Gold reserve: Difference between revisions

→Officially reported gold holdings: Update. |

→Privately held gold: Update. |

||

| Line 284: | Line 284: | ||

! width="20%"| Reference |

! width="20%"| Reference |

||

|- |

|- |

||

| 1 || [[SPDR Gold Shares]] || align="right"| 1, |

| 1 || [[SPDR Gold Shares]] || align="right"| 1,299.87 || <ref>[http://www.spdrgoldshares.com/inc/Barlist.pdf Bar list] from [http://www.spdrgoldshares.com/ SPDR Gold Shares web site]</ref> |

||

|- |

|- |

||

| 2 || [[iShares]] Gold Trust || align="right"| |

| 2 || [[iShares]] Gold Trust || align="right"| 107.95 || <ref>from [http://us.ishares.com/product_info/fund/overview/IAU.htm iShares Gold Trust (IAU)], as of May, 2009</ref> |

||

|- |

|- |

||

| 3 || [[Gold_exchange-traded_fund#Central Fund of Canada|Central Fund of Canada]] || align="right"| 46. |

| 3 || [[Gold_exchange-traded_fund#Central Fund of Canada|Central Fund of Canada]] || align="right"| 46.77 || <ref>[http://www.centralfund.com/Nav%20Form.htm Central Fund of Canada]</ref> |

||

|- |

|- |

||

| 4 || [[BullionVault]] (storage) || align="right"| 21. |

| 4 || [[BullionVault]] (storage) || align="right"| 21.36 || <ref>[http://www.bullionvault.com/audit.do Daily Audit - Allocated Gold Bar Lists And Bank Statements - BullionVault.com]</ref> |

||

|- |

|- |

||

| 5 || [[GoldMoney]] (storage) || align="right"| 16. |

| 5 || [[GoldMoney]] (storage) || align="right"| 16.39 || <ref>[http://goldmoney.com/report-monthly.html Monthly Audit - GoldMoney.com]</ref> |

||

|- |

|- |

||

|} |

|} |

||

Revision as of 12:41, 9 December 2010

A gold reserve is the gold held by a central bank or nation intended as a store of value and as a guarantee to redeem promises to pay depositors, note holders (e.g., paper money), or trading peers, or to secure a currency.

Today, gold reserves are almost exclusively, albeit rarely, used in the settlement of international transactions.[citation needed]

At the end of 2004, central banks and investment funds held 19% of all above-ground gold as bank reserve assets.[1]

It has been estimated that all the gold mined by the end of 2009 totaled 165,000 tonnes.[2] At a price of US$1000/oz., exceeded in 2008 and 2009, one tonne of gold has a value of approximately US$32.15 million. The total value of all gold ever mined would exceed US$5 trillion at that valuation.[note 1]

IMF gold holdings

As of June 2009, the International Monetary Fund held 3,217 tonnes (103.4 million oz.) of gold,[3][4] which had been constant for several years. In Fall 2009, the IMF announced that it will sell one eighth of its holdings, a maximum of 12,965,649 fine troy ounces (403.3 tonnes) based on a new income model agreed upon in April 2008, and subsequently announced the sale of 200 tonnes to India,[5] 10 tonnes to Sri Lanka,[6] , a further 10 Metric tonnes of Gold was also sold to the Central Bank of Bangladesh in September 2010 and 2 tonnes to the Bank of Mauritius.[7] These gold sales were conducted in stages at prevailing market prices.

The IMF maintains an internal book value of its gold that is far below market value. In 2000, this book value was SDR 35, or about US$47 per troy ounce.[8] An attempt to revalue the gold reserve to today's value has met resistance for different reasons. For example, Canada is against the idea of revaluing the reserve, as it may be a prelude to selling the gold on the open market and therefore depressing gold prices.[9]

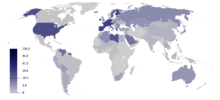

Officially reported gold holdings

The International Monetary Fund regularly maintains statistics of national assets as reported by various countries. This data is used by the World Gold Council to periodically rank and report the gold holding of countries and official organizations.[10]

