Brad Katsuyama

Bradley 'Brad' Katsuyama is a financial services executive, working as the president, CEO and co-founder of the IEX, the Investors Exchange.[1] Katsuyama is also the focus of Flash Boys,[2] a non-fiction book by Michael Lewis about high frequency trading (HFT) in financial markets.[3]

Personal life

Born in 1979, Katsuyama is a native of Markham, Ontario, Canada and is a graduate of Wilfrid Laurier University in Waterloo, Ontario. He is married with two children. Katsuyama lives in New York with his wife Ashley and his two sons, Brandon and Rylan.[4][5]

Career

RBC and Pre-IEX Career

Before founding IEX, Katsuyama worked for many years at the Royal Bank of Canada (RBC). Brad has over 13 years of experience in the securities trading industry and was formerly the Global Head of Electronic Sales and Trading at RBC Capital Markets. In this role, he was responsible for multiple global teams including: electronic sales, electronic trading, algorithmic trading, market structure strategy, client implementation and product management. His prior management roles at RBC were Head of US Cash Equity Trading, Head of US Hedge Fund Coverage, and Head of US Technology Trading.[6]

Problem Discovery and Response

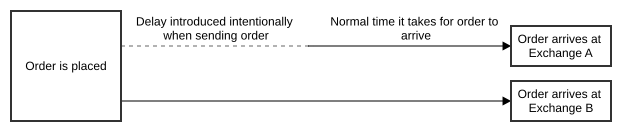

While at RBC he noticed that placing a single large order that can be fulfilled only through many different stock exchanges was being taken as an advantage by stock scalpers. Scalpers, noticing the order would not be able to be fulfilled by one single exchange, would instead buy the securities in the other exchanges, so that by the time the rest of the large order arrived to those exchanges the scalpers could sell the securities at a higher price. All these events would happen in milliseconds not perceivable to humans but perceivable to computers. He instead led a team that implemented THOR, a securities' order-management system where large orders are split into many different sub-orders with each sub-order arriving at the same time to all the exchanges through the use of intentional delays.[7]

Post-RBC and IEX Founding

Following Katsuyama's discovery of the certain unfair trading practices he decided to fundamentally change the business of the stock market, leaving RBC in 2012 to start-up a fairer dark pool.[5] The Investors Exchange, IEX was born from his RBC departure. IEX is organized as an alternative trading system, also known as a dark pool, though company representatives have stated their intention to convert to a public exchange upon reaching sufficient trading volume. It opened for its first day of trading on October 25, 2013. [8] Opponents of the IEX assert that the IEX is trying to build its business by generating fear, mistrust and accusations, FMA.[9] On the other hand, financial writer Michael Lewis praised IEX as an appropriate and beneficial response to alleged HFT abuses.[10] Since the publishing of Flash Boys and the opening of IEX, several U.S. authorities have confirmed they are looking into certain practices used by high-frequency traders. The FBI, the U.S. Securities and Exchange Commission, the U.S. Justice Department and the attorney-general of New York State all have investigations underway.[5]

References

- ^ "IEX Group - About Us | A Market That Works For Investors". Iextrading.com. Retrieved 2014-04-03.

- ^ Lewis, Michael (2014). Flash Boys: Cracking the Money Code. London, UK: Allen Lane. ISBN 9780241003633.

- ^ "The New York Times". nytimes.com. Retrieved 2014-04-11.

- ^ "Canadian says 'moral compass' led him to solve unfair gaming of stock markets by high-frequency traders". business.financialpost.com/. 2014-03-31. Retrieved 2014-05-08.

- ^ a b c "Canadian Brad Katsuyama's 'overwhelming' life as hero of Michael Lewis's Flash Boys". theglobeandmail.com. 2014-04-04. Retrieved 2014-05-08.

- ^ "IEX Trading Executive Team". iextrading.com. Retrieved 2014-05-08.

- ^ "Trading chief exits RBC - Financial News". Efinancialnews.com. 2012-09-19. Retrieved 2014-04-03.

- ^ "How IEX is Combating Predatory Types of High Frequency Traders". Forbes.com. 2014-04-23. Retrieved 2014-05-08.

- ^ This charge is not unlike the Amdahl Corporation assertion that IBM Corporation achieved its market dominance by generating fear, uncertainty and doubt, FUD.

- ^ "Dow Jones & Co. MarketWatch - 'Epic' debate on high-frequency trading between Michael Lewis, Brad Katsuyama and William O'Brien". marketwatch.com. Retrieved 2014-05-11.