Money supply

| Part of a series on |

| Finance |

|---|

|

In economics, the money supply or money stock, is the total amount of money available in an economy at a particular point in time.[1] There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits (depositors' easily-accessed assets on the books of financial institutions).[2][3]

Money supply data are recorded and published, usually by the government or the central bank of the country. Public and private-sector analysts have long monitored changes in money supply because of its possible effects on the price level, inflation and the business cycle.[4]

That relation between money and prices is historically associated with the quantity theory of money. There is strong empirical evidence of a direct relation between long-term price inflation and money-supply growth, at least for rapid increases in the amount of money in the economy. That is, a country such as Zimbabwe which saw rapid increases in its money supply also saw rapid increases in prices (hyperinflation). This is one reason for the reliance on monetary policy as a means of controlling inflation in the U.S. [5][6] This causal chain is contentious, however: some heterodox economists argue that the money supply is endogenous (determined by the workings of the economy, not by the central bank) and that the sources of inflation must be found in the distributional structure of the economy.[7] In addition to some economists' seeing the central bank's control over the money supply as feeble, many would also say that there are two weak links between the growth of the money supply and the inflation rate: first, an increase in the money supply can cause a sustained increase in real production instead of inflation in the aftermath of a recession, when many resources are underutilized. Second, if the velocity of money, i.e., the ratio between nominal GDP and money supply, changes an increase in the money supply could have either no effect, an exaggerated effect, or an unpredictable effect on the growth of nominal GDP.

Empirical measures

Money is used as a medium of exchange, in final settlement of a debt, and as a ready store of value. Its different functions are associated with different empirical measures of the money supply. There is no single "correct" measure of the money supply: instead, there are several measures, classified along a spectrum or continuum between narrow and broad monetary aggregates. Narrow measures include only the most liquid assets, the ones most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.)

This continuum corresponds to the way that different types of money based that are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures are less closely related to monetary-policy actions.[6] It is matter of perennial debate as to whether narrower or broader versions of the money supply have a more predictable link to nominal GDP.

The different types of money are typically classified as Ms. The number of Ms usually range from M0 (narrowest) to M3 (broadest) but which Ms are actually used depends on the system. The typical layout for each of the Ms is as follows:

| Type of money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Notes and coins (currency) in circulation (outside Federal Reserve Banks, and the vaults of depository institutions) | V[8] | V | V | V | V | V |

| Notes and coins (currency) in bank vaults | V[9] | V | ||||

| Federal Reserve Bank credit (minimum reserves and excess reserves) | V | |||||

| traveler's checks of non-bank issuers | V | V | V | V | ||

| demand deposits | V | V | V | V | ||

| other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. | V[10] | V | V | V | ||

| savings deposits | V | V | V | |||

| time deposits less than $100,000 and money-market deposit accounts for individuals | V | V | ||||

| large time deposits, institutional money market funds, short-term repurchase and other larger liquid assets[11] | V | |||||

| all money market funds | V |

- M0: In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money.[12]

- MB: is referred to as the monetary base or total currency.[13] This is the base from which other forms of money (like checking deposits, listed below) are created and is traditionally the most liquid measure of the money supply. [14]

- M1: Bank reserves are not included in M1.

- M2: represents money and "close substitutes" for money.[15] M2 is a broader classification of money than M1. Economists use M2 when looking to quantify the amount of money in circulation and trying to explain different economic monetary conditions. M2 is a key economic indicator used to forecast inflation.[16]

- M3: Since 2006, M3 is no longer published or revealed to the public by the US central bank.[17] However, there are still estimates produced by various private institutions.

- MZM: Money with zero maturity. It measures the supply of financial assets redeemable at par on demand.

The ratio of a pair of these measures, most often M2/M0, is called an (actual, empirical) money multiplier.

Fractional-reserve banking

The different forms of money in government money supply statistics arise from the practice of fractional-reserve banking. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system[18][19]:

- central bank money (physical currency, government money)

- commercial bank money (money created through loans) - sometimes referred to as private money, or checkbook money[20]

In the money supply statistics, central bank money is MB while the commercial bank money is divided up into the M1-M3 components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

Reserves are deposits that banks have received but have not loaned out. In the USA, the Federal Reserve regulates the percentage that banks must keep in their reserves before they can make new loans. This percentage is called the minimum reserve requirement. This means that if a person makes a deposit for $1000.00 and the bank reserve mandated by the FED is 10% then the bank must increase its reserves by $100.00 and is able to loan the remaining $900.00. The maximum amount of money the banking system can legally generate with each dollar of reserves is called the (theoretical) money multiplier, and, following the formula for the sum of an infinite convergent geometric series, can be calculated as the reciprocal of the minimum reserve. For example, with a reserve of 20%, the money multiplier would be 5, as 20% divided into 100% makes 5.

