Black–Scholes model

The Black–Scholes model (pronounced /ˌblæk ˈʃoʊlz/[1]) is a mathematical model of a financial market containing certain derivative investment instruments. From the model, one can deduce the Black–Scholes formula, which gives the price of European-style options. The formula led to a boom in options trading and the creation of the Chicago Board Options Exchange. lt is widely used by options market participants.[2] Many empirical tests have shown the Black -Scholes price is “fairly close” to the observed prices, although there are well-known discrepancies such as the “option smirk”.[3]

The model was first articulated by Fischer Black and Myron Scholes in their 1973 paper, “The Pricing of Options and Corporate Liabilities.” They derived a partial differential equation, now called the Black–Scholes equation, which governs the price of the option over time. The key idea behind the derivation was to perfectly hedge the option by buying and selling the underlying asset in just the right way and consequently “eliminate risk". This hedge is called delta hedging and is the basis of more complicated hedging strategies such as those engaged in by Wall Street investment banks. The hedge implies there is only one right price for the option and is given by the Black–Scholes formula.

Robert C. Merton was the first to publish a paper expanding the mathematical understanding of the options pricing model and coined the term Black–Scholes options pricing model. Merton and Scholes received the 1997 Nobel Prize in Economics (The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel) for their work. Though ineligible for the prize because of his death in 1995, Black was mentioned as a contributor by the Swedish academy.[4]

The Black-Scholes World

The Black–Scholes model of the market for a particular stock makes the following explicit assumptions:

- There is no arbitrage opportunity (i.e., there is no way to make a riskless profit.).

- It is possible to borrow and lend cash at a known constant risk-free interest rate.

- It is possible to buy and sell any amount, even fractional, of stock (this includes short selling)

- The above transactions do not incur any fees or costs

- The stock price follows a geometric Brownian motion with constant drift and volatility.

- The underlying security does not pay a dividend.[5]

From these assumptions, Black and Scholes showed that “it is possible to create a hedged position, consisting of a long position in the stock and a short position in the option, whose value will not depend on the price of the stock.”[6]

Several of these assumptions of the original model have been removed in subsequent extensions of the model. Modern versions account for changing interest rates (Merton, 1976)[citation needed], transaction costs and taxes (Ingersoll, 1976)[citation needed], and dividend payout (Merton, 1973)[citation needed].

Notation

Let

- , be the price of the stock (please note as below).

- , the price of a derivative as a function of time and stock price.

- the price of a European call option and the price of a European put option.

- , the strike of the option.

- , the annualized risk-free interest rate, continuously compounded.

- , the drift rate of , annualized.

- , the volatility of the stock's returns; this is the square root of the quadratic variation of the stock's log price process.

- , a time in years; we generally use: now=0, expiry=T.

- , the value of a portfolio.

Finally we will use which denotes the standard normal cumulative distribution function,

- .

which denotes the standard normal probability density function,

- .

The Black-Scholes equation and its derivation

The following derivation is given in Hull's Options, Futures, and Other Derivatives.[7] That, in turn, is based on the classic argument in the original Black–Scholes paper.

Per the model assumptions above, the price of the underlying asset (typically a stock) follows a geometric Brownian motion. That is,

where W is Brownian motion. Note that W, and consequently its infinitesimal increment dW, represents the only source of uncertainty in the price history of the stock. Intuitively, W(t) is a process that jiggles up and down in such a random way that its expected change over any time interval is 0 (also, more technically, its variance over time T should be equal to T); a good discrete analogue for W is a simple random walk. Thus the above equation states that the infinitesimal rate of return on the stock has an expected value of μ dt and a variance of .

The payoff of an option at maturity is known. To find its value at an earlier time we need to know how evolves as a function of and . By Itō's lemma for two variables we have

Now consider a certain portfolio, called the delta-hedge portfolio, consisting of being short one option and long shares at time . The value of these holdings is

Over the time period , the total profit or loss from changes in the values of the holdings is:

Now discretize the equations for dS/S and dV by replacing differentials with deltas:

and appropriately substitute them into the expression for :

Notice that the term has vanished. Thus uncertainty has been eliminated and the portfolio is effectively riskless. The rate of return on this portfolio must be equal to the rate of return on any other riskless instrument; otherwise, there would be opportunities for arbitrage. Now assuming the risk-free rate of return is we must have over the time period

If we now equate our two formulas for we obtain:

Simplifying, we arrive at the celebrated Black–Scholes partial differential equation:

With the assumptions of the Black–Scholes model, this second order partial differential equation holds for any type of option as long as its price function is twice differentiable with respect to and once with respect to . Different pricing formulae for various options will arise from the choice of payoff function at expiry and appropriate boundary conditions.

