Savings account: Difference between revisions

Undid revision 357661488 by 75.145.131.82 (talk) |

|||

| Line 8: | Line 8: | ||

Within most [[Europe]]an countries, interest paid on deposit accounts is taxed at source. The high rates of some countries has led to the development of a significant offshore savings industry. The [[European Union Savings Directive]] has made arrangements with many [[offshore financial centre]]s for either information on interest earned to be shared with [[European Union|EU]] tax authorities or for withholding tax to be deducted on interest paid on offshore accounts, because of concerns relating to potential [[tax evasion]]. Account holders must either pay the withholdlose account holder information to relevant tax authorities. <ref>http://www.ft.com/cms/s/ae51ab84-0d9f-11db-a385-0000779e2340.html</ref> |

Within most [[Europe]]an countries, interest paid on deposit accounts is taxed at source. The high rates of some countries has led to the development of a significant offshore savings industry. The [[European Union Savings Directive]] has made arrangements with many [[offshore financial centre]]s for either information on interest earned to be shared with [[European Union|EU]] tax authorities or for withholding tax to be deducted on interest paid on offshore accounts, because of concerns relating to potential [[tax evasion]]. Account holders must either pay the withholdlose account holder information to relevant tax authorities. <ref>http://www.ft.com/cms/s/ae51ab84-0d9f-11db-a385-0000779e2340.html</ref> |

||

takes two years too mature |

|||

==Costs== |

==Costs== |

||

Revision as of 14:16, 28 April 2010

Savings accounts are accounts maintained by retail financial institutions that pay interest but can not be used directly as money ( for example, by writing a cheque). These accounts let customers set aside a portion of their liquid assets while earning a monetary return.

Regulations

In the United States, under Regulation D, 12 CFR 204.2(d)(2), the term "savings deposit" includes a deposit or an account that meets the requirements of Sec. 204.2(d)(1) and from which, under the terms of the deposit contract or by practice of the depository institution, the depositor is permitted or authorized to make up to six transfers or withdrawals per month or statement cycle of at least four weeks. The depository institution may authorize up to three of these six transfers to be made by check, draft, debit card, or similar order drawn by the depositor and payable to third parties. There is no regulation limiting number of deposits, however some banks may choose to limit deposits themselves.

Within most European countries, interest paid on deposit accounts is taxed at source. The high rates of some countries has led to the development of a significant offshore savings industry. The European Union Savings Directive has made arrangements with many offshore financial centres for either information on interest earned to be shared with EU tax authorities or for withholding tax to be deducted on interest paid on offshore accounts, because of concerns relating to potential tax evasion. Account holders must either pay the withholdlose account holder information to relevant tax authorities. [1]

Costs

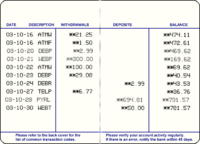

Withdrawals from a savings account are occasionally costly and are sometimes much higher and more time-consuming than the same financial transaction being performed on a demand (current) account. However, most savings accounts do not limit withdrawals, unlike certificates of deposit. In the United States, violations of Regulation D often involve a service charge, or even a downgrade of the account to a checking account. With online accounts, the main penalty is the time required for the Automated Clearing House to transfer funds from the online account to a "brick and mortar" bank where it can be easily accessed. During the period between when funds are withdrawn from the online bank and transferred to the local bank, no interest is earned.

Online savings accounts

Some financial institutions offer online-only savings accounts. These usually pay higher interest rates and sometimes carry higher security restrictions. Those with high interest rates have risen in popularity with the rise of the internet.[2]

References

- ^ http://www.ft.com/cms/s/ae51ab84-0d9f-11db-a385-0000779e2340.html

- ^ James. "Online Savings Accounts". Retrieved 2010-1-10.

{{cite web}}: Check date values in:|accessdate=(help)

External links

- Template:Dmoz

- What Savings Account is Best For You? It is not always High Interest Rate.