Example

Note: The examples apply when read in sequential order.

M0

- Laura has ten US $100 bills, representing $1000 in the M0 supply for the United States. (MB = $1000, M0 = $1000, M1 = $1000, M2 = $1000)

- Laura burns one of her $100 bills. The US M0, and her personal net worth, just decreased by $100. (MB = $900, M0 = $900, M1 = $900, M2 = $900)

M1

- Laura takes the remaining nine bills and deposits them in her checking account at her bank. (MB = $900, M0 = 0, M1 = $900, M2 = $900)

- The bank then calculates its reserve using the minimum reserve percentage given by the Fed and loans the extra money. If the minimum reserve is 10%, this means $90 will remain in the bank's reserve. The remaining $810 can only be used by the bank as credit, by lending money, but until that happens it will be part of the banks excess reserves.

- The M1 money supply increased by $810 when the loan is made. M1 the money has been created. ( MB = $900 M0 = 0, M1 = $1710, M2 = $1710)

- Laura writes a check for $400, check number 7771. The total M1 money supply didn't change, it includes the $400 check and the $500 left in her account. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura's check number 7771 is accidentally destroyed in the laundry. M1 and her checking account do not change, because the check is never cashed. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura writes check number 7772 for $100 to her friend Alice, and Alice deposits it into her checking account. MB does not change, it still has $900 in it, Alice's $100 and Laura's $800. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- The bank lends Mandy the $810 credit that it has created. Mandy deposits the money in a checking account at another bank. The other bank must keep $81 as a reserve and has $729 available for loans. This creates a promise-to-pay money from a previous promise-to-pay, thus the M1 money supply is now inflated by $729. (MB = $900, M0 = 0, M1 = $2439, M2 = $2439)

- Mandy's bank now lends the money to someone else who deposits it on a checking account on yet another bank, who again stores 10% as reserve and has 90% available for loans. This process repeats itself at the next bank and at the next bank and so on, until the money in the reserves backs up an M1 money supply of $9000, which is 10 times the M0 money. (MB = $900, M0 = 0, M1 = $9000, M2 = $9000)

M2

- Laura writes check number 7774 for $1000 and brings it to the bank to start a Money Market account (these do not have a credit-creating charter), M1 goes down by $1000, but M2 stays the same. This is because M2 includes the Money Market account in addition to all money counted in M1. (M0 = $4900, M1 = $6710, M2 = $6710)

Foreign Exchange

- Laura writes check number 7776 for $200 and brings it downtown to a foreign exchange bank teller at Credit Suisse to convert it to British Pounds. On this particular day, the exchange rate is exactly USD $2.00 = GBP £1.00. The bank Credit Suisse takes her $200 check, and gives her two £50 notes (and charges her a dollar for the service fee). Meanwhile, at the Credit Suisse branch office in Hong Kong, a customer named Huang has £100 and wants $200, and the bank does that trade (charging him an extra £.50 for the service fee). US M0 still has the $900, although Huang now has $200 of it. The £50 notes Laura walks off with are part of Britain's M0 money supply that came from Huang.

- The next day, Credit Suisse finds they have an excess of GB Pounds and a shortage of US Dollars, determined by adding up all the branch offices' supplies. They sell some of their GBP on the open FX market with Deutsche Bank, which has the opposite problem. The exchange rate stays the same.

- The day after, both Credit Suisse and Deutsche Bank find they have too many GBP and not enough USD, along with other traders. Then, To move their inventories, they have to sell GBP at USD $1.999, that is, 1/10 cent less than $2 per pound, and the exchange rate shifts. None of these banks has the power to increase or decrease the British M0 or the American M0; they are independent systems.

