Personal budget: Difference between revisions

Reverted good faith edits by Eestrella198 (talk): Test edit. (TW) |

|||

| Line 3: | Line 3: | ||

A '''personal budget''' is a [[finance plan]] that allocates future personal [[income]] towards [[expense]]s, [[savings]] and [[debt]] repayment. Past spending and [[consumer debt|personal debt]] are considered when creating a personal budget. There are several methods and tools available for creating, using and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses. |

A '''personal budget''' is a [[finance plan]] that allocates future personal [[income]] towards [[expense]]s, [[savings]] and [[debt]] repayment. Past spending and [[consumer debt|personal debt]] are considered when creating a personal budget. There are several methods and tools available for creating, using and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses. |

||

== |

== Home budget == |

||

A budget allocates or distributes expected income to expected expenses and intended savings. The following sample illustrates how income might be allocated. |

A budget allocates or distributes expected income to expected expenses and intended savings. The following sample illustrates how income might be allocated. |

||

{|class="wikitable" |

{|class="wikitable" |

||

Revision as of 08:02, 23 July 2016

A personal budget is a finance plan that allocates future personal income towards expenses, savings and debt repayment. Past spending and personal debt are considered when creating a personal budget. There are several methods and tools available for creating, using and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses.

Home budget

A budget allocates or distributes expected income to expected expenses and intended savings. The following sample illustrates how income might be allocated.

| Category | Percentage | Annual Amount | Monthly Amount |

|---|---|---|---|

| Total Income | 2000 | ||

| Taxes | 0 | ||

| Net Spendable | 1500 | ||

| Percentages below are for percent of Net Spendable | |||

| Net Spendable | |||

| Housing | 1000 | ||

| Food | 300 | ||

| Automobile | 200 | ||

| Insurance | 100 | ||

| Debt Repayment | |||

| Entertainment and Recreation | 200 | ||

| Clothing | |||

| Savings | 200 | ||

| Medical/Dental | |||

| Miscellaneous | |||

| School/Childcare | |||

| Investments |

Average annual expenses (2014) per household in the United States are:[1]

| Category | 2012 | 2013 | 2014 | % Change 2012-13 |

% Change 2013-14 |

|---|---|---|---|---|---|

| Food at home | 3,921 | 3,977 | 3,971 | 1.5 | -0.2 |

| Food away from home | 2,678 | 2,625 | 2,787 | -2.0 | 6.2 |

| Housing | 16,887 | 17,148 | 17,789 | 1.5 | 3.8 |

| Apparel and services | 1,736 | 1,604 | 1,786 | -7.6 | 11.3 |

| Transportation | 8,998 | 9,004 | 9,073 | 0.1 | 0.8 |

| Health Care | 3,556 | 3,631 | 4,290 | 2.1 | n/a |

| Entertainment | 2,605 | 2,482 | 2,728 | -4.7 | 9.9 |

| Cash Contributions | 1,913 | 1,834 | 1,788 | -4.1 | -2.5 |

| Personal Insurance and pensions | 5,591 | 5,528 | 5,726 | -1.1 | 3.6 |

| Other Expenditures | 3,557 | 3,267 | 3,548 | -8.2 | 8.6 |

| Total | 51,442 | 51,100 | 53,495 | -0.7% | 4.7% |

Tools

A variety of tools are helpful for constructing a personal budget. Regardless of the tool used, a budget's usefulness relies on the accuracy and currency of the data. Computer generated budgets have become commonly used as they replace the need to rewrite and recalculate the budget every time there is a change.

- Pencil and paper

A simple budget can be written on a piece of a paper with a pencil and, optionally, a calculator. Such budgets can be organized in ring binders or a file cabinet. Simpler still are pre-formatted budgeting books or bookkeeping forms in which a budget can be created by filling in the blanks.