The gold listed for each of the countries in the table may not be physically stored in the country listed, as central banks generally have not allowed independent audits of their reserves.

| Rank | Country/Organization | Gold (tonnes) |

Gold's share of national forex reserves (%)[10] |

|---|---|---|---|

| - | 10,792.6 | 60.7% | |

| 1 | 8,133.5 | 73.9% | |

| 2 | 3,401.8 | 70.3% | |

| 3 | IMF | 2,846.7 | - |

| 4 | 2,451.8 | 68.6% | |

| 5 | 2,435.4 | 67.2% | |

| 6 | 1,054.1 | 1.7% | |

| 7 | 1,040.1 | 16.4% | |

| 8 | 775.2 | 6.7% | |

| 9 | 765.2 | 3.0% | |

| 10 | 612.5 | 57.5% | |

| 11 | 557.7 | 8.1% | |

| 12 | 501.4 | 27.9% | |

| 13 | 423.6 | 4.6% | |

| 14 | 382.5 | 81.1% | |

| 15 | 363.9 | 52.4% | |

| 16 | 322.9 | 3.0% | |

| 17 | 310.3 | 16.8% | |

| 18 | 286.8 | 27.6% | |

| 19 | 281.6 | 38.6% | |

| 20 | 280.0 | 56.2% | |

| 21 | 227.5 | 36.8% | |

| 22 | 175.9 | 14.0% | |

| 23 | 173.6 | 4.5% | |

| 24 | 143.8 | 5.6% | |

| 25 | 127.4 | 2.5% | |

| 26 | 125.7 | 11.1% | |

| 27 | 124.9 | 12.2% | |

| 28 | BIS | 120.0 | - |

| 29 | 116.1 | 6.0% | |

| 30 | 111.7 | 78.7% | |

| 31 | 103.7 | 9.1% | |

| 32 | 102.9 | 4.5% | |

| 33 | 99.5 | 2.5% | |

| 34 | 79.9 | 8.1% | |

| 35 | 79.0 | 13.5% | |

| 36 | 75.6 | 8.7% | |

| 37 | 73.1 | 3.6% | |

| 38 | 67.3 | 10.0% | |

| 39 | 66.5 | 3.3% | |

| 40 | 64.4 | 16.2% | |

| 41 | 54.7 | 4.5% | |

| 42 | 49.1 | 20.6% | |

| 43 | 39.9 | 9.9% | |

| 44 | WAEMU | 36.5 | 12.2% |

| 45 | 36.4 | 1.5% | |

| 46 | 35.1 | 24.5% | |

| 47 | 34.7 | 3.6% | |

| 48 | 33.6 | 0.5% | |

| 49 | 31.8 | 65.4% | |

| 50 | 28.3 | 13.4% | |

| 51 | 27.2 | 3.5% | |

| 52 | 26.3 | 31.0% | |

| 53 | 25.8 | - | |

| 54 | 22.0 | 4.2% | |

| 55 | 21.4 | - | |

| 56 | 17.5 | 11.9% | |

| 57 | 14.4 | 0.2% | |

| 58 | 13.9 | 50.8% | |

| 59 | 13.5 | 5.2% | |

| 60 | 13.1 | 4.2% | |

| 61 | 13.1 | 36.3% | |

| 62 | 12.8 | 4.3% | |

| 63 | 12.7 | 1.2% | |

| 64 | 12.4 | 14.4% | |

| 65 | 12.4 | 2.1% | |

| 66 | 8.8 | 36.5% | |

| 67 | 7.7 | 4.0% | |

| 68 | 7.5 | 0.3% | |

| 69 | 7.3 | 10.6% | |

| 70 | CEMAC | 7.1 | 2.3% |

| 71 | 6.9 | 5.3% | |

| 72 | 6.9 | 1.1% | |

| 73 | 6.8 | 12.7% | |

| 74 | 6.8 | - | |

| 75 | 6.0 | 11.8% | |

| 76 | 5.8 | 3.8% | |

| 77 | 4.7 | - | |

| 78 | 3.9 | 6.8% | |

| 79 | 3.4 | 0.2% | |

| 80 | 3.3 | - | |

| 81 | 3.2 | 13.4% | |

| 82 | 3.1 | 17.7% | |

| 83 | 3.1 | 0.3% | |

| 84 | 2.6 | 6.5% | |

| 85 | 2.2 | 11.7% | |

| 86 | 2.1 | 0.0% | |

| 87 | 2.0 | 11.4% | |

| 88 | 2.0 | 2.0% | |

| 89 | 2.0 | 2.9% | |

| 90 | 1.9 | 0.8% | |

| 91 | 1.6 | 2.8% | |

| 92 | 1.6 | 1.1% | |

| 93 | 0.9 | 1.2% | |

| 94 | 0.9 | 2.4% | |