Money supplies around the world

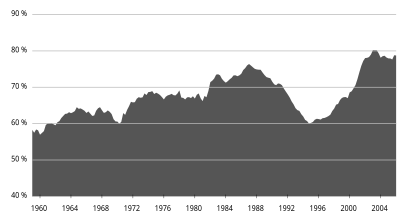

United States

|

|

The Federal Reserve previously published data on three monetary aggregates, but on 10 November 2005 announced that as of 23 March 2006, it would cease publication of M3.[17] Since the Spring of 2006, the Federal Reserve only publishes data on two of these aggregates. The first, M1, is made up of types of money commonly used for payment, basically currency (M0) and checking account balances. The second, M2, includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. As mentioned, the third aggregate, M3 is no longer published. Prior to this discontinuation, M3 had included M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands; it had also included balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The following details their principal components[21]:

- M0: The total of all physical currency, plus accounts at the central bank that can be exchanged for physical currency.

- M1: The total of all physical currency part of bank reserves + the amount in demand accounts ("checking" or "current" accounts).

- M2: M1 + most savings accounts, money market accounts, retail money market mutual funds,and small denomination time deposits (certificates of deposit of under $100,000).

- M3: M2 + all other CDs (large time deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreements.

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided.[17] Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Libertarian congressman Ron Paul (R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation."[22] Some of the data used to calculate M3 are still collected and published on a regular basis.[17] Current alternate sources of M3 data are available from the private sector[23]. However, some would argue [citation needed] that since the Federal Reserve has even less control over the fluctuations of M3 than over those of M2, it is unclear why this number is relevant to monetary policy.

As of 4 November 2009 the Federal Reserve reported that the U.S. dollar monetary base is $1,999,897,000,000. This is an increase of 142% in 2 years.[24] The monetary base is only one component of money supply, however. M2, the broadest measure of money supply, has increased from approximately $7.41 trillion to $8.36 trillion from November 2007 to October 2009, the latest month-data available. This is a 2-year increase in U.S. M2 of approximately 12.9%.[25]

United Kingdom

There are just two official UK measures. M0 is referred to as the "wide monetary base" or "narrow money" and M4 is referred to as "broad money" or simply "the money supply".

- M0: Cash outside Bank of England + Banks' operational deposits with Bank of England.

- M4: Cash outside banks (ie. in circulation with the public and non-bank firms) + private-sector retail bank and building society deposits + Private-sector wholesale bank and building society deposits and Certificate of Deposit. [26]

There are several different definitions of money supply to reflect the differing stores of money. Due to the nature of bank deposits, especially time-restricted savings account deposits, the M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.

European Union

The European Central Bank's definition of euro area monetary aggregates[27]:

- M1: Currency in circulation + overnight deposits

- M2: M1 + Deposits with an agreed maturity up to 2 years + Deposits redeemable at a period of notice up to 3 months

- M3: M2 + Repurchase agreements + Money market fund (MMF) shares/units + Debt securities up to 2 years

Australia

The Reserve Bank of Australia defines the monetary aggregates as[28]:

- M1: currency bank + current deposits of the private non-bank sector

- M3: M1 + all other bank deposits of the private non-bank sector

- Broad Money: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

- Money Base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector

New Zealand

The Reserve Bank of New Zealand defines the monetary aggregates as[29]:

- M1: notes and coins held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central government deposits

- M2: M1 + all non-M1 call funding (call funding includes overnight money and funding on terms that can of right be broken without break penalties) minus inter-institutional non-M1 call funding

- M3: the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and any Reserve Bank repos with non-M3 institutions. M3 consists of notes & coin held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus central government deposits

India

The Reserve Bank of India defines the monetary aggregates as[30]:

- Reserve Money (M0): Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

- M1: Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI).

- M2: M1 + Savings deposits with Post office savings banks.

- M3: M1+ Time deposits with the banking system = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits).

- M4: M3 + All deposits with post office savings banks (excluding National Savings Certificates).

Japan

The Bank of Japan defines the monetary aggregates as[31]:

- M1: cash currency in circulation + deposit money

- M2 + CDs: M1 + quasi-money + CDs

- M3 + CDs: (M2 + CDs) + deposits of post offices + other savings and deposits with financial institutions + money trusts

- Broadly-defined liquidity: (M3 + CDs) + money market + pecuniary trusts other than money trusts + investment trusts + bank debentures + commercial paper issued by financial institutions + repurchase agreements and securities lending with cash collateral + government bonds + foreign bonds

Link with inflation

Monetary exchange equation

Money supply is important because it is linked to inflation by the equation of exchange [citation needed]:

