JPMorgan Chase: Difference between revisions

m →Offices: changed the gallery's "per row" setting to three because of left-to-right scrolling |

mNo edit summary |

||

| Line 523: | Line 523: | ||

[[Category:Banks established in 1799]] |

[[Category:Banks established in 1799]] |

||

[[Category:Mutual fund families]] |

[[Category:Mutual fund families]] |

||

[[Category:Registered Banks of New Zealand]] |

|||

[[ar:جي بي مورجان تشايس]] |

[[ar:جي بي مورجان تشايس]] |

||

Revision as of 20:51, 1 June 2010

| Company type | Public (NYSE: JPM) |

|---|---|

| Industry | Banking Financial services |

| Founded | New York City (1799) |

| Headquarters | New York City, New York, USA |

Area served | Worldwide |

Key people | Jamie Dimon (Chairman, President & CEO) |

| Products | Finance and insurance Consumer Banking Corporate Banking Investment Banking Global Wealth Management Mortgage loans Credit Cards |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 226,623 (2010) |

| Website | JPMorganChase.com JPMorgan.com Chase.com |

JPMorgan Chase & Co. is one of the oldest financial services firms in the world. It has operations in 60 countries. It is a leader in financial services with assets of $2 trillion, and the largest market capitalization[1] and third largest deposit base U.S. banking institution behind Wells Fargo and Bank of America. The hedge fund unit of JPMorgan Chase is the largest hedge fund in the United States with $53.5 billion in assets as of the end of 2009.[2] Formed in 2000, when Chase Manhattan Corporation merged with J.P. Morgan & Co., the firm serves millions of consumers in the United States and many of the world's most prominent corporate, institutional and governmental clients.

The JP Morgan brand is used by the Investment Bank as well as the Asset Management, Private Banking, Private Wealth Management, and Treasury & Securities Services divisions. Fiduciary activity within Private Banking and Private Wealth Management is done under the aegis of JPMorgan Chase Bank, N.A.—the actual trustee. The Chase brand is used for credit card services in the United States and Canada, the bank's retail banking activities in the United States, and commercial banking.

JP Morgan Chase is one of the Big Four banks of the United States with Bank of America, Citigroup and Wells Fargo.[3][4][5][6][7][8][9]

Business

JPMorgan Chase’s activities are organized, for management reporting purposes, into six business segments:[11]

- Investment Bank

- Investment banking: advisory; debt and equity underwriting

- Market making and trading: Fixed income, Equity

- Corporate lending

- Principal investing

- Prime services

- Research

- Retail Financial Services

- Retail banking: Consumer and business banking (including Business Banking Loans);

- Consumer Lending: Loan originations and balances (including home lending, student, auto and other loans); Mortgage production and servicing;

- Card Services

- Credit cards

- Merchant acquiring

- Commercial Banking

- Middle-market banking

- Commercial term lending

- Mid-corporate banking

- Real estate banking

- Treasury & Securities Services

- Treasury Services (Global Trade, Core Cash Management, Liquidity, Import/Export Advisory)

- Worldwide Securities Services

- Asset Management

- Investment Management (including Institutional and Retail)

- Private Bank

- Private Wealth Management

- JPMorgan Securities (formerly Bear Stearns Brokerage)

- Corporate - Includes the company's private equity; One Equity Partners, Treasury and Corporate functions.

Key financial data

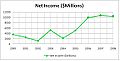

| Year | 2004[12] | 2005[12] | 2006[12] | 2007[13] | 2008[14] |

|---|---|---|---|---|---|

| Revenue | 43,097 | 54,533 | 61,437 | 71,372 | 67,252 |

| EBITDA | 7,140 | 13,740 | 22,218 | ||

| Net Income | 4,466 | 8,483 | 14,444 | 15,365 | 5,605 |

| Employees | 160,968 | 168,847 | 174,360 | 180,667 | 224,961 |

-

Asset & Liability

-

Asset/Liability Ratio

-

Net Income

[15] JPMorgan Chase was the biggest bank at the end of 2008 as an individual bank. (not including subsidiaries)

History

JPMorgan Chase, in its current structure, is the result of the combination of several large U.S. banking companies over the last decade including Chase Manhattan Bank, J.P. Morgan & Co., Bank One, Bear Stearns and Washington Mutual. Going back further, its predecessors include major banking firms among which are Chemical Bank, Manufacturers Hanover, First Chicago Bank, National Bank of Detroit, Texas Commerce Bank, Providian Financial and Great Western Bank.

