Oligopoly

This article or section is in a state of significant expansion or restructuring. You are welcome to assist in its construction by editing it as well. If this article or section has not been edited in several days, please remove this template. If you are the editor who added this template and you are actively editing, please be sure to replace this template with {{in use}} during the active editing session. Click on the link for template parameters to use.

This article was last edited by JONJONAUG (talk | contribs) 15 years ago. (Update timer) |

An oligopoly is a market form in which a market or industry is dominated by a small number of sellers (oligopolists). The word is derived from the Greek for few (entities with the right to) sell. Because there are few participants in this type of market, each oligopolist is aware of the actions of the others. The decisions of one firm influence, and are influenced by, the decisions of other firms. Strategic planning by oligopolists always involves taking into account the likely responses of the other market participants. This causes oligopolistic markets and industries to be at the highest risk for collusion.

Description

Oligopoly is a common market form. As a quantitative description of oligopoly, the four-firm concentration ratio is often utilized. This measure expresses the market share of the four largest firms in an industry as a percentage.

Oligopolistic competition can give rise to a wide range of different outcomes. In some situations, the firms may employ restrictive trade practices (collusion, market sharing etc.) to raise prices and restrict production in much the same way as a monopoly. Where there is a formal agreement for such collusion, this is known as a cartel. A primary example of such a cartel is OPEC which has a profound influence on the international price of oil.

Firms often collude in an attempt to stabilise unstable markets, so as to reduce the risks inherent in these markets for investment and product development. There are legal restrictions on such collusion in most countries. There does not have to be a formal agreement for collusion to take place (although for the act to be illegal there must be a real communication between companies) - for example, in some industries, there may be an acknowledged market leader which informally sets prices to which other producers respond, known as price leadership.

In other situations, competition between sellers in an oligopoly can be fierce, with relatively low prices and high production. This could lead to an efficient outcome approaching perfect competition. The competition in an oligopoly can be greater than when there are more firms in an industry if, for example, the firms were only regionally based and didn't compete directly with each other.

The welfare analysis of oligopolies suffers, thus, from a sensitivity to the exact specifications used to define the market's structure. In particular, the level of dead weight loss is hard to measure. The study of product differentiation indicates oligopolies might also create excessive levels of differentiation in order to stifle competition.

Oligopoly theory makes heavy use of game theory to model the behavior of oligopolies:

- Stackelberg's duopoly. In this model the firms move sequentially (see Stackelberg competition).

- Cournot's duopoly. In this model the firms simultaneously choose quantities (see Cournot competition).

- Bertrand's oligopoly. In this model the firms simultaneously choose prices (see Bertrand competition).

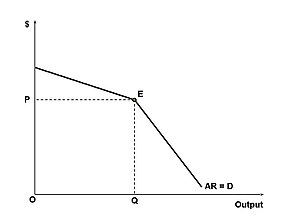

Demand curve

In an oligopoly, firms operate under imperfect competition . Following from the fierce price competitiveness created by this sticky-upward demand curve, firms utilize non-price competition in order to accrue greater revenue and market share.

"Kinked" demand curves are similar to traditional demand curves, as they are downward-sloping. They are distinguished by a hypothesized convex bend with a discontinuity at the bend - the "kink." Therefore, the first derivative at that point is undefined and leads to a jump discontinuity in the marginal revenue curve.

Classical economic theory assumes that a profit-maximizing producer with some market power (either due to oligopoly or monopolistic competition) will set marginal costs equal to marginal revenue. This idea can be envisioned graphically by the intersection of an upward-sloping marginal cost curve and a downward-sloping marginal revenue curve (because the more one sells, the lower the price must be, so the less a producer earns per unit). In classical theory, any change in the marginal cost structure (how much it costs to make each additional unit) or the marginal revenue structure (how much people will pay for each additional unit) will be immediately reflected in a new price and/or quantity sold of the item. This result does not occur if a "kink" exists. Because of this jump discontinuity in the marginal revenue curve, marginal costs could change without necessarily changing the price or quantity.

The motivation behind this kink is the idea that in an oligopolistic or monopolistically competitive market, firms will not raise their prices because even a small price increase will lose many customers. This is because competitors will generally ignore price increases, with the hope of gaining a larger market share as a result of now having comparatively lower prices. However, even a large price decrease will gain only a few customers because such an action will begin a price war with other firms. The curve is therefore more price-elastic for price increases and less so for price decreases. Firms will often enter the industry in the long run.

