Mastercard: Difference between revisions

m Reverted edits by 69.149.143.110 (talk) to last version by 216.119.215.193 |

|||

| Line 27: | Line 27: | ||

In 1966 a number of banks formed the Interbank Card Association. The name '''Master Charge''' was licensed by the above mentioned California banks from the [[First National Bank of Louisville, Kentucky]] in 1967. With the help of [[New York]]'s [[Marine Midland Bank]], now [[HSBC Bank USA]], these banks joined with the [[Interbank Card Association]] (ICA) to create "Master Charge: The Interbank Card". The card was given a significant boost in 1969, when [[Citibank|National City Bank]] joined, merging its proprietary [[The Everything Card|Everything Card]] with Master Charge. |

In 1966 a number of banks formed the Interbank Card Association. The name '''Master Charge''' was licensed by the above mentioned California banks from the [[First National Bank of Louisville, Kentucky]] in 1967. With the help of [[New York]]'s [[Marine Midland Bank]], now [[HSBC Bank USA]], these banks joined with the [[Interbank Card Association]] (ICA) to create "Master Charge: The Interbank Card". The card was given a significant boost in 1969, when [[Citibank|National City Bank]] joined, merging its proprietary [[The Everything Card|Everything Card]] with Master Charge. |

||

In 1979, "Master Charge: The Interbank Card" was renamed simply "'''MasterCard'''". In the early 1990s MasterCard bought the British [[Access (credit card)|Access card]] and the Access name was dropped. In 2002, MasterCard International merged with [[Europay International|Europay International SA]], another large credit-card issuer association, which for many years issued cards under the name '''Eurocard'''. |

In 1979, "Master Charge: The Interbank Card HELLO" was renamed simply "'''MasterCard'''". In the early 1990s MasterCard bought the British [[Access (credit card)|Access card]] and the Access name was dropped. In 2002, MasterCard International merged with [[Europay International|Europay International SA]], another large credit-card issuer association, which for many years issued cards under the name '''Eurocard'''. |

||

In 2006, MasterCard International underwent another name change to MasterCard Worldwide. This was done in order to suggest a more global scale of operations. In addition, the company introduced a new corporate logo adding a third circle to the two that had been used in the past (the familiar card logo, resembling a [[Venn diagram]], remains unchanged). A new corporate tagline was introduced at the same time: "The Heart of Commerce".<ref>{{cite news |

In 2006, MasterCard International underwent another name change to MasterCard Worldwide. This was done in order to suggest a more global scale of operations. In addition, the company introduced a new corporate logo adding a third circle to the two that had been used in the past (the familiar card logo, resembling a [[Venn diagram]], remains unchanged). A new corporate tagline was introduced at the same time: "The Heart of Commerce".<ref>{{cite news |

||

Revision as of 10:56, 10 February 2009

| File:Mastercard Worldwide Logo.svg | |

| Company type | Public (NYSE: MA) |

|---|---|

| ISIN | US57636Q1040 |

| Industry | Financial services |

| Founded | 1966 |

| Headquarters | Purchase, New York, United States |

Area served | Worldwide |

Key people | Richard N. Haythornthwaite (Chairman) Robert W. Selander (CEO, President & Director) |

| Products | Payment systems |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 5,000 (2008) |

| Website | MasterCard.com |

MasterCard Worldwide (NYSE: MA) is a multinational corporation based in Purchase, New York, United States. Throughout the world, its principal business is to process payments between the banks of merchants and the banks of purchasers that use its "MasterCard" brand debit and credit cards to make purchases. MasterCard Worldwide has been a publicly traded company since 2006. Prior to its initial public offering, MasterCard Worldwide was a membership organization owned by the 25,000+ financial institutions that issue its card.

It was originally created in 1966 by United California Bank (later First Interstate Bank and subsequently merged into Wells Fargo Bank), Wells Fargo, Crocker National Bank (also subsequently merged into Wells Fargo), and the Bank of California (subsequently merged into the Union Bank of California) as a competitor to the BankAmericard issued by Bank of America, which is now the VISA credit card and issued by Visa Inc.

History

In 1966 a number of banks formed the Interbank Card Association. The name Master Charge was licensed by the above mentioned California banks from the First National Bank of Louisville, Kentucky in 1967. With the help of New York's Marine Midland Bank, now HSBC Bank USA, these banks joined with the Interbank Card Association (ICA) to create "Master Charge: The Interbank Card". The card was given a significant boost in 1969, when National City Bank joined, merging its proprietary Everything Card with Master Charge.

In 1979, "Master Charge: The Interbank Card HELLO" was renamed simply "MasterCard". In the early 1990s MasterCard bought the British Access card and the Access name was dropped. In 2002, MasterCard International merged with Europay International SA, another large credit-card issuer association, which for many years issued cards under the name Eurocard.