Chemical Banking Corporation

The New York Chemical Manufacturing Company was founded in 1823 as a maker of various chemicals. In 1824, the company amended its charter to perform banking activities and created the Chemical Bank of New York. After 1851, the bank was separated from its parent and grew organically and through a series of mergers, most notably with Corn Exchange Bank in 1954, Texas Commerce Bank (a large bank in Texas) in 1986, and Manufacturer's Hanover Trust Company in 1991 (the first major bank merger "among equals"). In the 1980s and early 1990s, Chemical emerged as one of the leaders in the financing of leveraged buyout transactions. In 1984, Chemical launched Chemical Venture Partners to invest in private equity transactions alongside various financial sponsors. By the late 1980s, Chemical developed its reputation for financing buyouts, building a syndicated leveraged finance business and related advisory businesses under the auspices of pioneering investment banker, Jimmy Lee.[16][17] At many points throughout this history, Chemical Bank was the largest bank in the United States (either in terms of assets or deposit market share).

In 1996, Chemical Bank acquired the Chase Manhattan Corporation taking the more prominent Chase name. In 2000, the combined company acquired J.P. Morgan & Co. and combined the two names to form what is today JPMorgan Chase & Co. JPMorgan Chase retains Chemical Bank's headquarters at 270 Park Avenue and stock price history.

Chase Manhattan Bank

The Chase Manhattan Bank was formed upon the 1931 purchase of Chase National Bank (established in 1877) by the Bank of the Manhattan Company (established in 1799), the company's oldest predecessor institution. The Bank of the Manhattan Company was the creation of Aaron Burr, who transformed The Manhattan Company from a water carrier into a bank.

Led by David Rockefeller during the 1970s and the 1980s, Chase Manhattan emerged as one of the largest and most prestigious banking concerns, with leadership positions in syndicated lending, treasury and securities services, credit cards, mortgages, and retail financial services. Weakened by the real estate collapse in the early 1990s, it was acquired by Chemical Bank in 1996 retaining the prominent Chase name. Prior to its notable merger with J.P. Morgan & Co., the New Chase expanded the investment and asset management groups through two acquisitions. In 1999, it acquired San Francisco-based Hambrecht & Quist for $1.35 billion. In April 2000, UK-based Robert Fleming & Co. was sold to the new Chase Manhattan Bank for $7.7 billion.

According to page 114 of An Empire of Wealth by John Steele Gordon, the origin of this strand of JPMorgan Chase's history runs as follows:

At the turn of the nineteenth century, obtaining a bank charter required an act of the state legislature. This of course injected a powerful element of politics into the process and invited what today would be called corruption but then was regarded as business as usual. Hamilton's political enemy—and eventual murderer—Aaron Burr was able to create a bank by sneaking a clause into a charter for a company, called the Manhattan Company, to provide clean water to New York City. The innocuous-looking clause allowed the company to invest surplus capital in any lawful enterprise. Within six months of the company's creation, and long before it had laid a single section of water pipe, the company opened a bank, the Bank of the Manhattan Company. Still in existence, it is today J.P.Morgan Chase, the second largest bank in the United States.

J.P. Morgan & Company

The heritage of the House of Morgan traces its roots to the partnership of Drexel, Morgan & Co., which in 1895 was renamed J.P. Morgan & Co. (see also: J. Pierpont Morgan). Arguably the most influential financial institution of its era, J.P. Morgan & Co. financed the formation of the United States Steel Corporation, which took over the business of Andrew Carnegie and others and was the world's first billion-dollar corporation. In 1895, J.P. Morgan & Co. supplied the United States government with $62 million in gold to float a bond issue and restore the treasury surplus of $100 million. In 1892, the company began to finance the New York, New Haven and Hartford Railroad and led it through a series of acquisitions that made it the dominant railroad transporter in New England. Although his name was big, Morgan owned only 19% of Morgan assets. The rest was owned by the Rothschild family following a series of bailouts and rescues attributed by some to Morgan's stubborn will and seemingly "non-existent" investment savvy.

