CARES Act

| |

| Long title | To provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic. |

|---|---|

| Acronyms (colloquial) | CARES Act |

| Announced in | the 116th United States Congress |

| Citations | |

| Public law | Pub. L. 116–136 (text) (PDF) |

| Legislative history | |

| |

The Coronavirus Aid, Relief, and Economic Security Act (H.R. 748),[1] also known as the CARES Act,[2] is a law meant to address the economic fallout of the 2020 coronavirus pandemic in the United States. In its original form, it was introduced in the United States Senate by Majority Leader Mitch McConnell (R-KY)[3], although the bill was heavily amended before it was passed.

The original bill included $500 billion in direct payments to Americans,[2] "$208 billion in loans for major industries that have been impacted by the coronavirus", and "$300 billion for small businesses".[3] As a result of bipartisan negotiations, the bill grew to $2 trillion in the version unanimously passed by the Senate on March 25, 2020.[4][5] The next day, it was passed in the House via voice vote and signed into law by President Donald Trump.

Unprecedented in size and scope,[4] the legislation was the largest-ever economic stimulus package in U.S. history,[6] amounting to 10% of total U.S. gross domestic product.[7] The bill was much larger than the $831 billion stimulus act passed in 2009 as part of the response to the Great Recession.[7]

The bill is referred to by lawmakers as "Phase 3" of Congress's coronavirus response.[8][9] The first phase "was an $8.3 billion bill spurring coronavirus vaccine research and development" (the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020), which was signed into law on March 6, 2020. The second phase was "an approximately $104 billion package largely focused on paid sick leave and unemployment benefits for workers and families" (the Families First Coronavirus Response Act), which was signed into law on March 18, 2020.[8]

Background

Reduction of economic activity

In response to the coronavirus pandemic there was a dramatic reduction in economic activity, both globally and in the United States, as a result of the enactment of social distancing measures meant to curb the spread of the virus. These measures included working from home, widespread cancellation of events, cancellation of classes (or moving in-person to online classes), reduction of travel, and the closure of businesses.

In March it was predicted that without government intervention most airlines around the world would go bankrupt.[10] On Monday, March 16 the trade group representing the American airline industry requested a $50 billion federal bailout.[11] On March 18 the National Restaurant Association wrote the President of the United States and members of Congress to say they were "estimating that the industry's sales will decline by $225 billion during the next three months, which will prompt the loss of between five and seven million jobs."[12] The National Restaurant Association requested aid to restaurants in the amount of $145 billion.[12]

In an effort to gain Republican support for a large stimulus package that at the time was envisioned to be about $1 trillion, United States Secretary of the Treasury Steven Mnuchin told Republican Senators that the United States unemployment rate could reach 20% if no government action was taken.[13] Almost 3.3 million Americans filed for unemployment in the week ending March 21, "nearly five times more than the previous record of 695,000 set in 1982".[14]

On March 20, Goldman Sachs predicted the U.S. gross domestic product would "decline by 24% in the second quarter of 2020 because of the coronavirus pandemic".[15] Deutsche Bank predicted the U.S. economy would shrink by 12.9% in the second quarter of 2020.[16]

Initial proposals

In mid-March 2020, Democratic politicians Andrew Yang, Alexandria Ocasio-Cortez, and Tulsi Gabbard advocated for universal basic income in response to the 2020 coronavirus pandemic in the United States;[17][18] Gabbard suggested that it be a temporary measure until the crisis subsides.[19] On March 13, Democratic representatives Ro Khanna and Tim Ryan introduced legislation to provide payments to low-income citizens during the crisis via an earned income tax credit.[20][21] On March 16, Republican senators Mitt Romney and Tom Cotton stated their support for a $1,000 basic income, the former saying it should be a one-time payment to help with short-term costs.[22] On 17 March, the Trump administration indicated that some payment would be given to non-millionaires as part of a stimulus package.[23][24]

