2000s commodities boom

The 2000s commodities boom is the rise in many physical commodity prices (such as those of food stuffs, metals, fuels and alike) which occurred during the decade of the 2000s, following the Great Commodities Depression of the 1980s and 1990s, largely due to the rising demand from emerging markets such as the BRIC countries and the former Yugoslavia, as well as the result of both natural and man made concerns over long term supply availability. The was a sharp down turn in prices during 2008 and early 2009 as a result of the credit crunch and sovereign debt crisis, but prices began to rise as demand recovered from late 2009 to mid 2010.

The Great Commodities Depression

The Great Commodities Depression is a term used in economic history to describe the protracted declines in the prices of raw materials roughly from 1982-1998. From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Since 1968 the price of gold has ranged widely, from a high of $850/oz ($27,300/kg) on January 21, 1980, to a low of $252.90/oz ($8,131/kg) on June 21, 1999 (London Gold Fixing).[1]

The analysis of this period is based on the work of Robert Solow and is rooted in macroeconomic theories of trade including the Mundell-Fleming model[2].

One opinion stated that-

“The volatility and interest rates found its way into commodity inputs and all sectors of the world economy."

Commodity Trading Manual, By Patrick J. Catania, Chicago Board of Trade, Peter Alonzi, Chicago Board of Trade Market & Product[2].

Hence, in the case of an economic crisis commodities prices follow the trends in exchange rate (coupled) and its prices decrease in case there are downward trends of diminishing Money Supply[2].

FX impacts commodities prices and so does MS (the advent of a crises will pull commodities $’s down)[2].

The Great 2000s Commodities Boom

A commodity price bubble, known as the 2000s commodities boom, was created following the collapse in the mid 2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding housing prices had gone from boom to bust in several western nations, including the UK, USA, Ireland, Greece, Canada and Spain.

The renewed interest in coal by China's and Taiwan's energy companies and the rise of alternative power sources like wind farms helped modify coal prices over the 2000s.

Chlorine price steadily increaced trough out 2007 and early 2008 as demand for P.V.C. and some metals like copper, Neodymium and Tantalum rose due to the increased groath of the BRIC countries demand for elctrical goods. Russia increased production, but the U.S.A. off set this with production cuts in the late 1990s and mid 2000s.

Both phosphorus, rhodium, molybdenum, manganese, vanadium and palladium are used in high grade steals, oil based lubricants, automotive catalytic converters, chemical plant’s catalysts, electronics, TV screens and in radio isotopes [3]. Demand for these metals appeared to be on the up as computers, mobile phones and ipods became all the more popular in the mid to late 2000s. Thulium is used in x-ray tubes and Neodymium is used in high strength/high grade magnets.

Both molybdenum, rhodium, neodymium and palladium are relitvly scarce metals; whlie manganese and vanadium are, like phosphorus and sulphur fairly abundant for minor minerals. The major metals such as iron, lead and tin are commonplace.

Recycling of the aluminium, ferrous metals, copper fractions, gold, palladium and platinum in mobile phones, computers and ipods had got under way by the mid 2000s [4][5][6][7][8][9]. Battery recycling has helped bring down both the nickel and cadmium prices.

Sulfuric acid (an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure due to flooding, precipitating similarly steep price increases.[10][11]

On occasions, the media reported that some market speculators were also blamed for manipulating, if not overtly pushing up oil prices by over stating the problems concerning the arrival of the pending peak oil crisis[12] ant the political situation in Iraq.

Food stuffs

Corn, wheat, rice, cocoa and Soya beans

Both a rising global population and a sharp decline in food crop production in favour of a sharp rise in biofuel crops helped cause a sharp rise in basic food stock prices,[13]. Ethiopia also saw a drought threaten it's already frail farm lands in 2007.[14] Cocoa was also affected by a bad crop in 2008, due to disease and unusually heavy rain in parts of West Africa.

Between 2006 and 2008 average world prices for rice rose by 217%, wheat by 136%, corn by 125% and soybeans by 107%.[15] Rising demand both both India and Egypt (who were and still are heavily over populated), helped to ramp up demand for American wheat during this hyper-bull market during August 2007[16]. Discounted wheat sold at about £11-£15/t. August 2007, with non discounted wheat at slightly higher price. The November 2007 wheat futures market was trading at nearly £165/t, with November 2008 contracts at £128.50[17]. The market became rather bearish, if not down right boorish as non futures prices froze up and stagnated in December 2007[18]. The price of wheat reached record highs after Kazakhstan to limit supplies being sold overseas in early 2008. Egypt and China were consuming more food as thier wage packets and national econamies grew[19], but had slowed down by late 2008.Food riots hit Egypt on April the 12th, 2008, as national bread prices rose rapidly in March and April 2008 [20].