- M is the total dollars in the nation’s money supply

- V is the number of times per year each dollar is spent

- P is the average price of all the goods and services sold during the year

- Q is the quantity of assets, goods and services sold during the year

In mathematical terms, this equation is really an identity which is true by definition rather than describing economic behavior. That is, each term is defined by the values of the other three. Unlike the other terms, the velocity of money has no independent measure and can only be estimated by dividing PQ by M. Adherents of the quantity of money assume that the velocity of money is stable and predictable, being determined mostly by financial institutions. If that assumption is valid, then changes in M can be used to predict changes in PQ. If not, then the equation of exchange is useless to macroeconomics. Most macroeconomists replace the equation of exchange with equations for the demand for money which describe more regular and predictable economic behavior. However, predictability (or the lack thereof) of the velocity of money is equivalent to predictability (or the lack thereof) of the demand for money (since in equilibrium real money demand is simply Q/V). Either way, this unpredictability made policy-makers at the Federal Reserve rely less on the money supply in steering the U.S.economy. Instead, the focus has shifted to interest rates such as the fed funds rate.

In practice, macroeconomists almost always use real GDP to measure Q, omitting the role of all transactions except for those involving newly-produced goods and services (i.e., consumption goods, investment goods, government-purchased goods, and exports). That is, the only assets counted as part of Q are newly-produced investment goods. But the original quantity theory of money did not follow this practice: PQ was the monetary value of all new transactions, whether of real goods and services or of paper assets.

The quantity of assets goods and service sold during the year could be grossly estimated by GDP back in the 1960s. This is not the case anymore because of the rise of financial transactions relative to real transaction.

Economists have noted[citation needed] that M3 growth (and the growth of other measures of the money supply) may not affect all assets or goods equally. For example, an almost constant rise in M3 in the 1970s, '80s and '90s produced a rise in consumer goods "inflation" in the seventies and a rise in the stock market in the '80s and '90s and a rise in home prices after 2001. When home prices went down, the Federal Reserve kept its loose monetary policy and lowered interest rates; the attempt to slow price declines in one asset class, e.g. real estate, may well have caused prices in other asset classes to rise, e.g. commodities[citation needed].

Rates of growth

In terms of percentage changes (to a close approximation under small growth rates,[32] the percentage change in a product, say XY, is equal to the sum of the percentage changes %ΔX + %ΔY). So:

- %ΔP + %ΔQ = %ΔM + %ΔV

That equation rearranged gives the "basic inflation identity":

- %ΔP = %ΔM + %ΔV - %ΔQ

Inflation (%ΔP) is equal to the rate of money growth (%ΔM), plus the change in velocity (%ΔV), minus the rate of output growth (%ΔQ).[33] As before, this equation is only useful if %ΔV follows regular behavior. It also loses usefulness if the central bank lacks control over %ΔM.

Bank reserves at central bank

The examples and perspective in this section may not represent a worldwide view of the subject. |

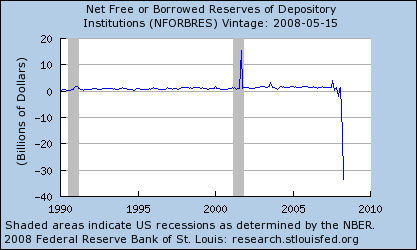

When a central bank is "easing", it triggers an increase in money supply by purchasing government securities on the open market thus increasing available funds for private banks to loan through fractional-reserve banking (the issue of new money through loans) and thus the amount of bank reserves and the monetary base rise. By purchasing government bonds (especially Treasury Bills), this bids up their prices, so that interest rates fall at the same time that the monetary base increases.

With "easy money," the central bank creates new bank reserves (in the US known as "federal funds"), which allow the banks lend more. These loans get spent, and the proceeds get deposited at other banks. Whatever is not required to be held as reserves is then lent out again, and through the "multiplying" effect of the fractional-reserve system, loans and bank deposits go up by many times the initial injection of reserves.

In contrast, when the central bank is "tightening", it slows the process of private bank issue by selling securities on the open market and pulling money (that could be loaned) out of the private banking sector. By increasing the supply of bonds, this lowers their prices and raises interest rates at the same time that the money supply is reduced.

This kind of policy reduces or increases the supply of short term government debt in the hands of banks and the non-bank public, lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (money) and thereby the ability of private banks to issue new money through issuing debt.