With guidance from the White House, Senate Majority Leader Mitch McConnell proposed a third stimulus package amounting to more than $1 trillion.[a] It was suggested that $200–500 billion would fund tax rebate checks to Americans who made between $2,500 and $75,000 in 2018 to help cover short-term costs[28][29] via one or two payments of $600–1,200 per adult and $500 per child.[30][31][32] Democrats prepared a $750 billion package as a counter-offer,[33][34] which focused on expanding unemployment benefits instead of tax rebates.[32] A compromise plan was made to set aside $250 billion for tax rebates and the same amount for unemployment.[25]

Provisions

The Act contains the following provisions.[36]

- Allocates up to $500 billion to the Economic Stabilization Fund ("Main Street Lending Program") for assistance to eligible businesses, states, and municipalities. A business is eligible if it has significant operations in the United States, a majority of its employees based in the United States, and it either has fewer than 10,000 employees or has less than $2.5 billion of revenue. Each loan is a minimum of $1&nsbp;million, has a four-year maturity, and restrictions on compensation of highly paid employees.[37] The program is limited to $25 billion for passenger air carriers, $4 billion for air cargo carriers, and $17 billion for businesses critical to maintaining national security.[38][39]

- Creates a $349 billion loan program, called the Paycheck Protection Program (PPP), for small businesses with funds available for loans originated from February 15 through June 30, 2020.[38][40]

- Allocates $130 billion in relief to the medical and hospital industries.[38]

- Creates a $14 billion higher education emergency relief fund to provide cash grants to college students for costs such as course materials, technology, food, housing, and child care. Each college will determine which of its students receive cash grants.[37]

- Expands the Small Business Administration's Economic Injury Disaster Loans (EIDL) to cover most nonprofit organizations, including faith-based organizations. An unsecured EIDL can be for up to $25,000, while a secured EIDL may be for up to $2 million. The applicant must have an acceptable credit history and be able to repay the EIDL. Each EIDL has a low interest rate and has a term of up to 30 years. An EIDL applicant may receive a $10,000 advance payment that is not required to be repaid. Proceeds from an EIDL may be used to pay for ordinary and necessary operating expenses, liabilities, and other bills not able to be paid because of a decrease in revenue. An EIDL may not replace lost revenue or lost profits. An EIDL may not be used for business expansion.[37]

- Provides credits against the 2020 personal income tax for eligible individuals who are neither nonresident aliens nor claimed as dependents by another taxpayer. These payments will be sent to eligible individuals in April 2020.

- $1,200 to each individual or $2,400 to each married couple filing jointly, and

- $500 for each dependent who is a qualifying child under age 17 as of December 31, 2020.

- The credits are reduced, but not below zero, by each five percent of so much of the taxpayers' adjusted gross income as exceeds $150,000 for a joint return; $112,500 for a head of household; or $75,000 for other taxpayers.[38][41]

- Expands eligibility for unemployment insurance and provides people with an additional $600 per week on top of the unemployment amount determined by each state.[38][42] Gig workers and freelancers are covered by unemployment insurance for the first time.[43] Provides payments to states in order to reimburse nonprofit organizations, government agencies, and Indian tribes for half of the unemployment benefits they have to reimburse the state through December 31, 2020.[37]

- Expands telehealth services in Medicare.[38][38][44]

- Provides the Secretary of the Treasury with the authority to make loans or loan guarantees to states, municipalities, and eligible businesses.[38][45]

- Provides a refundable employee retention tax credit for employers whose operations were suspended due to COVID-19 or whose revenue has significantly decreased due to COVID-19. The tax credit is equal to 50% of qualified wages paid between March 13, 2020, and December 31, 2020. Maximum credit is $5,000 per employee. Qualified wages include the cost of qualified health care. Qualified wages do not include wages paid for Emergency Paid Sick Leave or Emergency Family Medical Leave. A business is not eligible for the credit if it receives a Paycheck Protection Program loan.[37]

- Allows employers to defer payment of the employers' share of social security tax for up to two years. Payment of the portion of self-employment tax corresponding to the employer's share of social security tax may also be deferred for up to two years. Payment of these taxes incurred after having a Paycheck Protection Program loan forgiven cannot be deferred, but taxes incurred before the loan forgiveness may continue to be deferred.[37]

- Allows individuals who take the standard deduction to take a tax credit for up to $300 of charitable contributions per year, effective January 1, 2020.[37]

- Increases the limit for most tax-deductible charitable contributions from 50% to 100% of adjusted gross income for individuals and from 10% to 25% for corporations. Increases the limit for tax-deductions for charitable contributions of food inventory from 15% to 25% of income.[37]

- Payments of student loan principal and interest of by an employer to either an employee or a lender is not taxable to the employee if paid between March 27, 2020, and December 31, 2020. The maximum amount that is tax-free is $5,250 per employee.[46]

- Suspends required minimum distributions for 2020.