In late April 2008 rice prices hit 24 cents (U.S.) per U.S. pound, more than doubling the price in just seven months. The price of wheat had risen from an already high £88 per tonne to £91 from January to March 2010, due to the bullish market and currency concerns [21]. This lead to food riots in places such as Haiti, Indonesia, the Ivory Coast, Uzbekistan, Egypt [22][23] and Ethiopia.[24] The market remains faily bullish.

Paper

Recycled paper

The price of recycled paper has varied greatly over the last 30 or so years[25][26] [27][28] [29][30][31]. The German price of €100/£49 per tonne was typical for the year 2003 [28] and it steadily rose over the years. By the September of 2008 saw the American price of $235 per ton, which had fallen to just $120 per ton[25], and in the January of 2009, the UK's fell six weeks from about £70.00 per ton, to only £10.00 per ton[26][29]. The slump was probably due to the economic down turn in East Asia leading to market for waste paper drying up in China[29]. 2010 averaged at $120.32 over the start of the year, but saw a rapid rise global prices in May 2010[27], with the June 2010 resting $217.11 per ton in the USA as China's paper market began to reopen[27]!

Fuel

Coal

Coal prices start 2009 at AU$72 per short tonne, rose to AU$73 per tonne in September[32] and then up to AU$84 per tonne in the October of 2009[32] due to renewed interest by China's and Taiwan's energy companies. In the beginning of 2010 prices were about AU$112.50 per short tonne, but then fell to a new low point of AU$111.05 per short tonne in mid 2010 and were on the slip to with the rise of alternative power sources became popular.

Oil

During 2003, the price rose above $30, reached $60 by August 11, 2005, and peaked at $147.30 in July 2008.[33] Commentators attributed the heavy price increases to many factors, including reports from the United States Department of Energy and others showing a decline in petroleum reserves,[34] worries over peak oil,[35] Middle East tension, and oil price speculation.[36]

For a time, geo-political events and natural disasters indirectly related to the global oil market had strong short-term effects on oil prices, such as North Korean missile tests,[37] the 2006 conflict between Israel and Lebanon,[38] worries over Iranian nuclear plans in 2006,[39] Hurricane Katrina,[40][41] and various other factors.[42] By 2008, such pressures appeared to have a insignificant impact on oil prices given the onset of the global recession.[43] The recession caused demand for energy to shrink in late 2008, with oil prices falling from the July 2008 high of $147 to a December 2008 low of $32.[44] Oil prices stabilized by October 2009 and established a trading range between $60 and $80.[44]

The price of oil nearly tripled from $50 to $147 from early 2007 to 2008, before plunging as the financial crisis began to take hold in late 2008.[45] Experts debate the causes, which include the flow of money from housing and other investments into commodities to speculation and monetary policy [46] or the increasing feeling of raw materials scarcity in a fast growing world economy and thus positions taken on those markets, such as Chinese increasing presence in Africa. An increase in oil prices tends to divert a larger share of consumer spending into gasoline, which creates downward pressure on economic growth in oil importing countries, as wealth flows to oil-producing states.[47]

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year.[48] In July 2008, oil peaked at $147.30[33] a barrel and a gallon of gasoline was more than $4 across most of the U.S.A. The economic contraction in the fourth quarter of 2008 caused a dramatic drop in demand and prices fell below $35 a barrel at the end of the year.[33] Some believe that this oil price spike was the product of Peak Oil.[49][unreliable source?] There is concern that if the economy was to improve, oil prices might return to pre-recession levels.[50]

In testimony before the Senate Committee on Commerce, Science, and Transportation on June 3, 2008, former director of the CFTC Division of Trading & Markets (responsible for enforcement) Michael Greenberger specifically named the Atlanta-based IntercontinentalExchange, founded by Goldman Sachs, Morgan Stanley and British Petroleum as playing a key role in the speculative run-up of oil futures prices traded off the regulated futures exchanges in London and New York.[51]

The price of oil rose to $77 per barrel on June 24 as a cyclone begins to form in the south western Caribbean[52]. The price for July 2010 was about $84–$90 per barrel of crude oil.

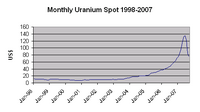

Uranium

Uranium traded at about $15–$20/ per kgU sine the late 1980s due to a 10 year secular bear market, with a 2001 low of just over $10/kgU. The 2007 Uranium bubble started in 2005[54] and began to accelerate badly with the 2006 flooding of the Cigar Lake Mine in Saskatchewan[55][56][57]. Uranium prices peaked at peaking at roughly 300$/kgU in mid-2007[58], began to fall in mid 2008 and are now hovering about 100$/kgU[59]. The stock prices of many stock price of uranium mining and exploration companies rose sharply, only to fall later in this boom to[55].