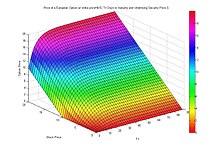

Black–Scholes formula

The Black Scholes formula calculates the price of European put and call options. It can be obtained by solving the Black–Scholes stochastic differential equation for the corresponding terminal and boundary conditions.

The value of a call option for a non-dividend paying underlying stock in terms of the Black–Scholes parameters is:

Also,

The price of a corresponding put option based on put-call parity is:

For both, as above:

- is the cumulative distribution function of the standard normal distribution

- is the time to maturity

- is the spot price of the underlying asset

- is the strike price

- is the risk free rate (annual rate, expressed in terms of continuous compounding)

- is the volatility of returns of the underlying asset

Interpretation

The terms , are the probabilities of the option expiring in-the-money under the equivalent exponential martingale probability measure (numéraire=stock) and the equivalent martingale probability measure (numéraire=risk free asset), respectively. The equivalent martingale probability measure is also called the risk-neutral probability measure. Note that both of these are probabilities in a measure theoretic sense, and neither of these is the true probability of expiring in-the-money under the real probability measure. To calculate the probability under the real (“physical”) probability measure, additional information is required—the drift term in the physical measure, or equivalently, the market price of risk.

Derivation

We now show how to get from the general Black–Scholes PDE to a specific valuation for an option. Consider as an example the Black–Scholes price of a call option, for which the PDE above has boundary conditions

The last condition gives the value of the option at the time that the option matures. The solution of the PDE gives the value of the option at any earlier time, . To solve the PDE we transform the equation into a diffusion equation which may be solved using standard methods. To this end we introduce the change-of-variable transformation

Then the Black–Scholes PDE becomes a diffusion equation

The terminal condition now becomes an initial condition

Using the standard method for solving a diffusion equation we have

which, after some manipulations, yields

where

Reverting to the original set of variables yields the above stated solution to the Black–Scholes equation.

Other derivations

Above we used the method of arbitrage-free pricing (“delta-hedging”) to derive the Black–Scholes PDE, and then solved the PDE to get the valuation formula. It is also possible to derive the latter directly using a Risk neutrality argument (for the underlying logic see Rational pricing#Risk neutral valuation). This method gives the price as the expectation of the option payoff under a particular probability measure, called the risk-neutral measure, which differs from the real world measure.

The Greeks

“The Greeks” measure the sensitivity to change of the option price under a slight change of a single parameter while holding the other parameters fixed. Formally, they are partial derivatives of the option price with respect to the independent variables (technically, one Greek, gamma, is a partial derivative of another Greek, called delta).

The Greeks are not only important for the mathematical theory of finance, but for those actively involved in trading. Any trader worth his or her salt will know the Greeks and make a choice of which Greeks to hedge to limit exposure. Financial institutions will typically set limits for the Greeks that their trader cannot exceed. Delta is the most important Greek and traders will zero their delta at the end of the day. Gamma and vega are also important but not as closely monitored.

The Greeks for Black–Scholes are given in closed form below. They can be obtained by straightforward differentiation of the Black–Scholes formula.

| What | Calls | Puts | |

|---|---|---|---|

| delta | |||

| gamma | |||

| vega | |||

| theta | |||

| rho | |||

Note that the gamma and vega formulas are the same for calls and puts. This can be seen directly from put-call parity.

In practice, some sensitivities are usually quoted in scaled-down terms, to match the scale of likely changes in the parameters. For example, rho is often reported divided by 10,000 (1bp rate change), vega by 100 (1 vol point change), and theta by 365 or 252 (1 day decay based on either calendar days or trading days per year).

Extensions of the model

The above model can be extended for variable (but deterministic) rates and volatilities. The model may also be used to value European options on instruments paying dividends. In this case, closed-form solutions are available if the dividend is a known proportion of the stock price. American options and options on stocks paying a known cash dividend (in the short term, more realistic than a proportional dividend) are more difficult to value, and a choice of solution techniques is available (for example lattices and grids).

Instruments paying continuous yield dividends

For options on indexes, it is reasonable to make the simplifying assumption that dividends are paid continuously, and that the dividend amount is proportional to the level of the index.

The dividend payment paid over the time period is then modelled as

for some constant (the dividend yield).

Under this formulation the arbitrage-free price implied by the Black–Scholes model can be shown to be

and

where now

is the modified forward price that occurs in the terms :

and

Exactly the same formula is used to price options on foreign exchange rates, except that now q plays the role of the foreign risk-free interest rate and S is the spot exchange rate. This is the Garman-Kohlhagen model (1983).