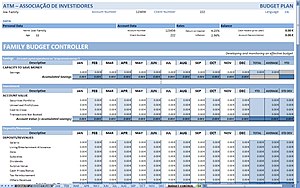

- Spreadsheet software

Spreadsheet software allows budgeting by performing calculations using formulas, for example in keeping track of income and expenditure. A drawback of budget spreadsheets is that some do not offer date-shifting, so information has to be reentered or moved at the end of each month.

- Money-management software

Some software is written specifically for money management. Products such as MoneyWiz, Fortora Fresh Finance, Moneydance, Quicken, Microsoft Money (discontinued), and GnuCash are designed to keep track of individual account information, such as checking, savings or money-market accounts. These programs can categorize past expenses and display monthly reports that are useful for budgeting future months.

- Money-management websites

Several websites, such as Mint.com and Housebudgetplanner.com and FamBudge by Socuis have been devised to help manage personal finances. Some may have a privacy policy governing the use and sharing of supplied financial information.

- Spending-management software

Spending-management software is a variation of money-management software. Unlike typical budgeting that allocates future personal income towards expenses, savings and debt repayment, this type of software utilizes a known amount of money, the cash on hand, to give the user information regarding what is left to spend in the current month. This method eliminates some of the guesswork associated with forecasting what a person might receive for income when it comes to allocating budgeted money. Like money-management software, some spending-management software packages can connect to online bank accounts in order to retrieve a current status report.

Concepts

Personal budgeting, while not particularly difficult, tends to carry a negative connotation among many consumers. Sticking to a few basic concepts helps to avoid several common pitfalls of budgeting.

- Purpose

A budget should have a purpose or defined goal that is achieved within a certain time period. Knowing the source and amount of income and the amounts allocated to expense events are as important as when those cash flow events occur.

- Simplicity

The more complicated the budgeting process is, the less likely a person is to keep up with it. The purpose of a personal budget is to identify where income and expenditure is present in the common household; it is not to identify each individual purchase ahead of time. How simplicity is defined with regards to the use of budgeting categories varies from family to family, but many small purchases can generally be lumped into one category (Car, Household items, etc.).

- Flexibility

The budgeting process is designed to be flexible; the consumer should have an expectation that a budget will change from month to month, and will require monthly review. Cost overruns in one category of a budget should in the next month be accounted for or prevented. For example, if a family spends $40 more than they planned on food in spite of their best efforts, next month's budget should reflect an approximate $40 increase and corresponding decrease in other parts of the budget.

"Busting the budget" is a common pitfall in personal budgeting; frequently busting the budget can allow consumers to fall into pre-budgeting spending habits. Anticipating budget-busting events (and underspending in other categories), and modifying the budget accordingly, allows consumers a level of flexibility with their incomes and expenses.

- Budgeting for irregular income

Special precautions need to be taken for families operating on an irregular income. Households with an irregular income should keep two common major pitfalls in mind when planning their finances: spending more than their average income, and running out of money even when income is on average.

Clearly, a household's need to estimate their average (yearly) income is paramount; spending, which will be relatively constant, needs to be maintained below that amount. A budget being an approximate estimation, room for error should always be allowed so keeping expenses 5% or 10% below the estimated income is a prudent approach. When done correctly, households should end any given year with about 5% of their income left over. Of course, the better the estimates, the better the results will be.

To avoid running out of money because expenses occur before the money actually arrives (known as a cash flow problem in business jargon) a "safety cushion" of excess cash (to cover those months when actual income is below estimations) should be established. There is no easy way to develop a safety cushion, so families frequently have to spend less than they earn until they have accumulated a cushion. This can be a challenging task particularly when starting during a low spot in the earning cycle, although this is how most budgets begin. In general, households that start out with expenses that are 5% or 10% below their average income should slowly develop a cushion of savings that can be accessed when earnings are below average. Whether this rate of building a cushion is fast enough for a given financial situation depends on how variable income is, and whether the budgeting process starts at a high or low point during the earnings cycles.