There was also a brief resurgence of interest in nuclear power by the UK government between 2006 and 2008 due to the apparently insecure nature of Middle Eastern oil and after the closure of several old and uneconomically/unenvironmentally viable coal fired power stations at the time. This helped the Uranium price to rally at this date.

Precious metals

Gold

There was a sharp shift in the prices of Gold and, to a lesser existent, both silver and platinum. Prices were at or near an all time high in late 2010 due to people using the precious metals as a safe haven for their money as both the de facto value of cash and the stock market prices became more erratic in the late 2000s.

The period from 1999 to 2001 marked the "Brown Bottom" after a 20-year secular bear market at $252.90 per troy ounce.[60] Prices increased rapidly from 1991, but the 1980 high was not exceeded until January 3, 2008 when a new maximum of $865.35 per troy ounce was set (a.m. London Gold Fixing).[61] Another record price was set on March 17, 2008 at $1,023.50/oz ($32,900/kg)(am. London Gold Fixing).[61] In the fall of 2009, gold markets experience renewed momentum upwards due to increased demand and a weakening US dollar. On December 2, 2009, Gold passed the important barrier of US$1,200 per ounce to close at $1,215.[62] Gold further rallied hitting new highs in May 2010 after the European Union debt crisis prompted further purchase of gold as a safe asset.[63][64][65].

Since April 2001 the gold price has more than tripled in value against the US dollar,[66] prompting speculation that the long secular bear market had ended and a bull market has returned.[67] Gold's price finally stood at $1,350 per troy oz on July 1, 2010 [68].

Silver

Silver cost $4 per troy ounce in 1992[63], started to rise rapidly in early 2004[63], reached $18 per troy oz by late 2007, slipped badly to $10 per troy oz during the Credit Crunch of 2008[63], but was selling in late 2009 and again in early 2010 at just under $18 per troy oz of metal[63].

Platinum

Platinum first sold at about $350 per troy oz in 1992[63] and stayed rather flat save for a small dip to about $325 per troy oz in the mid 1990’s[63] and a equally small rise to about $375 per troy ounce in the Millennium period. It started to gain value in mid 2002[63] and grew on a experiential curve model as the prices then began to sky-rocket upwards[63]! The high point was when it was trading for $2,200 per troy oz in early 2007[63]. Prices crashed back down to reality with a mere $800 per troy oz in January 2008[63], but the price had recovered back to a reasonable $1,600 per troy oz by early 2010[63].

Rhenium

Because of the low availability relative to demand, rhenium is among the most expensive industrial metals, with an average price exceeding US$6,000 per kilogram, as of mid 2009. It first traded in 1928 at US$10,000 per kilogram of metal, but traded at US$ 250 per Troy ounce in mid 2010 [69]. It traded in July, 2010, at about US$4,000-4,500/kg [70].

Other non-fissile metals

Aluminium

Aluminium is a widely used, mined, refined and trusted metal[71][72]. The fortunes of this metal are linked to the rise and fall of the aircraft, electrical and automotive industries[73][74].

The price of aluminium was 80 cents per lb in 1995 and 45 cents per lb in 1998 and hovered around this until the January 2003, when it started to rise to $1.50 per pound and in 2006 and $1.40 per lb in the December of 2007[75] [76]. It collapsed down to a mere 60 cents per lb in the November of 2008, but is now hovering at about $1.00 per lb, with a new April peak of $1.10 per pound of Aluminium[75][77].

Nickel

The price of nickel price boomed in the late 1990s, then the price of nickel imploded from around $51,000 /£36,700 per metric tonne in May 2007 to about $11,550/£8,300 per metric ton in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then.[78] As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian mining industry.[79]. Battery recycling has helped bring down both the nickel and cadmium prices.

Copper

It was also noticed that a copper price bubble was occurring at the same time as the oil bubble. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600[80]. The price slump lasted until 2004 which saw a price surge that had copper reaching $9,000 per tonne in the May of 2006, but it eventually fell down to $7,040 per tonne in early 2008.[81] When the slump came, it hit some copper mining countries like the D.R.C. very hard. Mining authorities announced on the 10th of December, 2009, that the Dikulushi mine, which is situated in the Democratic Republic of the Congo’s Katanga Province, would close due to poor copper prices[82].

