Marginal revenue

Marginal revenue (or marginal benefit) is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit.[1][2][3][4][5] To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production.[6] Marginal revenue is a fundamental tool for economic decision making within a firm's setting, together with marginal cost to be considered.[7]

In a perfectly competitive market, the incremental revenue generated by selling an additional unit of a good is equal to the price the firm is able to charge the buyer of the good.[3][8] This is because a firm in a competitive market will always get the same price for every unit it sells regardless of the number of units the firm sells since the firm's sales can never impact the industry's price.[1][3]Therefore, in a perfectly competitive market, firms set the price level equal to their marginal revenue .[6]

However, a monopoly firm is large and any changes in its output levels impacts market prices, which determines the entire industry's sales.[1] As a result, a monopolist firm is required to lower the price of units sold in order to increase output by 1 unit.[1][3][6] Since a reduction in price leads to a decline in revenue on each good sold by the firm, the marginal revenue generated is always lower than the price level charged .[1][3][6] The marginal revenue (the increase in total revenue) is the price the firm gets on the additional unit sold, less the revenue lost by reducing the price on all other units that were sold prior to the decrease in price. Marginal revenue is the concept of a firm sacrificing the opportunity to sell the current output at a certain price, in order to sell a higher quantity at a reduced price.[6]

A firm’s profits will be maximized when marginal revenue (MR) equals marginal cost (MC). If then a profit-maximizing firm will increase output for more profit, while if then the firm will decrease output for additional profit. Thus the firm will choose the profit-maximizing output level as that for which .[9]

Definition

Marginal revenue is equal to the ratio of the change in revenue for some change in quantity sold to that change in quantity sold. This can be formulated as:[10]

This can also be represented as a derivative when the change in quantity sold becomes arbitrarily small. Define the revenue function to be

where Q is output and P(Q) is the inverse demand function of customers. By the product rule, marginal revenue is then given by

where the prime sign indicates a derivative. For a firm facing perfect competition, price does not change with quantity sold (), so marginal revenue is equal to price. For a monopoly, the price decreases with quantity sold (), so marginal revenue is less than price (for positive )[6]

Marginal revenue curve

The marginal revenue curve is affected by the same factors as the demand curve – changes in income, changes in the prices of complements and substitutes, changes in populations, etc.[11] These factors can cause the MR curve to shift and rotate.[12] These factors can cause the MR curve to shift and rotate. Marginal revenue curve differs under perfect competition and imperfect competition (monopoly).[13]

Under perfect competition, there are multiple firms present in the market. Changes in the supply level of a single firm does not have an impact on the total price in the market.[14] Firms follow the price determined by market equilibrium of supply and demand and are price takers.[15] The marginal revenue curve is a horizontal line at the market price, implying perfectly elastic demand and is equal to the demand curve.[16]

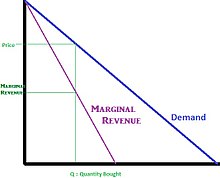

Under monopoly, one firm is a sole seller in the market with a differentiated product.[13] The supply level (output) and price is determined by the monopolist in order to maximise profits, making a monopolist a price maker.[17] The marginal revenue for a monopolist is the private gain of selling an additional unit of output. The marginal revenue curve is downward sloping and below the demand curve and the additional gain from increasing the quantity sold is lower than the chosen market price.[18][19] Under monopoly, the price of all units lowers each time a firm increases its output sold, this causes the firm to face a diminishing marginal revenue.[20]

Relationship between marginal revenue and elasticity

The relationship between marginal revenue and the elasticity of demand by the firm's customers can be derived as follows:[21]

where R is total revenue, P(Q) is the inverse of the demand function, and e < 0 is the price elasticity of demand. If demand is inelastic (e > –1) then MR will be negative, because to sell a marginal (infinitesimal) unit the firm would have to lower the selling price so much that it would lose more revenue on the pre-existing units than it would gain on the incremental unit. If demand is elastic (e < –1) MR will be positive, because the additional unit would not drive down the price by so much. If the firm is a perfect competitor, so that it is so small in the market that its quantity produced and sold has no effect on the price, then the price elasticity of demand is negative infinity, and marginal revenue simply equals the (market-determined) price.

Marginal revenue and markup pricing

Profit maximization requires that a firm produces where marginal revenue equals marginal costs. Firm managers are unlikely to have complete information concerning their marginal revenue function or their marginal costs. However, the profit maximization conditions can be expressed in a “more easily applicable form”:

- MR = MC,

- MR = P(1 + 1/e),

- MC = P(1 + 1/e),

- MC = P + P/e,

- (P - MC)/ P = –1/e.[22]

Markup is the difference between price and marginal cost. The formula states that markup as a percentage of price equals the negative (and hence the absolute value) of the inverse of the elasticity of demand.[22]

(P - MC)/ P = –1/e is called the Lerner index after economist Abba Lerner.[23] The Lerner index is a measure of market power — the ability of a firm to charge a price that exceeds marginal cost. The index varies from zero (when demand is infinitely elastic (a perfectly competitive market) to 1 (when demand has an elasticity of –1). The closer the index value is to 1, the greater is the difference between price and marginal cost. The Lerner index increases as demand becomes less elastic.[23]

Alternatively, the relationship can be expressed as:

- P = MC/(1 + 1/e).