- Increases the maximum amount of a loan from an employer-sponsored retirement plan from $50,000 to $100,000 and from 50% of vested assets to 100% of vested assets.

- Delays the 80% limitation on net operating losses from 2018 to 2021. Allows net operating losses from 2018, 2019, and 2020 to be carried back to up to five years. Delays the $500,000 limitation on deductible net operating losses until 2021.[37]

- When a consumer affected by COVID-19 requests and receives flexibility with their payment obligations from a creditor, the creditor is required to report to credit bureaus that the consumer is in compliance with their payment obligations.[47]

Legislative history

Initial criticism and negotiations

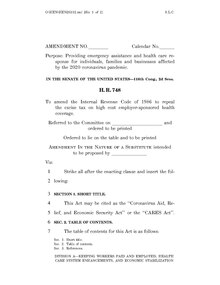

The House initially passed a tax cut bill in mid-2019 and sent it to the Senate, which then used it as a shell bill and added an amendment in the nature of a substitute, fulfilling the constitutional requirement that all bills for raising revenue must originate in the House. After the new bill was released by the Senate, Speaker of the House Nancy Pelosi (D-CA) issued a statement that read in part: "We are beginning to review Senator McConnell's proposal and on first reading, it is not at all pro-worker and instead puts corporations way ahead of workers."[48] Senate Minority Leader Chuck Schumer (D-NY) criticized the fact that Democrats were not involved by Republicans in drafting the bill.[49]

Among Senate Republicans there was "significant debate and disagreement" regarding "President Donald Trump's proposal to provide most Americans with $1,000-plus checks to boost spending and stimulate the economy".[48] Senator Richard Shelby (R-AL), the Republican chair of the Senate Appropriations Committee, stated "I personally think that if we're going to help people we should direct the cash payments maybe as a supplement to unemployment, not to the people who are working every day, just a blank check to everybody in America making up to $75,000."[48]

Early procedural votes

On the evening of Sunday March 22, 2020, Senate Democrats blocked the bill in a key procedural vote; the vote was 47–47, while 60 votes were needed to proceed.[50] Immediately thereafter, "Dow futures hit their 5% 'limit down' overnight, and were off 600 points at one stage Monday morning."[50][51]

In response, Mitch McConnell "announced another procedural vote on the package timed for 9:45 a.m. Monday—minutes after the stock market opens—but it was blocked by Democrats who don't want to be forced to take the vote."[52] The second key procedural vote on the CARES Act, a cloture vote to end debate, failed the afternoon of Monday, March 23; 60 votes were needed, but it failed 49–46.[53][51] Both procedural votes were on a "shell" bill framed to repeal an Obamacare tax which passed the House on July 17, 2019.[54] For procedural reasons, the text will be replaced by the new language passed by the Senate.[55][56]

Procedural votes for the bill were made more difficult by the fact that five Republican Senators were in self-quarantine: Senator Rand Paul, who had tested positive for coronavirus disease 2019, as well as Senators Mike Lee, Mitt Romney, Cory Gardner, and Rick Scott.[52]

Nancy Pelosi indicated that the House would prepare its own bill, expected to exceed $2.5 trillion, as a counter-offer,[57] which was criticized by Republicans as "a progressive wishlist seemingly unrelated to the crisis".[58]

Senate agreement

Early in the morning of Wednesday March 25, Senate leaders announced they had come to an agreement on a modified version of the CARES Act,[59] the full text of which exceeds 300 pages.[60] Mitch McConnell "announced news of a breakthrough on the Senate floor shortly after 1:30 a.m. Wednesday".[59]