Rhodium

Rhodium prices rose brief during the millennium period[63] due to increased demand, then collapsed to nearly their original 1995-7 starting price of $500/oz between 2002 and 2004.[63]

Later on, the mysterious and unexpected Rhodium price bubble of 2008 suddenly increased prices from just over $500/oz in late 2006 to $9,000/oz-$9,500/oz in July 2008[63], only for the price then to tumble down only $1,000/oz in January 2009.[63][83]. Both an increase in demand in the American automotive industry, a herd instinct among investors, a then bullish market in rare metals and a rogue speculator or rogue speculators on Wall Street were all at least partly to blame for the sudden rise and fall in the rare metal's price[84].

Palladium

Most palladium is used for catalytic converters in the automobile industry.[85]. It is also used for some medical, high grade steel, industrial, dental and electronic purposes.

Palladium prices rose sharply during the millennium period[63] due to increased demand, then collapsed to nearly their original starting price by the end 2002[63], only to start to rise less dramatically in 2006 the year [63]. Palladium prices in 1992 and 2002-04 was about $200/oz. It rapidly shot up to approximately $1,000/oz between 1999–2001 and collapsed to only $200/oz by late 2002, but is now just under $500/oz per of Palladium in 2010[63].

In the run up to 2000, Russian supply of palladium to the global market was repeatedly delayed and disrupted[86] because the export quota was not granted on time, for political reasons. The ensuing market panic drove the palladium price to an all-time high of $1,100 per troy ounce in January 2001.[87] Around this time, the Ford Motor Company, fearing auto vehicle production disruption due to a possible palladium shortage, stockpiled large amounts of the metal purchased near the price high. When prices fell in early 2001, Ford lost nearly US$1 billion.[88] World demand for palladium increased from 100 tons in 1990 to nearly 300 tons in 2000. The global production of palladium from mines was 222 metric tons in 2006 according to the USGS.

Lead

The price of lead price rose sharply in early 2007, then collapsed to nearly their original starting price by the end of the next year[89]. Lead prices began to rise in early 2007 due to increased word wide demand. Prices were about $1,200 per tonne of lead in the July, then hurtled up to $2,220 per tonne of lead by September and collapsed back down to $1,200 per tonne in the October of that year. Despite the bullish market condition, the price had collapsed by the July of 2009 and was only worth about $1,400 per tonne of lead[90]. The lead and Zinc markets became rather bearish for several months afterwards. Prices were hovering at between $1,770 and $2,175 per tonne of lead[91][91] as the markets became more bullish and increased prices after China's car scrapage scheme had caused a general upturn in lead, zinc, cadmium and aluminium production[91][92]. By the June of 2010 prices stood at only $870 per tonne of lead bad back to about $2,200 in the July of 2010[92][93][94][95].

Zinc

The price of zinc price rose sharply in early 2007 after a 5 year secular bear market, then collapsed to nearly their original starting price by the end of the next year[89]. Zinc also exhibited similar bullish trading patterns as most metals did since 2004, but with a different overall price[92].

Zinc sale prices were 80 cents per lb in the July of 2008[96], which was typical of it’s 2004-2008 pricing levels[96]. By the January of 2009 it had bottomed out and was worth a mere 45 cents per lb[96]. A spectacular bull market and increased Chinese interest in galvanised construction steel caused prices to top off at $1.20 per pound of metal by the January of 2010[96]. It then quickly fell back to a routine 80 cents by the July of 2010[96].

Zinc is popular in manufacturing and building since it's ability to create corrosion-resistant zinc plating of steel (hot-dip galvanizing) is the major application for zinc. Other applications are in batteries and alloys, such as brass. A variety of zinc compounds are commonly used, such as zinc carbonate and zinc gluconate (as dietary supplements), zinc chloride (in deodorants), zinc pyrithione (anti-dandruff shampoos), zinc sulfide (in luminescent paints), and zinc methyl or zinc diethyl in the organic laboratory.

Neodymium

Neodymium, a fairly rare metal[97][98] which is used in high grade magnets[99][100][101], saw its prices rise due to increased demand, as were typical of this general market trend. The average price was $16.10 per kg in November and December 2009[102], but it began trading in June 2010 at $20–$45 per kg[103].

Neodymium serves as a constituent of high strength neodymium magnets, which are widely used in loudspeakers, computer hard drives, high power/weight electric motors (e.g. for those in hybrid cars) and in high efficiency generators (such as aircraft and wind turbine generators).[104]

There was also a strong resurgence of interest in wind farms by the UK government between 2008 and 2010 due to the continuing fears of insecurity in Middle Eastern oil supplies to the industrialised nations and after the closure of several old and uneconomically/non-environmentally viable coal-fueled power stations earlier that decade. This helped the price to rally in 2010.

Other metals

The cadmium, tantalium, manganese, thulium, iron, tin, chromium, indium, columbium/niobium, cobalt, molybdenum and vanadium prices rose sharply in early 2007[63][89], then collapsed to nearly their original starting price by the end of the next year[63][89] [105] due to uncertainty about supplies matching the demand, especially those of the BRIC countries' electronics industries.

