Expected value of including uncertainty

In decision theory and quantitative policy analysis, the expected value of including information (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty.[1][2]

Background

Benjamin Franklin famously wrote "in this world nothing can be said to be certain, except death and taxes"[3]. We all have to make decisions everyday in the ubiquous presence of uncertainty, ranging from mundane to larger high-stakes decisions. For most of our day-to-day decisions, we have developed various heuristics to cope act reasonably in the presence of uncertainty, often hardly thinking twice about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decisions makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis. To facilitate methodical analysis, while retaining transparency in the decision making process, analysts will make use of quantitative modeling software such as Analytica. The academic field that focuses on this style of decision making and analysis is known as decision analysis.

When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as input variables. From these inputs, other quantities (i.e., result variables) can be computed that provide information for the decision maker. For example, in the example detailed below, I must decide how soon before my flight to leave for the airport (my decision). One input variable is how long it takes to drive from my house to the airport parking garage. From this and other inputs, the model can compute whether I'm likely to miss the flight and what the net cost (in minutes) will be for various decisions.

To reach a decision, a very common practice is to ignore uncertainty. Decisions are reached through quantitative analysis and model building by simply using a best guess (single value) for each input variable. Decisions are then made on computed point estimates. In many cases, however, ignoring uncertainty can lead to very poor decisions, with estimations for result variables often misleading the decision maker[4]

An alternative to ignoring uncertainty in quantiative decision models is to explicitly encode uncertainty as part of the model. Due to the adoption of powerful software tools such as Analytica that allows representations of uncertainty to be explicitly encoded, along with high availability of computation power, this practice is becoming more commonplace among decision analytic modelers. With this approach, a probability distribution is provided for each input variable, rather than a single best guess. The variance in that distribution reflects the degree of subjective uncertainty (or lack of knowledge) in the input quantity. The software tools then use methods such as Monte Carlo analysis to propagate the uncertainty to result variables, so that a decision maker obtains an explicit picture of the impact that uncertainty has on his decisions, and in many cases can make a much better decision as a result.

When comparing the two approaches—ignoring uncertainty versus modeling uncertainty explicitly—the natural question to ask is how much difference it really makes to the quality of the decisions reached. In the 1960s, Ronald A. Howard proposed[5] one such measure, the Expected value of perfect information (EVPI), a measure of how much it would be worth to learn the "true" values for all uncertain input variables. While providing a highly useful measure of sensitivity to uncertainty, the EVPI does not directly capture the actual improvement in decisions obtained from explicitly representing and reasoning about uncertainty. For this, Max Henrion, in his Ph.D. thesis, introduced the expected value of including uncertainty (EVIU), the topic of this article.

Formalization

Let

When not including uncertainty, you find the optimal decision using only , the expected value of the uncertain quantity. Hence, the decision ignoring uncertainty is given by:

The optimal decision taking uncertainty into account is the standard Bayes decision that maximizes expected utility:

The EVIU is the difference in expected utility between these two decisions:

The uncertain quantity x and decision variable d may each be composed of many scalar variables, in which case the spaces X and D are each vector spaces.

Example

The plane catching example described here is taken, with permission from Lumina Decision Systems, from an example model shipped with the Analytica visual modeling software.

The diagram shows an influence diagram depiction of an Analytica model for deciding how early I should leave from home in order to catch my flight from the airport. The single decision, in the green rectangle, is the number of minutes that I will decide to leave prior to my plane's departure time. Four uncertain variables appear on the diagram in cyan ovals: The time required to drive from home to the airport's parking garage (in minutes), time to get from the parking garage to the gate (in minutes), the time before departure that I need to be at the gate by, and the loss (in minutes) incurred if I miss the flight. Each of these nodes contains a probability distribution, viz:

Time_to_drive_to_airport := LogNormal(median:60,gsdev:1.3) Time_from_parking_to_gate := LogNormal(median:10,gsdev:1.3) Gate_time_before_departure := Triangular(min:20,mode:30,max:40) Loss_if_miss_the_plane := LogNormal(median:400,stddev:100)

Each of these distributions is taken to be statistically independent. The probability distribution for the first uncertain variable, Time_to_drive_to_airport, with median 60 and a geometric standard deviation of 1.3, is depicted in this graph:

The model calculates the cost (the red hexagonal variable) as the number of minutes (or minute equivalents) consumed to successfully board the plane. If I arrive too late, I will miss my plane and incur the large loss (negative utility) of having to wait for the next flight. If I arrive too early, I'll incur the cost of having to needlessly wait around for my flight.