Thus, for example, if e is –2 and MC is $5.00 then price is $10.00.

Example If a company can sell 10 units at $20 each or 11 units at $19 each, then the marginal revenue from the eleventh unit is (11 × 19) - (10 × 20) = $9.

See also

Notes

- ^ a b c d e Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., 1991.

- ^ Edwin Mansfield, "Micro-Economics Theory and Applications, 3rd Edition", New York and London:W.W. Norton and Company, 1979.

- ^ a b c d e Roger LeRoy Miller, "Intermediate Microeconomics Theory Issues Applications, Third Edition", New York: McGraw-Hill, Inc, 1982.

- ^ Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988.

- ^ John Black, "Oxford Dictionary of Economics", New York: Oxford University Press, 2003.

- ^ a b c d e f Schiller, Bradley R., 1943- (2017). Essentials of economics. Gebhardt, Karen. (10th ed ed.). New York: McGraw-Hill/Irwin. ISBN 978-1-259-23570-2. OCLC 955345952.

{{cite book}}:|edition=has extra text (help)CS1 maint: multiple names: authors list (link) CS1 maint: numeric names: authors list (link) - ^ Mankiw, N. Gregory. (2009). Principles of microeconomics (5th ed ed.). Mason, OH: South-Western Cengage Learning. ISBN 978-0-324-58998-6. OCLC 226358094.

{{cite book}}:|edition=has extra text (help) - ^ O'Sullivan & Sheffrin (2003), p. 112.

- ^ David., Prentice; 1962-, Waschik, Robert G. (2010). Managerial economics : a strategic approach. Routledge. p. 33. ISBN 9780415495172. OCLC 432989728.

{{cite book}}:|last2=has numeric name (help)CS1 maint: multiple names: authors list (link) - ^ Pindyck, Robert S.,. Microeconomics. Rubinfeld, Daniel L., (Global edition, Eighth edition ed.). Boston [Massachusetts]. ISBN 978-1-292-08197-7. OCLC 908406121.

{{cite book}}:|edition=has extra text (help)CS1 maint: extra punctuation (link) CS1 maint: multiple names: authors list (link) - ^ Landsburg, Steven E., 1954-. Price theory and applications (Ninth edition ed.). Stamford, CT. ISBN 1-285-42352-6. OCLC 891601555.

{{cite book}}:|edition=has extra text (help)CS1 maint: multiple names: authors list (link) CS1 maint: numeric names: authors list (link) - ^ Landsburg, S Price 2002. p. 137.

- ^ a b Kumar, Manoj (2015-05-08). "Revenue Curves under Different Markets (With Diagram)". Economics Discussion. Retrieved 2020-10-26.

- ^ "The Supply Curve of a Competitive Firm". saylordotorg.github.io. Retrieved 2020-10-26.

- ^ "Demand in a Perfectly Competitive Market". www.cliffsnotes.com. Retrieved 2020-10-26.

- ^ Microeconomics : theory through applications. Open Textbook Library,. Arlington, Virginia. ISBN 978-1-4533-1328-2. OCLC 953968136.

{{cite book}}: CS1 maint: extra punctuation (link) CS1 maint: others (link) - ^ McLean, William J. (William Joseph) (2013). Economics and contemporary issues. Applegate, Michael. (9e ed.). Mason, Ohio: South-Western Cengage Learning. ISBN 978-1-111-82339-9. OCLC 775406167.

- ^ Tuovila, Alicia. "Marginal Revenue (MR) Definition". Investopedia. Retrieved 2020-10-26.

- ^ "Marginal revenue for a monopolist". www.economics.utoronto.ca. Retrieved 2020-10-26.

- ^ "The Monopoly Model". saylordotorg.github.io. Retrieved 2020-10-26.

- ^ Perloff (2008) p. 364.

- ^ a b Pindyck, R & Rubinfeld, D (2001) p. 334.

- ^ a b Perloff (2008) p. 371.

References

- Landsburg, S 2002 Price Theory & Applications, 5th ed. South-Western.

- Perloff, J., 2008, Microeconomics: Theory & Applications with Calculus, Pearson. ISBN 9780321277947

- Pindyck, R & Rubinfeld, D 2001: Microeconomics 5th ed. Page Prentice-Hall. ISBN 0-13-019673-8

- Samuelson & Marks, 2003 Managerial Economics 4th ed. Wiley

- O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Pearson Prentice Hall. ISBN 0-13-063085-3.