Niobium is used in the steel of gas pipe lines due to the alloy's high strength and low corrosion rate [106].

Battery recycling has helped bring down both the nickel and cadmium prices. About 86% of all cadmium production was used in batteries during 2009. The rapid growth of wind farms and heavy duty magnates has made neodymium prices rally again and both Brazil and China's renewed interest in high grade steel has improved the Vanadium price recently. The way these metal's prices rose and fell due to increased demand, were typical of this general market trend.

Chemicals

Sulphuric acid

In 2002 95% pure Sulphuric acid cost £55 and 90% acid cost £40 per tonne.[107] Due to floods in Poland and increased demand in China, the acid’s price soared to $329/tonne in May 2008, from just $90/tonne in October 2007. It has become steadily cheaper since the start of 2010.

Most industrial chemicals exhibited similar price trends due to bad weather in the EU and USA along with increased demand by the BRIC nations.

Non metals

Chlorine

Both P.V.C. plastics, caustic soda, industrial paper bleach and ordinary household and industrial bleachs saw their prices rise sharply in 2008 as a result of volatility on the world's chlorine market.

As a result of fight of supply and high operating rates in May 1997, 2 chlorine producers took the bold initiative of pushing of calling for an average price rice of $25 per short ton price increase[108]. Other producers were considering plan bringing the total bring the total price increase for the 1997 product year to date of up to $80 per short and fob ton[108], from $45–$50 per short and fob ton in May 1996. This occurred as both rapidly ascending demand from the vinyl polymer chain market and the unusually strong seasonal demand and no new production capacity on the immediate horizon coincided. The price increase had it's firm foundations in the incumbent bullish market dynamics of the mid 2000s[108]. Occidental Chemical Corporation suggested a minor rise as other firms took a wait-and-see approach[108] and Russia raised production slightly to ease the cost of domestic bleach and swimming pool chloro-tablet costs [108].

Chlorine prices rose in May 2005 as both growing energy costs, shrinking supply and high market tariffs in the EU, NAFTA and Latin America[109], the increased use of chlorine-based chemicals for the aquatics industry[109]. The price of chlorine caustic was $350 per dry short ton, up from $100 last March[109]. Chlorine was priced at $330 per dry short ton, up $130 on last year’s price of $200 last year[109].

The gas's price steadily increased throughout 2007 and early 2008 as demand for P.V.C. and some metals like copper, Neodymium and Tantalum rose due to the increased growth of the BRIC countries demand for elctrical goods.

America’s chlorine prices rose suddenly from about $125–$150 per ton fob between June and August 2009 months on a sharp rise in chlor-alkali production and capacity cuts after a year in which production quotes largely stay flat[110]. The spot price surged more than 300% to about $475–$525 ton fob in August 2009[110]. Both Russia and European Union were also increasing chlorine production to stabilise world prices [110].

Non discounted American chorine was priced at $390–410 short ton and discounted prices stood at $300 per short ton between November 2009 and February 2010[111]. As the European chlorine production spiked in November to a daily output of 26,971 tonnes, before falling to 23,667 in December short ton as over the Christmas and New Year holidays[111]. Production was about European production was 25.8% higher than December 2008 levels [112].

The economic fallout and aftermath

Many firms, individuals, and hedge funds went bankrupt or suffered heavy losses due to purchasing commodities at high prices only to see their values decline sharply in mid to late 2008. Many manufacturing companies were also crippled by the rising cost of oil and other commodities such as transition metals.

The 2008 price glitch

In the second half of 2008, the prices of most commodities fell dramatically on expectations of diminished demand in the world recession and credit crunch.[113] Prices began to rise again in late 2009 to mid 2010.

The 34th G8 summit

The food and fuel crises were both discussed at the 34th G8 summit in July 2008.[114]

Opinions on the 2007-2008 commodities bubble and its aftermath.

Coincidentally, long-only commodity index funds started just before the bubbles, became popular at the same time – by one estimate investment increased from $90 billion in 2006 to $200 billion at the end of 2007, while commodity prices increased 71% – which raised concern as to whether these index funds caused the commodity bubble.[115] The empirical research has been mixed.[115]

In February 2008, analyst Gary Dorsch wrote:

Commodities have historically been regarded as wildly volatile and risky, but since 2006, crude oil, gold, copper, silver, platinum, cocoa, and grains have soared, hitting record highs, and have trounced returns in the mismanaged G-7 stock markets... A remarkable run-up in prices of wheat, corn, oilseeds, rice, and dairy products, along with sharply higher energy prices, have been blamed on supply shortfalls, strong demand for bio-fuels, and an inflow of $150 billion from investment funds. From a year ago, Chicago wheat futures have soared +120%, corn +20%, and soybeans are +80% higher. Rough rice is up 55%, and platinum touched $2,000 /oz, up 80% from a year ago, while US cocoa futures hit a 24-year high... Fund managers are pouring money into commodities across the board as a hedge against the explosive growth of the world's money supply, and competitive currency devaluations engineered by central banks.[116]