On the floor of the Senate, McConnell stated "the Senate has reached a bipartisan agreement on a historic relief package for this pandemic" and that "this is a wartime level of investment for our nation."[61] McConnell continued the analogy to war by saying the CARES Act would provide "ammunition" to health care workers who are the "frontline heroes who put themselves at risk to care for patients" by providing them "the ammunition they need".[62] Chuck Schumer stated on the Senate floor that "Like all compromises, this bill is far from perfect, but we believe the legislation has been improved significantly to warrant its quick consideration and passage, and because many Democrats and Republicans were willing to do the serious and hard work, the bill is much better off than where it started."[61]

The result of the agreement between Senate leaders and the White House was a $2 trillion bill that "is the largest economic relief bill in U.S. history".[64] The bill was criticized by Representative Alexandria Ocasio-Cortez and New York Governor Andrew Cuomo.[64] Republican Senators Lindsey Graham, Tim Scott, Ben Sasse, and Rick Scott expressed concern the bill's strong unemployment provisions "encourage employees to be laid off instead of working".[65] Senator Bernie Sanders then threatened to block the legislation and impose more stringent conditions for the $500 billion earmarked for corporate bailouts if the unemployment provision was removed by the proposed amendment of the four Republican Senators.[66] To address these concerns, Senate leaders "agreed to allow an amendment vote on the floor".[65] The Republican-led amendment to cap unemployment benefits failed in a 48–48 vote.[67]

Late in the night of Wednesday, March 25, 2020, the Senate passed the $2 trillion bill in a unanimous 96–0 vote. The four Senators not voting (all Republicans) were Rand Paul (who had tested positive for coronavirus), Mitt Romney and Mike Lee (who were both in isolation after contact with Senator Paul), and Senator John Thune who was "feeling ill".[5]

House vote

On March 25, Pelosi said that "many of the provisions in there have been greatly improved because of negotiation," and hoped to pass the bill by unanimous consent.[68]

Representative Thomas Massie, a Republican from Kentucky, attempted to maneuver for a roll-call vote, but the quorum present did not support the idea. Massie's threat to demand a recorded vote nonetheless "compelled dozens, if not hundreds, of lawmakers to return to Capitol Hill from their home districts, navigating across interstates and through airports at a time when public health officials have urged Americans to avoid nonessential travel and gathering in large groups."[69] Massie's actions received bipartisan criticism. Former Secretary of State John Kerry, a Democrat, tweeted "Congressman Massie has tested positive for being an asshole. He must be quarantined to prevent the spread of his massive stupidity,"[70] a message which was shared by President Trump on Twitter.[69] Republican Representative Peter T. King called Massie's actions "disgraceful" and "irresponsible".[69]

The House passed the bill on March 27 by a near-unanimous, unrecorded voice vote.[71][72][73]

Signed into law and signing statement

A few hours after the House passed the bill, it was signed into law by President Trump.[74]

The legislation required the creation of a Pandemic Response Accountability Committee. A committee chair was to be selected by the inspectors general; they selected Glenn Fine, who was serving as acting Pentagon inspector general. However, on April 6, Trump removed Fine from his position as acting Pentagon inspector general, making him ineligible to chair the committee. (The new acting Pentagon inspector general is Sean W. O’Donnell.)[75]

The legislation also requires oversight by a separate Special Inspector General for Pandemic Recovery (SIGPR) who will monitor loans and investments from a $500 billion corporate bailout fund established by the legislation.[76][77] A provision in the legislation empowers the special inspector general to audit the use of the fund; requires the Treasury Department and other executive-branch entities to provide information to the special inspector general; and directs the special inspector general to report to Congress "without delay" if an agency unreasonably withholds requested information.[76] The Pandemic Response Accountability Committee will coordinate the work of the SIGPR. In a signing statement, Trump suggested he could gag the SIGPR insofar as his constitutional powers as president enabled him to block the SIGPR's reports to Congress.[76] According to The New York Times, the statement was consistent with Trump's "history of trying to keep damaging information acquired by an inspector general from reaching Congress".[76] As of April 7, Trump is expected to nominate White House lawyer Brian Miller for this job.[75]

Montana Senator Jon Tester and Utah Senator Mitt Romney drafted a letter to the president in support of an independent Special Inspector General.[78]