In 2006, MasterCard International underwent another name change to MasterCard Worldwide. This was done in order to suggest a more global scale of operations. In addition, the company introduced a new corporate logo adding a third circle to the two that had been used in the past (the familiar card logo, resembling a Venn diagram, remains unchanged). A new corporate tagline was introduced at the same time: "The Heart of Commerce".[1]

Features

Many issuing institutions include various features with credit card accounts, such as extended warranties on items bought with the card, damage waiver on cars rented with the card, and accident insurance during travel bought with the card.

Shareholders

Based on an SEC filing (DEF 14A) on April 24, 2008, MasterCard's largest current shareholders are:

(Class A Stock)

- 15.6% - The Mastercard Foundation

- 13.6% - Marsico Capital Management, LLC

- 8.9% - Atticus Capital, LP

- 5.1% - FMR Corp.

(Class M Stock)

- 9.5% - Citigroup, Inc.

- 8.5% - JP Morgan Chase & Co.

- 5.1% - HSBC Holdings, LLC

- 5.1% - Bank of America Corp.

IPO

The company, which had been organized as a cooperative of banks, had an initial public offering on May 25, 2006 at $39.00 USD. The stock is traded on the NYSE under the symbol MA.

Litigation

Both MasterCard and Visa have paid approximately $3 billion in damages resulting from a class-action lawsuit filed by Hagens Berman in January 1996.[2] The litigation cites several retail giants as plaintiffs, including Wal-Mart, Sears Roebuck & Company, and Safeway.[3]

Advertising

MasterCard's current advertising campaign slogan is "There are some things money can't buy. For everything else, there's MasterCard."

The first of these Priceless ads was run during the World Series in 1997 and there are numerous different TV, radio and print ads.[4] It was created by McCann-Erickson.[citation needed] MasterCard actually registered Priceless as a trademark.[5] Actor Billy Crudup has been the voice in the US market; in the UK, actor Jack Davenport is the voice.

The purpose of the campaign is to position MasterCard as a friendly credit card company with a sense of humor, as well as respond to the public's worry that everything is being commodified and that people are becoming too materialistic.[6]

Many parodies have been made using this same pattern, especially on Comedy Central, though MasterCard has threatened legal action,[7] contending that MasterCard views such parodies as a violation of its rights under the federal and state trademark and unfair competition laws, under the federal and state anti-dilution laws, and under the Copyright Act. Despite these claims, however, noted US consumer advocate and presidential candidate Ralph Nader emerged victorious (after a four-year battle) in the suit MasterCard brought against him after he produced his own "Priceless" political commercials.[8]

During Super Bowl XXXIX on February 6, 2005, a MasterCard commercial was introduced featuring 10 legendary advertising characters from various foods and household products. The characters included Chef Boyardee, Charlie the Tuna, the Pillsbury Doughboy, Count Chocula, the Vlasic pickle stork, the Morton Salt girl, the Jolly Green Giant, Mr. Peanut from Planters, the Gorton's fisherman, and Mr. Clean.[citation needed]

Sports sponsorships

MasterCard currently sponsors the New Zealand All Blacks, the country's rugby union team.[9] MasterCard also sponsors the UEFA Champions League. For many years, it also sponsored FIFA World Cup but withdrew its contract after a court settlement and its rival Visa took up the contract in 2007.[10] It is currently the sponsor of the Memorial Cup Tournament of the Canadian Hockey League. MasterCard has just announced new sponsorship deal with Australian Cricket team and is also the founding sponsor of IPL cricket team Mumbai Indians.[11] It was the official credit card of UEFA Euro 2008.

In 1997, MasterCard was the main sponsor of the aborted MasterCard Lola Formula One team.

On October 12, 2007 MasterCard offered $160,000 to the municipal government of Toronto so that the city could keep its ice rinks open, as the city is facing a budget shortfall.[12]

Management and Board of Directors

Key executives include:[13]

|

|

As of December 2004, the following banks are represented on MasterCard's board of directors:

|

In January 2005, Washington Mutual Bank, the third largest issuer of debit cards in the United States, announced that it was changing its debit-card branding from VISA to MasterCard. The change will make Washington Mutual MasterCard's largest bank customer.

MasterMoney

MasterMoney is the branding of a MasterCard debit card distributed in North America. Like many debit cards, the brand has capabilities of being used as an ATM card as well as a credit card, providing sufficient funds are in one's bank account (usually a checking account) in order to complete a transaction.

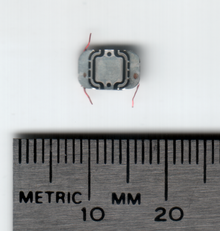

PayPass

MasterCard PayPass is an EMV compatible, "contactless" payment feature based on the ISO 14443 standard that provides cardholders with a simpler way to pay by tapping a payment card or other payment device, such as a phone or key fob, on a point-of-sale terminal reader rather than swiping or inserting a card.