Examples

In industrialized countries barriers to entry have found oligopolies forming in many sectors of the economy:

Unprecedented levels of competition, fueled by increasing globalization, have resulted in oligopolies emerging in many market sectors. Market share in an oligopoly are typically determined on the basis of product development and advertising. There are now only a small number of manufacturers of civil passenger aircraft, though Brazil (Embraer) and Canada (Bombardier) have fielded entries into the smaller-market passenger aircraft market sector. A further instance arises in a heavily regulated market such as wireless communications. In some areas only two or three providers are licensed to operate.

Australia

- Most media outlets are owned either by News Corporation, Time Warner, or Fairfax Media[1]

- Retailing is dominated by Coles-Myer and Woolworths [citation needed]

Canada

- Three companies (Rogers Wireless, Bell Mobility and Telus) constitute over a 94% share of Canada's wireless market.[2] [3]

United Kingdom

- Four companies (Tesco, Sainsbury's, Asda and Morrisons) share between them them 74.4% of the grocery market[4]

- Scottish & Newcastle, Molson Coors, and Inbev control two thirds of the beer brewing industry. [5]

- The detergent market is dominated by two players Unilever and Proctor & Gamble[6]

United States

- Anheuser-Busch, SABMiller, and Molson Coors control about 80% of the beer industry.[7]

- Boeing and Airbus have a duopoly over the airliner market[8]

- Many media industries today are essentially oligopolies. Six movie studios receive 90% of American film revenues, and four major music companies receive 80% of recording revenues. There are just six major book publishers, and the television industry was an oligopoly of three networks – ABC, CBS, and NBC – from the 1950s through the 1970s. Television has diversified since then, especially because of cable, but today it is still mostly an oligopoly (due to concentration of media ownership) of five companies: Disney/ABC, CBS Corporation, NBC Universal, Time Warner, and News Corporation.[9]

Worldwide

- The accountancy market is controlled by PriceWaterhouseCoopers, KPMG, Deloitte Touche Tohmatsu, and Ernst & Young (commonly known as the Big Four)[10]

- Three leading food processing companies, Kraft Foods, PepsiCo and Nestle, together form a large proportion[vague] of global processed food sales. These three companies are often used as an example of "The rule of 3"[11], which states that markets often become an oligopoly of three large firms. An analogy could be drawn with Orwell's dystopian world in his novel Nineteen Eighty Four, where three superpowers dominate the globe but none on its own has enough power to defeat either of the others.

See also

- Market form

- Duopoly

- Perfect competition

- Monopsony

- Oligopolistic reaction

- Oligopsony

- Monopoly

- Big Business

- Collusion

- Beat The Market: An Oligopoly Simulation Game

Notes

- ^ Media Industry Profile: Australia, Datamonitor, Oct. 2008

{{citation}}: Check date values in:|date=(help) - ^ http://cwta.ca/CWTASite/english/facts_figures_downloads/SubscribersStats_en_2008_Q4.pdf

- ^ http://www.crtc.gc.ca/eng/publications/reports/policymonitoring/2008/cmr2008.pdf

- ^ Probe says 'too few supermarkets', BBC News, 31 October 2007, retrieved 2009-04-03

- ^ Beer Industry Profile: United Kingdom, Datamonitor, Dec. 2008

{{citation}}: Check date values in:|date=(help) - ^ Neff, Jack (2002). "Unilever cedes laundry war". Advertising Age. 73 (21).

{{cite journal}}:|access-date=requires|url=(help); Unknown parameter|month=ignored (help) - ^ Beer Industry Profile: United States, Datamonitor, Dec. 2008

{{citation}}: Check date values in:|date=(help) - ^ Airlines Industry Profile: United States, Datamonitor, Nov. 2008, pp. 13–14

{{citation}}: Check date values in:|date=(help) - ^ Rodman, George. Mass Media in a Changing World. New York (2nd ed.), McGraw Hill, 2008

- ^ Accountancy Industry Profile: Global, Datamonitor, Sep. 2008

{{citation}}: Check date values in:|date=(help) - ^ The Rule of Three, New York: Boston Publishing Co.

{{citation}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)

External links

- BasicEconomics.info - Oligopoly Market Structure

- Microeconomics by Elmer G. Wiens: Online Interactive Models of Oligopoly, Differentiated Oligopoly, and Monopolistic Competition

- Vives, X. (1999). Oligopoly pricing, MIT Press, Cambridge MA. (A comprehensive work on oligopoly theory)

- Oligopoly Watch A blog on current oligopoly issues from a business and social perspective

- Simulations in Managerial/Business Economics

- Simulations in Principles of Economics