Commentary

Bipartisan passage

Congress passed the CARES Act relatively quickly and with unanimity from both parties despite its $2.2 trillion price tag, indicating the severity of the global pandemic and the need for emergency spending, as viewed by lawmakers.[79] Writing in The New Republic, journalist Alex Shephard nevertheless questioned how the Republican Party "... had come to embrace big spending" when, during the Great Recession, no Republicans in the House and only three in the Senate supported President Barack Obama's $800 billion stimulus, known as the American Recovery and Reinvestment Act of 2009 (ARRA), often citing the deficit and national debt.[80] Shephard opined that, unlike CARES, much of the media attention to ARRA focused on its impact on the deficit and he questioned whether Republicans would again support a major spending request under a hypothetical future Democratic president.[81]

President Trump remarked upon passage of CARES in the Senate that "The Democrats have treated us fairly ... I really believe we've had a very good back-and-forth. And I say that with respect to [Senate Minority Leader] Chuck Schumer".[79] Nonetheless, after unanimous passage in the Senate and near-unanimous passage in the House, no Democrats were invited to the signing ceremony.[82][83]

See also

- Financial impact of the 2019–20 coronavirus pandemic

- Coronavirus Preparedness and Response Supplemental Appropriations Act

- Families First Coronavirus Response Act

- Paycheck Protection Program

- List of acts of the 116th United States Congress

- 2020 in United States politics and government

- 2020s in United States political history

References

Footnotes

- ^ This included $300 billion to help small businesses with forgivable loans up to $10 million[25] and $200 billion to support industries such as airlines, cruise companies, and hotels through loans and other measures.[26] Democrats advocated for banning stock buy-backs to prevent these funds from being used to make a profit.[27]

Citations

- ^ "House Coronavirus Relief Bill Would Boost Federal Employee Benefits". FEDweek. March 25, 2020. Retrieved March 25, 2020.

- ^ a b Parkinson, John (March 20, 2020). "Senate scrambles to strike deal on $1T pandemic relief for businesses, families". ABC News. New York City. Retrieved March 22, 2020.

- ^ a b Carney, Jordain (March 19, 2020). "McConnell introduces third coronavirus relief proposal". The Hill. New York City: Capitol News Company. Retrieved March 22, 2020.

- ^ a b Emily Cochrane & Sheryl Gay Stolberg, $2 Trillion Coronavirus Stimulus Bill Is Signed Into Law, New York Times (March 27, 2020).

- ^ a b Pramuk, Jacob. "Senate passes $2 trillion coronavirus stimulus package, sending it to the House". CNBC. Retrieved March 26, 2020.

- ^ Sarah D. Wire, Senate passes $2-trillion economic stimulus package, Los Angeles Times (March 25, 2020).

- ^ a b Sandhya Kambhampati, The coronavirus stimulus package versus the Recovery Act, Los Angeles Times (March 26, 2020).

- ^ a b Nilsen, Ella; Zhou, Li (March 17, 2020). "What we know about Congress' potential $1 trillion coronavirus stimulus package". Vox. New York City: Vox Media. Retrieved March 22, 2020.

- ^ Treene, Alayna (March 19, 2020). "The growing coronavirus stimulus packages". Axios. Arlington, Virginia: Axios Media Inc. Retrieved March 22, 2020.

- ^ Ziady, Hanna. "Most airlines could be bankrupt by May. Governments will have to help". CNN Business. Retrieved March 28, 2020.

- ^ Wallace, Gregory; Mattingly, Phil; Isidore, Chris. "US airline industry seeks about $50 billion in federal help". CNN Business. Retrieved March 28, 2020.

- ^ a b Gangitano, Alex. "Restaurant industry estimates $225B in losses from coronavirus". The Hill. Retrieved March 28, 2020.

- ^ "Mnuchin warns senators of 20% U.S. unemployment without coronavirus rescue—source". Reuters. March 18, 2020. Retrieved March 28, 2020.

- ^ "Coronavirus: Record number of Americans file for unemployment". BBC News. Retrieved March 28, 2020.

- ^ Reinicke, Carmen. "Goldman Sachs now says US GDP will shrink 24% next quarter amid the coronavirus pandemic—which would be 2.5 times bigger than any decline in history". Markets Insider. Retrieved March 28, 2020.