In 2003, MasterCard concluded a nine-month PayPass market trial in Orlando, Florida, with JPMorgan Chase, Citibank, and MBNA. More than 16,000 cardholders and more than 60 retailer locations participated in the market trial. In addition, MasterCard worked with Nokia, AT&T Wireless, and JPMorgan Chase to incorporate MasterCard PayPass into mobile phones using Near Field Communication technology, in Dallas, Texas.

In 2005, MasterCard began to roll out PayPass in certain markets. As of September 2008, the following financial institutions have issued the MasterCard PayPass:

- Bank of America

- JPMorgan Chase (available through its "blink" contactless feature in the United States)

- Citibank (both MasterCard credit and debit cards)

- HSBC Bank USA (debit card only)

- Washington Mutual (WaMu Debit MasterCard with PayPass) "Gold & Platinum Debit Cards"

- Key Bank (debit card only)

- Citizens Bank and Charter One Bank (both MasterCard credit and debit cards)

- Commonwealth Bank (Australia)

- Garanti Bank (Turkey, available through its Bonus Trink Card)

- Banco de Oro Universal Bank (Philippines, available through its BDO International ATM Card)

- Bank of Montreal (Canada, available on most Mosaik cards issued after November 1, 2007[14])

- President's Choice Financial (Canada)

- CIMB Bank (Malaysia)

- Bank Zachodni WBK SA (Poland)

- Deutsche Kreditbank AG (Germany, issuer of Lufthansa Miles & More credit cards)

- Natwest (United Kingdom), on Maestro cards; limited use in the London Docklands and City of London)

- HSBC (United Kingdom), on credit cards; limited use in selected areas of London

- Canadian Tire Options Mastercard (Canada)[15]

- Capital One (Canada)[16]

- Barclaycard (UK)

- Shinhan Bank (South Korea)

A U.S. issued HSBC Debit MasterCard with PayPass can be used in the U.K.

Banknet

MasterCard operates Banknet, a global telecommunications network linking all MasterCard card issuers, acquirers and data processing centers into a single financial network. The operations hub is located in St. Louis, Missouri.

MasterCard's network is significantly different from Visa's. Visa's is a star based system where all endpoints terminate at one of several main data centers, where all transactions are processed centrally. MasterCard's network is an edge based, peer-to-peer network where transactions travel a meshed network directly to other endpoints, without the need to travel to a single point. This allows MasterCard's network to be much more resilient, in that a single failure cannot isolate a large number of endpoints.[citation needed]

EPS-Net

MasterCard Europe operates a Network known as EPS-Net - this interfaces Banknet but is up for replacement in 2009. EPS-Net is used to link Issuers and Acquirers for Online POS/ATM Transaction Processing.

See also

- Access credit card

- American Express

- China UnionPay

- Cirrus

- Credit Card

- Damage waiver

- Diners Club

- Discover

- Interchange fee

- JCB

- Maestro

- Mondex

- Octopus card

- Visa

References

- ^ Jay Loomis (2006-06-28). "MasterCard changing name". The Journal News.

{{cite news}}: Check date values in:|date=(help) - ^ Visa/MasterCard Litigation, January 1st 1996

- ^ VISA CHECK/MASTERMONEY ANTITRUST LITIGATION WEBSITE

- ^ Priceless Film Festival

- ^ Priceless, Trademark Electronic Search System, Retreieved July 5th 2006

- ^ Priceless, Jim Farrell, New American Dream, Retrieved July 5th 2006

- ^ Threats of legal action: MasterCard International (April 9, 2001). "Re: MasterCard/Infringement by NETFUNNY.COM web site". Retrieved 2006-07-30.

{{cite web}}: Check date values in:|date=(help); Cite has empty unknown parameters:|month=and|coauthors=(help) - ^ George B. Daniels, District Judge (March 9, 2004). "Decision of the US District Court in the case of MasterCard International Incorporated v. Ralph Nader" (PDF). US District Court, Southern District of New York. Retrieved 2006-07-30.

{{cite web}}: Cite has empty unknown parameters:|month=and|coauthors=(help) - ^ Promotion All Blacks

- ^ Visa signs $170m deal with Fifa Visa signs $170m deal with Fifa

- ^ "Mastercard is founding sponsor of Mumbai Indians". IndianTelevision.com. Retrieved 2008-04-27.

- ^ MasterCard Canada Wants to Keep Torontonians Skating – Offers City $160,000 to Open Rinks in December

- ^ MasterCard Investor Relations, accessed 4 November 2006

- ^ "BMO Adds 'Tap & Go' Convenience to Mosaik MasterCard". Retrieved 2007-12-08.

- ^ "Canadian Tire Financial Services - Options MasterCard - PayPass". Retrieved 2008-05-07.

- ^ "Tap & Go with Capital One Canada". Retrieved 2008-05-07.

External links

- Official website

- Corporate website

- Merchant website

- Business website

- How MasterCard Works (interactive site)