Economist James D. Hamilton has argued that the increase in oil prices in the period of 2007 through 2008 was a significant cause of the recession. He evaluated several different approaches to estimating the impact of oil price shocks on the economy, including some methods that had previously shown a decline in the relationship between oil price shocks and the overall economy. All of these methods "support a common conclusion; had there been no increase in oil prices between 2007:Q3 and 2008:Q2, the US economy would not have been in a recession over the period 2007:Q4 through 2008:Q3."[117] Hamilton's own model, a time-series econometric forecast based on data up to 2003, showed that the decline in GDP could have been successfully predicted to almost its full extent given knowledge of the price of oil. The results imply that oil prices were entirely responsible for the recession; however, Hamilton himself acknowledged that this was probably not the case but maintained that it showed that oil price increases made a significant contribution to the downturn in economic growth.[118]

Synoptic chart on 1990-2010 prices

All prices are in either £, €, $/US$ or AU$, depending on the nationality of sources available.

See also

- Oil price increases since 2003

- 2007-2008 world food price crisis

- Late-2000s recession

- Dot-com bubble

- Battery recycling

- PowerGenix

- Tantalum capacitor

References

- ^ Kitco.com, Gold - London PM Fix 1975 - present (GIF), Retrieved 2006-07-22.

- ^ a b c d International Commodity Agreements: A Legal Study. By B. S. Chimni, Published by Routledge in 1987. ISBN 9780709954200, 299 pages

- ^ http://www.climaxmolybdenum.com/products/whatismolybdenum/howismolybdenumused.htm

- ^ http://www.envocare.co.uk/mobile_phones.htm

- ^ http://www.reuters.com/article/idUST13528020080427

- ^ http://www.globalissues.org/article/442/guns-money-and-cell-phones

- ^ http://www.eoearth.org/article/Cell_phone_recycling

- ^ http://www.nokia.com/corporate-responsibility/environment/case-studies/mobile-phones-yield-valuable-raw-materials

- ^ http://www.globalwitness.org/media_library_detail.php/718/en/metals_in_mobile_phones_help_finance_congo_atrocities

- ^ "Sulfuric acid prices explode".

- ^ "Dow Declares Force Majeure for Caustic Soda".

- ^ worries over peak oil,

- ^ "Biofuels major cause of global food riots", Kazinform (Kazakhstan National Information Agency), April 11, 2008

- ^ A malnourished Ethiopian infant is comforted by her mother at a relief camp in 2005. Addis Ababa says the number of Ethiopians in need of emergency food aid in drought-affected regions has risen to 4.5 million. © 2007 AFP Boris Heger (June 3, 2008). "France 24 | 4.5 million drought-stricken Ethiopians need food aid: govt | France 24". France24.com. Retrieved 2008-10-03.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ Financial speculators reap profits from global hunger

- ^ [[1]]

- ^ [[2]]

- ^ [[3]]

- ^ [[4]]

- ^ [[5]]

- ^ http://www.fwi.co.uk/Articles/2010/03/24/120506/Market-report-Wheat-prices-edge-upwards.htm

- ^ "Egyptian boy dies from wounds sustained in Mahalla food riots", International Herald Tribune. April 8, 2008

- ^ Steavenson, Wendell (2009-01-09). "It's the baladi, stupid". The Australian Financial Review. p. Perspectives Review supplement (pp. 3–5).

The difference between the subsidised and market price of bread [in Egypt] is exploited at every stage of production and sale, by importers, millers, warehousers, traders, bakers and consumers alike.

- ^ A malnourished Ethiopian infant is comforted by her mother at a relief camp in 2005. Addis Ababa says the number of Ethiopians in need of emergency food aid in drought-affected regions has risen to 4.5 million. © 2007 AFP Boris Heger (June 3, 2008). "France 24 | 4.5 million drought-stricken Ethiopians need food aid: govt | France 24". France24.com. Retrieved 2008-10-03.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ a b [6]

- ^ a b http://www.dailymail.co.uk/news/article-1104741/Recycling-crisis-Taxpayers-foot-UKs-growing-waste-paper-mountain-market-collapses.html

- ^ a b c http://www.recycle.cc/freepapr.htm

- ^ a b http://www.independent.co.uk/news/business/news/recycled-paper-up-in-price-593502.html

- ^ a b c http://www.wildaboutbritain.co.uk/forums/waste-recycling-and-pollution/46521-paper-recycling-crisis.html

- ^ http://www.recycle.net/Paper/scrap/xv120500.html

- ^ http://www.howtoadvice.com/PaperRecycling/

- ^ a b http://www.commodityonline.com/news/Coal-prices-to-surge-in-2010-despite-ample-supply-22154-3-1.html

- ^ a b c http://tfc-charts.com/chart/QM/W Cite error: The named reference "tfc-charts.com" was defined multiple times with different content (see the help page).