Models that utilize EVIU may use a utility function, or equivalently they may utilize a loss function, in which case the utility function is just the negative of the loss function. In either case, the EVIU will be positive. The main difference is just that with a loss function, you make a decision by minimizing loss, rather than by maximizing utility. The example here uses a loss function, Cost.

The definitions for each of the computed variables is thus:

Time_from_home_to_gate := Time_to_drive_to_airport + Time_from_parking_to_gate + Loss_if_miss_the_plane Value_per_minute_at_home := 1

Cost := Value_per_minute_at_home * Time_I_leave_home +

(If Time_I_leave_home < Time_from_home_to_gate Then Loss_if_miss_the_plane Else 0)

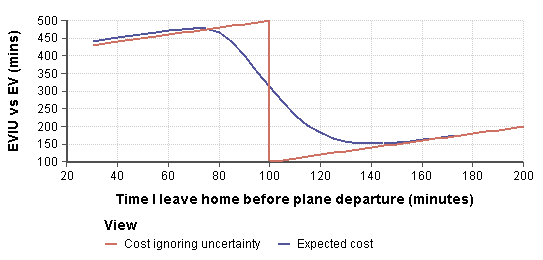

The following graph displays the expected value taking uncertainty into account (the smooth blue curve) to the expected utility ignoring uncertainty, graphed as a function of the decision variable.

Notice that when we ignore uncertainty here, we act as though we will make our flight with certainty as long as we leave at least 100 minutes before our flight, and will miss our flight with certainty if we leave any later than that. Because we act as if everything is uncertain, the optimal action is to leave exactly 100 minutes (or 100 minutes, 1 second) before our flight.

When we take uncertainty into account, the expected value smooths out (the blue curve), and the optimal action is to leave 140 minutes before our flight. The expected value curve, with a decision at 100 minutes before the flight, shows the expected cost when ignoring uncertainty to be 313.7 minutes, while the expected cost when we leave 140 minute prior is 151 minutes. The difference between these two is the EVIU:

In other words, if we explicitly take uncertainty into account when we make our decision, we will save ourselves 162.7 minutes on average.

Relation to expected value of perfect information (EVPI)

Both EVIU and EVPI compare the expected value of the Bayes' decision with another decision made without uncertainty. For EVIU this other decision is made when the uncertainty is ignored, although it is there, while for EVPI this other decision is made after the uncertainty is removed by obtaining perfect information about x.

The EVPI is the expected cost of being uncertain about x, while the EVIU is the additional expected cost of pretending you are not uncertain.

The EVIU, like the EVPI, gives expected value in terms of the units of the utility function.

See also

- Expected value of perfect information (EVPI)

- Expected value of sample information

- Analytica visual modeling and decision analysis software

References

- ^ Morgan, M. Granger and Henrion, Max (1990). "Chap. 12". Uncertainty: A Guide to Dealing with Uncertainty in Quantitative Risk and Policy Analysis. Cambridge University Press. ISBN 0521365422.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Henrion, M. (1982). The value of knowing how little you know: The advantages of a probabilistic treatment of uncertainty in policy analysis (Ph.D. thesis). Carnegie Mellon University.

- ^ From a letter to Jean-Baptiste Leroy, 1789, reprinted in The Works of Benjamin Franklin, 1817

- ^ Danziger, Jeff; Sam L. Savage (2009). The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty. New York: Wiley. ISBN 0-471-38197-7.

{{cite book}}: External link in|author= - ^ Howard, Ron A. (1966). "Information value theory". IEEE Transactions on Systems Science and Cybernetics. 1: 22–6.

![{\displaystyle E[x]}](https://wikimedia.org/enwiki/api/rest_v1/media/math/render/svg/604728821497d9094bd347a8e27040b2ff58c88c)

![{\displaystyle d_{iu}={\arg \max _{d}}~U(d,E[x])}](https://wikimedia.org/enwiki/api/rest_v1/media/math/render/svg/b30ebdb3e96173692ad8c1f7ecac270ed3a7d9e5)

![{\displaystyle EVIU=\int _{X}\left[U(d^{*},x)-U(d_{iu},x)\right]f(x)\,dx}](https://wikimedia.org/enwiki/api/rest_v1/media/math/render/svg/96e5d5dfea393781a806a7be78104205a6d55005)