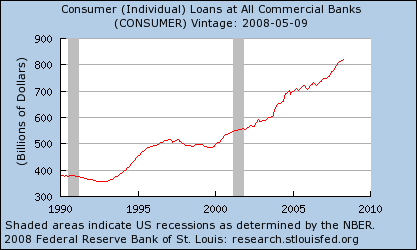

The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to fall with the emergence of money funds, which require no reserves. Then in the early 1990s, reserve requirements were dropped to zero on savings deposits, CDs, and Eurodollar deposit. At present, reserve requirements apply only to "transactions deposits" – essentially checking accounts. The vast majority of funding sources used by private banks to create loans are not limited by bank reserves. Most commercial and industrial loans are financed by issuing large denomination CDs. Money market deposits are largely used to lend to corporations who issue commercial paper. Consumer loans are also made using savings deposits, which are not subject to reserve requirements. This means that instead of the amount of loans supplied responding passively to monetary policy, we often see it rising and falling with the demand for funds and the willingness of banks to lend.

Some academics argue that the money multiplier does not exist, because this would assume that the money supply is exogenous, i.e. determined by the monetary authorities via open market operations. If Central Banks usually target the interest rates (as their policy instrument) then this leads of endogenous money supply (policy outcome).[34]

This article needs to be updated. (March 2009) |

Neither commercial nor consumer loans are any longer limited by bank reserves. Nor are they directly linked proportional to reserves. Between 1995 and 2008, the amount of consumer loans has steadily increased out of proportion to bank reserves. Then, as part of the financial crisis, bank reserves rose dramatically as new loans shrank.

In recent years, some academic economists renowned for their work on the implications of rational expectations have argued that open market operations are irrelevant. These include Robert Lucas, Jr., Thomas Sargent, Neil Wallace, Finn E. Kydland, Edward C. Prescott and Scott Freeman. The Keynesian side points to a major example of ineffectiveness of open market operations in encountered in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This zero bound problem has been called the liquidity trap or "pushing on a string" (the pusher being the central bank and the string being the real economy).

Arguments

The main functions of the central bank are to maintain low inflation and a low level of unemployment. (Sometimes, however, these goals are in conflict.) The U.S. Central bank may attempt to do this by artificially influencing the demand for goods by increasing or decreasing the nation's money supply (relative to trend), which lowers or raises interest rates, which stimulates or restrains spending on goods and services.

An important debate amongst economists in the second half of the twentieth century concerned the central bank's ability to predict how much money should be in circulation, given current employment rates, and inflation rates. Some economists like Milton Friedman believed that the central bank would always get it wrong, leading to wider swings in the economy than if it were just left alone.[35] This is why they advocated a non-interventionist approach—one of targeting a pre-specified path for the money supply independent of current economic conditions— even though in practice this might involve regular intervention with open market operations (or other monetary-policy tools) to keep the money supplies on target.

The Chairman of the U.S. Federal Reserve, Ben Bernanke, has suggested that over the last 10 to 15 years, many modern central banks have become relatively adept at manipulation of the money supply, leading to a smoother business cycle, with recessions tending to be smaller and less frequent than in earlier decades, a phenomenon he terms "The Great Moderation" [36] However, these assumptions may very well prove ill-conceived by the global financial crisis of 2008–2009, which represented the exact opposite of moderation. History will judge whether or not the the Fed's policies have proven effective in preventing recessions, severe or mild. Furthermore, it may be that the functions of the central bank may need to encompass more than the shifting up or down of interest rates or bank reserves: these tools, although valuable, may not in fact moderate the volatility of money supply (or its velocity).

See also

Notes

- ^ Paul M. Johnson. "Money stock:," A Glossary of Political Economy Terms

- ^ Alan Deardorff. "Money supply," Deardorff's Glossary of International Economics

- ^ Karl Brunner , "money supply," The New Palgrave: A Dictionary of Economics, v. 3, p. 527.

- ^ The Money Supply - Federal Reserve Bank of New York

- ^ Milton Friedman 1987). “quantity theory of money”, The New Palgrave: A Dictionary of Economics, v. 4, pp. 15-19.

- ^ a b "money supply Definition". Retrieved 2008-07-20.