Built in 1914, 23 Wall Street was known as the "House of Morgan," and for decades the bank's headquarters was the most important address in American finance. At noon, on September 16, 1920, a terrorist bomb exploded in front of the bank, injuring 400 and killing 38. Shortly before the bomb went off, a warning note was placed in a mailbox at the corner of Cedar Street and Broadway. The warning read: "Remember we will not tolerate any longer. Free the political prisoners or it will be sure death for all of you. American Anarchists Fighters." While theories abound about who was behind the Wall Street bombing and why they did it, after 20 years of investigation the FBI rendered the case inactive without ever finding the perpetrators.

In August 1914, Henry P. Davison, a Morgan partner, traveled to the UK and made a deal with the Bank of England to make J.P. Morgan & Co. the monopoly underwriter of war bonds for the UK and France. The Bank of England became a "fiscal agent" of J.P. Morgan & Co., and vice-versa. The company also invested in the suppliers of war equipment to Britain and France. Thus, the company profited from the financing and purchasing activities of the two European governments.

In the 1930s, all of J.P. Morgan & Co. along with all integrated banking businesses in the United States, was required by the provisions of the Glass-Steagall Act to separate its investment banking from its commercial banking operations. J.P. Morgan & Co. chose to operate as a commercial bank, because at the time commercial lending was perceived as more profitable and prestigious. Additionally, many within J.P. Morgan believed that a change in political climate would eventually allow the company to resume its securities businesses but it would be nearly impossible to reconstitute the bank if it were disassembled.

In 1935, after being barred from securities business for over a year, the heads of J.P. Morgan spun off its investment-banking operations. Led by J.P. Morgan partners, Henry S. Morgan (son of Jack Morgan and grandson of J. Pierpont Morgan) and Harold Stanley, Morgan Stanley was founded on September 16, 1935 with $6.6 million of nonvoting preferred stock from J.P. Morgan partners. In order to bolster its position, in 1959, J.P. Morgan merged with the Guaranty Trust Company of New York to form the Morgan Guaranty Trust Company. The bank would continue to operate as Morgan Guaranty Trust through the 1980s, before beginning to migrate back toward the use of the J.P. Morgan brand. In 1984, the group finally purchased the Purdue National Corporation of Lafayette Indiana, uniting a history between the two figures of Salmon Portland Chase and John Purdue. In 1988, the company once again began operating exclusively as J.P. Morgan & Co.

Bank One Corporation

In 2004, JPMorgan Chase merged with Bank One Corp., bringing on board current chairman and CEO Jamie Dimon as president and COO and designating him as CEO William B. Harrison, Jr.'s successor. Dimon's pay was pegged at 90% of Harrison's. Dimon quickly made his influence felt by embarking on a cost-cutting strategy and replaced former JPMorgan Chase executives in key positions with Bank One executives—many of whom were with Dimon at Citigroup. Dimon became CEO in January 2006 and Chairman in December 2006.

Bank One Corporation was formed upon the 1998 merger between Bank One of Columbus, Ohio and First Chicago NBD. These two large banking companies had themselves been created through the merger of many banks. This merger was largely considered a failure until Jamie Dimon—recently ousted as President of Citigroup—took over and reformed the new firm's practices—especially its disastrous technology mishmash inherited from the many mergers prior to this one. Mr. Dimon effected more than sufficient changes to make Bank One Corporation a viable merger partner for JPMorgan Chase.

