Manitoba, Saskatchewan, Alberta, Northwest Territories, and Nunavut

- 7: British Columbia, Yukon, and new business numbers.

- 8: Used exclusively for the BN (Business Number) assigned to business owners and corporations. Due to the limited number of BNs available, new BNs can start with a 7.

- 9: Temporary resident[5]

- 0: CRA-assigned individual tax numbers, temporary tax numbers or adoption tax numbers

See also

[edit]- National Insurance number (NINO) – British equivalent

- Death Master File, a database of deaths maintained by the Social Security Administration in the US

- Canada service numbers, military identification numbers for the Canadian Armed Forces introduced in the 1990s.

References

[edit]- ^ Curry, Bill (15 May 2012). "Your wallet just got a bit lighter: Ottawa nixes SIN cards". The Globe and Mail. Retrieved 12 February 2020.

- ^ "Social Insurance Number – Overview". Canada.ca. Employment and Social Development. 28 June 2019. Retrieved 12 February 2020.

- ^ "Information for Employers". Service Canada. 3 December 2006.

- ^ "Protecting your SIN: Who can ask for my SIN". User guidance document from Service Canada website. 12 November 2020.

- ^ Canada, Employment and Social Development (2016-06-13). "Social Insurance Number that begins with a "9"". Canada.ca. Retrieved 2020-09-25.

External links

[edit]- Social Insurance Number – Overview at the Government of Canada

- The Social Insurance Number (SIN) Code of Practice at the Government of Canada

- Directive on Social Insurance Number at the Government of Canada

- Social Insurance Number Regulations at Department of Justice

- Best Practices for the use of Social Insurance Numbers in the private sector at the office of the Privacy Commissioner of Canada

- Protecting your SIN at the Government of Canada

- Protecting your Social Insurance Number at the office of the Privacy Commissioner of Canada

- Fact Sheet: Social Insurance Numbers (SIN) (archived) at the office of the Privacy Commissioner of Canada