| 95 | 0.7 | - | |

| 96 | 0.7 | 0.7% | |

| 97 | 0.6 | 1.0% | |

| 98 | 0.4 | 0.8% | |

| 99 | 0.4 | 6.2% | |

| 100 | 0.3 | 8.4% | |

| 101 | 0.3 | 2.4% | |

| 102 | 0.3 | 0.4% | |

| 103 | 0.3 | 0.1% | |

| 104 | 0.2 | - | |

| 105 | 0.2 | 0.3% | |

| 106 | 0.2 | 0.0% | |

| 107 | 0.2 | 1.6% | |

| 108 | 0.1 | 0.1% | |

| 109 | 0.0 | 0.1% | |

| 110 | 0.0 | 0.5% | |

| 111 | 0.0 | 0.0% | |

| 112 | 0.0 | - | |

| 113 | 0.0 | 0.0% | |

| - | World | 30,562.5 | - |

Privately held gold

As of October 2009, gold exchange-traded funds held 1,750 tonnes of gold for private and institutional investors.[11]

Gold Holdings Corp. a publicly listed gold company estimates that the amount of in-ground verified gold resources currently controlled by publicly traded gold mining companies is roughly 50,000 tonnes.[12]

| Rank | Organization | Gold (Tonnes) | Reference |

|---|---|---|---|

| 1 | SPDR Gold Shares | 1,299.87 | [13] |

| 2 | iShares Gold Trust | 107.95 | [14] |

| 3 | Central Fund of Canada | 46.77 | [15] |

| 4 | BullionVault (storage) | 21.36 | [16] |

| 5 | GoldMoney (storage) | 16.39 | [17] |

World gold holdings

| Holding | Percentage |

|---|---|

| Jewelry | 52% |

| Central banks | 18% |

| Investment (bars, coins) | 16% |

| Industrial | 12% |

| Unaccounted | 2% |

See also

- Foreign exchange reserves

- Sovereign wealth fund

- United States Bullion Depository

- Federal Reserve Bank of New York

- Gold as an investment

- Peak Gold

- Strategic Petroleum Reserve

- Moscow gold, the reserves of the Bank of Spain sent to the Soviet Union during the Spanish Civil War.

Notes

- ^ One tonne is approximately 32150.75 troy ounces

References

- ^ Central Banks and Official Institutions World Gold Council

- ^ gold knowledge/frequently asked questions World Gold Council

- ^ "Gold in the IMF". International Monetary Fund. 2009-09-18.

- ^ "Quarterly Gold and FX Reserves". World Gold Council. June 2009.

- ^ IMF Announces Sale of 200 metric tons of Gold to the Reserve Bank of India

- ^ IMF Announces Sale of 10 Metric Tons of Gold to the Central Bank of Sri Lanka

- ^ IMF Announces Sale of 2 Metric Tons of Gold to the Bank of Mauritius

- ^ "IMF completes off-market gold sales". 2000-04-07.

- ^ Gold falls on IMF sale concerns

- ^ a b c Reserve asset statistics

- ^ Daily Gold ETF Monitor

- ^ Gold Holdings by Company

- ^ Bar list from SPDR Gold Shares web site

- ^ from iShares Gold Trust (IAU), as of May, 2009

- ^ Central Fund of Canada

- ^ Daily Audit - Allocated Gold Bar Lists And Bank Statements - BullionVault.com

- ^ Monthly Audit - GoldMoney.com

- ^ DollarDaze Economic Commentary Blog