Bank One Corporation traced its roots to First Bancgroup of Ohio, founded as a holding company for City National Bank of Columbus, Ohio and several other banks in that state, all of which were renamed "Bank One" when the holding company was renamed Bank One Corporation. With the beginning of interstate banking they spread into other states, always renaming acquired banks "Bank One", though for a long time they resisted combining them into one bank. After the NBD merger, adverse financial results led to the departure of CIO John B. McCoy, whose father and grandfather had headed Banc One and predecessors. Jamie Dimon, a former key executive of Citigroup, was brought in to head the company. JPMorgan Chase completed the acquisition of Bank One in Q3 2004.

Bear Stearns

At the end of 2007, Bear Stearns & Co. Inc. was the fifth largest investment bank in the United States but its market capitalization had deteriorated through the second half of 2007. On Friday, March 14, 2008 Bear Stearns lost 47% of its equity market value to close at $30.00 per share as rumors emerged that clients were withdrawing capital from the bank. Over the following weekend it emerged that Bear Stearns might prove insolvent and on or around March 15, 2008 the Federal Reserve engineered a deal to prevent a wider systemic crisis from the collapse of Bear Stearns.

On March 16, 2008, after a weekend of intense negotiations between JPMorgan, Bear, and the federal government, JPMorgan Chase announced that it had plans to acquire Bear Stearns in a stock swap worth $2.00 per share or $240 million pending shareholder approval scheduled within 90 days. In the interim, JPMorgan Chase agreed to guarantee all Bear Stearns trades and business process flows.[18] Two days later, on March 18, 2008, JPMorgan Chase formally announced the acquisition of Bear Stearns for $236 million. The stock swap agreement was signed in the late-night hours of March 18, 2008, with JPMorgan agreeing to exchange 0.05473 of each of its shares upon closure of the merger for one Bear share, valuing the Bear shares at $2 each. [19]

On March 24, 2008, after considerable public discontent by Bear Stearns shareholders over the low acquisition price threatened the deal's closure, a revised offer was announced at approximately $10 per share. Under the revised terms, JPMorgan also immediately acquired a 39.5% stake in Bear Stearns (using newly issued shares) at the new offer price and gained a commitment from the board (representing another 10% of the share capital) that its members would vote in favour of the new deal. With sufficient commitments thus in hand to ensure a successful shareholder vote, the merger was completed on June 2, 2008.

Washington Mutual

On September 25, 2008, JPMorgan Chase bought most of the banking operations of Washington Mutual from the receivership of the FDIC. That night, the Office of Thrift Supervision, in what was by far the largest bank failure in American history, had seized Washington Mutual Bank and placed it into receivership. The FDIC sold the bank's assets, secured debt obligations and deposits to JPMorgan Chase & Co for $1.836 billion, which re-opened the bank the following day. As a result of the takeover, Washington Mutual shareholders lost all their equity.[20]

JPMorgan Chase raised $10 billion in a stock sale to cover writedowns and losses after taking on deposits and branches of Washington Mutual.[21] Through the acquisition, JPMorgan now owns the former accounts of Providian Financial, a credit card issuer WaMu acquired in 2005. The company announced plans to complete the rebranding of Washington Mutual branches to Chase by late 2009.

Chief executive Alan H. Fishman was flying from New York to Seattle on the day the bank was closed, and eventually received a $7.5 million sign-on bonus and cash severance of $11.6 million after being CEO for 17 days.

Other recent acquisitions

In 2006, JPMorgan Chase purchased Collegiate Funding Services, a portfolio company of private equity firm Lightyear Capital, for $663 million. CFS was used as the foundation for the Chase Student Loans, previously known as Chase Education Finance.[22]

In April, 2006, JPMorgan Chase announced it would swap its corporate trust unit for The Bank of New York Co.'s retail and small business banking network. The swap valued The Bank of New York business at $3.1 billion and JPMorgan's trust unit at $2.8 billion and gave Chase access to 338 additional branches and 700,000 new customers in New York, New Jersey, and Indiana.