- ^ Lance Taylor: Reconstructing Macroeconomics, 2004

- ^ http://dollardaze.org/blog/?post_id=00565

- ^ http://dollardaze.org/blog/?post_id=00565

- ^ http://research.stlouisfed.org/fred2/series/M1

- ^ http://www.investopedia.com/terms/m/m3.asp

- ^ http://moneyterms.co.uk/m0/

- ^ http://dollardaze.org/blog/?post_id=00565

- ^ "M0". Investopedia. Retrieved 2008-07-20.

- ^ "M2". Investopedia. Retrieved 2008-07-20.

- ^ "M2 Definition". InvestorWords.com. Retrieved 2008-07-20.

- ^ a b c d Discontinuance of M3, Federal Reserve, November 10, 2005, revised March 9, 2006.

- ^ Bank for International Settlements - The Role of Central Bank Money in Payment Systems. See page 9, titled, "The coexistence of central and commercial bank monies: multiple issuers, one currency": http://www.bis.org/publ/cpss55.pdf

A quick quote in reference to the 2 different types of money is listed on page 3. It is the first sentence of the document:

- "Contemporary monetary systems are based on the mutually reinforcing roles of central bank money and commercial bank monies."

- ^ European Central Bank - Domestic payments in Euroland: commercial and central bank money:

http://www.ecb.int/press/key/date/2000/html/sp001109_2.en.html One quote from the article referencing the two types of money:

- "At the beginning of the 20th almost the totality of retail payments were made in central bank money. Over time, this monopoly came to be shared with commercial banks, when deposits and their transfer via checks and giros became widely accepted. Banknotes and commercial bank money became fully interchangeable payment media that customers could use according to their needs. While transaction costs in commercial bank money were shrinking, cashless payment instruments became increasingly used, at the expense of banknotes"

- ^ Chicago Fed - Our Central Bank: http://www.chicagofed.org/consumer_information/the_fed_our_central_bank.cfm

- the reference is found in the "Money Manager" section:

- "the Fed works to control money at its source by affecting the ability of financial institutions to "create" checkbook money through loans or investments. The control lever that the Fed uses in this process is the "reserves" that banks and thrifts must hold."

- the reference is found in the "Money Manager" section:

- ^ ebook: The Federal Reserve - Purposes and Functions:http://www.federalreserve.gov/pf/pf.htm

- ^ What the Price of Gold Is Telling Us

- ^ See, for example

- ^ Federal Reserve Statistics[1]

- ^ Federal Reserve Statistics[2]

- ^ www.bankofengland.co.uk Explanatory Notes - M4 retrieved August 13 2007

- ^ The ECB's definition of euro area monetary aggregates: http://www.ecb.int/stats/money/aggregates/aggr/html/hist.en.html

- ^ RBA: Glossary - Text Only Version

- ^ Series description – Monetary and financial statistics

- ^ Handbook of Statistics on Indian Economy. See the document at the bottom of the page titled, "Notes on Tables". The link to this pdf document is: http://rbidocs.rbi.org.in/rdocs/Publications/PDFs/80441.pdf The definitions are on the fourth page of the document

- ^ http://www.boj.or.jp/en/type/exp/stat/exms01.htm click on the link to the exms01.pdf file. They are defined in Appendix 1 which on the 11th page of the pdf.

- ^ http://www.mhhe.com/economics/mcconnell15e/graphics/mcconnell15eco/common/dothemath/percentagechangeapproximation.html

- ^ "Breaking Monetary Policy into Pieces", May 24 2004, http://www.hussmanfunds.com/wmc/wmc040524.htm

- ^ Martijn Boermans & Basil Moore (2009). "Locked-in and Sticky textbooks" [3]

- ^ Milton Friedman (1962). Capitalism and Freedom.

- ^ FRB: Speech, Bernanke-The Great Moderation-February 20, 2004

External links

Data

- Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

- U.S. M1,M2 Money Supply Historical Table

- Money Stock Measures (H.6)

- Data on Monetary Aggregates in Australia

- Monetary Statistics on Hong Kong Monetary Authority

- Monetary Survey on People's Bank of China

Articles

- Do all banks hold reserves, and, if so, where do they hold them? (11/2001)

- What effect does a change in the reserve requirement have on the money supply? (08/2001)

- St. Louis Fed: Monetary Aggregates

- Anna J. Schwartz on money supply

- Discontinuance of M3 Publication

- Investopedia: Money Zero Maturity (MZM)

Computer simulations

- Money Supply Process by Fiona Maclachlan, Wolfram Demonstrations Project.