Allocation guidelines

There are several guidelines to use when allocating money for a budget as well. Past spending is one of the most important priorities; a critical step in most personal budgeting strategies involves keeping track of expenses via receipts over the past month so that spending for the month can be reconciled with budgeted spending for the next month. Any of the following allocation guidelines may be used; choose one that will work well with your situation.

The 60% Solution

The 60% Solution is a budgeting system created by former MSN Money's editor-in-chief, Richard Jenkins. The name "The 60% Solution" originates from Jenkins' suggestion on spending 60% of a household's gross income (before taxes) on fixed expenses. Fixed expenses includes federal, state and Social Security taxes, insurance, regular bills and living expenses- like food and clothing, car and house payments.[2]

The other 40% breaks down as follows, with 10% allocated to each category:

- Retirement: Money set aside into an IRA or 401(k).

- Long-term savings: Money set aside for car purchases, major home fix-ups, or to pay down substantial debt loads.

- Irregular expenses: Vacations, major repair bills, new appliances, etc.

- Fun money: Money set aside for entertainment purposes.

If an individual has a high amount of non-mortgage debt, Jenkins advises that the 20% apportioned to retirement and long-term savings be directed towards paying off debt; once the debt is paid off, the 20% (Retirement + Savings) is to be immediately redirected back into the original categories. According to Jenkins, tracking each individual expense is unnecessary, as the balance of his primary checking account is roughly equivalent to the amount of money that can be spent in this plan.

Software designed to easily set up and track a 60% Solution Budget is built into the "deluxe" and higher versions of Microsoft Money 2007 and Microsoft Money Plus.

Housing as 25% of spendable income

Another allocation principle is that housing expenses (mortgage or rent) should be limited to 25% of spendable income. This rule of thumb especially applies to families moving to new housing; if a house payment for a $300,000 house, plus taxes, will result in a $2,000 monthly mortgage bill, will it take up too large a portion of the budget? (To calculate, find income level, tax rate and mortgage interest rate.)

In housing markets with exceptionally high prices, such as California, New York City, or Boston, Massachusetts, in the early 2000s, this rule of thumb may be difficult to follow. A high percentage of income spent on housing will necessitate lower percentages in other categories.

One of the critical factors that many people overlook during the budgeting process is the "supplier-replacement cost-cutting technique". This is the process of scrutinizing each current expenditure, comparison shopping and replacing with a lower cost, equal quality alternative. The newfound savings is then reapplied to debt, savings accounts and enjoyment spending.

Following a budget

Once a budget is constructed and the proper amounts are allocated to their proper categories, the focus for personal budgeting turns to following the budget. As with allocation, there are various methods available for following a budget.

Envelopes

Envelope Accounting or the Envelope System is a method of budgeting where on a regular basis (i.e. monthly, biweekly, etc.) a certain amount of money is set aside for a specific purpose, or category, in an envelope marked for that purpose. Then anytime you make a purchase you look in the envelope for the type of purchase being considered to see if there are sufficient funds to make the purchase. If the money is there, all is well. Otherwise, you have three options: 1) you do not make the purchase; 2) you wait until you can allocate more money to that envelope; 3) you sacrifice another category by moving money from its associated envelope. The flip side is true as well, if you do not spend everything in the envelope this month then the next allocation adds to what is already there resulting in more money for the next month.

With envelope budgeting, the amount of money left to spend in a given category can be calculated at any time by counting the money in the envelope. Optionally, each envelope can be marked with the amount due each month (if a bill is known ahead of time) and the due date for the bill.

Spreadsheet budgeting with date-shifting

Budget spreadsheets with date-shifting typically offer a detailed view of a 12-month, income and expense, plan. A good way to follow and manage a budget when using a spreadsheet that offers date-shifting is to set the current month a few months before the current month along the 12-month cycle, month 4 for example. In this way previous expenses and results can be viewed when creating or adjusting the budgeting planning.

See also

References

- ^ US Department of Labor Report "Consumer Expenditures 2014"

- ^ Jenkins, Richard. "A simpler way to save: the 60% solution". Retrieved 2013-10-08.