In March, 2008, JPMorgan acquired the UK-based carbon offsetting company ClimateCare.[23]

In November, 2009, JPMorgan announced it would acquire the balance of JPMorgan Cazenove, an advisory and underwriting joint venture established in 2004 with the Cazenove Group, for GBP1 billion.[24]

Acquisition history

The following is an illustration of the company's major mergers and acquisitions and historical predecessors (this is not a comprehensive list):

| JPMorgan Chase & Co |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Banking subsidiaries

JPMorgan Chase & Co. owns five bank subsidiaries in the United States:[29]

- Chase Bank USA, National Association

- JPMorgan Chase Bank, National Association

- JPMorgan Chase Bank, Dearborn

- J.P. Morgan Trust Company, National Association

- Custodial Trust Company

Offices

Although the old Chase Manhattan Bank's headquarters were once located at the One Chase Manhattan Plaza building in downtown Manhattan, the current world headquarters for JPMorgan Chase & Co. are located at 270 Park Avenue.

The bulk of North American operations take place in four buildings located adjacent to each other on Park Avenue in New York City: the former Union Carbide Building at 270 Park Avenue, the hub of sales and trading operations, and the original Chemical Bank building at 277 Park Avenue, where most investment banking activity took place. Asset and wealth management groups are located at 245 Park Avenue and 345 Park Avenue. Other groups are located in the former Bear Stearns building at 383 Madison Avenue.

Approximately 10,000 employees are located in Columbus at the McCoy Center, the former Bank One offices.

The bank moved some of its operations to the JPMorgan Chase Tower in Houston, when it purchased Texas Commerce Bank. Since merging with Bank One in 2004, retail services are headquartered at the Chase Tower in Chicago.

-

JPMorgan Chase Tower at 270 Park Avenue, New York

-

Former Bear Stearns headquarters at 383 Madison Avenue, New York

-

J.P. Morgan International Plaza in Dallas

The Card Services division has its headquarters in Wilmington, Delaware, with Card Services offices in Elgin, Illinois; Springfield, Missouri; Frederick, Maryland; San Antonio and Mumbai. There are also large operations centers in Brooklyn; Columbus; Dallas; Indianapolis; Milwaukee; Toronto; Rochester, New York; Fort Worth, Texas; Tampa, Florida; Orlando, Florida; Louisville, Kentucky; Newark, Delaware; Phoenix, Arizona and Burlington, Ontario. Operations centers in the United Kingdom are located in Bournemouth, Glasgow, London, Liverpool and Swindon of which London hosts the European headquarters. There are also backoffice and technology operations offices based in Manila and Cebu, Philippines, and Mumbai and Bangalore, and Hyderabad, and Delhi, India and Mexico City.

The JPMorgan Investment Bank also maintained a number of high-profile offices around the globe, with the largest concentrations outside the U.S. in London, Tokyo, Hong Kong and Singapore. In August 2008, the bank announced plans to construct a new European headquarters, based at Canary Wharf, London.[30]

Controversy

Legal proceedings

WorldCom

J.P. Morgan Chase, which helped underwrite $15.4 billion of WorldCom's bonds, agreed in the middle of March 2005 to pay $2 billion; that was 46 percent, or $630 million, more than it would have paid had it accepted an investor offer in May of $1.37 billion. J.P. Morgan was the last big lender to settle. Its payment is the second largest in the case, exceeded only by the $2.6 billion accord reached in Q4 2004 by Citigroup.[31] In March 2005, 16 of WorldCom's 17 former underwriters reached settlements with the investors.[32][33]

Jefferson County, Alabama

In November 2009, J.P. Morgan Chase & Co. agreed to a $722 million settlement with the U.S. Securities and Exchange Commission to end a probe into sales of derivatives that helped push Alabama’s most populous county to the brink of bankruptcy. The settlement came a week after Birmingham, Alabama Mayor Larry Langford was convicted on 60 counts of bribery, money laundering, and tax evasion related to bond swaps for Jefferson County, Alabama. The SEC alleged that J.P. Morgan, which had been chosen by the county commissioners to underwrite the floating-rate sewer bond deals and provide interest-rate swaps, had made undisclosed payments to close friends of the commissioners in exchange for the deal. J.P. Morgan then allegedly made up for the costs by charging higher interest rates on the swaps.[34]

Major sponsorships

- Chase Field, Phoenix, Arizona, - Arizona Diamondbacks, MLB.