- ^ "Record oil price sets the scene for $200 next year". AME. July 6, 2006. Retrieved 2007-11-29.

- ^ "Peak Oil News Clearinghouse". EnergyBulletin.net.

- ^ "The Hike in Oil Prices: Speculation -- But Not Manipulation".

- ^ "Missile tension sends oil surging". CNN. Retrieved 2010-04-21.

- ^ "Oil hits $100 barrel". BBC News. 2008-01-02. Retrieved 2009-12-31.

- ^ "Iran nuclear fears fuel oil price". BBC News. 2006-02-06. Retrieved 2009-12-31.

- ^ The Macroeconomic Effects of Hurricane Katrina, CRS Report for Congress

- ^ Hurricane Katrina whips oil price to a record high - The Times Online, August 30, 2005

- ^ Gross, Daniel (2008-01-05). "Gas Bubble: Oil is at $100 per barrel. Get used to it". Slate.

- ^ "Oil Prices Fall As Gustav Hits". Sky News. September 2, 2008. Retrieved May 5, 2009.

- ^ a b "Oil Ministers See Demand Rising, Price May Exceed $85". Bloomberg. 2010-05-10. Cite error: The named reference "2010prices" was defined multiple times with different content (see the help page).

- ^ "Light Crude Oil Chart". Futures.tradingcharts.com. Retrieved 2010-05-01.

- ^ Conway, Edmund (2008-05-26). "Soros - Rocketing Oil Price is a Bubble". London: Telegraph.co.uk. Retrieved 2010-05-01.

- ^ "Mises Institute-The Oil Price Bubble". Mises.org. 2008-06-02. Retrieved 2010-05-01.

- ^ "Crude oil prices set record high 102.08 dollars per barrel".

- ^ Peak Oil and the Financial Crisis http://www.alternet.org/story/75649/

- ^ Oil prices and future economic stability http://www.thestar.com/business/article/535378

- ^ "Energy Market Manipulation and Federal Enforcement Regimes". Digitalcommons.law.umaryland.edu. Retrieved 2010-05-01.

- ^ http://af.reuters.com/article/energyOilNews/idAFSGE65O02G20100625

- ^ "NUEXCO Exchange Value (Monthly Uranium Spot)".

- ^ http://news.goldseek.com/TonyLocantro/1121781600.php

- ^ a b http://www.uraniumseek.com/news/UraniumSeek/1219431716.php

- ^ http://www.uranium.info/prices/monthly.html

- ^ http://www.neimagazine.com/story.asp?sectionCode=132&storyCode=2050703

- ^ http://randomroger.blogspot.com/2007/02/uranium-bubble.html

- ^ http://www.infomine.com/investment/charts.aspx?mv=1&f=f&r=10y&c=curanium.xusd.ukg#chart

- ^ Goldfinger Brown's £2 billion blunder in the bullion market, The Times, 15 April 2007

- ^ a b "LBMA statistics". Lbma.org.uk. 2008-12-31. Retrieved 2009-04-05.

- ^ "Gold hits yet another record high". BBC News. 2009-12-02. Retrieved 2009-12-06.

- ^ a b c d e f g h i j k l m n o p q r s t u v http://www.kitco.com/scripts/hist_charts/yearly_graphs.plx

- ^ http://online.wsj.com/article/BT-CO-20100511-717954.html?mod=WSJ_latestheadlines

- ^ http://www.marketwatch.com/story/gold-prices-resume-rise-as-eu-plan-pondered-2010-05-11?reflink=MW_news_stmp

- ^ Kitco.com 10 Year gold chart

- ^ "Gold starts 2006 well, but this is not a 25-year high! | Financial Planning". Ameinfo.com. Retrieved 2009-04-05.

- ^ http://www.resourceinvestor.com/News/2010/7/Pages/Gold-Bubble-on-the-Verge-of-Bursting.aspx

- ^ http://www.periodic.lanl.gov/elements/75.html

- ^ http://metalsplace.com/prices/rhenium/

- ^ http://www.webelements.com/aluminium/

- ^ http://www.world-aluminium.org/?pg=13

- ^ http://www.aluminiumtoday.com/

- ^ http://www.abc.net.au/news/stories/2010/07/02/2942839.htm?section=business

- ^ a b [7]

- ^ [8]

- ^ [9]

- ^ "Business | Miner BHP to lay off 6,000 staff". BBC News. 2009-01-21. Retrieved 2010-05-01.