Instruments paying discrete proportional dividends

It is also possible to extend the Black–Scholes framework to options on instruments paying discrete proportional dividends. This is useful when the option is struck on a single stock.

A typical model is to assume that a proportion of the stock price is paid out at pre-determined times . The price of the stock is then modelled as

where is the number of dividends that have been paid by time .

The price of a call option on such a stock is again

where now

is the forward price for the dividend paying stock.

Black–Scholes in practice

The Black–Scholes model disagrees with reality in a number of ways, some significant. It is widely employed as a useful approximation, but proper application requires understanding its limitations – blindly following the model exposes the user to unexpected risk.

Among the most significant limitations are:

- the underestimation of extreme moves, yielding tail risk, which can be hedged with out-of-the-money options;

- the assumption of instant, cost-less trading, yielding liquidity risk, which is difficult to hedge;

- the assumption of a stationary process, yielding volatility risk, which can be[citation needed] hedged with volatility hedging;

- the assumption of continuous time and continuous trading, yielding gap risk, which can be hedged with Gamma hedging.

In short, while in the Black–Scholes model one can perfectly hedge options by simply Delta hedging, in practice there are many other sources of risk.

Results using the Black–Scholes model differ from real world prices because of simplifying assumptions of the model. One significant limitation is that in reality security prices do not follow a strict stationary log-normal process, nor is the risk-free interest actually known (and is not constant over time). The variance has been observed to be non-constant leading to models such as GARCH to model volatility changes. Pricing discrepancies between empirical and the Black–Scholes model have long been observed in options that are far out-of-the-money, corresponding to extreme price changes; such events would be very rare if returns were lognormally distributed, but are observed much more often in practice.

Nevertheless, Black–Scholes pricing is widely used in practice,[2][8] for it is easy to calculate and explicitly models the relationship of all the variables. It is a useful approximation, particularly when analyzing the directionality that prices move when crossing critical points. It is used both as a quoting convention and a basis for more refined models. Although volatility is not constant, results from the model are often useful in practice and helpful in setting up hedges in the correct proportions to minimize risk. Even when the results are not completely accurate, they serve as a first approximation to which adjustments can be made.

One reason for the popularity of the Black–Scholes model is that it is robust in that it can be adjusted to deal with some of its failures. Rather than considering some parameters (such as volatility or interest rates) as constant, one considers them as variables, and thus added sources of risk. This is reflected in the Greeks (the change in option value for a change in these parameters, or equivalently the partial derivatives with respect to these variables), and hedging these Greeks mitigates the risk caused by the non-constant nature of these parameters. Other defects cannot be mitigated by modifying the model, however, notably tail risk and liquidity risk, and these are instead managed outside the model, chiefly by minimizing these risks and by stress testing.

Additionally, rather than assuming a volatility a priori and computing prices from it, one can use the model to solve for volatility, which gives the implied volatility of an option at given prices, durations and exercise prices. Solving for volatility over a given set of durations and strike prices one can construct an implied volatility surface. In this application of the Black–Scholes model, a coordinate transformation from the price domain to the volatility domain is obtained. Rather than quoting option prices in terms of dollars per unit (which are hard to compare across strikes and tenors), option prices can thus be quoted in terms of implied volatility, which leads to trading of volatility in option markets.

The volatility smile

One of the attractive features of the Black–Scholes model is that the parameters in the model (other than the volatility) — the time to maturity, the strike, the risk-free interest rate,and the current underlying price — are unequivocally observable. All other things being equal, an option's theoretical value is a monotonic increasing function of implied volatility. By computing the implied volatility for traded options with different strikes and maturities, the Black–Scholes model can be tested. If the Black–Scholes model held, then the implied volatility for a particular stock would be the same for all strikes and maturities. In practice, the volatility surface (the three-dimensional graph of implied volatility against strike and maturity) is not flat. The typical shape of the implied volatility curve for a given maturity depends on the underlying instrument. Equities tend to have skewed curves: compared to at-the-money, implied volatility is substantially higher for low strikes, and slightly lower for high strikes. Currencies tend to have more symmetrical curves, with implied volatility lowest at-the-money, and higher volatilities in both wings. Commodities often have the reverse behaviour to equities, with higher implied volatility for higher strikes.