- Major League Soccer

- Chase Auditorium (formerly Bank One Auditorium) in Chicago.

- The JPMorgan Chase Corporate Challenge, owned and operated by JPMorgan Chase, is the largest corporate road racing series in the world with over 200,000 participants in 12 cities in six countries on five continents. It has been held annually since 1977 and the races range in size from 4,000 entrants to more than 60,000.

- JPMorgan Chase is the official sponsor of the US Open.

Notable former employees

Business

- Andrew Crockett - former General Manager of the Bank for International Settlements (1994–2003)

- Pierre Danon - chairman of eircom

- Dina Dublon - member of the board of directors of Microsoft, Accenture and PepsiCo and former executive vice president and chief financial officer of JPMorgan Chase.

- Maria Elena Lagomasino - member of the board of directors of The Coca-Cola Company and former CEO of JPMorgan Private Bank.

- Thomas W. Lamont - acting head of J.P. Morgan & Co. on Black Tuesday

- Lewis Reford - Canadian political candidate

- Jan Stenbeck - former owner of Investment AB Kinnevik

- David Rockefeller - patriarch of the Rockefeller Family

- Winthrop Aldrich - son of the late Sen. Nelson Aldrich

- Henry S. Morgan - son of J. Pierpont Morgan, co-founder of Morgan Stanley

- Harold Stanley - former JPMorgan partner, co-founder of Morgan Stanley

- Bear Chuhta - CEO, co-founder of Morgan Stanley

Politics and public service

- Tony Blair - Prime Minister of the United Kingdom (1997–2007)[35]

- William M. Daley - U.S. Secretary of Commerce (1997–2000)

- Michael Forsyth, Baron Forsyth of Drumlean - Secretary of State for Scotland (1995–97)

- Thomas S. Gates, Jr. - U.S. Secretary of Defense (1959–61)

- Rick Lazio - Member of the U.S. House of Representatives (1993–2001)

- Antony Leung - Financial Secretary of Hong Kong (2001–03)

- Frederick Ma - Hong Kong Secretary for Commerce and Economic Development (2007–present)

- Dwight Morrow - U.S. Senator (1930–31)

- Margaret Ng - Member of the Hong Kong Legislative Council

- George P. Shultz - U.S. Secretary of Labor (1969–70), U.S. Secretary of Treasury (1972–74), U.S. Secretary of State (1982–89)

- David Laws - U.K. Chief Secretary to the Treasury (May 2010)

Other

- R. Gordon Wasson - Ethnomycologist and former JPMorgan vice president[36][37]

Notable awards

| Publication | Award |

| 2008 Awards | |

| Business Week |

|

| Risk magazine |

|

| 2007 Awards | |

| Risk magazine |

|

| Profit & Loss |

|

| Waters magazine (Fifth Annual Waters Rankings, June 2007) |

|

| ISIPS (Eighth Annual FSmetrics Award Dinner, May 2007) |

|

| Asian Investor (Asian Investor 2007 Achievement Awards, May 2007) |

|

| ICFA (European Custody & Fund Administration Awards, 2007) |

|

| The Asset (Annual Triple A Awards, 2007) |

|

| Complinet (Third Annual Compliance Awards, February 2007) |

|

| 2006 Awards | |

| Business Week |

|

| The Banker (November 2006) |

|

| Financial-i (Leaders In Innovation Awards, November 2006) |

|

| Funds Europe (November 2006) |

|

| Waters magazine (Fourth Annual Waters Rankings, July 2006) |

|

| ISF Magazine (Repo/Securities Lending Survey, June 2006) |

|

| Asian Investor (2006 Achievement Awards) |

|

| Profit and Loss magazine (2006 P&L Digital Awards) |

|

| Global Investor (Annual Foreign Exchange Client Satisfaction Survey, March 2006) |

|

| Global Custodian Magazine (Tri-Party Securities Financing Survey, March 2006) |

|

| The Asset (Triple A Awards 2006) |

|

See also

Index products

References

- ^ JPMorgan Chase's Market Value Tops Bank of America (Update2)

- ^ http://www.marketfolly.com/2010/03/worlds-largest-hedge-funds.html

- ^ Winkler, Rolfe (SEP 15, 2009). "Break Up the Big Banks". Reuters. Retrieved 17 December 2009.