- ^ Winck, Ben. "The worst global recession since World War II: Deutsche Bank just unveiled a bleak new forecast as the coronavirus rocks economies worldwide". Markets Insider. Retrieved March 28, 2020.

- ^ Clifford, Catherine (March 13, 2020). "Andrew Yang, AOC, Harvard professor: Free cash payments would help during coronavirus pandemic". CNBC. Retrieved March 16, 2020.

- ^ Relman, Eliza (March 12, 2020). "Alexandria Ocasio-Cortez demands the government distribute a universal basic income and implement 'Medicare for all' to fight the coronavirus". Business Insider. Retrieved March 14, 2020.

- ^ Garcia, Victor (March 12, 2020). "Gabbard pitches 'emergency, temporary' $1,000 payment to every adult as coronavirus outbreak spreads". Fox News. Retrieved March 14, 2020.

- ^ Moreno, J. Edward (March 13, 2020). "Lawmakers call for universal basic income amid coronavirus crisis". The Hill. Retrieved March 16, 2020.

- ^ Corbett, Jessica (March 13, 2020). "House Democrats Propose Sending Checks of Up to $6,000 to Help Ease Workers' Pain During Coronavirus Pandemic". Common Dreams. Retrieved March 16, 2020.

- ^ Lahut, Jake (March 16, 2020). "Tom Cotton is calling for Americans to get cash payments through the coronavirus outbreak". Business Insider. Retrieved March 18, 2020.

- ^ Singman, Brooke (March 17, 2020). "Trump wants to send Americans checks 'immediately' in response to coronavirus, Mnuchin says". Fox News. Retrieved March 18, 2020.

- ^ Hunt, Kasie; Caldwell, Leigh Ann; Tsirkin, Julie; Shabad, Rebecca (March 17, 2020). "White House eyeing $1 trillion coronavirus stimulus package". NBC News. Retrieved March 18, 2020.

- ^ a b Mattingly, Phil (March 21, 2020). "Stimulus package could top $2 trillion as negotiators look to clear final major hurdles". CNN. Retrieved March 22, 2020.

- ^ Stone, Peter (March 20, 2020). "Washington lobbyists in frenzied battle to secure billion-dollar coronavirus bailouts". The Guardian.

- ^ Press, Associated (March 21, 2020). "Congress and White House resume talks on $1tn pandemic rescue deal". The Guardian. Retrieved March 22, 2020.

- ^ Hunt, Kasie; Caldwell, Leigh Ann; Tsirkin, Julie; Shabad, Rebecca (March 17, 2020). "White House eyeing $1 trillion coronavirus stimulus package". NBC News. Retrieved March 18, 2020.

- ^ Singman, Brooke (March 17, 2020). "Trump wants to send Americans checks 'immediately' in response to coronavirus, Mnuchin says". Fox News. Retrieved March 18, 2020.

- ^ Breuninger, Kevin (March 19, 2020). "Trump wants direct payments of $1,000 for adults, $500 for kids in coronavirus stimulus bill, Mnuchin says". CNBC. Retrieved March 20, 2020.

- ^ Re, Gregg (March 19, 2020). "McConnell's coronavirus stimulus plan would provide payments of $1,200 per person, $2,400 for couples". Fox News. Retrieved March 20, 2020.

- ^ a b Bolton, Alexander (March 20, 2020). "Democrats balk at $1,200 rebate checks in stimulus plan". The Hill. Retrieved March 20, 2020.

- ^ Carney, Jordain (March 18, 2020). "McConnell takes reins of third coronavirus bill". The Hill. Retrieved March 18, 2020.

- ^ Caygle, Heather; Bresnahan, John; Ferris, Sarah (March 18, 2020). "Pelosi looks to lay down marker on next stimulus plan". Politico. Retrieved March 18, 2020.

- ^ "Relief Package Would Limit Coronavirus Damage, Not Restore Economy". www.wsj.com. March 26, 2020. Retrieved March 27, 2020.

- ^ "H.R. 748: Coronavirus Aid, Relief, and Economic Security Act". govtrack. Civic Impulse, LLC. March 27, 2020.