Despite the existence of the volatility smile (and the violation of all the other assumptions of the Black–Scholes model), the Black–Scholes PDE and Black–Scholes formula are still used extensively in practice. A typical approach is to regard the volatility surface as a fact about the market, and use an implied volatility from it in a Black–Scholes valuation model. This has been described as using "the wrong number in the wrong formula to get the right price."[9] This approach also gives usable values for the hedge ratios (the Greeks).

Even when more advanced models are used, traders prefer to think in terms of volatility as it allows them to evaluate and compare options of different maturities, strikes, and so on.

Valuing bond options

Black–Scholes cannot be applied directly to bond securities because of pull-to-par. As the bond reaches its maturity date, all of the prices involved with the bond become known, thereby decreasing its volatility, and the simple Black–Scholes model does not reflect this process. A large number of extensions to Black–Scholes, beginning with the Black model, have been used to deal with this phenomenon. See Bond option: Valuation.

Interest rate curve

In practice, interest rates are not constant-they vary by tenor, giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time. This volatility may make a significant contribution to the price, especially of long-dated options.This is simply like the interest rate and bond price relationship which is inversely related.

Short stock rate

It is not free to take a short stock position. Similarly, it may be possible to lend out a long stock position for a small fee. In either case, this can be treated as a continuous dividend for the purposes of a Black–Scholes valuation.

Remarks on notation

The reader is warned of the inconsistent notation that appears in this article. Thus the letter is used as:

- (1) a constant denoting the current price of the stock

- (2) a real variable denoting the price at an arbitrary time

- (3) a random variable denoting the price at maturity

- (4) a stochastic process denoting the price at an arbitrary time

It is also used in the meaning of (4) with a subscript denoting time, but here the subscript is merely a mnemonic.

In the partial derivatives, the letters in the numerators and denominators are, of course, real variables, and the partial derivatives themselves are, initially, real functions of real variables. But after the substitution of a stochastic process for one of the arguments they become stochastic processes.

The Black–Scholes PDE is, initially, a statement about the stochastic process , but when is reinterpreted as a real variable, it becomes an ordinary PDE. It is only then that we can ask about its solution.

The parameter that appears in the discrete-dividend model and the elementary derivation is not the same as the parameter that appears elsewhere in the article. For the relationship between them see Geometric Brownian motion.

Criticism

Espen Gaarder Haug and Nassim Nicholas Taleb argue that the Black–Scholes model merely recast existing widely used models in terms of practically impossible "dynamic hedging" rather than "risk," to make them more compatible with mainstream neoclassical economic theory.[10]

Jean-Philippe Bouchaud argues: 'Reliance on models based on incorrect axioms has clear and large effects. The Black–Scholes model[11], for example, which was invented in 1973 to price options, is still used extensively. But it assumes that the probability of extreme price changes is negligible, when in reality, stock prices are much jerkier than this. Twenty years ago, unwarranted use of the model spiralled into the worldwide October 1987 crash; the Dow Jones index dropped 23% in a single day, dwarfing recent market hiccups.

See also

- Black model, a variant of the Black–Scholes option pricing model.

- Binomial options model, which is a discrete numerical method for calculating option prices.

- Monte Carlo option model, using simulation in the valuation of options with complicated features.

- Financial mathematics, which contains a list of related articles.

- Heat equation, to which the Black–Scholes PDE can be transformed.

- Real options analysis

- Black Shoals, a financial art piece

- Stochastic volatility

Notes

- ^ http://www.merriam-webster.com/dictionary/scholes

- ^ a b Bodie, Zvi (2008). Investments (7th ed.). New York: McGraw-Hill/Irwin. p. 751. ISBN 978-0-07-326967-2.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Bodie, Kane, and Marcus, 7th ed. p. 770-771.

- ^ Nobel prize foundation, 1997 Press release

- ^ Although the original model assumed no dividends, trivial extensions to the model can accommodate a continuous dividend yield factor.

- ^ Black, Fischer and Scholes, Myron. “The Pricing of Options and Corporate Liabilities”. Journal of Political Economy 81 (3): 637–654.

- ^ Hull, John C. (2008). Options, Futures and Other Derivatives (7 ed.). Prentice Hall. pp. 287–288. ISBN 0135052831.