{{cite web}}: Check date values in:|date=(help) - ^ Tully, Shawn (February 27, 2009). "Will the banks survive?". Fortune Magazine/CNN Money. Retrieved 17 December 2009.

- ^ "Citigroup posts 4th straight loss; Merrill loss widens". The Associated Press. 2008-10-16. Retrieved 17 December 2009.

- ^ Winkler, Rolfe (August 21, 2009). "Big banks still hold regulators hostage". Reuters, via Forbes.com. Retrieved 17 December 2009.

- ^

Temple, James (November 18, 2008). "Bay Area job losses likely in Citigroup layoffs i". The San Francisco Chronicle. Retrieved 17 December 2009.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Dash, Eric (August 23, 2007). "4 Major Banks Tap Fed for Financing". The New York Times. Retrieved 17 December 2009.

- ^ Pender, Kathleen (November 25, 2008). "Citigroup gets a monetary lifeline from feds". The San Francisco Chronicle. Retrieved 17 December 2009.

- ^ de la Merced, Michael J. (June 16, 2008). "JPMorgan's Stately Old Logo Returns for Institutional Business". The New York Times. Retrieved 14 December 2009.

- ^ JPMorgan Chase SEC Form 10-K 2007 Annual Report. Securities and Exchange Commission

- ^ a b c OpesC OPESC.org

- ^ JPMorgan Chase & Co. 2007 Annual Report

- ^ Shareholder.com

- ^ Money Economics Top 10 Banks Project

- ^ Jimmy Lee's Global Chase. New York Times, April 14, 1997

- ^ Kingpin of the Big-Time Loan. New York Times, August 11, 1995

- ^ Guerrera, Francesco (March 16, 2008). "Bear races to forge deal with JPMorgan". Financial Times. Retrieved 2008-03-16.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Quinn, James (March 19, 2008). "JP Morgan Chase bags bargain Bear Stearns". London: Telegraph.co.uk. Retrieved 2008-03-19.

{{cite news}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Ellis, David. "JPMorgan buys WaMu", CNNMoney.com, 2008-09-25.

- ^ JPMorgan Raises $10 Billion in Stock Sale After WaMu (Update3)

- ^ Chase to Acquire Collegiate Funding Services. Business Wire, Dec 15, 2005

- ^ "JPMorgan acquires carbon offset firm ClimateCare". The Guardian. London. March 26, 2008.

- ^ "JPMorgan Buys Rest of Cazenove for 1 Billion Pounds". Bloomberg. November 19, 2009.

- ^ Other Successors to the break-up of The House of Morgan: Morgan Stanley and Morgan, Grenfell & Co.

- ^ Predecessors to J.P. Morgan & Company include Drexel, Morgan & Co., Dabney, Morgan & Co. and J. S. Morgan & Co.

- ^ On March 18, 2008, JPMorgan Chase announced the acquisition of Bear Stearns for $236 million. On March 24, 2008, a revised offer was announced at approximately $10 per share

- ^ On September 25, 2008, JPMorgan Chase announced the acquisition of Washington Mutual for $1.8 Billion.

- ^ "Organization Hierarchy of JPMorgan Chase & Co" (database). Federal Reserve System. Retrieved 2008-09-22.

- ^ "Bloomberg: JPMorgan to Move European Head Office to Canary Wharf". 2008-08-01.

- ^ NYtimes.com

- ^ Bloomberg.com

- ^ KCCLCC.net

- ^ Bloomberg.com

- ^ Tony Blair starts $1M bank job - CNN.com

- ^ http://www.imaginaria.org/wasson/life.htm

- ^ "Medicine: Mushroom Madness". Time. June 16, 1958. Retrieved May 7, 2010.

- ^ http://bwnt.businessweek.com/interactive_reports/career_launch_2008/index.asp

- ^ http://www.risk.net/risk/news/1500929/jp-morgan-wins-risk-derivatives-house-award