- ^ a b c d e f g h i Socha, Matthew; McGregor, Sara; Adams, Amanda M.; Walker, Deborah (April 13, 2020). "COVID-19 Federal Stimulus and Not-For-Profit Organizations". Cherry Bekaert LLP.

- ^ a b c d e f g h "Senate Passes the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act")". Foley & Lardner LLP. Retrieved March 27, 2020.

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 4003(b)

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 1102, amending the Small Business Act 15 U.S.C. § 636(a)

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 2201, amending 26 U.S.C. § 6428

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 2102

- ^ Pofeldt, Elaine (March 30, 2020). "The historic $2 trillion CARES Act will be an economic lifeline for gig workers and freelancers". CNBC. Retrieved April 1, 2020.

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 3212

- ^ Coronavirus Aid, Relief, and Economic Security Act, Section 4003(b)(4)

- ^ McGinnis, Brian; Ludwig, Steven K.; Nagle, Robert C.; MacDonald, Andrew M.; McNelis III, Joseph A. (March 30, 2020). "An Employer's Guide to CARES Act Relief". Fox Rothschild LLP.

- ^ Sachs, Gerald S.; Baker, Allyson B.; Pompan, Jonathan L.; Arculin, R. Andrew; Frechette, Peter S. (April 3, 2020). "CFPB Offers Guidance on FCRA Compliance During the COVID-19 Pandemic", Venable LLP.

- ^ a b c Mattingly, Phil; Foran, Clare; Barrett, Ted (March 19, 2020). "Senate Republicans unveil $1 trillion economic stimulus package to address coronavirus fallout". CNN. Atlanta, Georgia: Turner Broadcasting Systems. Retrieved March 22, 2020.

- ^ Snell, Kelsey; Grisales, Claudia; Davis, Susan; Walsh, Deirdre (March 19, 2020). "Senate Republicans Unveil New Coronavirus Relief Package". NPR. Retrieved March 22, 2020.

- ^ a b Belvedere, Matthew. "5 things to know before the stock market opens Monday". CNBC. Retrieved March 25, 2020.

- ^ a b Mill, David; Lee, Muhyung; Webb, Sean. "Coronavirus: CARES Act Vote Fails in Senate; Summary of the Tax Provisions of the Bill". National Law Review. Retrieved March 25, 2020.

- ^ a b Mattingly, Phil; Foran, Clare; Barrett, Ted. "Senate GOP ramps up pressure on Democrats over coronavirus stimulus package with Monday vote". CNN. Retrieved March 25, 2020.

- ^ Parkinson, John. "Senate showdown over pandemic relief stalls as Pelosi preps Democratic bill". ABC News. Retrieved March 25, 2020.

- ^ "Where do you stand?". www.countable.us. Retrieved March 27, 2020.

- ^ "What's the Status of the 'Phase 3' Coronavirus Relief Bill?". www.countable.us. Retrieved March 27, 2020.

- ^ Carney, Jordain. "Senate fails to advance coronavirus stimulus bill for second time in two days". The Hill. Retrieved March 25, 2020.

- ^ Pramuk, Jacob (March 23, 2020). "House Democrats to introduce a $2.5 trillion coronavirus stimulus plan as Senate bill stalls". CNBC. Retrieved March 23, 2020.

- ^ Re, Gregg (March 23, 2020). "Pelosi's coronavirus stimulus includes return of 'Obamaphones', other unrelated items, GOP says". Archived from the original on March 23, 2020. Retrieved March 23, 2020.

{{cite web}}:|archive-date=/|archive-url=timestamp mismatch; March 24, 2020 suggested (help) - ^ a b Davis, Susan; Grisales, Claudia; Snell, Kelsey. "Senate Reaches Historic Deal On $2 Trillion Coronavirus Economic Rescue Package". NPR. Retrieved March 25, 2020.

- ^ Stein, Jeff (March 25, 2020). "What's in the $2.2 trillion coronavirus Senate stimulus package". The Washington Post. Retrieved March 26, 2020.

- ^ a b Egan, Lauren; Tsirkin, Julie; Shabad, Rebecca. "White House, Senate reach deal on massive $2 trillion coronavirus spending bill". NBC News. Retrieved March 25, 2020.