- ^ http://www.wilmott.com/blogs/paul/index.cfm/2008/4/29/Science-in-Finance-IX-In-defence-of-Black-Scholes-and-Merton

- ^ R Rebonato: Volatility and correlation in the pricing of equity, FX and interest-rate options (1999)

- ^ http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1012075

- ^ Jean-Philippe Bouchaud (Capital Fund Management, physic professor at École Polytechnique): Economics needs a scientific revolution, NATURE|Vol 455|30 Oct 2008 OPINION ESSAY p. 1181

References

Primary references

- Black, Fischer (1973). "The Pricing of Options and Corporate Liabilities". Journal of Political Economy. 81 (3): 637–654. doi:10.1086/260062.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) [1] (Black and Scholes' original paper.) - Merton, Robert C. (1973). "Theory of Rational Option Pricing". Bell Journal of Economics and Management Science. 4 (1). The RAND Corporation: 141–183. doi:10.2307/3003143. JSTOR 3003143. [2]

- Hull, John C. (1997). Options, Futures, and Other Derivatives. Prentice Hall. ISBN 0-13-601589-1.

Historical and sociological aspects

- Bernstein, Peter (1992). Capital Ideas: The Improbable Origins of Modern Wall Street. The Free Press. ISBN 0-02-903012-9.

- MacKenzie, Donald (2003). "An Equation and its Worlds: Bricolage, Exemplars, Disunity and Performativity in Financial Economics". Social Studies of Science. 33 (6): 831–868. doi:10.1177/0306312703336002. [3]

- MacKenzie, Donald (2003). "Constructing a Market, Performing Theory: The Historical Sociology of a Financial Derivatives Exchange". American Journal of Sociology. 109 (1): 107–145. doi:10.1086/374404.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) [4] - MacKenzie, Donald (2006). An Engine, not a Camera: How Financial Models Shape Markets. MIT Press. ISBN 0-262-13460-8.

Further reading

- Haug, E. G (2007). "Option Pricing and Hedging from Theory to Practice". Derivatives: Models on Models. Wiley. ISBN 9780470013229. The book gives a series of historical references supporting the theory that option traders use much more robust hedging and pricing principles than the Black, Scholes and Merton model.

- Triana, Pablo (2009). Lecturing Birds on Flying: Can Mathematical Theories Destroy the Financial Markets?. Wiley. ISBN 9780470406755. The book takes a critical look at the Black, Scholes and Merton model.

External links

Discussion of the model

- Ajay Shah. Black, Merton and Scholes: Their work and its consequences. Economic and Political Weekly, XXXII(52):3337-3342, December 1997 link

- Inside Wall Street's Black Hole by Michael Lewis, March 2008 Issue of portfolio.com

- Whither Black-Scholes? by Pablo Triana, April 2008 Issue of Forbes.com

- Black Scholes model lecture by Professor Robert Shiller from Yale

Derivation and solution

- Proving the Black-Scholes Formula

- Derivation of the Black-Scholes Equation for Option Value, Prof. Thayer Watkins

- Solution of the Black–Scholes Equation Using the Green's Function, Prof. Dennis Silverman

- Solution via risk neutral pricing or via the PDE approach using Fourier transforms (includes discussion of other option types), Simon Leger

- Step-by-step solution of the Black-Scholes PDE, planetmath.org.

- On the Black-Scholes Equation: Various Derivations, Manabu Kishimoto

- The Black-Scholes Equation Expository article by mathematician Terence Tao.

Revisiting the model

- Why We Have Never Used the Black-Scholes-Merton Option Pricing Formula, Nassim Taleb and Espen Gaarder Haug

- The illusions of dynamic replication, Emanuel Derman and Nassim Taleb

- When You Cannot Hedge Continuously: The Corrections to Black-Scholes, Emanuel Derman

- In defence of Black Scholes and Merton, Paul Wilmott

Computer implementations

- Black–Scholes in Multiple Languages, espenhaug.com

- Black–Scholes Pricing and Greeks, soarcorp.com

- Chicago Option Pricing Model (Graphing Version), sourceforge.net

- Online Option Pricing: Black & Scholes method, pricing-option.com — Preceding unsigned comment added by crougeaux (talk • contribs)

Historical

- Trillion Dollar Bet—Companion Web site to a Nova episode originally broadcast on February 8, 2000. "The film tells the fascinating story of the invention of the Black-Scholes Formula, a mathematical Holy Grail that forever altered the world of finance and earned its creators the 1997 Nobel Prize in Economics."

- BBC Horizon A TV-programme on the so-called Midas formula and the bankruptcy of Long-Term Capital Management (LTCM)

![{\displaystyle [t,t+\Delta t]}](https://wikimedia.org/enwiki/api/rest_v1/media/math/render/svg/fd8ae4682cc8a0effd72cabd232c13037c4590d0)

![{\displaystyle \mathbb {E} \left[\max\{S-K,0\}\right]}](https://wikimedia.org/enwiki/api/rest_v1/media/math/render/svg/863ba0bfae3e388f449d39f27dfe01c2fe3bf901)