- ^ "(AU) - Mincor's result reflects a return to better days for sulphide nickel". Proactive Investors. 2010-02-18. Retrieved 2010-05-01.

- ^ "Copper prices London". Retrieved 3 July 2010.

- ^ "Historical Copper Prices, Copper Prices History". Dow-futures.net. 2007-01-22. Retrieved 2010-05-01.

- ^ http://www.afrol.com/articles/31969

- ^ "Historical Rhodium Charts". Kitco. Retrieved 2010-02-19.

- ^ http://www.resourceinvestor.com/News/2008/8/Pages/Can-One-Man-s-Actions-Take--6-Billion-In-Value-Out.aspx

- ^ Kielhorn, J.; Melber, C.; Keller, D.; Mangelsdorf, I. (2002). "Palladium - A review of exposure and effects to human health". International Journal of Hygiene and Environmental Health. 205 (6): 417. doi:10.1078/1438-4639-00180. PMID 12455264.

- ^ Williamson, Alan. "Russian PGM Stocks" (PDF). The LBMA Precious Metals Conference 2003. The London Bullion Market Association.

- ^ "Historical Palladium Charts and Data". Kitco. Retrieved 2007-08-09.

- ^ "Ford fears first loss in a decade". BBC News. 2002-01-16. Retrieved 2008-09-19.

- ^ a b c d http://www.metalprices.com/

- ^ http://uk.reuters.com/article/idUKLD66926820090713

- ^ a b c http://www.commodityonline.com/news/Lead-prices-plunge-as-LME-stocks-rise-relentlessly-25819-3-1.html

- ^ a b c http://www.proactiveinvestors.co.uk/companies/news/17843/ecclestone-bullish-on-zinc-and-lead-prices-by-end-of-2010-17843.html

- ^ http://www.livecharts.co.uk/livewire/2010/05/14/european-concerns-lead-to-oil-price-drop/

- ^ http://www.metalprices.com/FreeSite/metals/pb/pb.asp

- ^ http://www.metalmarkets.org.uk/metals/lead/

- ^ a b c d e "Zinc prices London". Retrieved 3 July 2010.

- ^ http://www.metal-pages.com/metalprices/historical/

- ^ [[ http://www.google.co.uk/search?hl=en&rlz=1T4GUEA_enGB374GB374&&sa=X&ei=5f0uTKDsN4zu0gS10JCYAw&ved=0CB4QBSgA&q=Neodymium+prices&spell=1]]

- ^ http://www.baotou.com/pro/pro.htm#Neodymium

- ^ http://www.bizrate.co.uk/handtools/products__keyword--neodymium+prices.html

- ^ http://www.pidc.com/technology.html

- ^ http://www.mineralnet.co.uk/Article/2391506/Rare-earth-pricing-resurges.html

- ^ http://www.mineralnet.co.uk/Article/2461365/Rare-earth-prices-climbing.html

- ^ Steve Gorman, As hybrid cars gobble rare metals, shortage looms, Reuters, Mon Aug 31, 2009

- ^ http://www.metalbulletin.com/Article/2464668/ICA-raises-indium-price-to-640-per-kg.html

- ^ http://chemistry.about.com/od/elementfacts/a/niobium.htm

- ^ http://ed.icheme.org/costchem.html

- ^ a b c d e http://findarticles.com/p/articles/mi_hb4250/is_199705/ai_n13243412/

- ^ a b c d [10]

- ^ a b c [11]

- ^ a b [12]

- ^ http://www.icis.com/v2/chemicals/9075194/chlorine/pricing.html

- ^ "Commodities crash".

- ^ "Africa's Plight Dominates First Day of G8 Summit".

- ^ a b Irwin SH, Sanders DR. (2010). The Impact of Index and Swap Funds on Commodity Futures Markets. OECD Working Paper. doi:10.1787/5kmd40wl1t5f-en

- ^ Gary Dorsch (14-02-2008). "Central Bankers Fueling Global Commodity Inflation". SafeHaven.com.

{{cite web}}: Check date values in:|date=(help) - ^ Hamilton, James D. "Oil prices and the economic recession of 2007–08." Voxeu.org. 16 June 2009. http://voxeu.org/index.php?q=node/3664

- ^ Hamilton http://voxeu.org/index.php?q=node/3664

Further reading

- Chimni, B. S. (1987). International Commodity Agreements: A Legal Study. London: Croom Helm. ISBN 0709954204.