- ^ "MARCH 24, 2020 Senate Session, Part 2". C-SPAN. Retrieved March 25, 2020.

- ^ "READ: $2 Trillion Coronavirus Relief Bill". NPR.org. Retrieved March 26, 2020.

- ^ a b Taylor, Andrew; Lisa, Mascaro. "Senate trudging toward vote on virus rescue package". NPR. Retrieved March 26, 2020.

- ^ a b Zanona, Melanie; Ferris, Sarah; Caygle, Heather. "Senate back on track to vote on massive coronavirus package". Politico. Retrieved March 26, 2020.

- ^ Zachary, Basu. "Senators threaten to delay coronavirus relief bill with last-minute objections". Axios. Retrieved March 26, 2020.

- ^ Muñoz, Gabriella; Boyer, Dave. "Senate rejects coronavirus stimulus package amendment to cap unemployment benefits". Washington Times. Retrieved March 26, 2020.

- ^ Raju, Manu; Barrett, Ted; Foran, Clare; Wilson, Kristin (March 25, 2020). "White House, Senate reach historic $2 trillion stimulus deal amid growing coronavirus fears". CNN. Retrieved March 25, 2020.

- ^ a b c Forgey, Quint. "Both parties pile on Massie after effort to force recorded vote flops". Politico. Retrieved March 28, 2020.

- ^ "John Kerry 10:55 a.m.—Mar 27, 2020 Tweet". Twitter. Retrieved March 28, 2020.

- ^ Hughes, Siobhan; Andrews, Natalie (March 27, 2020). "House Passes $2 Trillion Coronavirus Stimulus Package". Wall Street Journal. ISSN 0099-9660. Retrieved March 27, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ Taylor, Andrew; Fram, Alan; Kellman, Laurie; Superville, Darlene (March 28, 2020). "Trump signs $2.2 trillion stimulus package after swift congressional votes". www.timesofisrael.com. Retrieved April 6, 2020.

{{cite web}}: CS1 maint: url-status (link) - ^ "U.S. Senate: Glossary Term | Voice Vote". www.senate.gov. Retrieved April 6, 2020.

- ^ Zeballos-Roig, Joseph (March 27, 2020). "Trump signs the $2 trillion coronavirus economic relief bill into law, which includes checks for Americans and business loans". Business Insider. Retrieved March 27, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ a b Nakashima, Ellen (April 7, 2020). "Trump removes inspector general who was to oversee $2 trillion stimulus spending". Washington Post. Retrieved April 7, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ a b c d Charlie Savage, Trump Suggests He Can Gag Inspector General for Stimulus Bailout Program, New York Times (March 27, 2020).

- ^ Wilkie, Christina; Macias, Amanda (April 7, 2020). "Trump removes inspector general overseeing $2 trillion coronavirus relief package days after he was appointed". CNBC. Retrieved April 7, 2020.

{{cite web}}: CS1 maint: url-status (link) - ^ Byrnes, Jesse (April 3, 2020). "Trump selects White House lawyer for coronavirus inspector general". TheHill. Retrieved April 5, 2020.

- ^ a b Phillips, Amber (March 26, 2020). "'Totally unprecedented in living memory': Congress's bipartisanship on coronavirus underscores what a crisis this is". washingtonpost.com. Retrieved March 31, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ Rogers, David (February 13, 2009). "Senate passes $787 billion stimulus bill". Politico.com. Retrieved March 31, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ Shephard, Alex (March 30, 2020). "A Tale of Two Stimulus Packages". The New Republic. Retrieved March 31, 2020.

{{cite news}}: CS1 maint: url-status (link) - ^ Swanson, Ian (March 27, 2020). "Trump signs $2T coronavirus relief package". TheHill. Retrieved April 6, 2020.

- ^ Shabad, Rebecca; Edelman, Adam (March 27, 2020). "Trump signs $2 trillion coronavirus stimulus bill". NBC News. Retrieved April 6, 2020.

{{cite web}}: CS1 maint: url-status (link)

Further reading

- "What's in the $2 Trillion Senate Coronavirus Bill". The Wall Street Journal. March 26, 2020.